CoreWeave Stock Performance: Key Factors Influencing Its Value

Table of Contents

Market Demand and Competition in the Cloud Computing Sector

The cloud computing sector is experiencing phenomenal growth, fueled largely by the insatiable appetite for AI and high-performance computing (HPC). This surge creates a fertile ground for companies like CoreWeave.

Growth of AI and its Impact on CoreWeave

The explosive growth of artificial intelligence is directly impacting CoreWeave's potential. AI models require immense computational power, driving up demand for GPU-accelerated cloud computing services – CoreWeave's specialty.

- Increased demand for GPU computing: AI training and inference rely heavily on Graphics Processing Units (GPUs), making CoreWeave's specialized infrastructure highly valuable.

- CoreWeave's specialized infrastructure: CoreWeave offers a unique infrastructure optimized for AI workloads, providing a competitive advantage.

- Competitive advantages in AI workloads: Their focus on GPU-based cloud computing positions them strategically to capitalize on the burgeoning AI market.

Competition Analysis

While CoreWeave enjoys a strong position, it faces competition from established giants like AWS, Google Cloud, and Microsoft Azure. However, CoreWeave's unique selling propositions could help it carve out a significant market share.

- Competitive pricing strategies: CoreWeave may employ competitive pricing to attract customers.

- Innovative technology offerings: Focusing on specialized solutions for AI and HPC gives CoreWeave a niche advantage.

- Market share analysis: Analyzing CoreWeave's market share acquisition and penetration will be crucial in assessing its future stock performance.

- Potential for disruption: CoreWeave's innovative approach has the potential to disrupt the established players in specific market segments.

CoreWeave's Financial Performance and Projections

Analyzing CoreWeave's financial performance and projections is crucial for understanding its future stock valuation.

Revenue Growth and Profitability

Examining CoreWeave's revenue growth and profitability is essential. Key performance indicators (KPIs) like customer acquisition cost (CAC) and lifetime value (LTV) will be closely scrutinized.

- Revenue streams: Identifying CoreWeave's various revenue streams (e.g., cloud services, software licenses) will offer a clearer picture.

- Profitability margins: Assessing profitability margins will indicate the company's efficiency and sustainability.

- Expense management: Efficient expense management will be a key factor influencing profitability and investor confidence.

- Growth trajectory: Analyzing the historical and projected growth trajectory will help predict future financial performance.

Funding Rounds and Investor Sentiment

CoreWeave's funding rounds reveal valuable information about investor confidence and valuation. The participation of prominent investors is a positive indicator.

- Investment amounts: The size of investment rounds indicates investor interest and the company's potential.

- Investor profiles: The types of investors involved (e.g., venture capitalists, strategic investors) provide insights into market perception.

- Valuation metrics: Analyzing the valuation at each funding round offers a snapshot of the company's growth.

- Implications for future funding: Successful funding rounds generally signal positive future prospects.

Technological Innovation and Scalability

CoreWeave's technological prowess and scalability are vital for long-term success and stock performance.

Technological Advantage

CoreWeave's technological advancements and proprietary technologies will significantly influence its competitive positioning.

- Unique technology: Identifying any unique technologies or patents held by CoreWeave will be important.

- Scalability of infrastructure: The ability to scale its infrastructure to meet growing demand is crucial.

- Data center efficiency: Efficient data center operations will contribute to lower costs and higher profitability.

- Sustainability initiatives: Environmentally friendly practices are increasingly important and could attract investors.

Future Technological Roadmap

CoreWeave's plans for future innovation are critical to maintaining its competitive edge.

- Research and development: Investment in R&D will showcase its commitment to innovation.

- Planned expansions: Expansion plans into new geographic regions or service offerings indicate growth potential.

- New service offerings: Introduction of new services will broaden its appeal and revenue streams.

- Strategic partnerships: Collaborations with other technology companies will strengthen its market position.

Regulatory Environment and Macroeconomic Factors

External factors can significantly influence CoreWeave's stock performance.

Regulatory Landscape

Data privacy regulations and industry-specific compliance requirements can impact CoreWeave's operations.

- Data privacy regulations: Compliance with data privacy regulations like GDPR and CCPA is essential.

- Compliance requirements: Meeting industry-specific compliance standards will be crucial.

- Industry-specific regulations: Understanding and complying with relevant industry regulations is vital.

Macroeconomic Conditions

Macroeconomic factors, such as inflation and interest rates, can impact investor sentiment and stock valuations.

- Impact of inflation: High inflation can increase operating costs and potentially affect profitability.

- Interest rate sensitivity: Changes in interest rates can influence borrowing costs and investment decisions.

- Economic downturn scenarios: A recession could impact demand for cloud services and consequently affect CoreWeave's performance.

