Corporate Earnings Strength: A Temporary Phenomenon?

Table of Contents

Analyzing the Current Surge in Corporate Earnings Strength

The robust performance of many corporations in recent quarters is a complex phenomenon with multiple contributing factors. Let's examine some key drivers.

The Role of Post-Pandemic Recovery

The post-pandemic recovery has significantly boosted corporate earnings strength. Several key elements contributed to this surge:

- Increased consumer spending: Following lockdowns, pent-up demand unleashed a wave of consumer spending, driving sales across numerous sectors. This boosted revenues and profitability for many businesses.

- Pent-up demand: Consumers delayed purchases during lockdowns, leading to a surge in demand once restrictions eased. This pent-up demand fueled strong sales growth across various sectors, from retail and hospitality to automotive and technology.

- Supply chain improvements: While still facing challenges, supply chains have shown significant improvement compared to the bottlenecks experienced in 2021 and early 2022. This eased production constraints and allowed businesses to meet increased demand.

These factors combined to create a powerful tailwind for corporate earnings. However, the question remains: how long will this last?

Government Stimulus and its Impact

Government stimulus packages played a crucial role in supporting businesses and boosting corporate earnings strength during the pandemic. However, the long-term impact is debated:

- Effect of government aid packages: Direct financial aid, loan programs, and tax breaks provided a lifeline to many struggling businesses, preventing widespread bankruptcies and aiding recovery.

- Temporary tax breaks: Reduced tax burdens provided a temporary boost to corporate profits, but these measures are often not sustainable in the long term.

- Sustainability of stimulus-driven growth: The question remains whether the growth fueled by stimulus is sustainable without continued government intervention. As these programs wind down, the true resilience of corporate earnings will be tested.

Understanding the impact of government fiscal policy on corporate profits is essential to forecasting future performance.

Industry-Specific Trends Driving Earnings Growth

While the overall economy contributes, specific industries have experienced exceptional growth, significantly impacting overall corporate earnings strength:

- Technology sector: The tech sector continues to be a major driver of growth, fueled by increased digital adoption, cloud computing expansion, and the rise of artificial intelligence.

- Energy sector: High energy prices have boosted the profitability of energy companies, particularly those involved in oil and gas production. This sector's performance has significantly contributed to overall corporate earnings growth.

- Continued growth potential: While some sectors show signs of cooling, others maintain strong growth potential, creating an uneven landscape in corporate performance.

Analyzing these industry-specific trends is crucial for accurately assessing the overall health of the economy and the future of corporate earnings strength.

Factors That Could Indicate a Temporary Phenomenon

While the current surge in corporate earnings is impressive, several factors raise concerns about its long-term sustainability.

Inflationary Pressures and Rising Interest Rates

Inflation and rising interest rates pose significant challenges to corporate earnings strength:

- Impact on profit margins: Rising input costs erode profit margins, squeezing profitability for many businesses.

- Effect on borrowing costs: Higher interest rates increase borrowing costs, making investments more expensive and potentially hindering growth.

- Decreased consumer confidence: Inflation can lead to decreased consumer confidence and reduced spending, impacting sales and corporate revenue. This can lead to a potential economic slowdown or even recession.

These macroeconomic factors could significantly curb the current strong performance of many corporations.

