CoreWeave (CRWV) Stock Market Performance: Explaining Today's Surge

Table of Contents

CoreWeave's Business Model and Recent Developments

CoreWeave's business model centers on providing cloud computing services specifically designed for high-performance computing (HPC) workloads. The company's specialization lies in leveraging the power of GPUs (Graphics Processing Units), making it a key player in the rapidly expanding fields of artificial intelligence (AI) and machine learning. This focus on GPU-powered cloud computing gives CoreWeave a significant competitive advantage.

- Specialized GPU Infrastructure: CoreWeave offers scalable and efficient cloud infrastructure built around powerful GPUs, crucial for training complex AI models and accelerating data processing tasks. This infrastructure provides a significant advantage for clients needing high performance and speed.

- Strategic Partnerships and Contract Wins: Recent partnerships with major technology companies and significant contract wins could be contributing to increased investor confidence. These achievements demonstrate CoreWeave's growing market penetration and the validation of its technology. Specific details regarding these partnerships and wins would need to be sourced from official company announcements.

- Competitive Advantages: CoreWeave’s competitive advantages include its ability to provide highly scalable and efficient GPU-powered cloud computing solutions. The company's focus on optimizing performance and reducing costs makes it an attractive option for businesses seeking to deploy AI and machine learning at scale.

- Expansion and Market Reach: CoreWeave's plans for expansion into new geographic markets and its efforts to broaden its service offerings further enhance its growth potential and appeal to investors.

Market Trends Influencing CRWV Stock

Several market trends are contributing to the positive sentiment surrounding CRWV stock. The broader technology sector has seen significant growth, and the AI and cloud computing sub-sectors are particularly vibrant.

- Booming AI Investment: The current surge in investment in artificial intelligence and related technologies is a major factor driving up the value of companies like CoreWeave. The increasing demand for AI infrastructure is a key growth catalyst.

- Positive Market Sentiment: Investor sentiment towards AI and cloud computing stocks is currently quite positive, reflecting the industry's strong growth trajectory and the belief in its long-term potential. This positive market sentiment is directly boosting CRWV's stock price.

- Broader Market Conditions: While broader market conditions, such as interest rate changes and economic indicators, can indirectly impact CRWV, the current positive sentiment within the technology sector is overriding those potential negative influences.

- Competitor Performance: While analyzing competitor performance is crucial, the success of similar companies in the space can indirectly boost investor confidence in the overall sector, leading to increased interest in CRWV.

Analyzing CoreWeave's Financial Performance

Assessing CoreWeave’s financial performance is essential to understanding the recent stock surge. Access to and analysis of recent financial reports (including revenue growth, profitability, and cash flow) would provide a clearer picture of the company's financial health.

- Key Financial Metrics: Examining key financial metrics such as revenue growth, operating margins, and cash flow from operations is crucial to determining the strength of CoreWeave's financial performance. A strong financial performance would naturally bolster investor confidence.

- Changes in Financial Performance: Any significant positive changes in the company's financial performance—such as unexpectedly strong revenue growth or improved profitability—could directly explain the recent surge in CRWV's stock price.

- Analyst Forecasts and Ratings: Analyst forecasts and ratings for CRWV stock can provide valuable insight into the market's expectations for the company's future performance. Positive analyst sentiment can influence investor behavior.

- Upcoming Financial Announcements: Anticipation of upcoming financial announcements, such as earnings reports, can significantly impact investor behavior and contribute to stock price volatility.

Risk Factors to Consider

Despite the positive outlook, investing in CRWV, like any stock, carries inherent risks. A thorough understanding of these risks is crucial for making informed investment decisions.

- Market Volatility: The technology sector is known for its volatility, and CRWV stock price is susceptible to fluctuations influenced by broader market trends and investor sentiment.

- Competition: The cloud computing and AI infrastructure markets are becoming increasingly competitive. New entrants and established players could pose challenges to CoreWeave's growth.

