CoreWeave Sets IPO Price At $40, Below Initial Estimates

Table of Contents

CoreWeave's IPO Pricing and Market Reaction

CoreWeave initially anticipated its IPO price to fall within a range of [Insert Initial Price Range]. However, the final price settled at $40 per share, representing a [Insert Percentage] decrease from the initially projected range. This news immediately impacted the market. The stock symbol, [Insert Stock Symbol], experienced [Describe the initial stock price movement – e.g., a slight dip, a more significant drop, or a relatively flat response] following the announcement. Analyst comments ranged from cautious optimism to concerns about the current market climate. The lower-than-expected price reflects the current investor sentiment towards the tech sector, marked by uncertainty and volatility.

- Initial price range: [Insert range]

- Final price per share: $40

- Percentage decrease from initial range: [Insert percentage]

- Stock symbol: [Insert stock symbol]

Factors Contributing to the Lower IPO Price

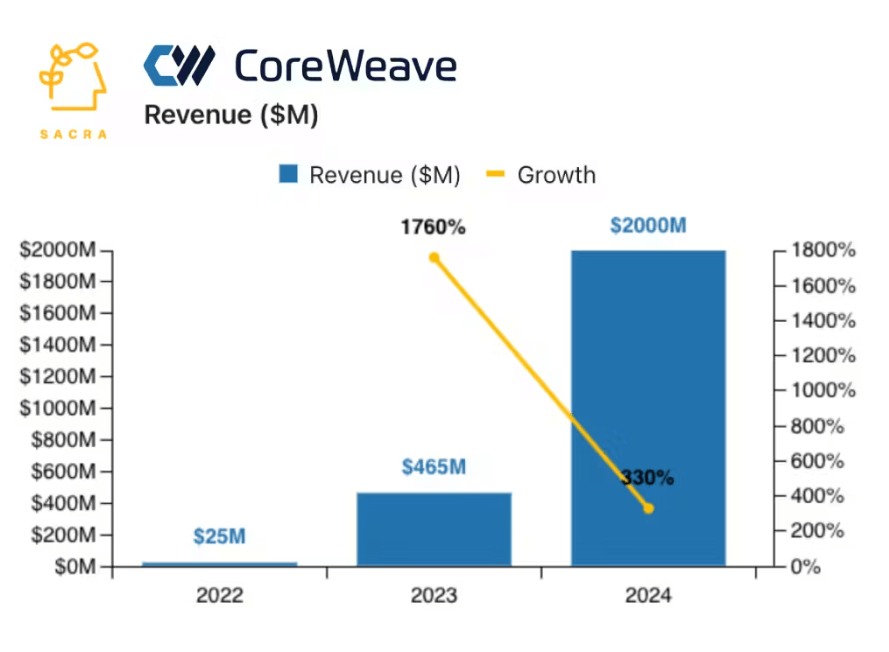

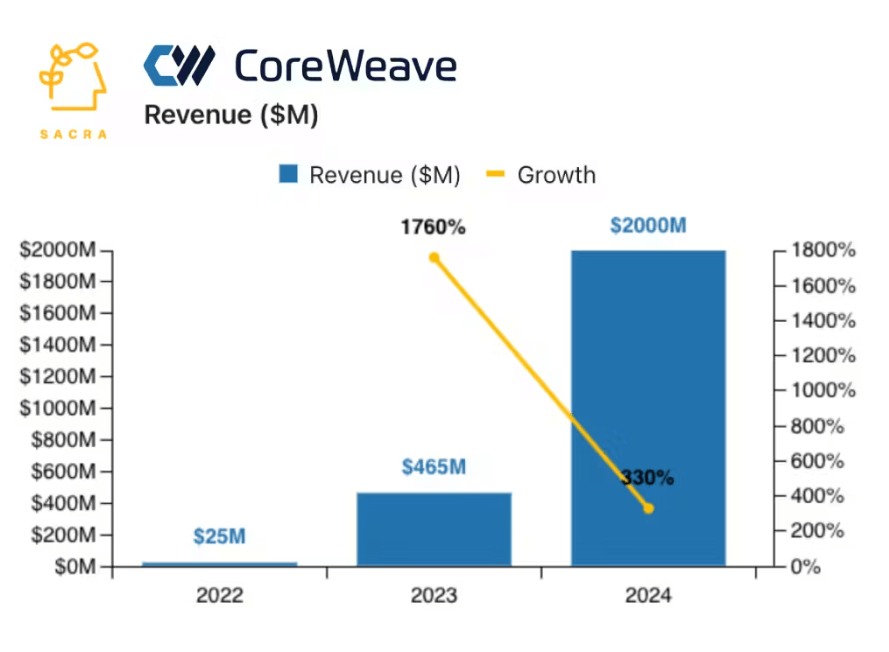

Several factors likely influenced CoreWeave's lower-than-anticipated IPO price. The current macroeconomic environment plays a significant role. Interest rate hikes, persistent inflation, and overall market volatility have created uncertainty, impacting investor risk appetite and valuations across the tech sector, including cloud computing companies. Furthermore, CoreWeave faces stiff competition from established giants like AWS, Azure, and GCP. These incumbents possess extensive market share, significant resources, and well-established brand recognition.

