D-Wave Quantum Inc. (QBTS) Stock Drop On Thursday: Reasons And Analysis

Table of Contents

H2: Potential Factors Contributing to the QBTS Stock Drop

Several interconnected factors likely contributed to the sharp decline in QBTS stock price on Thursday. Let's examine the most probable causes:

H3: Disappointing Earnings Report

A key factor influencing the negative market reaction was likely a disappointing earnings report released by D-Wave Quantum. Specific aspects that may have contributed include:

- Missed Revenue Projections: The company might have fallen short of projected revenue targets for the quarter, signaling slower-than-expected growth to investors.

- Lowered Guidance: A reduction in future revenue expectations often indicates internal challenges and can significantly impact investor confidence. This could have been due to factors such as slower-than-anticipated customer adoption or delays in product development.

- Increased Operating Expenses: Higher-than-anticipated operating expenses, potentially related to research and development or sales and marketing, can squeeze profit margins and reduce investor appeal.

- Negative Management Commentary: Statements from D-Wave's management during the earnings call might have dampened investor enthusiasm. Any indication of challenges, uncertainties, or lowered expectations would have likely fueled the sell-off. Comparing these figures to previous quarters and analyst expectations provides a clearer picture of the gravity of the situation.

H3: Broader Market Downturn in Tech Sector

Thursday's QBTS stock drop might not be entirely isolated. A broader downturn in the technology sector could have played a significant role.

- Overall Tech Sector Performance: If the broader tech sector experienced a downturn on Thursday, QBTS, as a tech stock, would likely be affected, regardless of its individual performance. This could be driven by macroeconomic factors or overall investor sentiment shifts.

- Economic Indicators: Negative economic news, such as rising interest rates or inflation concerns, can negatively impact investor sentiment toward growth stocks, including those in the tech sector.

- Competitor Activity: News or announcements from competing quantum computing companies could have indirectly impacted QBTS's stock price. Positive news for a competitor might lead to a relative decline in QBTS's perceived value.

H3: Investor Sentiment and Speculation

Investor sentiment and speculation often significantly influence stock prices, especially in the volatile quantum computing sector.

- Recent News and Events: Any recent positive or negative news concerning D-Wave Quantum, regardless of its financial relevance, could have swayed investor sentiment. Social media discussions and online forums can amplify these effects.

- Social Media Influence: The speed and reach of social media platforms can rapidly spread both positive and negative narratives, impacting investor decisions and driving short-term price fluctuations.

- Short-Term Speculation: Speculative trading based on short-term price movements can exacerbate market volatility, particularly for companies like QBTS operating in a relatively new and unproven technology field.

H3: Lack of Significant Technological Breakthroughs

The stock drop might reflect investor anxieties about the pace of technological advancements in D-Wave's quantum computing technology.

- Investor Expectations: High expectations surrounding the potential of quantum computing can lead to disappointment if the perceived progress is slower than anticipated. The market might be punishing QBTS for a lack of major breakthroughs compared to what investors had hoped for.

- Competitor Comparisons: The progress of competitors in the quantum computing field sets a benchmark against which D-Wave's advancements are measured. If competitors are perceived as making faster progress, it could negatively affect investor confidence in QBTS.

H2: Analyzing the Long-Term Outlook for QBTS

Despite Thursday's decline, it's crucial to analyze the long-term prospects of QBTS.

H3: Fundamental Strengths of D-Wave Quantum

D-Wave Quantum possesses several fundamental strengths:

- Pioneering Position: D-Wave is a pioneer in the field of quantum computing, holding a significant first-mover advantage.

- Strategic Partnerships: Collaborations with leading organizations can accelerate D-Wave's technology development and market penetration, leading to future growth.

- Market Potential: The potential applications of D-Wave's technology in various industries are vast, suggesting considerable long-term growth potential.

H3: Risks and Challenges Facing D-Wave

However, several risks and challenges remain:

- Rapidly Evolving Field: The quantum computing sector is highly competitive and rapidly evolving, making it difficult to predict long-term market dominance.

- Scaling Up Production: Producing quantum computers at scale presents significant technological and economic challenges.

- Securing Funding: Sustained investment is crucial for continued research and development, and securing funding can be a challenge for companies in this sector.

- Regulatory Hurdles: Navigating regulatory landscapes and potential market limitations adds complexity to the path to profitability.

H3: Investment Strategies Considering the Stock Drop

The stock drop presents an opportunity for some investors, but caution is warranted:

- Dollar-Cost Averaging: This strategy involves investing a fixed amount at regular intervals, regardless of the stock price, mitigating the impact of short-term volatility.

- Waiting for Consolidation: Investors might prefer to wait for the stock price to stabilize before making a purchase.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in the stock market involves significant risk, and you could lose money.