- Financial Risk: As with any young company, there's always a risk associated with CoreWeave's financial performance, particularly its ability to maintain its growth trajectory and achieve profitability.

- Regulatory Risks: Changes in regulations related to data privacy, cybersecurity, or cloud computing could negatively impact CoreWeave’s operations and financial performance. Due diligence is always essential.

Conclusion

The surge in CoreWeave (CRWV) stock price today reflects a combination of factors: the company's strong positioning in the rapidly growing AI infrastructure market, positive market sentiment towards technology stocks, and potentially strong financial results. While future performance is inherently uncertain, CoreWeave’s potential for substantial growth is evident.

Understanding the factors driving CoreWeave (CRWV) stock performance is vital for making sound investment decisions. Continue researching CoreWeave, monitoring market trends, and staying informed about the company's progress. Remember to conduct thorough due diligence before investing in CRWV or any other stock. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Trans Australia Run Record A New World Best In Sight

May 22, 2025

Trans Australia Run Record A New World Best In Sight

May 22, 2025 -

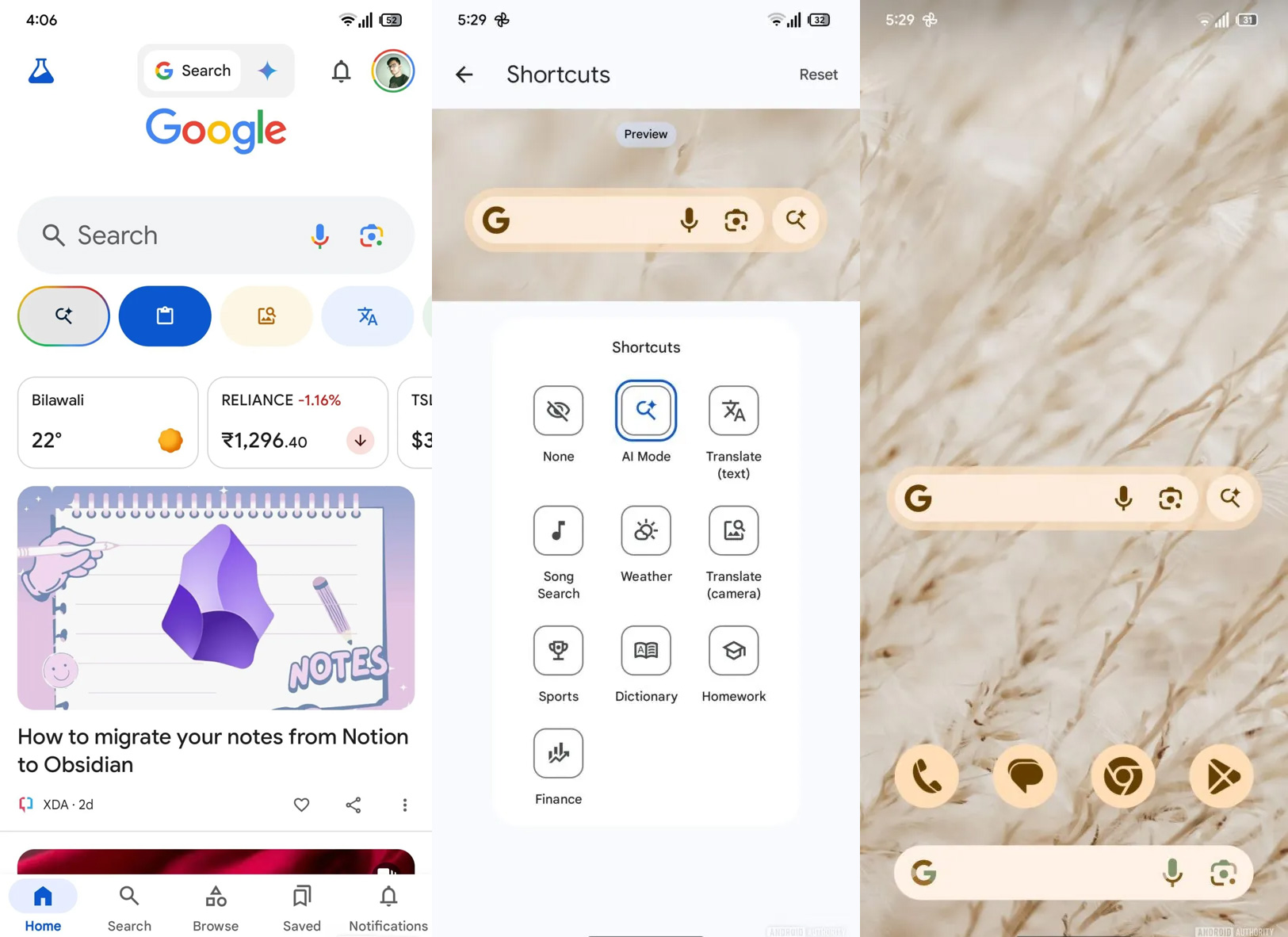

Google Searchs Ai Mode Opportunities And Implications

May 22, 2025

Google Searchs Ai Mode Opportunities And Implications

May 22, 2025 -

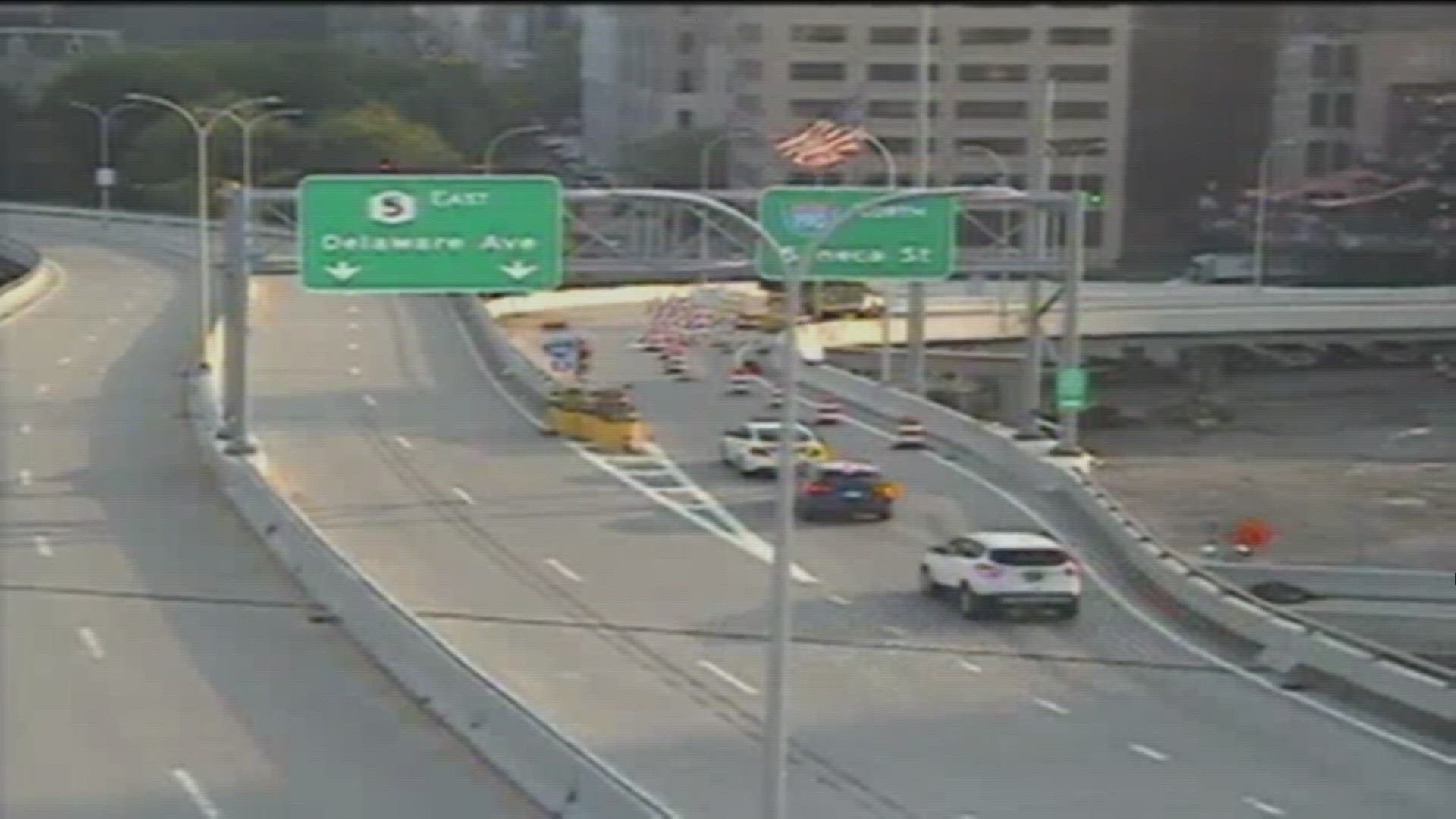

Route 15 On Ramp Closure Details On The Crash And Traffic Impact

May 22, 2025

Route 15 On Ramp Closure Details On The Crash And Traffic Impact

May 22, 2025 -

Espn Breaking Down The Bruins Crucial Offseason Moves

May 22, 2025

Espn Breaking Down The Bruins Crucial Offseason Moves

May 22, 2025 -

Otter Conservation In Wyoming Reaching A Critical Turning Point

May 22, 2025

