Credit Score Damage Control: Understanding The Impact Of Unpaid Student Loans

Table of Contents

The Devastating Effect of Unpaid Student Loans on Your Credit Score

Unpaid student loans have a profoundly negative impact on your credit score. This isn't just a minor inconvenience; it can significantly hinder your financial well-being for years to come. The damage stems from several key factors:

- Delinquency reporting to credit bureaus (Equifax, Experian, TransUnion): When you miss a student loan payment, your lender reports this delinquency to the three major credit bureaus. This negative mark remains on your credit report for several years, significantly impacting your credit score.

- Significant score reduction impacting loan approvals and interest rates: A lower credit score directly translates to higher interest rates on future loans – mortgages, auto loans, credit cards – making borrowing significantly more expensive. It can even make securing a loan impossible.

- Potential for collection agency involvement further damaging credit: If you continue to miss payments, your loan will likely be sent to a collection agency. This further damages your credit score and can lead to legal action.

- Difficulty securing future loans (mortgages, auto loans, etc.): Lenders use your credit score to assess your risk. A damaged credit score due to unpaid student loans can prevent you from securing essential loans, such as a mortgage for a home purchase or an auto loan.

- Impact on rental applications and employment opportunities (background checks): Some landlords and employers conduct credit checks as part of their screening process. A poor credit score can negatively impact your chances of securing housing or employment.

Understanding the Different Stages of Delinquency

The severity of the impact on your credit score increases with the length of delinquency. Understanding these stages is crucial:

- 30-day delinquency: While the initial impact might be relatively small, a 30-day delinquency is still a negative mark on your credit report and will cause your credit score to drop. This is a warning sign that action needs to be taken immediately.

- 60-day delinquency: A 60-day delinquency results in a more significant credit score decrease. You'll likely receive collection notices and the damage to your credit becomes more substantial.

- 90+ day delinquency: This represents severe credit score damage and almost certainly means your loan has been referred to collections. The negative impact on your credit report will be substantial and long-lasting. This stage often leads to wage garnishment or legal action.

- Impact of each stage on potential future borrowing: Each stage of delinquency exponentially reduces your chances of securing favorable loan terms. The longer you're delinquent, the harder it will be to borrow money in the future.

Strategies for Credit Score Repair After Student Loan Default

Even after your student loans have defaulted, there are steps you can take to repair your credit. Proactive measures are key:

- Contact your lender immediately: Don't wait until you're in deep trouble. Reach out to your lender to explore options like deferment (temporarily suspending payments), forbearance (reducing payments), or income-driven repayment plans (adjusting payments based on your income).

- Negotiate a repayment plan: Work with your lender to negotiate a repayment plan that fits your budget. Even small, consistent payments demonstrate good faith and can prevent further damage.

- Credit counseling: Seek professional guidance from a reputable non-profit credit counseling agency. They can help you create a budget, negotiate with creditors, and develop a plan to manage your debt.

- Debt consolidation: Consolidating multiple student loans into a single loan with a lower interest rate can simplify repayment and potentially lower your monthly payments.

- Dispute inaccuracies: Carefully review your credit report for any errors. If you find inaccuracies, dispute them with the credit bureaus immediately.

- Monitor your credit report regularly: Regularly check your credit report (you're entitled to a free copy annually from each bureau) to track your progress and identify any potential issues.

The Importance of Seeking Professional Help

Navigating the complexities of student loan debt and credit repair can be overwhelming. Consider seeking professional help:

- Expertise in navigating complex repayment options: Financial advisors and credit repair specialists possess in-depth knowledge of various repayment options and can help you choose the best course of action for your situation.

- Assistance in negotiating with lenders and collection agencies: They can act as intermediaries, negotiating more favorable terms on your behalf.

- Development of a personalized plan for credit score recovery: A professional can create a customized plan tailored to your specific circumstances, helping you regain control of your finances.

- Guidance on managing future debt: They'll provide valuable insights into responsible debt management to prevent future problems.

Conclusion

Unpaid student loans can severely damage your credit score, impacting various aspects of your financial life. However, proactive steps such as contacting your lender, exploring repayment options, and seeking professional help can significantly mitigate the damage and pave the way for credit score recovery. Remember that even a small effort towards addressing your student loan debt is a step in the right direction for your financial health.

Don't let unpaid student loans derail your financial future. Take control of your credit score today by exploring repayment options and seeking the necessary support to manage your student loan debt effectively. Start your credit score damage control now!

