Crack The Code: 5 Do's & Don'ts For Private Credit Jobs

Table of Contents

Do's for Landing Your Dream Private Credit Job

Develop Specialized Skills

The private credit industry demands a specialized skill set. To stand out from the crowd, you must master several key areas:

- Financial Modeling: Proficiency in building complex financial models, including LBO (leveraged buyout) models, is paramount.

- Valuation: A deep understanding of various valuation methodologies (DCF, precedent transactions, etc.) is essential for analyzing potential investments.

- Credit Analysis: Mastering the art of credit analysis, including assessing credit risk and structuring debt, is crucial.

- Due Diligence: Experience in conducting thorough due diligence investigations on potential investments is highly valued.

- Industry Knowledge: Familiarity with specific industries (e.g., real estate, healthcare, technology) will significantly enhance your appeal.

- Legal Document Understanding: Understanding loan agreements, security agreements, and other legal documents is crucial.

Mastering these skills requires dedication. Practice using software like Excel and the Bloomberg Terminal. Consider taking online courses on platforms like Coursera or edX, or pursuing relevant certifications like the CFA charter. The more specialized your skillset, the more competitive you will be in the private credit jobs market.

Network Strategically

Networking is not just beneficial; it's essential in the private credit industry. Many private credit jobs are never publicly advertised.

- Industry Events: Attend conferences, workshops, and networking events related to private equity, private debt, and alternative investments.

- LinkedIn: Actively connect with professionals working in private credit funds and related fields.

- Informational Interviews: Reach out to individuals working in your target roles for informational interviews to learn about their experiences and gain insights.

- Recruiters: Build relationships with recruiters who specialize in placing professionals in the finance industry, particularly private credit.

Remember, networking is about building genuine relationships, not just collecting contacts. Prepare thoughtful questions, show genuine interest in their work, and follow up after each interaction. These efforts can significantly increase your chances of uncovering hidden private credit job opportunities.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. They must showcase your skills and experience effectively.

- Tailor to Each Job: Customize your resume and cover letter for each application, highlighting the skills and experience most relevant to the specific job description.

- Quantify Accomplishments: Use numbers and data to demonstrate the impact of your work. Instead of saying "Improved efficiency," say "Improved efficiency by 15%."

- Highlight Relevant Skills: Emphasize your expertise in financial modeling, valuation, credit analysis, and other relevant skills.

- Private Credit Principles: Demonstrate your understanding of private credit principles, investment strategies, and market trends.

Use keywords from the job description to improve the chances of your application being noticed by Applicant Tracking Systems (ATS). A strong resume and cover letter are critical for landing an interview for private credit jobs.

Ace the Interview Process

The interview process for private credit jobs is rigorous. Preparation is key.

- Behavioral Questions: Prepare for common behavioral questions using the STAR method (Situation, Task, Action, Result).

- Technical Questions: Expect questions on financial modeling, valuation, and credit analysis. Practice your technical skills.

- Case Studies: Be ready to analyze hypothetical investment scenarios and demonstrate your problem-solving abilities.

- Market Trends: Stay up-to-date on current private credit market trends and be prepared to discuss them.

- Firm Research: Thoroughly research the firm's investment strategy, portfolio companies, and culture before the interview.

Demonstrate your enthusiasm for the industry and your understanding of private credit concepts. Your preparation will make a significant difference in securing a private credit analyst position or similar private credit jobs.

Don'ts for Private Credit Job Seekers

Neglecting Fundamental Financial Skills

A solid foundation in accounting, finance, and valuation is non-negotiable. Don't underestimate the importance of these core skills.

Underestimating the Importance of Networking

Don't rely solely on online job applications. The majority of private credit jobs are filled through networking. Active networking is your secret weapon.

Submitting Generic Applications

Avoid generic resumes and cover letters. Each application must be tailored to the specific job and company. Show genuine interest in each opportunity.

Ignoring Due Diligence on Firms

Don't accept a job offer without thoroughly researching the firm's reputation, culture, and investment strategy. Choose a firm whose values align with yours.

Unlock Your Private Credit Career

To summarize, landing a private credit job requires developing specialized skills, networking strategically, crafting compelling applications, and acing the interview process. Avoid neglecting fundamental skills, underestimating networking, submitting generic applications, and ignoring due diligence on potential employers. By following these do's and don'ts, you'll significantly increase your chances of landing your dream private credit job, breaking into the private credit industry, and mastering the art of private credit job hunting. Start applying these strategies today and begin your journey towards a successful career in private credit! Check out [link to relevant job board/resource] for more opportunities.

