CoreWeave (CRWV): Deconstructing Last Week's Stock Market Rally

Table of Contents

Understanding CoreWeave's Business Model and Recent Developments

CoreWeave's Position in the Cloud Computing Market

CoreWeave is a rapidly growing player in the cloud computing market, specializing in high-performance computing (HPC) solutions built on a sustainable infrastructure. Unlike general-purpose cloud providers like AWS, Google Cloud, and Microsoft Azure, CoreWeave focuses on a niche market demanding significant processing power, often for AI/ML workloads, gaming, and other computationally intensive applications. This targeted approach allows for a high degree of specialization and potentially stronger margins.

- Unique Selling Proposition (USP): CoreWeave differentiates itself through its sustainable, GPU-focused infrastructure built on repurposed Bitcoin mining hardware. This offers a cost-effective and environmentally conscious alternative to traditional HPC solutions.

- Recent Partnerships and Advancements: The company has been actively forging partnerships with key players in the AI and gaming industries, further solidifying its position and expanding its market reach. Recent announcements regarding technological advancements in their infrastructure also contributed to increased investor confidence.

Analyzing the Recent Earnings Report

CoreWeave's latest earnings report revealed impressive growth across key performance indicators (KPIs). Revenue growth significantly exceeded expectations, showcasing strong demand for their specialized cloud computing services. While profitability remains a focus for future growth, the positive revenue trajectory indicates a healthy business model with strong market traction.

- Positive Surprises: The earnings report revealed a significant increase in customer acquisition, surpassing previous projections. This underscores the growing demand for CoreWeave's sustainable and high-performance cloud computing solutions.

- Forward-Looking Guidance: The company provided positive forward-looking guidance, indicating confidence in continued growth and expansion in the coming quarters. This optimistic outlook further fueled the stock market rally.

Impact of Recent Market Trends

The surge in CRWV's stock price is not solely attributable to company-specific factors. Broader market trends also played a significant role. A general positive sentiment towards technology stocks, coupled with increased investor appetite for companies focused on sustainability and AI, created a fertile ground for CoreWeave's growth.

- Positive Market Sentiment: The overall positive sentiment in the tech sector, particularly around AI and cloud computing, acted as a tailwind for CoreWeave's stock performance.

- Related News and Events: Positive news coverage and industry accolades related to CoreWeave's technology and sustainable practices further enhanced investor perception and contributed to the rally.

Evaluating the Sustainability of the Rally

Identifying Potential Catalysts for Continued Growth

CoreWeave's long-term potential hinges on several key factors. Their focused growth strategy, expansion into new markets, and ongoing technological innovation are crucial to sustaining the recent rally.

- Future Catalysts: New product launches, strategic acquisitions of complementary businesses, and expansion into new geographical markets are potential catalysts that could fuel further growth. Regulatory changes favorable to sustainable technologies could also play a significant role.

Assessing Potential Risks and Challenges

While the future looks bright, CoreWeave faces potential headwinds. Intense competition from established players in the cloud computing market and economic downturns could impact future performance.

- Threats to the Business Model: Increased competition from larger cloud providers and potential technological disruptions could present challenges.

- Financial Risks: Maintaining profitability while scaling operations and investing in research and development represents a key financial risk.

