Could 3% Mortgage Rates Revitalize Canada's Real Estate?

Table of Contents

The Current State of the Canadian Real Estate Market

Cooling Market Conditions

The Canadian real estate market is undeniably cooling. High interest rates, coupled with economic uncertainty, have significantly dampened buyer enthusiasm. We're seeing a marked decrease in sales activity and a correction in home prices across the country.

- Average home price decreases across major Canadian cities: According to the Canadian Real Estate Association (CREA), the national average home price has decreased by X% year-over-year (insert actual data with source citation). Major cities like Toronto and Vancouver have seen even steeper declines.

- Reduced sales volume compared to previous years: Sales volume has fallen significantly, reflecting a decrease in both buyer demand and available listings. (Insert data with source citation).

- Impact on different property types: The impact of the cooling market varies by property type. Condos, often favoured by first-time homebuyers, have seen a more pronounced price correction than detached houses in some regions.

- Increased inventory levels in some areas: While still below historical averages, inventory levels are increasing in certain markets, giving buyers more options and potentially reducing upward pressure on prices.

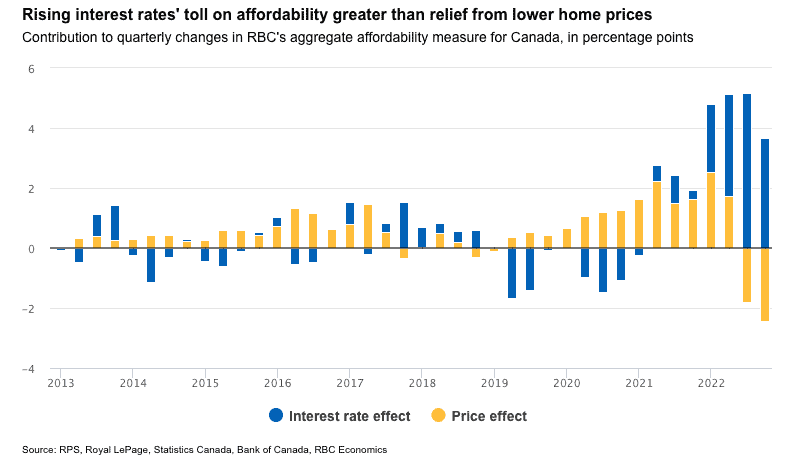

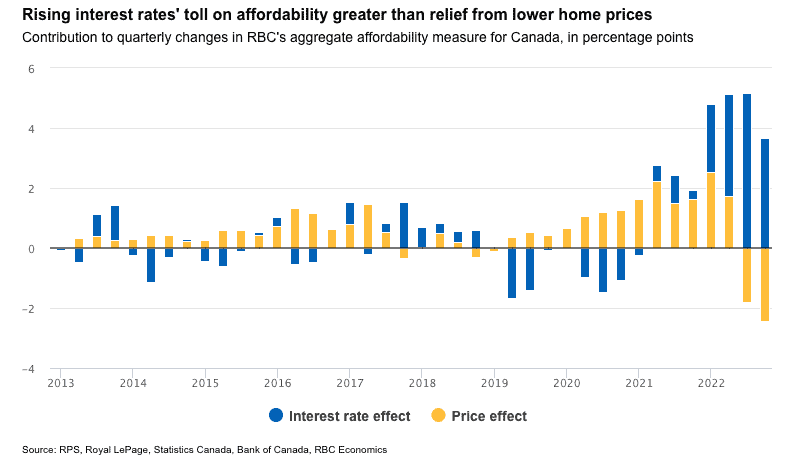

The Impact of High Interest Rates

The Bank of Canada's aggressive interest rate hikes have directly impacted affordability and buyer sentiment. Higher borrowing costs have reduced the purchasing power of potential homebuyers.

- Increased monthly mortgage payments: Even a small increase in interest rates can significantly impact monthly mortgage payments, making homeownership less accessible for many Canadians.

- Reduced borrowing power for potential homebuyers: Stricter stress test requirements, coupled with higher interest rates, have reduced the amount potential homebuyers can borrow.

- Increased stress test requirements: The Office of the Superintendent of Financial Institutions (OSFI) has implemented stricter stress tests to ensure borrowers can withstand higher interest rates, further limiting borrowing capacity.