Otter Conservation In Wyoming Reaching A Critical Turning Point

May 22, 2025

Latest Posts

-

Pat Mc Afee Show Insider Addresses Aaron Rodgers Trade Rumors To Steelers

May 22, 2025

Pat Mc Afee Show Insider Addresses Aaron Rodgers Trade Rumors To Steelers

May 22, 2025 -

No Rodgers Steelers News At Pat Mc Afee Show Insider Reports

May 22, 2025

No Rodgers Steelers News At Pat Mc Afee Show Insider Reports

May 22, 2025 -

Rodgers Steelers Rumors Debunked Pat Mc Afee Show Update

May 22, 2025

Rodgers Steelers Rumors Debunked Pat Mc Afee Show Update

May 22, 2025 -

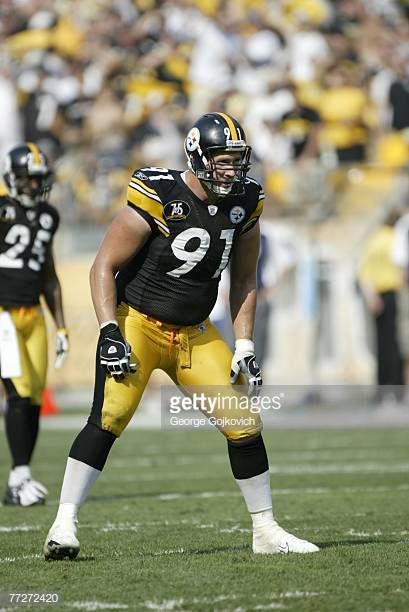

Obituary Ray Seals Former Pittsburgh Steelers Defensive Lineman 1964 2023

May 22, 2025

Obituary Ray Seals Former Pittsburgh Steelers Defensive Lineman 1964 2023

May 22, 2025 -

Pittsburgh Steelers Mourn The Passing Of Former Defensive Lineman Ray Seals At 59

May 22, 2025

Pittsburgh Steelers Mourn The Passing Of Former Defensive Lineman Ray Seals At 59

May 22, 2025