3. Conclusion

The QBTS stock drop on Thursday was likely a confluence of factors, including a disappointing earnings report, broader tech sector weakness, investor sentiment, and perceived slow technological progress. While these factors created short-term pressure, D-Wave Quantum's pioneering position and potential market opportunities suggest a potentially positive long-term outlook. However, the inherent risks associated with investing in a nascent technology field like quantum computing should not be underestimated. Before making any investment decisions regarding D-Wave Quantum (QBTS) stock, conduct thorough research and seek professional financial advice if needed. Further reading on D-Wave Quantum and the broader quantum computing stock market is highly recommended.

Featured Posts

-

Wwe Report Talent Reactions To Hinchcliffe Segment

May 21, 2025

Wwe Report Talent Reactions To Hinchcliffe Segment

May 21, 2025 -

Cassis Blackcurrant In Gastronomy Pairing And Applications

May 21, 2025

Cassis Blackcurrant In Gastronomy Pairing And Applications

May 21, 2025 -

The David Walliams Simon Cowell Britains Got Talent Controversy

May 21, 2025

The David Walliams Simon Cowell Britains Got Talent Controversy

May 21, 2025 -

Giorgos Giakoumakis Diminished Mls Transfer Value A Detailed Analysis

May 21, 2025

Giorgos Giakoumakis Diminished Mls Transfer Value A Detailed Analysis

May 21, 2025 -

Voyage En Loire Atlantique Quiz Histoire Gastronomie Et Patrimoine

May 21, 2025

Voyage En Loire Atlantique Quiz Histoire Gastronomie Et Patrimoine

May 21, 2025

Latest Posts

-

Abn Amro Heffingen Halveren Voedselexport Naar Verenigde Staten

May 22, 2025

Abn Amro Heffingen Halveren Voedselexport Naar Verenigde Staten

May 22, 2025 -

Abn Amro Amerikaanse Invoertarieven Halveren Voedselexport

May 22, 2025

Abn Amro Amerikaanse Invoertarieven Halveren Voedselexport

May 22, 2025 -

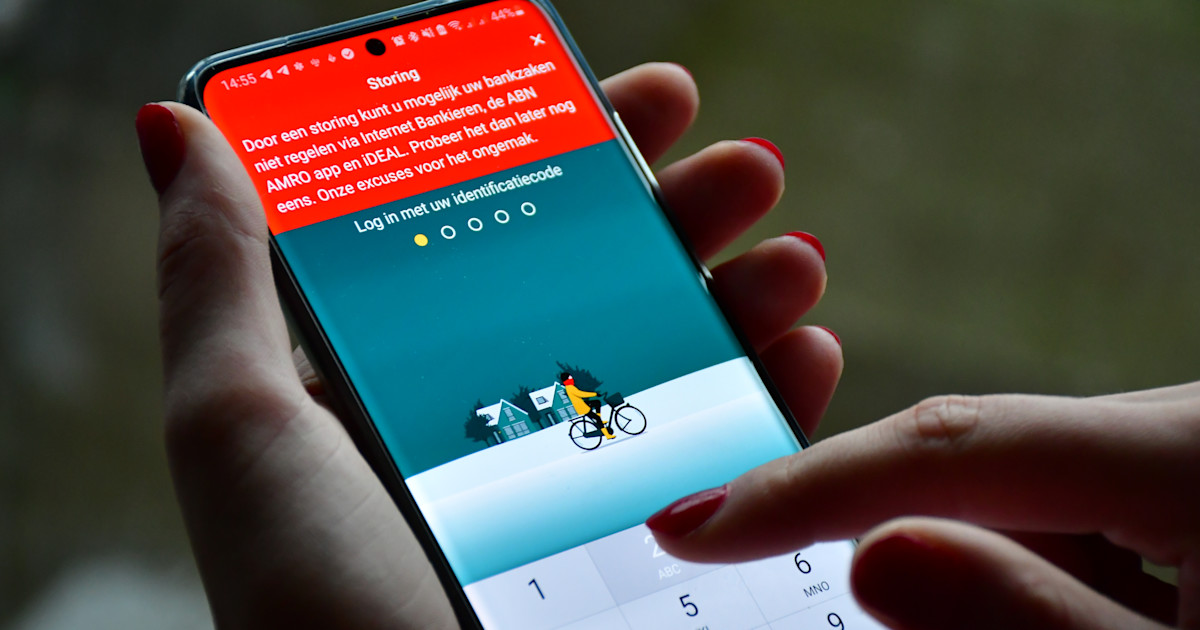

Abn Amro Alternatieven Voor Online Betaling Bij Opslag

May 22, 2025

Abn Amro Alternatieven Voor Online Betaling Bij Opslag

May 22, 2025 -

Problemen Met Online Betalingen Voor Abn Amro Opslagruimte

May 22, 2025

Problemen Met Online Betalingen Voor Abn Amro Opslagruimte

May 22, 2025 -

Abn Amro Huizenmarktverwachting 2024 Stijgende Prijzen Ondanks Risicos

May 22, 2025

Abn Amro Huizenmarktverwachting 2024 Stijgende Prijzen Ondanks Risicos

May 22, 2025