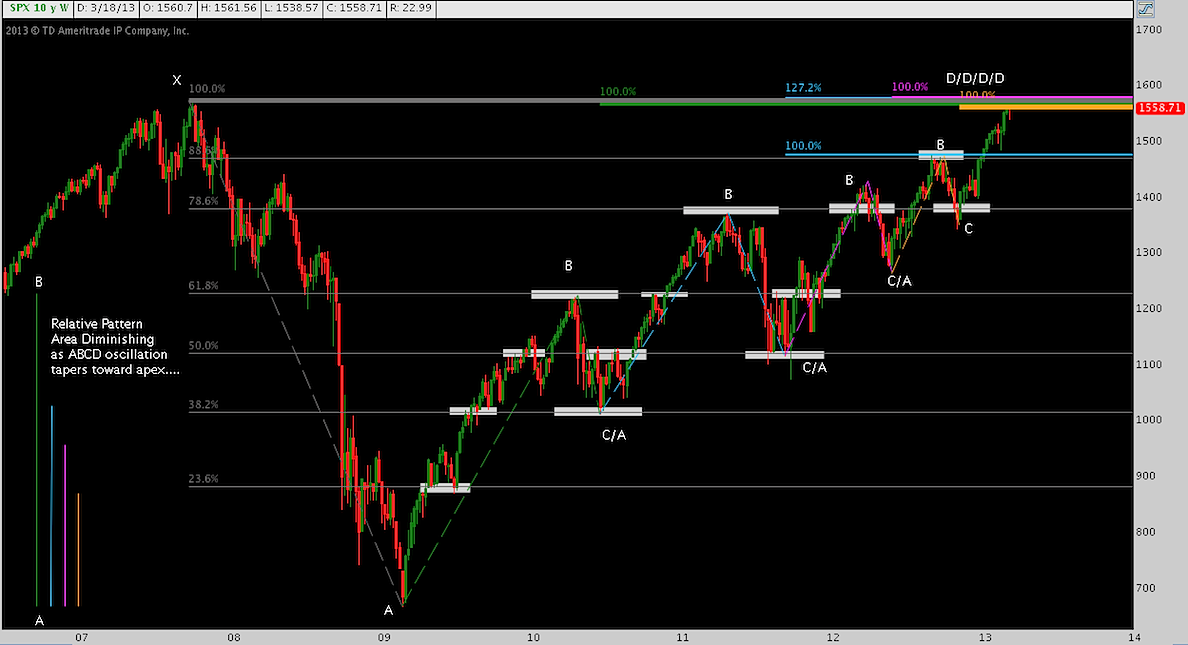

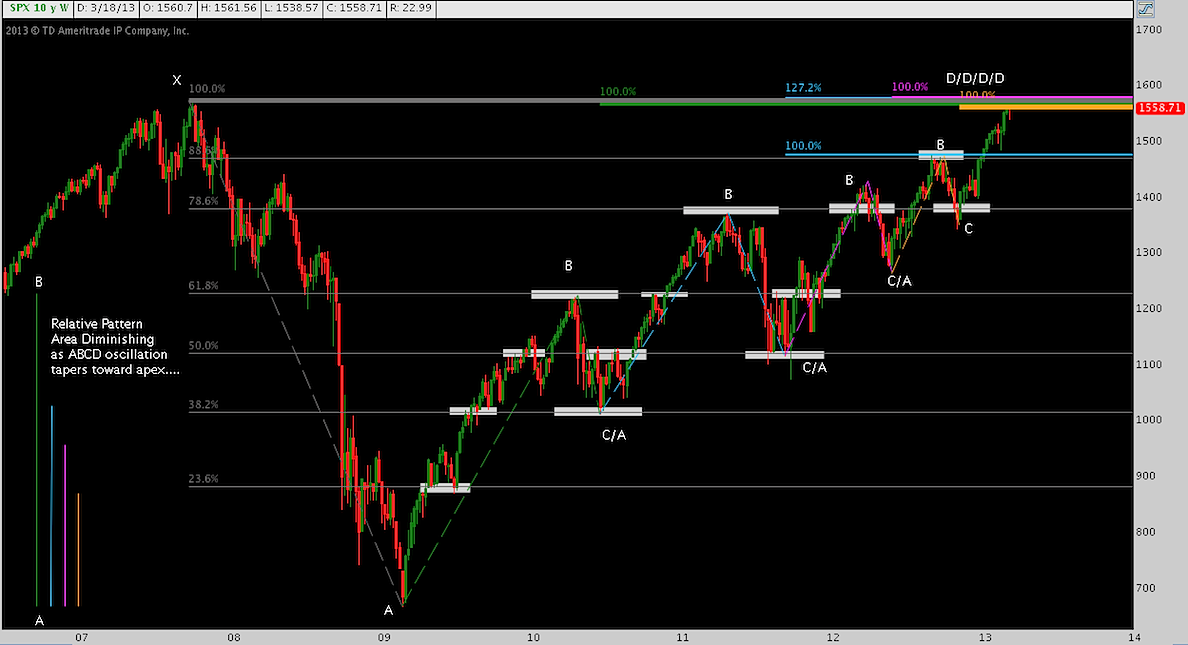

Technical Analysis of CRWV Stock Price

A brief look at the technical indicators shows a strong upward trend in CRWV's stock price last week. Certain chart patterns suggest potential support levels, but this should not be considered financial advice.

