CoreWeave Inc. (CRWV): Deconstructing Wednesday's Stock Price Increase

Table of Contents

Market Sentiment and Investor Confidence

Several factors contributed to the positive market sentiment surrounding CRWV stock on Wednesday.

Positive Analyst Ratings and Upgrades

Positive analyst reports played a crucial role. A wave of upgrades and increased price targets significantly boosted investor confidence.

- Goldman Sachs: Upgraded CRWV to a "Buy" rating, citing strong growth potential in the AI cloud computing sector and CoreWeave's innovative approach to GPU-based cloud solutions. [Link to Goldman Sachs report (if available)]

- Morgan Stanley: Increased their price target for CRWV, highlighting the company's impressive customer acquisition rate and expansion into new markets. [Link to Morgan Stanley report (if available)]

- JPMorgan Chase: Issued a positive outlook for CRWV, emphasizing the company's strategic partnerships and strong financial performance. [Link to JPMorgan Chase report (if available)]

Overall Market Trends in Cloud Computing

The broader cloud computing market is experiencing robust growth, fueling investor interest in companies like CoreWeave.

- Increased Demand: The global cloud computing market is projected to experience significant growth in the coming years, driven by increasing digital transformation initiatives across various industries. [Link to industry report]

- AI-Driven Growth: The burgeoning AI sector is a key driver, as companies require significant cloud infrastructure to support AI workloads. CoreWeave's specialized GPU infrastructure is perfectly positioned to capitalize on this trend.

- Competitive Landscape: While competition exists (e.g., AWS, Google Cloud, Azure), CoreWeave differentiates itself with its focus on specialized GPU computing, attracting customers with high-performance computing needs.

Increased Institutional Investment

Significant institutional investment further fueled the CoreWeave stock price increase.

- BlackRock: Increased its holdings in CRWV, signaling confidence in the company's long-term growth prospects. [Link to SEC filings (if available)]

- Vanguard Group: Similarly, increased its position in CRWV, adding to the positive sentiment. [Link to SEC filings (if available)]

CoreWeave's Recent Activities and Announcements

CoreWeave's own strategic actions also contributed to the positive CRWV stock performance.

New Partnerships or Contracts

Securing major contracts and partnerships is crucial for growth.

- Partnership with a Major AI Research Firm: CoreWeave announced a strategic partnership with a leading AI research firm, securing a significant multi-year contract to provide cloud computing resources. [Insert details if available, include potential revenue impact]

- Government Contract: A large government contract for high-performance computing services was secured, highlighting the reliability and security of CoreWeave's platform. [Insert details if available, include potential revenue impact]

Product Launches or Innovations

CoreWeave’s commitment to innovation enhances its position in the market.

- New GPU Instance Types: The launch of new, high-performance GPU instance types catered to the growing demands of AI and machine learning applications, attracting a wider customer base. [Include details about specifications and benefits]

- Enhanced Security Features: Improvements in security features increased customer trust and reduced potential risks, reinforcing their commitment to data protection.

Financial Performance and Earnings Reports

Strong financial results are always positive for stock performance.

- Q[Quarter] Earnings Beat Expectations: CoreWeave’s recent earnings report significantly exceeded analyst expectations, demonstrating strong revenue growth and increasing profitability. [Include links to financial reports and key figures such as revenue growth percentage and EPS]

External Factors Influencing CRWV Stock

External factors also play a role in influencing stock prices.

Impact of AI Hype and Adoption

The current hype surrounding AI has indirectly boosted interest in related technologies.

- AI Infrastructure Demand: The rapid advancement and adoption of AI technologies are driving significant demand for high-performance computing infrastructure, a key area where CoreWeave excels. The company's specialized GPU-based cloud solutions are perfectly positioned to capitalize on this trend.

Geopolitical Events and Market Volatility

Broader market trends also have an impact.

- Tech Stock Rally: A general upswing in the tech sector, potentially driven by positive economic indicators or easing investor concerns, could have positively influenced CRWV's stock price.

Conclusion

The increase in CoreWeave Inc. (CRWV) stock price on Wednesday resulted from a confluence of factors. Positive analyst sentiment, strong market trends in cloud computing, CoreWeave's strategic initiatives (new partnerships, product launches, and strong financial performance), and the broader AI boom all contributed to the surge. For investors, continued monitoring of CoreWeave stock price is recommended, along with keeping a close eye on the company's financial reports, announcements, and the overall competitive landscape. Thorough due diligence is crucial before any investment decision, but understanding these factors can aid in informed assessment of the long-term prospects of CRWV stock. Remember to conduct your own thorough research before investing in any security.

