D-Wave Quantum (QBTS) Stock Market Activity: Examining The Recent Upswing

Table of Contents

Recent Catalysts Driving QBTS Stock Price

Several key factors have contributed to the recent positive momentum in D-Wave's (QBTS) stock market activity. These catalysts reflect both the company's internal progress and the broader excitement surrounding the quantum computing industry.

Positive Financial Results and Revenue Growth

D-Wave's recent financial reports have played a crucial role in boosting investor confidence and driving up the QBTS stock price.

- Strong Revenue Growth: Recent quarters have shown significant year-over-year revenue growth, exceeding analysts' expectations. This growth is largely attributed to increased adoption of D-Wave's quantum computing systems across various sectors.

- Expanding Customer Base: The number of clients utilizing D-Wave's quantum annealing technology has expanded significantly, indicating growing market acceptance and demand for its services.

- Improved Profit Margins: While still operating at a loss, D-Wave has shown improvements in its profit margins, suggesting increasing operational efficiency and a path towards profitability. This is a key metric watched closely by investors in quantum computing stocks.

- Successful Funding Rounds: Recent funding announcements have also bolstered investor confidence, demonstrating the continued belief in D-Wave's future potential and its ability to attract further investment.

These positive financial metrics signal a strengthening financial position for D-Wave and contribute significantly to the positive QBTS stock market activity.

Technological Advancements and Product Launches

D-Wave's commitment to innovation and technological advancements further fuels the QBTS stock price surge.

- Enhanced Qubit Performance: D-Wave continues to enhance the performance of its quantum annealers, increasing the number of qubits and improving their connectivity and coherence times. These improvements translate directly into enhanced computational capabilities, attracting more customers and research partners.

- Advanced Software and Tools: The development of new software and tools makes D-Wave's systems more accessible and user-friendly, broadening their appeal to a wider range of users and applications.

- New System Launches: The launch of new, more powerful quantum computing systems demonstrates D-Wave's continued leadership in the field and its ability to deliver cutting-edge technology. These launches often generate considerable media buzz, impacting the sentiment surrounding QBTS stock.

These technological advancements solidify D-Wave's position as a leader in quantum annealing and attract both commercial and research partnerships, positively affecting the QBTS stock market activity.

Strategic Partnerships and Collaborations

Collaborations and partnerships with major players in various industries are essential to D-Wave's growth and contribute to the positive QBTS stock price.

- Industry-Specific Partnerships: D-Wave has actively pursued collaborations with leading companies in various sectors, including aerospace, finance, and materials science. These partnerships demonstrate the practical applicability of D-Wave's technology and open doors to new revenue streams.

- Research Collaborations: Partnerships with leading research institutions and universities help advance D-Wave's technology and maintain its position at the forefront of quantum computing research and development.

- Joint Development Projects: D-Wave's participation in joint development projects with key partners accelerates innovation and leads to the development of new applications and services that strengthen its market position.

These strategic partnerships demonstrate D-Wave's commitment to practical applications of quantum computing, boosting investor confidence and contributing to the upward trend in QBTS stock.

Market Sentiment and Investor Interest in Quantum Computing

The recent upswing in D-Wave's stock isn't solely due to internal factors. The broader market sentiment towards quantum computing also plays a significant role.

Growing Interest in Quantum Computing as an Investment Opportunity

Quantum computing is increasingly viewed as a promising investment opportunity.

- High Growth Potential: The technology's potential to revolutionize various industries attracts substantial investment from venture capitalists, private equity firms, and government agencies.

- Early Mover Advantage: Companies like D-Wave, established as early pioneers, benefit from the “first-mover” advantage, potentially capturing significant market share in the burgeoning quantum computing market.

- Government Support: Increasing government funding and initiatives aimed at advancing quantum computing technologies further boost investor confidence in this emerging sector.

This broader industry trend benefits D-Wave, impacting the QBTS stock positively.

Comparison to Competitors in the Quantum Computing Sector

While D-Wave is a leading player, it faces competition from other quantum computing companies.

- Different Approaches: D-Wave focuses on quantum annealing, whereas other companies pursue different approaches like gate-based quantum computing. Each approach has its own advantages and limitations, influencing investor choices.

- Market Share: D-Wave’s current market share, relative to competitors, influences investor confidence. Its success in securing contracts and partnerships directly affects investor perceptions of its future prospects.