Conclusion

CoreWeave's stock performance, when it eventually goes public, will be influenced by a complex interplay of factors. Strong market demand driven by AI growth, robust financial performance, technological innovation, and a favorable regulatory environment are all crucial for success. While predicting the future is inherently uncertain, a combination of these positive factors suggests a strong potential for growth. However, competitive pressures and macroeconomic conditions must also be carefully considered. To stay informed about CoreWeave stock performance and its future trajectory, continue monitoring the company’s progress and stay updated on developments within the rapidly evolving cloud computing market. Conduct thorough research and follow reputable news sources to make informed decisions about this exciting opportunity.

Featured Posts

-

The Critical Role Of Middle Managers In Fostering A Thriving Workplace

May 22, 2025

The Critical Role Of Middle Managers In Fostering A Thriving Workplace

May 22, 2025 -

New Orleans Jail Escape Sheriff Halts Campaign

May 22, 2025

New Orleans Jail Escape Sheriff Halts Campaign

May 22, 2025 -

Innovatief Digitaal Platform Transferz Krijgt Financiering Van Abn Amro

May 22, 2025

Innovatief Digitaal Platform Transferz Krijgt Financiering Van Abn Amro

May 22, 2025 -

The Future Of Google Ai Addressing Investor Concerns And Demonstrating Success

May 22, 2025

The Future Of Google Ai Addressing Investor Concerns And Demonstrating Success

May 22, 2025 -

Blake Livelys Lawyer Allegedly Threatened To Leak Taylor Swift Texts The Full Story

May 22, 2025

Blake Livelys Lawyer Allegedly Threatened To Leak Taylor Swift Texts The Full Story