Featured Posts

-

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Personazhey Izvestnoy Kinolenty

May 25, 2025

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Personazhey Izvestnoy Kinolenty

May 25, 2025 -

Europese Aandelenmarkt Een Vergelijking Met Wall Street En Toekomstperspectief

May 25, 2025

Europese Aandelenmarkt Een Vergelijking Met Wall Street En Toekomstperspectief

May 25, 2025 -

The Busiest Days To Fly Around Memorial Day 2025 A Travel Guide

May 25, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travel Guide

May 25, 2025 -

Pennsylvania Under Flash Flood Warning Thursday Morning Update

May 25, 2025

Pennsylvania Under Flash Flood Warning Thursday Morning Update

May 25, 2025 -

Escape To The Country Top Locations And Considerations

May 25, 2025

Escape To The Country Top Locations And Considerations

May 25, 2025

Latest Posts

-

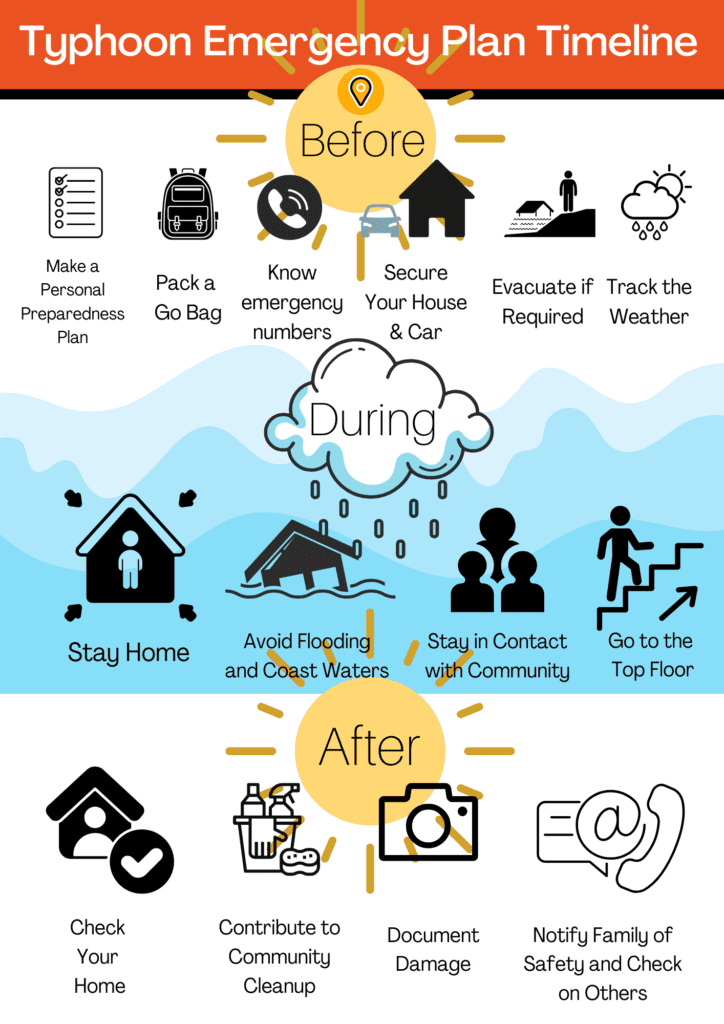

Staying Safe With Flood Alerts A Guide To Protecting Your Family And Home

May 25, 2025

Staying Safe With Flood Alerts A Guide To Protecting Your Family And Home

May 25, 2025 -

Navigating Flood Alerts Preparedness And Response For Your Community

May 25, 2025

Navigating Flood Alerts Preparedness And Response For Your Community

May 25, 2025 -

Effective Flood Alert Systems How They Work And Protect You

May 25, 2025

Effective Flood Alert Systems How They Work And Protect You

May 25, 2025 -

Heavy Rain Triggers Flash Flood Warning Across South Florida

May 25, 2025

Heavy Rain Triggers Flash Flood Warning Across South Florida

May 25, 2025 -

Flood Alerts A Comprehensive Guide To Safety And Preparedness

May 25, 2025

Flood Alerts A Comprehensive Guide To Safety And Preparedness

May 25, 2025