Featured Posts

-

Is The Doctor Who Christmas Special Scrapped

May 17, 2025

Is The Doctor Who Christmas Special Scrapped

May 17, 2025 -

How To Watch The Philadelphia 76ers Vs Ny Knicks Game Tonight Live Stream And Tv Info

May 17, 2025

How To Watch The Philadelphia 76ers Vs Ny Knicks Game Tonight Live Stream And Tv Info

May 17, 2025 -

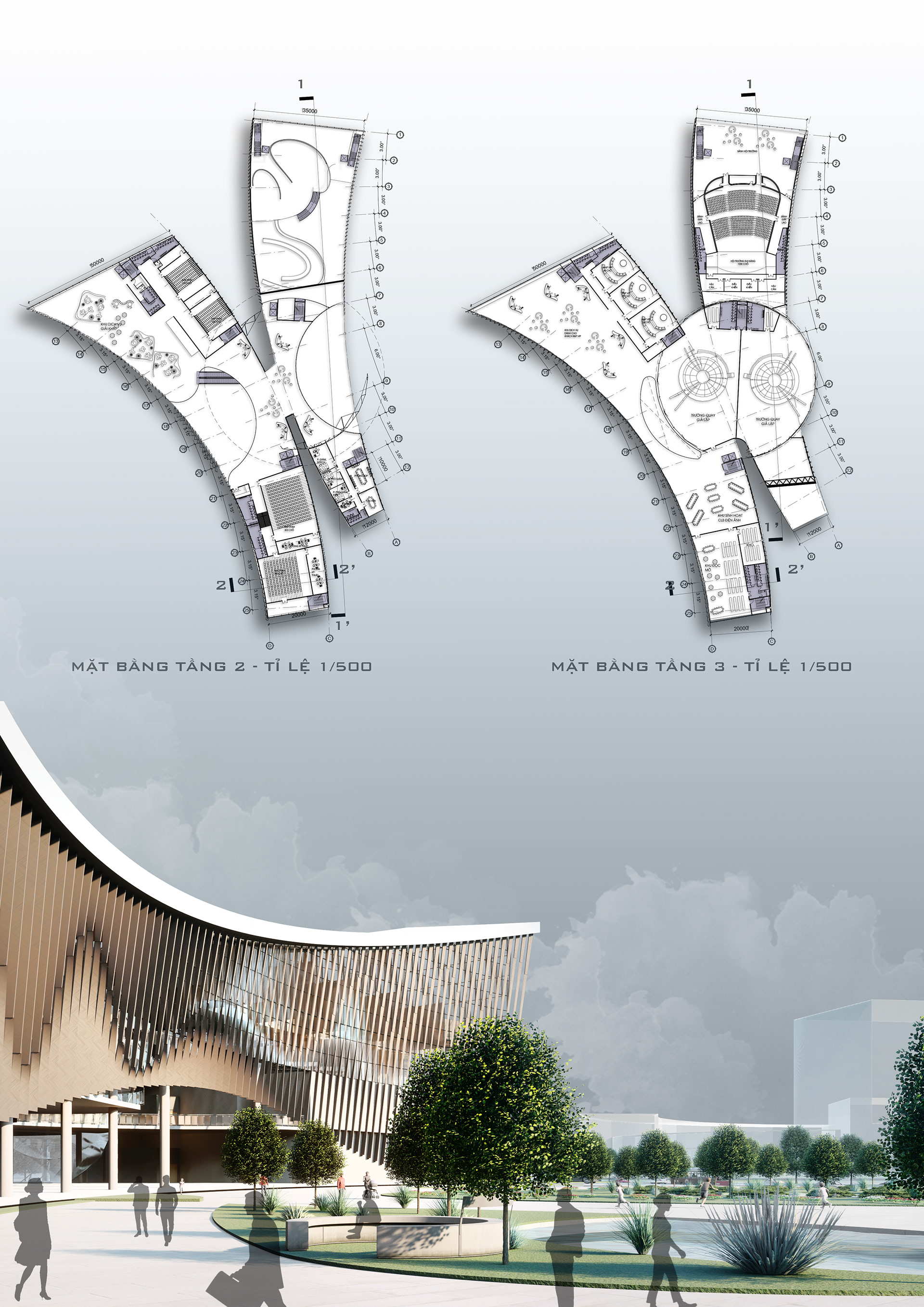

Can Canh Phoi Canh Cong Vien Dien Anh Thu Thiem De Xuat Hap Dan

May 17, 2025

Can Canh Phoi Canh Cong Vien Dien Anh Thu Thiem De Xuat Hap Dan

May 17, 2025 -

Understanding Red Carpet Rule Violations A Cnn Perspective

May 17, 2025

Understanding Red Carpet Rule Violations A Cnn Perspective

May 17, 2025 -

Ahtfae Jzayry Binjazat Almkhrj Allyby Sbry Abwshealt

May 17, 2025

Ahtfae Jzayry Binjazat Almkhrj Allyby Sbry Abwshealt

May 17, 2025