Crude Oil Market Report: Prices And Analysis - April 23, 2024

Table of Contents

Current Crude Oil Prices and Trends

Understanding current crude oil prices is crucial for anyone involved in the energy market or impacted by commodity prices. As of April 23, 2024, Brent crude oil is trading at $X per barrel, while West Texas Intermediate (WTI) crude is priced at $Y per barrel. (Note: Replace X and Y with the actual prices on April 23, 2024, obtained from a reliable source like Bloomberg or Reuters. Include a link to the source).

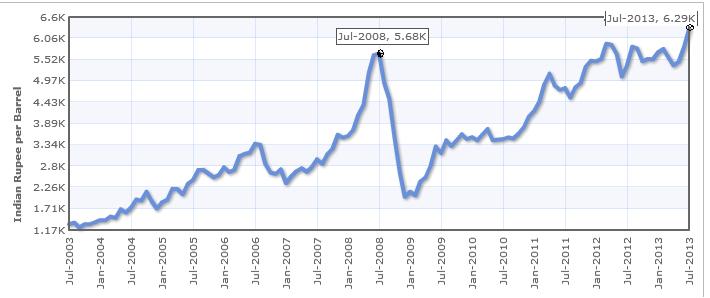

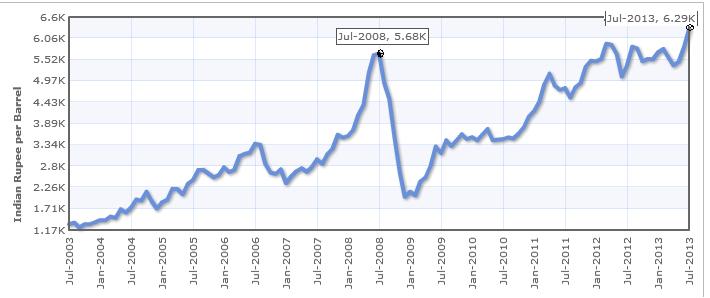

[Insert a chart here visually displaying the price movements of Brent and WTI crude oil over the past week and month.]

- Price Movements: Compared to this time last week, Brent crude shows a Z% change, while WTI has seen a Q% change. (Replace Z and Q with the actual percentage changes). This price movement can be attributed to [insert specific reasons for the price movements, e.g., increased demand from China, concerns about global recession, or recent OPEC+ decisions].

- Significant Price Spikes/Drops: A noticeable price drop occurred on [date] due to [reason]. Conversely, a significant price spike on [date] was triggered by [reason].

Impact of Geopolitical Factors

Geopolitical risk is a major driver of crude oil price volatility. Instability in oil-producing regions can significantly impact global supply and, consequently, prices.

- Middle East Tensions: Ongoing tensions in the Middle East, particularly [mention specific regions or conflicts], continue to pose a threat to oil supplies. Any escalation could lead to significant price increases.

- Russia-Ukraine Conflict: The ongoing conflict between Russia and Ukraine continues to create uncertainty in the global energy market, influencing crude oil prices and energy security across the globe. Sanctions imposed on Russia have disrupted supply chains and added to market volatility.

- OPEC+ Decisions: The decisions made by the OPEC+ alliance, which includes Saudi Arabia and Russia, regarding production quotas play a critical role in determining global oil supply and price. Any changes to these quotas have a direct impact on oil price movements.

Economic Indicators and Their Influence

Macroeconomic factors significantly influence crude oil demand and therefore its price. Global economic growth, inflation, and interest rates are key indicators to watch.

- Global Economic Growth: Strong global economic growth typically leads to increased industrial activity and higher oil demand, pushing prices upwards. Conversely, a slowdown or recession can depress demand and lower prices.

- Inflation and Interest Rates: High inflation rates and rising interest rates can dampen economic activity, potentially reducing oil demand. Central bank policies aimed at curbing inflation will also play a role.

- Economic Forecasts: Current forecasts suggest [mention current economic forecasts and their implications for oil demand]. A potential [mention possible economic scenario, e.g., mild recession] could significantly impact the future outlook for oil prices.

Future Outlook and Price Forecast

Predicting future crude oil prices with certainty is impossible. However, based on current market dynamics and anticipated events, we can offer a cautious outlook.

- Short-Term Forecast (Next 3-6 Months): We anticipate Brent crude to trade within a range of $[lower bound] to $[upper bound] per barrel, while WTI is expected to fluctuate between $[lower bound] and $[upper bound] per barrel. This forecast takes into account [mention key factors considered].

- Long-Term Forecast (Next Year and Beyond): Over the longer term, several factors could influence crude oil prices, including technological advancements in renewable energy, changes in geopolitical dynamics, and unexpected economic shifts. A broad range of $[lower bound] to $[upper bound] is plausible, but significant deviation is possible.

Conclusion

This crude oil market report has highlighted the significant price volatility currently characterizing the crude oil market. Geopolitical factors, economic indicators, and OPEC+ decisions all play crucial roles in shaping crude oil prices. While a short-term forecast has been provided, the inherent uncertainties in the market must be acknowledged. To make informed decisions related to crude oil and related investments, continuous monitoring of the market situation is essential. Stay informed by regularly consulting updated reports and analyses; consider subscribing to receive future reports for ongoing updates on crude oil price movements and market analysis. Understanding the nuances of the crude oil market will help you better navigate its ever-changing dynamics.

Featured Posts

-

Turning Trash To Treasure An Ai Powered Poop Podcast From Mundane Documents

Apr 24, 2025

Turning Trash To Treasure An Ai Powered Poop Podcast From Mundane Documents

Apr 24, 2025 -

Bitcoins Ascent Trumps Policies And Lower Fed Tension Boost Btc

Apr 24, 2025

Bitcoins Ascent Trumps Policies And Lower Fed Tension Boost Btc

Apr 24, 2025 -

The Bold And The Beautiful Liams Collapse A Spoiler Filled Update On His Health

Apr 24, 2025

The Bold And The Beautiful Liams Collapse A Spoiler Filled Update On His Health

Apr 24, 2025 -

Soaring California Gas Prices Prompt Governor Newsom To Seek Oil Industry Collaboration

Apr 24, 2025

Soaring California Gas Prices Prompt Governor Newsom To Seek Oil Industry Collaboration

Apr 24, 2025 -

E Bay And Section 230 A Judges Ruling On Banned Chemical Listings

Apr 24, 2025

E Bay And Section 230 A Judges Ruling On Banned Chemical Listings

Apr 24, 2025