- Support and Resistance Levels: While observing support and resistance levels can be helpful, it is crucial to remember that technical analysis is not a guarantee of future performance. This information should not be interpreted as investment advice.

Conclusion

The recent stock market rally for CoreWeave (CRWV) is a result of a confluence of factors: strong earnings, positive market sentiment, and the company's unique position in the rapidly expanding high-performance cloud computing market. Understanding CoreWeave's business model, recent developments, and future prospects is crucial for evaluating the sustainability of this rally. While the company's innovative approach and strong growth trajectory are promising, investors should also consider potential risks before making investment decisions.

This analysis of CoreWeave (CRWV) provides valuable insights into the recent market activity. However, further independent research and consideration of your personal risk tolerance are crucial before making any investment decisions related to CoreWeave stock or other cloud computing investments. Continue to monitor CRWV and the broader cloud computing market for future developments. Remember to conduct thorough due diligence before investing in CoreWeave or any other stock.

Featured Posts

-

Alleged Threat To Leak Taylor Swift Texts Investigating Blake Livelys Legal Team

May 22, 2025

Alleged Threat To Leak Taylor Swift Texts Investigating Blake Livelys Legal Team

May 22, 2025 -

Love Monster A Parents Guide To Understanding And Using The Story

May 22, 2025

Love Monster A Parents Guide To Understanding And Using The Story

May 22, 2025 -

Tuesdays Decline In Core Weave Crwv Stock A Detailed Look

May 22, 2025

Tuesdays Decline In Core Weave Crwv Stock A Detailed Look

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Passes Away

May 22, 2025

Adam Ramey Dropout Kings Vocalist Passes Away

May 22, 2025 -

Where To Watch Gumball Hulu And Disney

May 22, 2025

Where To Watch Gumball Hulu And Disney

May 22, 2025

Latest Posts

-

Analyzing The Pittsburgh Steelers Interest In Nfl Draft Quarterbacks

May 22, 2025

Analyzing The Pittsburgh Steelers Interest In Nfl Draft Quarterbacks

May 22, 2025 -

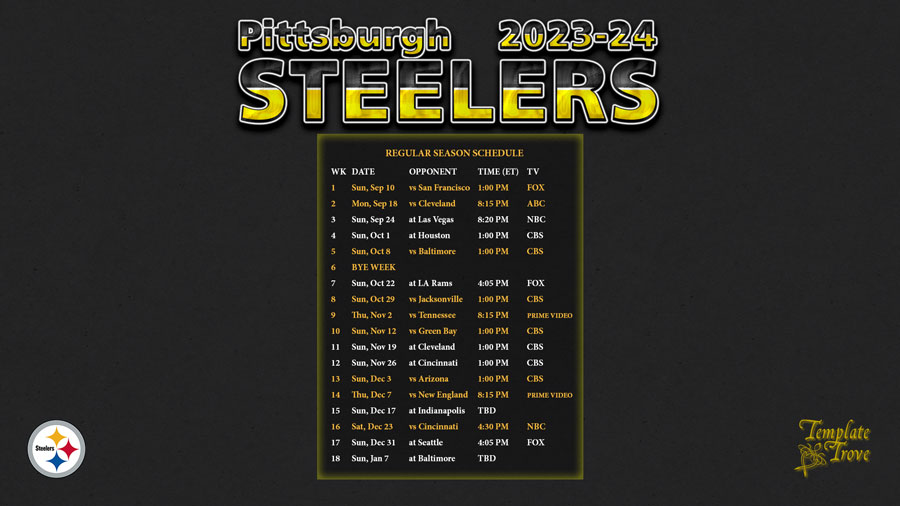

Pittsburgh Steelers Schedule A Deep Dive Into The Takeaways

May 22, 2025

Pittsburgh Steelers Schedule A Deep Dive Into The Takeaways

May 22, 2025 -

Pittsburgh Steelers Draft Strategy The Quarterback Question

May 22, 2025

Pittsburgh Steelers Draft Strategy The Quarterback Question

May 22, 2025 -

Nfl Draft 2024 Are The Pittsburgh Steelers Targeting A New Quarterback

May 22, 2025

Nfl Draft 2024 Are The Pittsburgh Steelers Targeting A New Quarterback

May 22, 2025 -

Steelers Schedule Released Important Takeaways For The Upcoming Season

May 22, 2025

Steelers Schedule Released Important Takeaways For The Upcoming Season

May 22, 2025