CoreWeave Stock Update: Current Market Performance And Future Outlook

Table of Contents

CoreWeave's Current Market Performance

Stock Price Analysis

Tracking CoreWeave's stock price requires close attention to daily fluctuations. While a publicly traded stock price isn't yet available (as of October 26, 2023, CoreWeave is a private company), analyzing its hypothetical performance based on comparable publicly traded cloud computing stocks offers valuable insights. We can observe trends in similar companies to anticipate potential CoreWeave price movements once it goes public. This would include factors like:

- Correlation with Tech Sector: The overall performance of the tech sector heavily influences cloud computing stocks. Positive tech market sentiment generally boosts CoreWeave's potential valuation.

- Interest Rate Sensitivity: Rising interest rates can negatively impact growth stocks like CoreWeave, as investors may shift towards more conservative investments.

- News Events: Major announcements regarding partnerships, new product launches, or funding rounds will likely significantly impact hypothetical CoreWeave price projections. (Note: Until CoreWeave goes public, price movements will be theoretical based on similar companies.)

(Insert hypothetical chart/graph visualizing price performance based on comparable stocks here)

Financial Performance Review

While detailed financial reports are not yet publicly available for CoreWeave, analyzing its funding rounds and growth trajectory provides a glimpse into its financial health. Key aspects to monitor once public filings are available include:

- Revenue Growth: The rate at which CoreWeave's revenue increases will be a critical indicator of its success. Strong revenue growth signals strong market demand for its services.

- Profitability: Achieving profitability will be a crucial milestone, demonstrating CoreWeave's ability to effectively manage costs and generate profits.

- Customer Acquisition Cost (CAC): A low CAC indicates efficiency in acquiring new clients, a key aspect of sustainable growth for any cloud computing company.

(Note: This section will require updates once CoreWeave releases its financial statements.)

Key Factors Influencing CoreWeave's Stock Price

Market Demand for GPU-Accelerated Computing

The demand for high-performance computing is exploding, fueled by the rapid growth of AI and machine learning. CoreWeave is perfectly positioned to capitalize on this trend:

- AI's Reliance on GPUs: Training advanced AI models requires immense computational power, making GPUs essential. CoreWeave's infrastructure directly addresses this need.

- Growth of Machine Learning Applications: The proliferation of machine learning applications across various industries further amplifies the demand for GPU-accelerated computing.

- Market Saturation Risk: While demand is high, potential market saturation from increased competition is a factor to consider. CoreWeave needs to maintain its innovative edge to stay ahead.

Competitive Landscape and Strategic Advantages

CoreWeave faces competition from established players like AWS, Google Cloud, and Azure, as well as other specialized GPU cloud providers. However, CoreWeave possesses several strategic advantages:

- Competitors: AWS, Google Cloud, Azure, and other smaller specialized providers.

- CoreWeave's Strengths: (Examples: Focus on sustainability, specialized expertise in specific AI workloads, superior pricing models – these would need to be researched and added based on available information.)

- Competitive Threats: New entrants into the GPU cloud computing market and the continuous innovation from existing competitors pose ongoing challenges.

Macroeconomic Factors and Regulatory Impacts

Broader macroeconomic conditions and regulatory changes will influence CoreWeave's stock performance:

- Interest Rate Hikes: Higher interest rates can increase borrowing costs and reduce investor appetite for growth stocks.

- Regulatory Hurdles: Data privacy regulations and antitrust concerns could impact CoreWeave's operations and growth.

- Geopolitical Events: Global events can create uncertainty and affect investor confidence in the tech sector.

Future Outlook and Investment Potential of CoreWeave Stock

Growth Projections and Market Opportunities

CoreWeave's future growth depends on several factors:

- Expansion Plans: CoreWeave's strategy for geographic expansion and market penetration will influence its growth trajectory.

- New Product Offerings: Development of new services and features will enhance its competitiveness and appeal to a broader customer base.

- Revenue Growth Projections: (This will need to be estimated based on market analysis and industry forecasts.)

Risk Assessment and Investment Considerations

Investing in CoreWeave stock carries inherent risks:

- Competition: Intense competition from established players could hinder CoreWeave's market share growth.

- Technological Disruptions: Rapid technological advancements could render CoreWeave's technology obsolete.

- Economic Downturns: Recessions can severely impact spending on cloud computing services.

Investors should carefully weigh these risks against the potential rewards before making any investment decisions.

Conclusion

CoreWeave's potential in the cloud computing market is significant, driven by the surging demand for GPU-accelerated computing. While challenges and risks exist, its strategic advantages and innovative focus position it for substantial growth. This CoreWeave stock update provides a preliminary overview; however, thorough independent research is crucial before any investment decisions are made. Stay informed on future CoreWeave updates and market analyses to refine your understanding of this dynamic company and make well-informed investment choices regarding CoreWeave stock.

