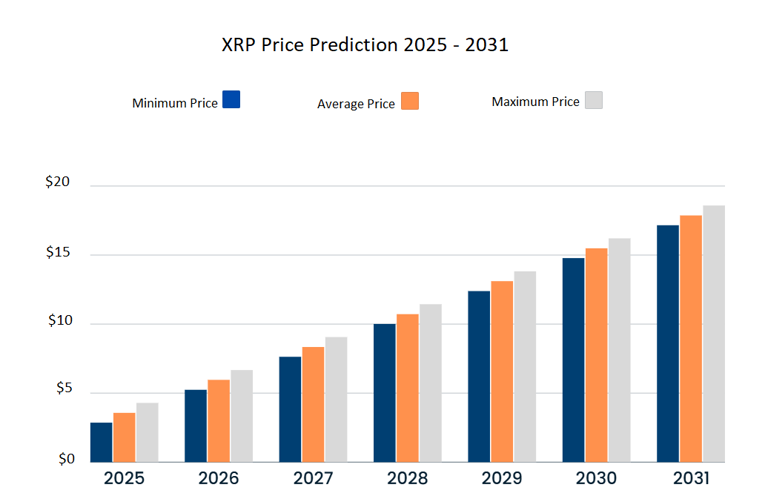

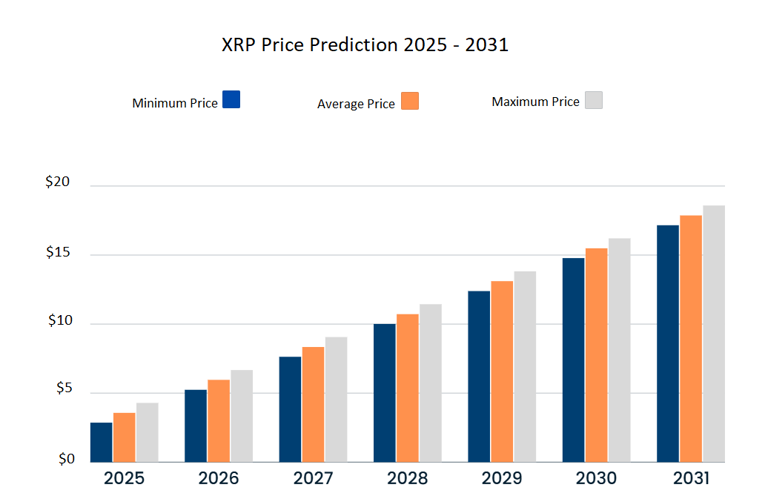

Could XRP Reach $5 By 2025? A Realistic Analysis

Table of Contents

The cryptocurrency market is notorious for its volatility, and XRP is no exception. Its price has swung wildly over the years, leading many to speculate about its future. An ambitious XRP price prediction frequently tossed around is a price of $5 by 2025. But is this realistic? This article aims to provide a realistic assessment of the likelihood of XRP reaching this target, considering various factors influencing its price. We'll delve into the current market conditions, technological advancements, and macroeconomic trends to formulate a well-informed XRP price prediction.

XRP, the native cryptocurrency of the Ripple network, facilitates fast and low-cost cross-border payments. While it has experienced periods of significant growth, it has also faced considerable setbacks, notably the ongoing legal battle with the Securities and Exchange Commission (SEC). Understanding its current market position and future prospects is crucial for anyone considering XRP as an investment.

XRP's Current Market Position and Adoption:

Market Capitalization and Trading Volume:

XRP consistently ranks among the top cryptocurrencies by market capitalization, though its position fluctuates. Analyzing its market cap alongside giants like Bitcoin and Ethereum provides crucial context. Its trading volume reflects its liquidity and overall market interest. Let's look at some key data points:

- Market Cap Comparison: While significantly smaller than Bitcoin and Ethereum, XRP's market cap shows its considerable size within the cryptocurrency ecosystem. Direct comparison reveals the substantial ground it needs to cover to reach a $5 price point, implying a massive increase in market cap.

- Trading Volume Trends: Examining historical trading volume reveals periods of high activity, often correlating with price spikes. Conversely, periods of low volume can indicate decreased market interest. Sustained high volume is essential for sustained price growth.

- Exchange Listings: The availability of XRP on major cryptocurrency exchanges is crucial for accessibility and trading liquidity. New listings on prominent exchanges can positively impact trading volume and price.

