CoreWeave (CRWV) Stock Price Movement: Understanding Today's Activity

Table of Contents

Recent News and Announcements Impacting CRWV

Recent news and announcements have played a significant role in shaping the CoreWeave (CRWV) stock price movement. Analyzing these events helps clarify the market's reaction and investor sentiment.

Press Releases and Financial Reports

Any new press releases, earnings reports, or financial announcements directly impact investor confidence and, subsequently, the stock price. For example, a recent unexpected surge in revenue or a significant new partnership could trigger a positive price reaction. Conversely, disappointing earnings or negative news about the company's operations could lead to a price decline.

- Positive News: A recent successful product launch or strategic acquisition could boost investor confidence and drive up the price.

- Negative News: Concerns about increased competition, supply chain issues, or regulatory hurdles could negatively affect the stock price.

- Example: Let's say CoreWeave released a press release announcing a major contract with a Fortune 500 company. This positive news would likely cause a surge in the stock price due to increased revenue expectations. (Link to hypothetical press release would go here). Conversely, news of a cybersecurity breach could lead to a sharp drop. (Link to hypothetical news article would go here).

Analyst Ratings and Price Targets

Analyst ratings and price target adjustments significantly influence investor perception and trading activity. A positive shift in analyst sentiment often results in increased buying pressure, leading to a price increase. Conversely, downgrades or lowered price targets may cause selling pressure and a price decline.

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Goldman Sachs | Buy | $35 | Oct 26, 2023 |

| Morgan Stanley | Hold | $30 | Oct 26, 2023 |

| JPMorgan Chase | Outperform | $40 | Oct 26, 2023 |

The overall consensus among analysts, as well as the range of price targets, provides a valuable indicator of future price movement. A wide range of price targets suggests significant uncertainty about the company's prospects.

Market Trends and Sector Performance

The overall market environment and the performance of the technology sector also play a crucial role in the CoreWeave (CRWV) stock price movement.

Broad Market Conditions

The performance of major market indices like the S&P 500 and Nasdaq often influences individual stock prices. A broad market downturn can negatively impact even the strongest performing stocks, while a bullish market can lift most stocks, including CRWV. The correlation between CRWV's performance and these broader indices should be considered when analyzing the stock's price movement.

Competitor Analysis

CoreWeave operates in a competitive cloud computing market. Analyzing the performance of its competitors provides valuable context for understanding CRWV's price fluctuations. If competitors are reporting strong earnings or experiencing significant growth, it could put pressure on CRWV's stock price, especially if CRWV is underperforming compared to its peers. Conversely, if competitors are struggling, it could benefit CRWV.

Trading Volume and Volatility

Unusual trading activity, including high or low volume and volatility, often indicates significant shifts in investor sentiment.

Unusual Trading Activity

Significant deviations from average trading volume can signal important market developments. Increased volume could suggest strong buying or selling pressure, while unusually low volume might indicate a lack of interest or investor uncertainty.

- High Volume: Could indicate a strong reaction to news, a significant shift in investor sentiment, or a short squeeze.

- Low Volume: May reflect a period of consolidation or uncertainty in the market.

Short Interest and Options Activity

High short interest (the number of shares sold short) can create upward pressure on the stock price as short-sellers are forced to buy back shares to cover their positions (a short squeeze). Conversely, a decrease in short interest might signal decreased negative sentiment. Significant options trading activity also contributes to price volatility and could indicate strong investor expectations of future price movements.

Conclusion

The CoreWeave (CRWV) stock price movement is a complex interplay of company-specific news, broad market trends, competitive dynamics, and trading activity. Understanding these factors is crucial for informed investing. Key takeaways include the significant impact of press releases, analyst ratings, and market sentiment on CRWV’s price. Monitoring trading volume and volatility, as well as competitor performance, provides additional insight. Understanding CoreWeave (CRWV) stock price movements is crucial for informed investing. Continue to monitor CoreWeave (CRWV) stock price activity closely by following reputable financial news sources and conducting your own thorough research before making any investment decisions.