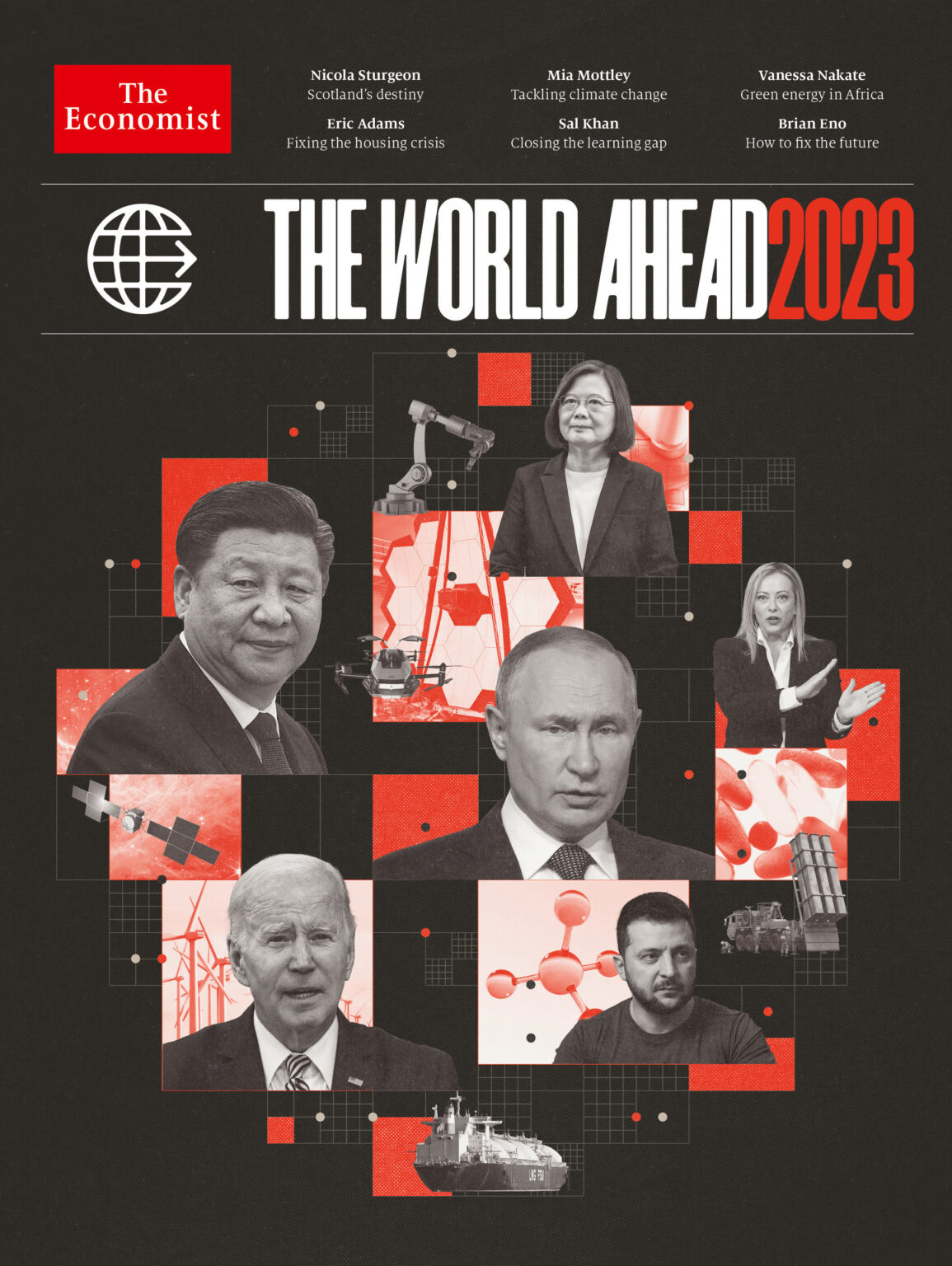

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability and ongoing supply chain disruptions are significant headwinds:

- Impact of global conflicts: Global conflicts and trade tensions create uncertainty and can disrupt supply chains, impacting production and increasing costs.

- Supply chain vulnerabilities: The lingering vulnerability of global supply chains remains a concern, potentially leading to further disruptions and cost increases.

- Uncertainty and its effect on investment: Geopolitical uncertainty discourages investment and can lead to decreased economic activity, negatively impacting corporate earnings.

These risks are substantial and could significantly dampen the current surge in corporate earnings strength.

Potential for a Recession

The possibility of a recession looms large, potentially significantly impacting corporate earnings strength:

- Economic indicators: Several economic indicators point to a potential economic downturn, including rising inflation, falling consumer confidence, and weakening manufacturing activity.

- Impact of a recession: A recession would likely lead to decreased consumer spending, reduced business investment, and lower corporate profits.

- Business resilience: Businesses need to develop strategies to navigate a potential economic downturn, focusing on cost efficiency and diversification.

Careful monitoring of economic indicators is critical for anticipating and mitigating the potential impact of a recession on corporate performance.

Conclusion

This article explored the factors driving the current strength in corporate earnings, highlighting both positive influences like post-pandemic recovery and potential threats such as inflation and geopolitical uncertainty. While the recent performance has been impressive, the sustainability of this corporate earnings strength remains questionable. A nuanced understanding of both the supporting and opposing factors is crucial for investors and businesses alike.

Call to Action: Understanding the complexities surrounding corporate earnings strength is critical for making informed investment decisions and strategic business planning. Stay informed about economic indicators and geopolitical events to navigate the ever-changing landscape of corporate earnings strength. Continue researching and analyzing key economic factors to assess the long-term prospects of corporate earnings strength and develop appropriate strategies for your business.

Featured Posts

-

Pilih Mana Perbandingan Lengkap Kawasaki W175 Dan Honda St 125 Dax

May 30, 2025

Pilih Mana Perbandingan Lengkap Kawasaki W175 Dan Honda St 125 Dax

May 30, 2025 -

Bts Future Top 10 Fan Questions Ahead Of 2025

May 30, 2025

Bts Future Top 10 Fan Questions Ahead Of 2025

May 30, 2025 -

Alcarazs Stunning Monte Carlo Victory A Comeback For The Ages

May 30, 2025

Alcarazs Stunning Monte Carlo Victory A Comeback For The Ages

May 30, 2025 -

Nominasi Amas 2025 Rm Bts Dan Kolaborasi Terbaru Yang Mengejutkan

May 30, 2025

Nominasi Amas 2025 Rm Bts Dan Kolaborasi Terbaru Yang Mengejutkan

May 30, 2025 -

Rediscovering The Lost Voices A Hollywood Golden Age Film Critic

May 30, 2025

Rediscovering The Lost Voices A Hollywood Golden Age Film Critic

May 30, 2025