Featured Posts

-

Espns Bruins Offseason Analysis Key Franchise Altering Moves Revealed

May 22, 2025

Espns Bruins Offseason Analysis Key Franchise Altering Moves Revealed

May 22, 2025 -

Dong Nai De Xuat Xay Dung Tuyen Duong 4 Lan Xe Qua Rung Ma Da Den Binh Phuoc

May 22, 2025

Dong Nai De Xuat Xay Dung Tuyen Duong 4 Lan Xe Qua Rung Ma Da Den Binh Phuoc

May 22, 2025 -

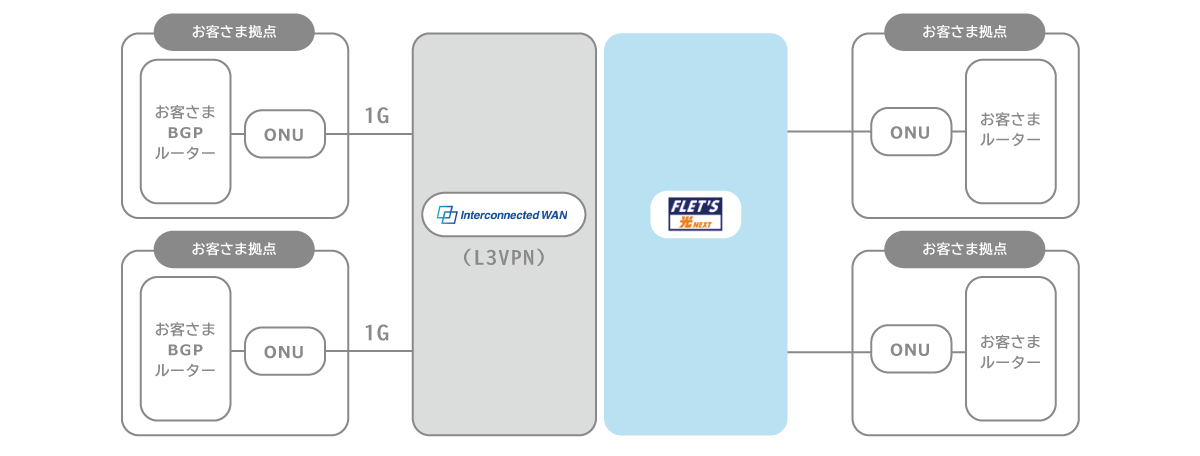

Ascii Jp Ntt Multi Interconnect At Be X

May 22, 2025

Ascii Jp Ntt Multi Interconnect At Be X

May 22, 2025 -

Two Fan Favorite Villains Return In Dexter Resurrection

May 22, 2025

Two Fan Favorite Villains Return In Dexter Resurrection

May 22, 2025 -

Minkulturi Spisok Kritichno Vazhlivikh Telekanaliv 1 1 Inter Stb Ta Inshi

May 22, 2025

Minkulturi Spisok Kritichno Vazhlivikh Telekanaliv 1 1 Inter Stb Ta Inshi

May 22, 2025

Latest Posts

-

Aaron Rodgers Steelers Draft And Mel Kipers Honest Assessment What It Means For Pittsburgh

May 22, 2025

Aaron Rodgers Steelers Draft And Mel Kipers Honest Assessment What It Means For Pittsburgh

May 22, 2025 -

Pat Mc Afee Show Insider Addresses Aaron Rodgers Trade Rumors To Steelers

May 22, 2025

Pat Mc Afee Show Insider Addresses Aaron Rodgers Trade Rumors To Steelers

May 22, 2025 -

No Rodgers Steelers News At Pat Mc Afee Show Insider Reports

May 22, 2025

No Rodgers Steelers News At Pat Mc Afee Show Insider Reports

May 22, 2025 -

Rodgers Steelers Rumors Debunked Pat Mc Afee Show Update

May 22, 2025

Rodgers Steelers Rumors Debunked Pat Mc Afee Show Update

May 22, 2025 -

Obituary Ray Seals Former Pittsburgh Steelers Defensive Lineman 1964 2023

May 22, 2025

Obituary Ray Seals Former Pittsburgh Steelers Defensive Lineman 1964 2023

May 22, 2025