Featured Posts

-

Peppa Pigs Parents Throw Gender Reveal Party A New Baby Arrives

May 22, 2025

Peppa Pigs Parents Throw Gender Reveal Party A New Baby Arrives

May 22, 2025 -

Espn Insider Deciphering The Bruins Pivotal Offseason Moves

May 22, 2025

Espn Insider Deciphering The Bruins Pivotal Offseason Moves

May 22, 2025 -

Rutte Ve Sanchez Nato Ve Elektrik Kesintilerinin Gelecegi

May 22, 2025

Rutte Ve Sanchez Nato Ve Elektrik Kesintilerinin Gelecegi

May 22, 2025 -

Trans Australia Run Is A New World Record On The Horizon

May 22, 2025

Trans Australia Run Is A New World Record On The Horizon

May 22, 2025 -

Core Weave Ipo Lower Than Expected Listing Price At 40

May 22, 2025

Core Weave Ipo Lower Than Expected Listing Price At 40

May 22, 2025

Latest Posts

-

Rodgers Steelers Rumors Debunked Pat Mc Afee Show Update

May 22, 2025

Rodgers Steelers Rumors Debunked Pat Mc Afee Show Update

May 22, 2025 -

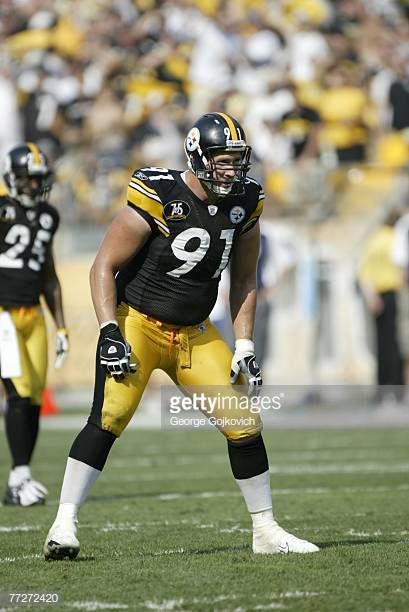

Obituary Ray Seals Former Pittsburgh Steelers Defensive Lineman 1964 2023

May 22, 2025

Obituary Ray Seals Former Pittsburgh Steelers Defensive Lineman 1964 2023

May 22, 2025 -

Pittsburgh Steelers Mourn The Passing Of Former Defensive Lineman Ray Seals At 59

May 22, 2025

Pittsburgh Steelers Mourn The Passing Of Former Defensive Lineman Ray Seals At 59

May 22, 2025 -

Jesse James Dream Draft Day Making The Team

May 22, 2025

Jesse James Dream Draft Day Making The Team

May 22, 2025 -

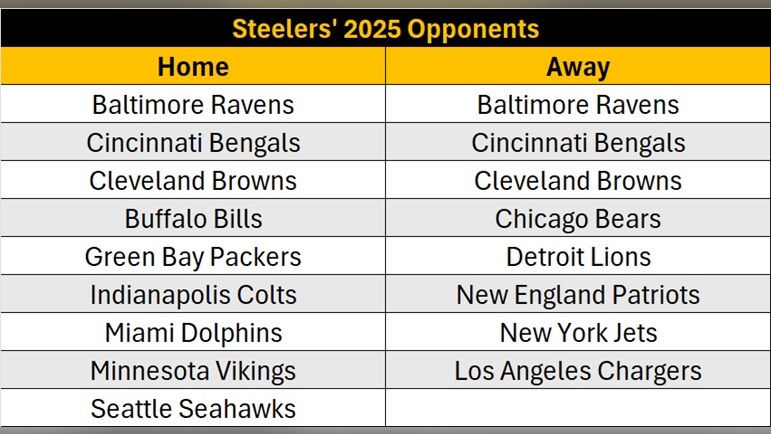

The Potential Pittsburgh Steelers 2025 Schedule A Look Ahead

May 22, 2025

The Potential Pittsburgh Steelers 2025 Schedule A Look Ahead

May 22, 2025