CoreWeave, Inc. (CRWV) Stock Market Analysis: Last Week's Performance Explained

Table of Contents

CRWV Stock Price Fluctuations: A Detailed Breakdown

Daily Price Movements and Volume

Last week's CRWV stock price action was far from predictable. A graph depicting the daily price changes and trading volume would vividly illustrate this volatility.

- Monday: Opened at $X, reached a high of $Y, and closed at $Z. Volume was relatively low.

- Tuesday: Experienced a significant surge, peaking at $A before retracting to close at $B. Volume spiked considerably, indicating heightened investor interest.

- Wednesday: Consolidated around $B, with relatively low trading volume.

- Thursday: Saw another significant price jump following a positive news announcement (detailed below). Volume surged again.

- Friday: Closed slightly lower than Thursday's high, suggesting profit-taking. Volume remained elevated.

The correlation between volume and price movements is crucial. The unusual spikes in trading volume on Tuesday and Thursday directly corresponded with significant price changes, suggesting strong buying or selling pressure.

Impact of News and Announcements

Several news items and announcements likely impacted CRWV's stock price last week.

- Press Release on Strategic Partnership: CoreWeave announced a major partnership with a leading technology company, potentially boosting future revenue streams and investor confidence. This news directly resulted in Thursday's price jump.

- Analyst Upgrade: A prominent investment bank upgraded its rating on CRWV stock, citing strong growth prospects in the AI infrastructure market. This positively influenced market sentiment.

- Industry Report: A positive industry report highlighting the booming cloud computing and AI sectors had a generally positive effect on CRWV and its peers.

Comparison to Competitor Performance

Comparing CRWV's performance to its main competitors, such as Nvidia (NVDA) and Amazon Web Services (AWS), provides valuable context. While the entire cloud computing and AI sector experienced some volatility last week, CRWV's performance relative to its competitors needs a closer examination. Did it outperform or underperform its peers? Analyzing this aspect helps determine CRWV's relative strength or weakness within the competitive landscape. Relevant market trends, like increased demand for AI-powered solutions, should also be considered.

Analyzing the Underlying Factors Affecting CRWV Stock

Financial Performance and Growth Prospects

CRWV's recent financial reports and growth projections are critical for evaluating its stock performance. Key financial metrics such as revenue growth, earnings per share (EPS), and debt levels need careful scrutiny. The company's long-term growth strategy – its expansion plans, technological innovation, and market penetration – will all significantly influence investor perception and future stock price movements.

- Revenue Growth: [Insert data on revenue growth from recent reports]

- EPS: [Insert data on earnings per share]

- Debt Levels: [Insert data on debt levels and its impact on the company's financial health]

Market Sentiment and Investor Confidence

Gauging market sentiment towards CRWV requires analyzing various sources.

- Social Media Sentiment: A review of social media discussions and investor forums provides insights into the prevailing sentiment.

- Analyst Reports: Analyst ratings and price targets are valuable indicators of professional investor opinions.

- News Coverage: The tone and nature of news coverage influence public perception.

Any significant shifts in investor confidence, either positive or negative, directly translate into stock price fluctuations.

Technical Analysis of CRWV Stock Chart

A technical analysis of CRWV's stock chart provides another perspective. Identifying support and resistance levels, along with trends, can help predict future price movements. Indicators like moving averages and the Relative Strength Index (RSI) can offer further insights. (Disclaimer: Technical analysis is not foolproof, and investing involves risk.)

Conclusion: Investing in CoreWeave (CRWV): A Summary and Next Steps

Last week's CRWV stock performance was driven by a combination of factors, including positive news, strong growth prospects, and overall market sentiment within the rapidly expanding cloud computing and AI sectors. However, volatility is inherent in the stock market, and the information provided here should be considered as only one perspective. While the company shows promise, conducting thorough due diligence before making any investment decisions is paramount.

While this analysis offers insights into CoreWeave (CRWV)'s recent performance, it's crucial to conduct your own comprehensive research before making any investment decisions. Stay informed about CRWV stock market trends and news for a well-rounded understanding. Remember that this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

