Credit Card Industry Braces For Impact Of Reduced Consumer Spending

Table of Contents

Impact on Credit Card Revenue and Profitability

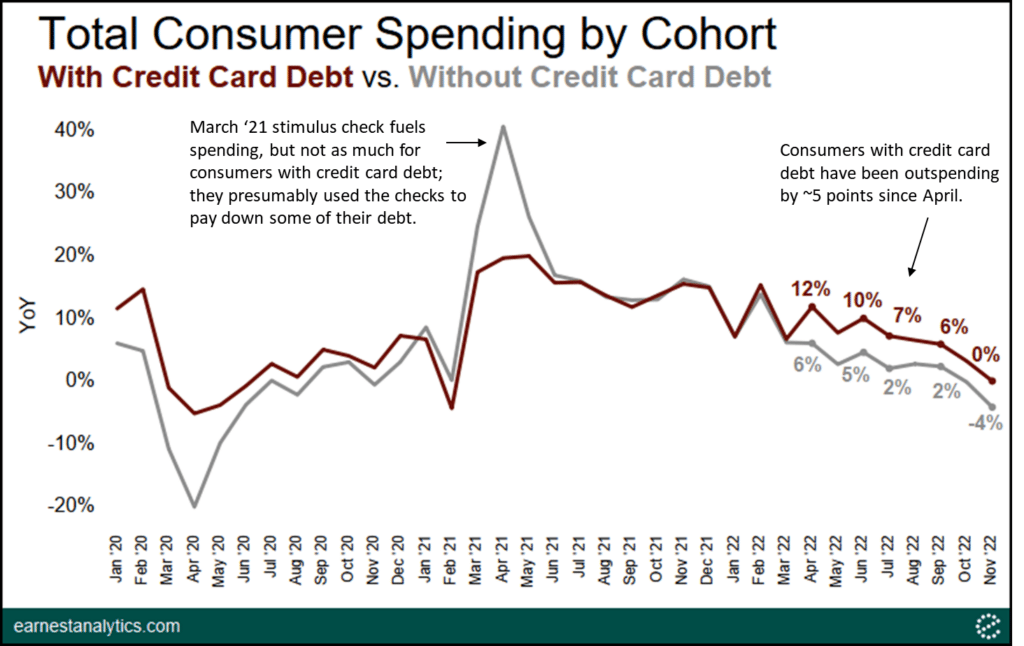

Reduced consumer spending directly impacts the profitability of the credit card industry. Lower spending translates to several key challenges:

Decreased Transaction Volumes

Reduced spending directly translates to fewer transactions processed by credit card companies, leading to a decline in interchange fees – their primary revenue source. Interchange fees are the fees merchants pay to card networks (like Visa and Mastercard) for processing credit card transactions. A reduction in these fees significantly impacts a credit card company's bottom line.

- Lower retail sales: Economic downturns often lead to decreased consumer confidence and reduced spending at physical stores.

- Less online shopping: While e-commerce remains resilient, reduced discretionary spending affects online purchases as well.

- Decreased travel and entertainment spending: These sectors are particularly vulnerable to economic downturns, resulting in fewer transactions.

The mechanics are simple: fewer purchases mean fewer interchange fees collected by credit card companies, leading to a direct reduction in revenue. Industry analysts predict a [Insert Statistic or Projection from a Reputable Source, e.g., "5-10% decrease in transaction volume" ] in the coming year due to reduced consumer spending.

Increased Delinquency Rates

As consumers face financial hardship – stemming from job losses, wage stagnation, or rising interest rates – the likelihood of missed or delayed credit card payments increases dramatically. This results in higher delinquency rates and potential loan losses for credit card companies.

- Job losses: Layoffs and reduced working hours directly impact consumers' ability to meet their financial obligations.

- Wage stagnation: Slower wage growth compared to inflation reduces consumers' purchasing power and increases financial strain.

- Rising interest rates: Higher interest rates increase the cost of borrowing and make it harder for consumers to manage their credit card debt.

Rising delinquencies directly impact a credit card company's balance sheet, potentially leading to significant write-offs and impacting profitability. The increased risk of default necessitates more stringent credit risk management practices.

Pressure on Credit Card Lending

With reduced consumer demand and increased risk, credit card companies may find it harder to issue new credit cards and increase credit limits, impacting overall loan portfolio growth.

- Increased risk aversion by lenders: Credit card companies become more cautious about extending credit due to the higher risk of defaults.

- Stricter credit scoring criteria: Lenders tighten their approval criteria, making it harder for consumers with less-than-perfect credit scores to obtain credit.

This pressure on credit card lending not only reduces revenue from new credit card issuance but also limits the potential for growth in the overall loan portfolio.

Strategic Responses by Credit Card Companies

Faced with these challenges, credit card companies are actively developing and implementing strategies to mitigate the impact of reduced consumer spending.

Aggressive Customer Retention Strategies

Credit card companies are intensifying efforts to retain existing customers by offering attractive incentives and rewards programs.

- Loyalty programs: Enhanced rewards programs to incentivize continued usage.

- Cashback offers: Increased cashback percentages on specific purchases or categories.