- Shift in buyer behavior (more cautious approach): Buyers are adopting a more cautious approach, delaying purchases or opting for smaller properties to manage their financial risk in this environment.

The Potential Impact of 3% Mortgage Rates

Increased Affordability

A return to 3% mortgage rates would have a dramatic impact on affordability. The reduction in interest payments would significantly increase the purchasing power of potential homebuyers.

- Significant reduction in monthly mortgage payments: Lower interest rates would translate to substantially lower monthly mortgage payments, making homeownership more attainable for a larger segment of the population.

- Increased purchasing power for buyers: With lower monthly payments, buyers could afford larger homes or properties in more desirable locations.

- Potential resurgence of first-time homebuyers: The improved affordability could lead to a resurgence in first-time homebuyers entering the market, boosting demand.

- Impact on different income brackets: The impact would be most pronounced for lower- and middle-income households, who are disproportionately affected by higher interest rates.

Resurgence in Buyer Demand

A drop to 3% rates would likely lead to a significant increase in buyer activity. This could potentially reignite bidding wars and drive price increases in many markets.

- Increased competition amongst buyers: Increased demand would create more competition among buyers, potentially leading to offers above asking price.

- Potential for accelerated price growth in specific markets: Certain markets, particularly those with limited inventory, could experience rapid price appreciation.

- Return of investor activity: Lower interest rates could entice investors back into the market, further driving up demand.

- Potential strain on existing housing supply: The surge in demand could outstrip the available housing supply, potentially exacerbating existing affordability challenges.

Regional Variations

The impact of 3% mortgage rates would likely vary across different regions of Canada. Factors like existing inventory levels, local economic conditions, and housing type will all play a role.

- Varying levels of existing inventory: Markets with low inventory levels will likely experience a more significant price increase than those with higher inventory.

- Differences in local economic conditions: Regional economic differences will also influence the extent of the market's response to lower rates.

- Impact on different housing types in different regions: The impact on different property types (e.g., condos vs. detached houses) will also vary across regions depending on local market dynamics.

Potential Challenges and Risks

Inflationary Pressures

While lower mortgage rates could stimulate the economy, they also pose the risk of fueling inflationary pressures. This could lead to the Bank of Canada raising interest rates again, negating the positive impact of the initial drop.

Market Volatility

A rapid shift to lower interest rates could increase market volatility, creating uncertainty for both buyers and sellers. The potential for speculative bubbles also increases in such an environment.

Supply Constraints

Canada continues to face a significant housing shortage. A sudden increase in demand driven by lower interest rates could exacerbate this problem, potentially driving prices even higher in the long run.

Conclusion

A return to 3% mortgage rates could potentially revitalize Canada's real estate market by boosting affordability and buyer demand. However, it's crucial to acknowledge the potential challenges, including inflationary pressures, increased market volatility, and persistent supply constraints. The interplay of these factors makes predicting the precise impact of such a significant rate decrease extremely complex. While the prospect of lower rates is alluring, it's essential to approach it with caution.

Call to Action: While the possibility of a return to 3% mortgage rates and the subsequent revitalization of Canada's real estate market is intriguing, the situation is far from simple. Stay informed about market trends and interest rate changes to make informed decisions about your real estate investments. Continuously monitor the Canadian mortgage rate landscape and its implications for your financial future.

Featured Posts

-

The Significance Of Sylvester Stallones Appearance In Jason Stathams Action Movie

May 12, 2025

The Significance Of Sylvester Stallones Appearance In Jason Stathams Action Movie

May 12, 2025 -

How Adam Sandler Met His Wife A New Netflix Films Untold Story

May 12, 2025

How Adam Sandler Met His Wife A New Netflix Films Untold Story

May 12, 2025 -

Semana De Turismo En Uruguay Un Analisis De Su Nombre Y El Laicismo Uruguayo

May 12, 2025

Semana De Turismo En Uruguay Un Analisis De Su Nombre Y El Laicismo Uruguayo

May 12, 2025 -

Superman Daredevil Vs Bullseye 1923 And More Your Daily Dose Of Comic Book News

May 12, 2025

Superman Daredevil Vs Bullseye 1923 And More Your Daily Dose Of Comic Book News

May 12, 2025 -

Shane Lowrys Feelings Mc Ilroys Masters 2024

May 12, 2025

Shane Lowrys Feelings Mc Ilroys Masters 2024

May 12, 2025