Featured Posts

-

Noumatrouff Mulhouse Programmation Hellfest

May 22, 2025

Noumatrouff Mulhouse Programmation Hellfest

May 22, 2025 -

The Allure Of Cassis Blackcurrant Flavor Profile And Uses

May 22, 2025

The Allure Of Cassis Blackcurrant Flavor Profile And Uses

May 22, 2025 -

Abn Amro Ziet Occasionverkopen Flink Toegenemen

May 22, 2025

Abn Amro Ziet Occasionverkopen Flink Toegenemen

May 22, 2025 -

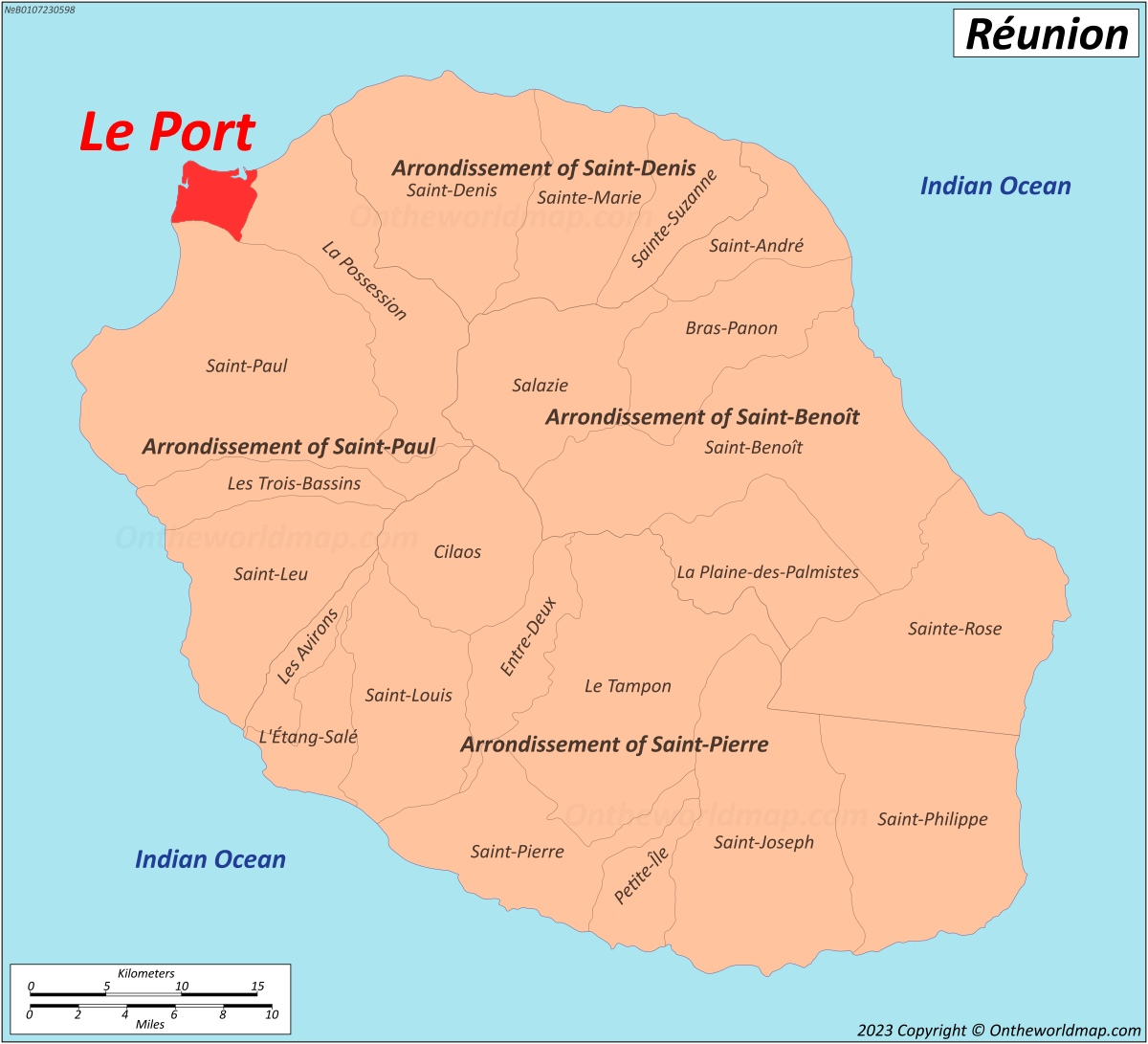

Le Port De La Croix Catholique Au College De Clisson Un Sujet Sensible

May 22, 2025

Le Port De La Croix Catholique Au College De Clisson Un Sujet Sensible

May 22, 2025 -

A Family Legacy The Traversos Of Cannes Film Festival Photography

May 22, 2025

A Family Legacy The Traversos Of Cannes Film Festival Photography

May 22, 2025

Latest Posts

-

Adam Ramey Dead At 31 Dropout Kings Singer Passes Away

May 22, 2025

Adam Ramey Dead At 31 Dropout Kings Singer Passes Away

May 22, 2025 -

Remembering A Rock Legend Frontman Passes Away At 32

May 22, 2025

Remembering A Rock Legend Frontman Passes Away At 32

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dead At Age Following Suicide

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dead At Age Following Suicide

May 22, 2025 -

Dropout Kings Adam Ramey Singer Dies At 31

May 22, 2025

Dropout Kings Adam Ramey Singer Dies At 31

May 22, 2025 -

Music World Mourns Dropout Kings Adam Ramey Dies At 32

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Dies At 32

May 22, 2025