May 22, 2025

Latest Posts

-

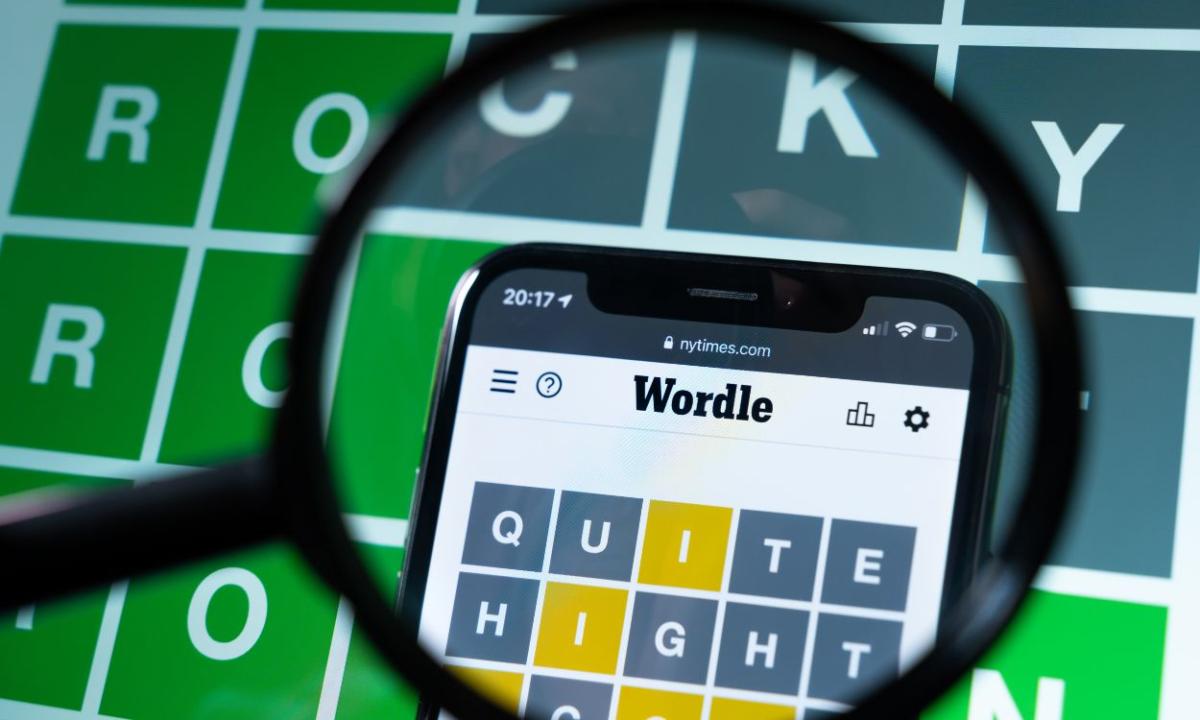

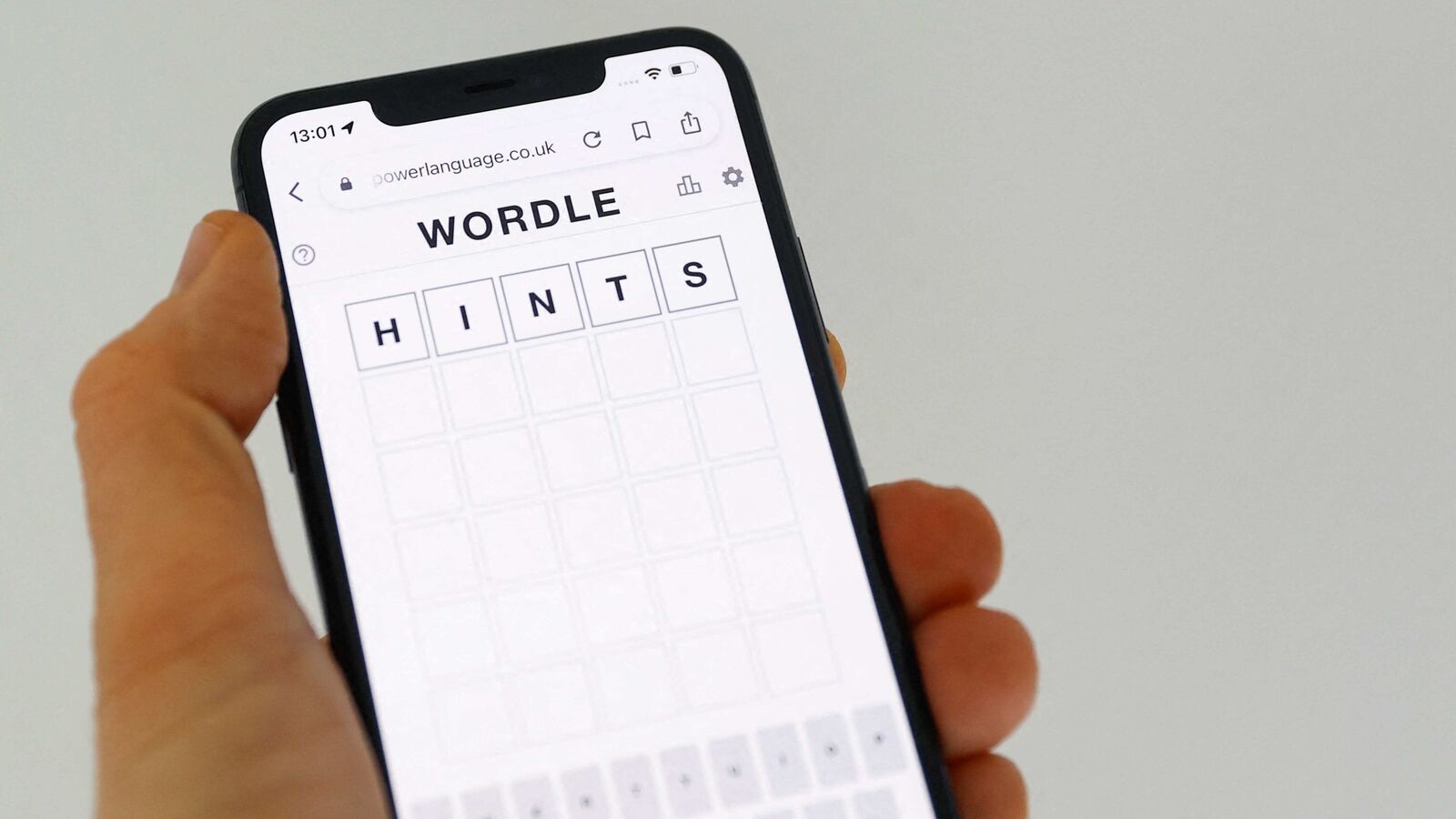

Wordle 370 March 20 Hints Clues To Help You Solve Todays Puzzle

May 22, 2025

Wordle 370 March 20 Hints Clues To Help You Solve Todays Puzzle

May 22, 2025 -

Wordle 370 Solution Hints And Clues For March 20th Game

May 22, 2025

Wordle 370 Solution Hints And Clues For March 20th Game

May 22, 2025 -

Thursdays Wordle 370 March 20th Hints Clues And Answer

May 22, 2025

Thursdays Wordle 370 March 20th Hints Clues And Answer

May 22, 2025 -

Saturday Wordle March 8th Puzzle 1358 Hints And Answer

May 22, 2025

Saturday Wordle March 8th Puzzle 1358 Hints And Answer

May 22, 2025 -

Wordle Game 370 March 20th Hints Clues And Solution

May 22, 2025

Wordle Game 370 March 20th Hints Clues And Solution

May 22, 2025