Investors might have also harbored specific concerns about CoreWeave's business model or financial projections. [Mention specific investor concerns, if any, and elaborate on them. For example, concerns about scalability, dependence on specific clients, or profitability in the long term]. These factors, combined with the broader market downturn, likely contributed to the lower IPO price.

- Impact of macroeconomic conditions: High inflation and interest rates reduced investor appetite for risk.

- Competition from established cloud providers (AWS, Azure, GCP): Intense competition in a mature market impacted valuation.

- Investor concerns about [mention specific concerns if any]: Addressing these concerns is crucial for CoreWeave's future success.

Implications for CoreWeave's Future

The lower IPO price has significant implications for CoreWeave's future. Securing funding for growth and expansion initiatives might be more challenging than initially anticipated. The company may need to adjust its strategic plans to navigate the current economic landscape and compete effectively against larger, more established players in the cloud computing market. This could mean prioritizing profitability over aggressive expansion, focusing on specific niche markets, or seeking strategic partnerships to bolster its market position.

- Impact on fundraising capabilities: Securing future funding rounds might require more concessions or a revised strategy.

- Competitive advantage implications: CoreWeave needs to clearly differentiate itself in a crowded market.

- Effect on future expansion plans: Growth strategies might need to be revised to align with the current valuation.

Analyst Opinions and Predictions

Analyst opinions on CoreWeave's post-IPO performance are varied. [Analyst 1's name], from [Analyst 1's firm], expressed [Analyst 1's view – e.g., cautious optimism, concerns about growth, etc.], predicting a stock price of [Analyst 1's prediction]. Conversely, [Analyst 2's name], from [Analyst 2's firm], offered a more positive outlook, citing [reasons for optimism], and setting a price target of [Analyst 2's prediction]. Overall, analyst sentiment appears [Summarize overall sentiment – e.g., cautiously optimistic, divided, predominantly pessimistic, etc.], reflecting the uncertainty surrounding CoreWeave's future in the competitive cloud computing market.

- [Analyst 1's view and prediction]: [Elaborate on the analyst's view and their reasoning.]

- [Analyst 2's view and prediction]: [Elaborate on the analyst's view and their reasoning.]

- [Summary of overall analyst sentiment]: A balanced perspective considering both positive and negative views.

CoreWeave IPO: What's Next?

CoreWeave's lower-than-expected IPO price highlights the challenges facing tech companies in the current economic climate. Macroeconomic factors, intense competition, and investor concerns all played a role in shaping the final valuation. The implications for CoreWeave's future are significant, requiring strategic adjustments to its growth plans and fundraising strategies. While the initial market reaction was [Describe the initial market reaction], the long-term prospects depend on CoreWeave's ability to navigate these challenges and differentiate itself in the crowded cloud computing market. Staying updated on CoreWeave's performance and the broader cloud computing market is crucial. Follow our blog for further analysis and insights on the CoreWeave IPO and its implications.

Featured Posts

-

Emergency Response To Large Chicken Barn Fire In Franklin County Pa

May 22, 2025

Emergency Response To Large Chicken Barn Fire In Franklin County Pa

May 22, 2025 -

From Scatological Data To Engaging Audio An Ai Driven Poop Podcast

May 22, 2025

From Scatological Data To Engaging Audio An Ai Driven Poop Podcast

May 22, 2025 -

Core Weave Crwv Stock Explaining The Tuesday Price Movement

May 22, 2025

Core Weave Crwv Stock Explaining The Tuesday Price Movement

May 22, 2025 -

Snehit Suravajjula Upsets Sharath Kamal At Wtt Contender Chennai 2025

May 22, 2025

Snehit Suravajjula Upsets Sharath Kamal At Wtt Contender Chennai 2025

May 22, 2025 -

Sse Cuts 3 Billion Spending Impact Of Slowing Growth

May 22, 2025

Sse Cuts 3 Billion Spending Impact Of Slowing Growth

May 22, 2025

Latest Posts

-

Wordle 370 March 20 Hints Clues To Help You Solve Todays Puzzle

May 22, 2025

Wordle 370 March 20 Hints Clues To Help You Solve Todays Puzzle

May 22, 2025 -

Wordle 370 Solution Hints And Clues For March 20th Game

May 22, 2025

Wordle 370 Solution Hints And Clues For March 20th Game

May 22, 2025 -

Thursdays Wordle 370 March 20th Hints Clues And Answer

May 22, 2025

Thursdays Wordle 370 March 20th Hints Clues And Answer

May 22, 2025 -

Saturday Wordle March 8th Puzzle 1358 Hints And Answer

May 22, 2025

Saturday Wordle March 8th Puzzle 1358 Hints And Answer

May 22, 2025 -

Wordle Game 370 March 20th Hints Clues And Solution

May 22, 2025

Wordle Game 370 March 20th Hints Clues And Solution

May 22, 2025