- Balance transfer promotions: Attractive offers to transfer balances from other high-interest credit cards.

These retention strategies aim to maintain transaction volume and revenue despite the overall decline in consumer spending. However, the effectiveness and cost-benefit analysis of such strategies require careful consideration.

Focus on Fintech Partnerships and Innovation

Collaboration with fintech companies to enhance digital offerings and explore new revenue streams will become increasingly crucial.

- Buy Now Pay Later (BNPL) integration: Offering BNPL options to attract customers and increase transaction volume.

- Enhanced mobile payment solutions: Investing in and improving mobile payment technologies for greater convenience and accessibility.

- Personalized financial management tools: Offering budgeting and financial planning tools to help customers manage their finances effectively.

These partnerships can help mitigate the impact of reduced spending and potentially open new market opportunities. The integration of innovative technologies will be critical for adaptation and survival.

Emphasis on Risk Management and Fraud Prevention

With increased financial stress, the risk of fraudulent activities increases, necessitating robust fraud detection and prevention mechanisms.

- Advanced analytics: Utilizing data analytics to identify and prevent fraudulent transactions.

- AI-powered fraud detection systems: Implementing artificial intelligence to detect and prevent fraud in real-time.

- Enhanced security measures: Strengthening security protocols and authentication measures to protect customer data and prevent unauthorized access.

Proactive risk management is paramount in this challenging economic environment. Investing in advanced technologies and security measures is crucial to protect both the company and its customers.

Conclusion

The impact of reduced consumer spending on the credit card industry is undeniable. Decreased transaction volumes, rising delinquency rates, and pressure on lending are significant challenges that require proactive and innovative solutions. Credit card companies must adapt by focusing on customer retention, strategic partnerships, and robust risk management strategies to navigate this period of economic uncertainty. Understanding the implications of reduced consumer spending is crucial for both industry players and consumers alike. Stay informed on the latest developments in the credit card industry and adapt your financial strategies accordingly to mitigate the effects of reduced consumer spending and plan for the future.

Featured Posts

-

Game Recap Hield And Paytons Bench Play Leads Warriors Past Blazers

Apr 24, 2025

Game Recap Hield And Paytons Bench Play Leads Warriors Past Blazers

Apr 24, 2025 -

Tariff Hopes Fuel Stock Market Rally Dow Up 1000 Points

Apr 24, 2025

Tariff Hopes Fuel Stock Market Rally Dow Up 1000 Points

Apr 24, 2025 -

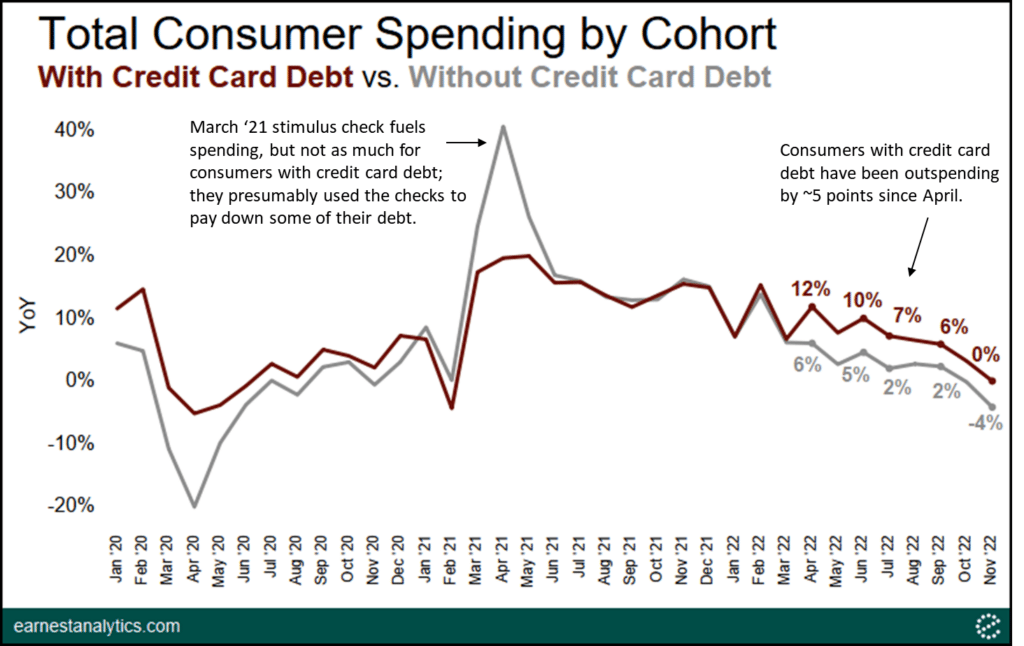

Fewer Border Crossings White House Reports Decline In Canada U S Border Apprehensions

Apr 24, 2025

Fewer Border Crossings White House Reports Decline In Canada U S Border Apprehensions

Apr 24, 2025 -

Zaboravljeni Projekt Tarantino I Travolta Film Koji Nikad Nisu Pogledali

Apr 24, 2025

Zaboravljeni Projekt Tarantino I Travolta Film Koji Nikad Nisu Pogledali

Apr 24, 2025 -

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025