Ripple's Legal Battles and Their Impact:

The SEC's lawsuit against Ripple has significantly impacted XRP's price and investor sentiment. The outcome of this case remains uncertain, yet carries immense weight:

- Key Arguments: The SEC alleges that XRP is an unregistered security, while Ripple maintains it's a utility token. The legal arguments are complex, and the resolution could have profound consequences for XRP's future.

- Potential Outcomes: A favorable ruling could lead to a significant surge in XRP's price, as it would remove a significant hurdle to wider adoption. Conversely, an unfavorable ruling could further depress the price.

- Impact on Investor Sentiment: The legal uncertainty has created considerable volatility in XRP's price. Positive news tends to generate price increases, while negative news leads to price drops. Investor confidence is directly linked to the lawsuit's outcome.

Institutional Adoption and Partnerships:

Ripple's success depends on the adoption of XRP by financial institutions for cross-border payments. The level of institutional partnerships plays a critical role:

- Significant Partnerships: Ripple has secured partnerships with several major financial institutions, demonstrating a growing interest in using XRP for its intended purpose. These partnerships add legitimacy and potential for wider adoption.

- Potential for Future Adoption: The more financial institutions integrate XRP into their systems, the greater the potential for price appreciation due to increased demand. This is a key factor in any long-term XRP price prediction.

Technological Factors and Future Development:

XRP Ledger's Scalability and Efficiency:

The XRP Ledger's performance is crucial for its long-term success:

- Transaction Speed and Low Fees: The XRP Ledger boasts fast transaction speeds and significantly lower fees compared to other payment networks. This makes it a competitive alternative for cross-border payments.

- Energy Consumption: The XRP Ledger's energy efficiency is another advantage, aligning with growing environmental concerns surrounding cryptocurrency mining.

- Potential for Improvement: Continuous upgrades and improvements to the XRP Ledger could further enhance its scalability and efficiency, making it even more attractive to users and institutions.

Ongoing Development and Future Upgrades:

Ripple's commitment to developing and improving the XRP Ledger is crucial:

- Upcoming Features: New features and upgrades could expand the XRP Ledger's functionality and attract new users. The development roadmap provides insights into potential future improvements.

- New Use Cases: Exploring and developing new use cases beyond cross-border payments can broaden XRP's appeal and drive adoption.

Macroeconomic Factors and Market Sentiment:

Overall Cryptocurrency Market Trends:

The broader cryptocurrency market significantly influences XRP's price:

- Bull and Bear Markets: Cryptocurrency markets are cyclical, experiencing periods of significant growth (bull markets) and decline (bear markets). XRP is susceptible to these broader market trends.

- Regulatory Changes: Regulatory developments globally can impact the entire cryptocurrency market, influencing investor sentiment and affecting XRP's price. This is a major external factor.

Investor Sentiment and Speculation:

Investor sentiment and speculation play a huge role in XRP's price volatility:

- Social Media Sentiment: Social media sentiment towards XRP can influence price movements, with positive news driving price increases and negative news causing price drops.

- Market Predictions: Influencer opinions and market predictions can sway investor sentiment and create speculative buying or selling pressure.

Conclusion:

Predicting whether XRP will reach $5 by 2025 requires careful consideration of several interconnected factors. While the potential for growth exists, driven by technological advantages and partnerships, the ongoing legal battle poses a significant challenge. The overall cryptocurrency market trends and investor sentiment will also play crucial roles. A positive resolution to the SEC lawsuit, coupled with increased institutional adoption and further development of the XRP Ledger, could significantly improve the probability of reaching this target. However, a negative outcome or a prolonged bear market could significantly hinder progress. While a $5 price target is ambitious, it's not entirely impossible.

Realistic Assessment: Given the current uncertainties, predicting the precise price is speculative. The probability of XRP reaching $5 by 2025 is moderate, contingent on several positive developments.

Call to Action: While predicting the future of XRP is challenging, understanding the factors influencing its price is crucial. Conduct your own in-depth research on XRP price prediction before making any investment decisions. Remember to always invest responsibly and only with capital you can afford to lose.