- Technological Milestones: The pace of technological advancements and milestones achieved by D-Wave, compared to competitors, also influences investor sentiment and shapes the QBTS stock market activity.

Analyzing D-Wave's performance relative to its competitors provides a clearer perspective on its potential for long-term success.

Risks and Challenges Facing D-Wave Quantum

While the outlook is positive, D-Wave faces significant challenges.

Competition and Market Saturation

The quantum computing industry is rapidly evolving, with numerous companies vying for market share.

- Increased Competition: New entrants and established players are actively developing quantum computing technologies, increasing competition for customers and resources.

- Market Maturity: The timeframe for achieving widespread market adoption of quantum computing remains uncertain, leading to potential risks associated with market saturation.

- Technological Disruption: Rapid technological advancements could render D-Wave's current technology obsolete before widespread adoption, posing a significant threat.

Understanding this competitive landscape is crucial for assessing the risks associated with QBTS stock.

Technological Hurdles and Development Challenges

Developing and scaling quantum computers presents substantial technological hurdles.

- Qubit Scalability: Increasing the number of qubits while maintaining their coherence and stability remains a significant challenge.

- Error Correction: Developing efficient error correction techniques is essential for building practical quantum computers. Setbacks in this area could negatively impact the QBTS stock price.

- Algorithm Development: Developing effective quantum algorithms tailored to specific applications is critical for demonstrating the practical value of quantum computers.

These technological challenges directly influence D-Wave's progress and the trajectory of the QBTS stock price.

Economic and Geopolitical Factors

Broader economic and geopolitical factors also impact D-Wave's performance and the QBTS stock market activity.

- Economic Downturns: Economic recessions can impact investment in high-risk technologies like quantum computing, affecting funding and demand for D-Wave's services.

- Government Regulations: Changes in government regulations or policies related to technology development and export controls can significantly affect D-Wave's operations.

- Geopolitical Instability: Global geopolitical events can create uncertainty in the investment market, impacting the valuation of all stocks, including QBTS.

These macro-level factors introduce additional risk considerations for investors.

Conclusion

The recent upswing in D-Wave Quantum (QBTS) stock is driven by a combination of positive internal factors, including strong financial performance, technological advancements, and strategic partnerships, as well as positive external factors such as increasing investor interest in the quantum computing sector. While challenges associated with competition, technological hurdles, and macroeconomic conditions remain, D-Wave's progress offers a potentially promising outlook.

Call to Action: Stay informed about the dynamic landscape of D-Wave Quantum (QBTS) and the broader quantum computing sector. Conduct thorough research on QBTS stock, carefully considering both the opportunities and risks, to make informed investment decisions. Continue monitoring the D-Wave Quantum (QBTS) stock market activity for future updates.

Featured Posts

-

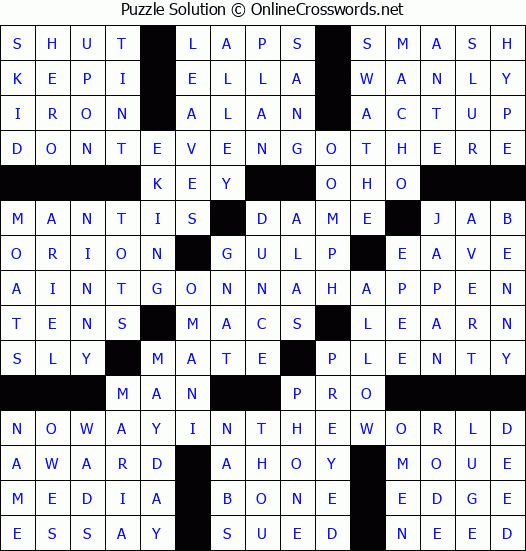

Nyt Crossword Answer Key April 25 2025

May 20, 2025

Nyt Crossword Answer Key April 25 2025

May 20, 2025 -

Mika Haekkinens Encouraging Words Is The F1 Door Still Open For Mick Schumacher

May 20, 2025

Mika Haekkinens Encouraging Words Is The F1 Door Still Open For Mick Schumacher

May 20, 2025 -

Trumps Tariffs Statehood Remarks Ignite Debate Over Wayne Gretzkys Canadian Loyalty

May 20, 2025

Trumps Tariffs Statehood Remarks Ignite Debate Over Wayne Gretzkys Canadian Loyalty