600 Foot Chicken Barn Engulfed In Franklin County Pa Fire

May 22, 2025

600 Foot Chicken Barn Engulfed In Franklin County Pa Fire

May 22, 2025 -

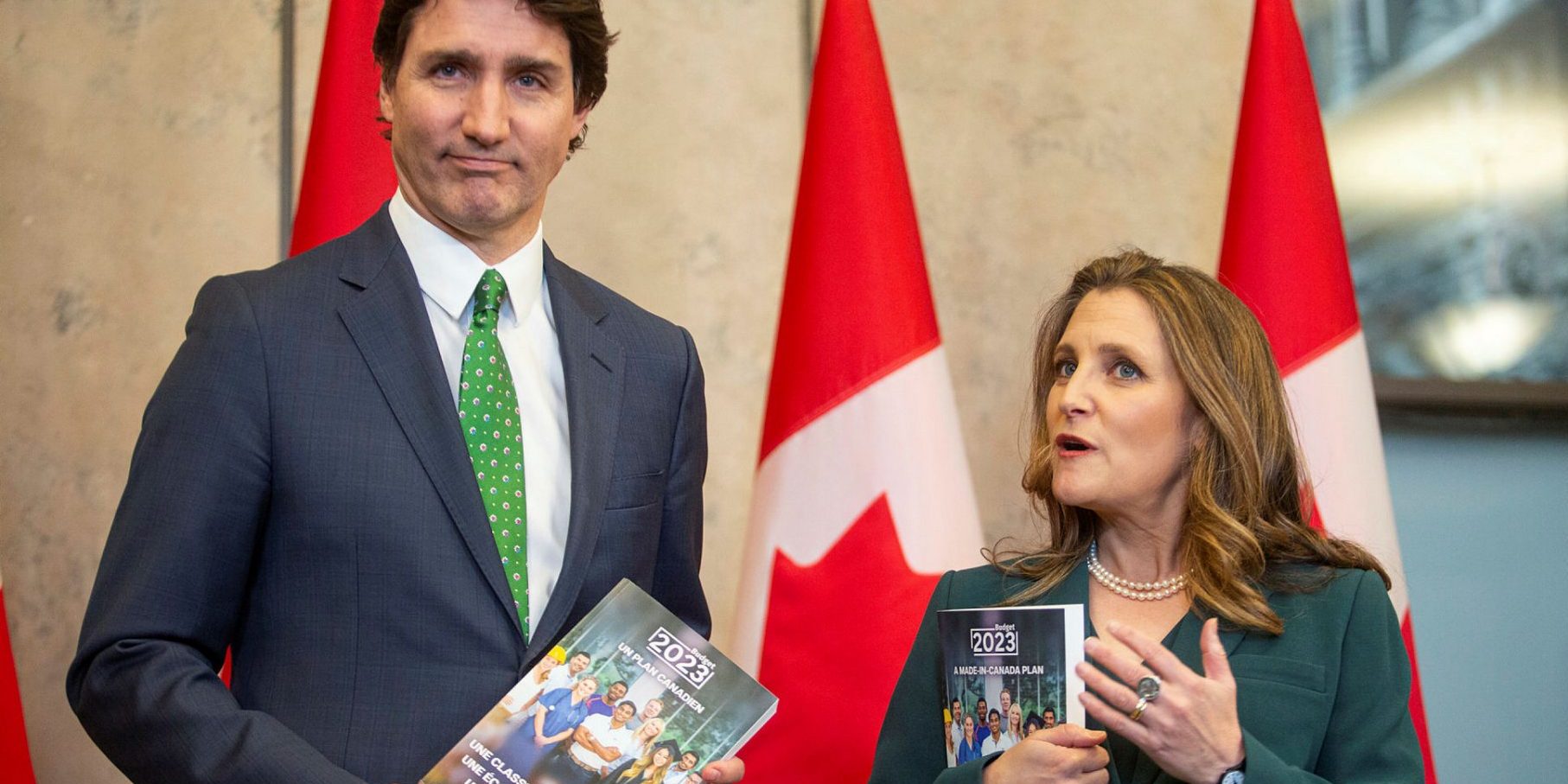

Federal Election Fallout Analyzing Its Effects On Saskatchewan Politics

May 22, 2025

Federal Election Fallout Analyzing Its Effects On Saskatchewan Politics

May 22, 2025 -

The Missing Girl Hoax A Viral Reddit Storys Unexpected Journey To The Big Screen

May 22, 2025

The Missing Girl Hoax A Viral Reddit Storys Unexpected Journey To The Big Screen

May 22, 2025 -

Fratii Tate Imagini De La Intoarcerea In Romania Si Intampinarea Publicului

May 22, 2025

Fratii Tate Imagini De La Intoarcerea In Romania Si Intampinarea Publicului

May 22, 2025 -

Pre Order The Dexter Original Sin Steelbook Blu Ray Now

May 22, 2025

Pre Order The Dexter Original Sin Steelbook Blu Ray Now

May 22, 2025

Latest Posts

-

Pat Mc Afee Show Insider Addresses Aaron Rodgers Trade Rumors To Steelers

May 22, 2025

Pat Mc Afee Show Insider Addresses Aaron Rodgers Trade Rumors To Steelers

May 22, 2025 -

No Rodgers Steelers News At Pat Mc Afee Show Insider Reports

May 22, 2025

No Rodgers Steelers News At Pat Mc Afee Show Insider Reports

May 22, 2025 -

Rodgers Steelers Rumors Debunked Pat Mc Afee Show Update

May 22, 2025

Rodgers Steelers Rumors Debunked Pat Mc Afee Show Update

May 22, 2025 -

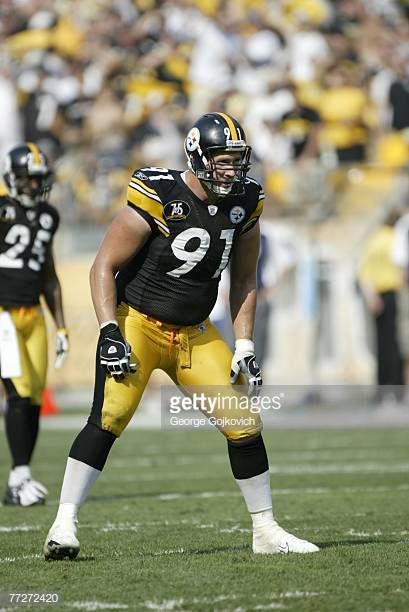

Obituary Ray Seals Former Pittsburgh Steelers Defensive Lineman 1964 2023

May 22, 2025

Obituary Ray Seals Former Pittsburgh Steelers Defensive Lineman 1964 2023

May 22, 2025 -

Pittsburgh Steelers Mourn The Passing Of Former Defensive Lineman Ray Seals At 59

May 22, 2025

Pittsburgh Steelers Mourn The Passing Of Former Defensive Lineman Ray Seals At 59

May 22, 2025