Featured Posts

-

Uber Expands Pet Transportation Services To Delhi And Mumbai

May 08, 2025

Uber Expands Pet Transportation Services To Delhi And Mumbai

May 08, 2025 -

Saglik Bakanligi Personel Alimi 37 000 Kisi Icin Basvuru Kilavuzu Ve Tarihler

May 08, 2025

Saglik Bakanligi Personel Alimi 37 000 Kisi Icin Basvuru Kilavuzu Ve Tarihler

May 08, 2025 -

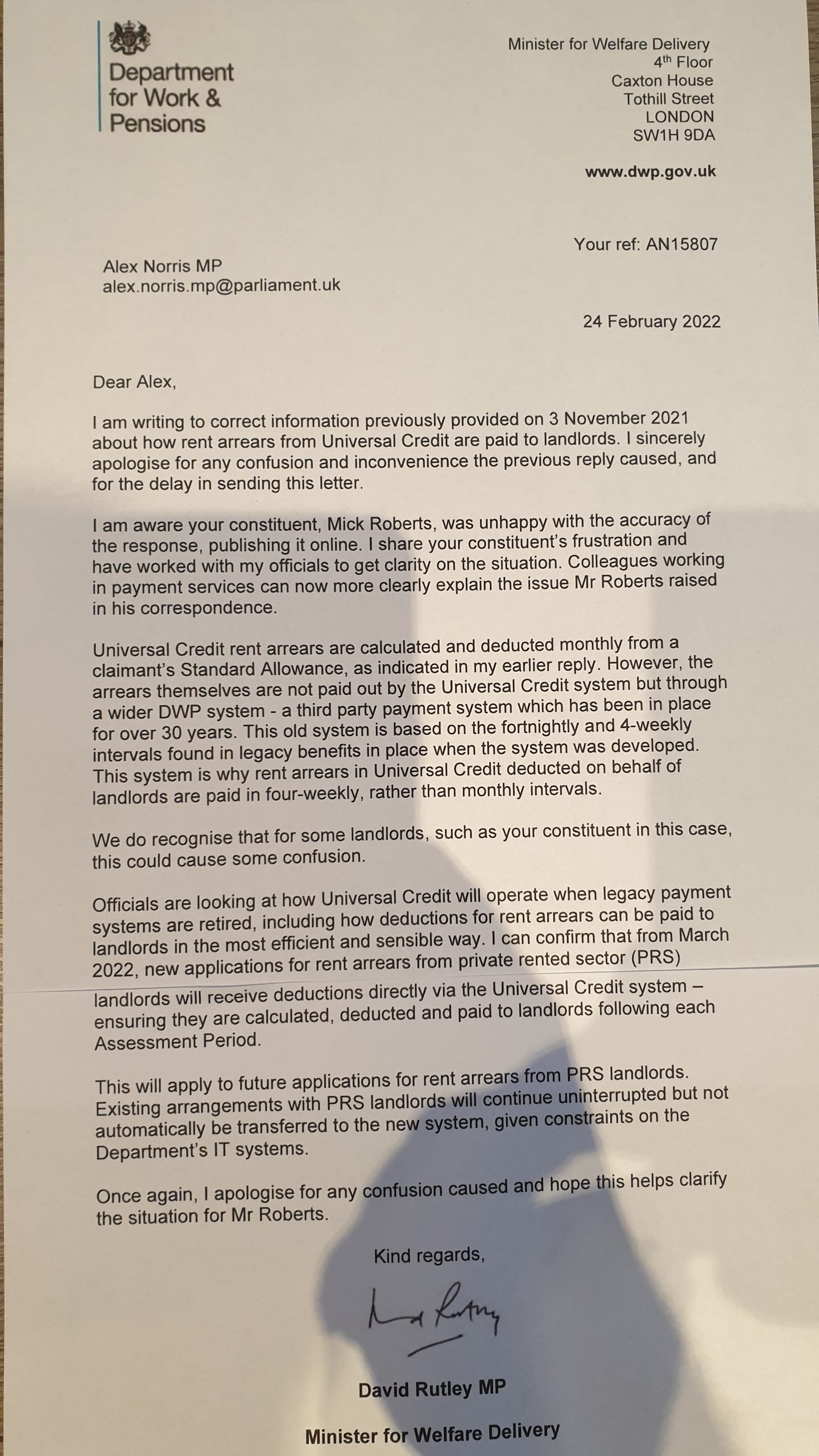

Lost Dwp Letter How To Avoid A 6 828 Financial Penalty

May 08, 2025

Lost Dwp Letter How To Avoid A 6 828 Financial Penalty

May 08, 2025 -

Us Canada Trade Talks A Path Towards Coherence

May 08, 2025

Us Canada Trade Talks A Path Towards Coherence

May 08, 2025 -

Dupla De Arrascaeta Garante Triunfo Do Flamengo No Brasileirao Contra O Gremio

May 08, 2025

Dupla De Arrascaeta Garante Triunfo Do Flamengo No Brasileirao Contra O Gremio

May 08, 2025