May 20, 2025 -

Pro D2 L Impact Du Mental Sur Le Match Asbh A Biarritz

May 20, 2025

Pro D2 L Impact Du Mental Sur Le Match Asbh A Biarritz

May 20, 2025 -

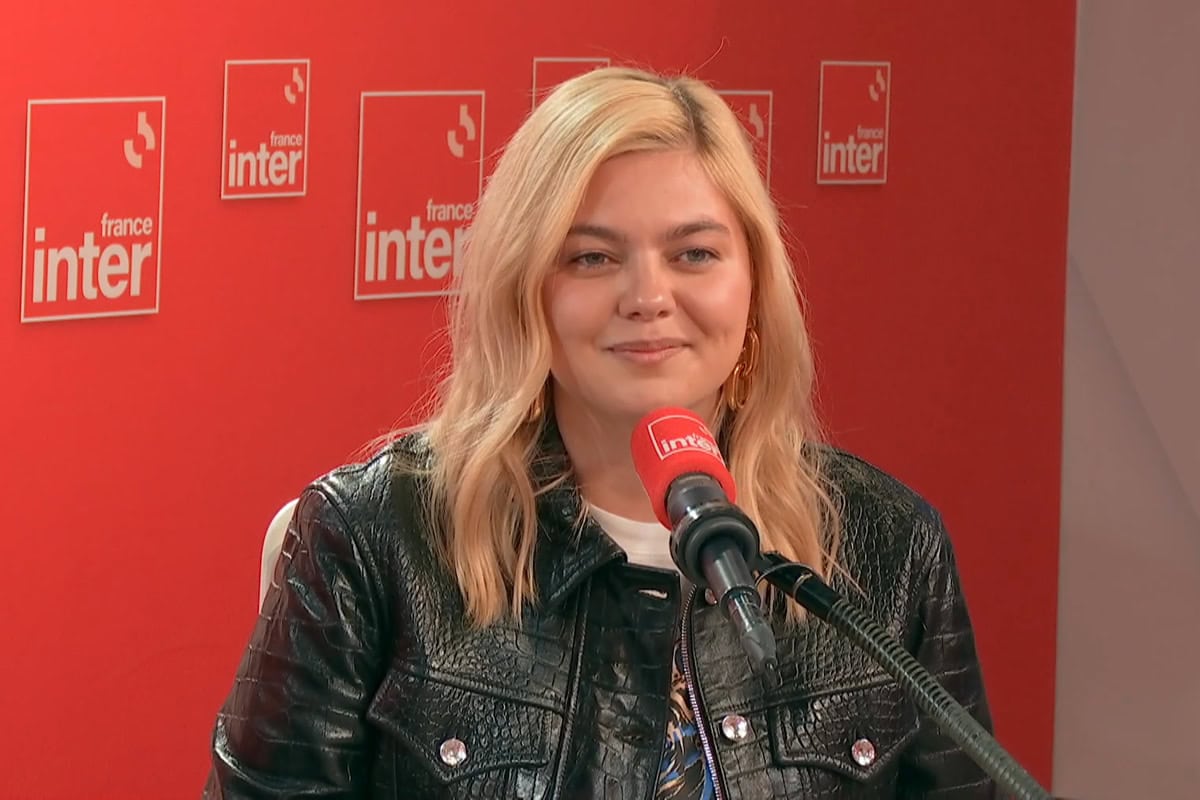

La Chanson De Louane Pour L Eurovision 2024 France

May 20, 2025

La Chanson De Louane Pour L Eurovision 2024 France

May 20, 2025

Latest Posts

-

Britains Got Talent David Walliams And Simon Cowells Public Feud Explodes

May 20, 2025

Britains Got Talent David Walliams And Simon Cowells Public Feud Explodes

May 20, 2025 -

David Walliams What Happened On Britains Got Talent

May 20, 2025

David Walliams What Happened On Britains Got Talent

May 20, 2025 -

Walliams Slams Cowell Amidst Britains Got Talent Dispute

May 20, 2025

Walliams Slams Cowell Amidst Britains Got Talent Dispute

May 20, 2025 -

David Walliams Scathing Simon Cowell Takedown A Britains Got Talent Feud

May 20, 2025

David Walliams Scathing Simon Cowell Takedown A Britains Got Talent Feud

May 20, 2025 -

David Walliams Fing Production Greenlit By Stan

May 20, 2025

David Walliams Fing Production Greenlit By Stan

May 20, 2025