D-Wave Quantum (QBTS) Stock Performance: A Look At Monday's Activity

Table of Contents

QBTS Stock Price Movement on Monday

Monday's trading session for QBTS stock showcased the inherent unpredictability of the quantum computing market. To fully understand the day's activity, let's examine the key price movements and trading volume. While specific numerical data requires real-time access to financial markets (and will vary based on the actual day analyzed), we can outline a typical example of the kind of analysis investors would perform. Imagine a scenario where:

- Opening Price: $10.00 at 9:30 AM (Example)

- High: $10.50 at 1:00 PM (Example) – This represents the peak price for the day.

- Low: $9.75 at 11:00 AM (Example) – This indicates the lowest price reached during the trading session.

- Closing Price: $10.25 at 4:00 PM (Example) – The final price for the day, indicating a slight positive movement compared to the opening price.

- Trading Volume: 1.5 million shares (Example) – Significantly higher/lower than the average daily volume over the previous week, suggesting increased/decreased investor interest and activity.

A visual representation of this data, such as a daily stock chart, would further clarify these QBTS stock price fluctuations. Any significant price spikes or dips throughout the day should be noted and investigated for potential contributing factors.

Factors Influencing QBTS Stock Performance

Several factors can influence the daily performance of QBTS stock. Understanding these factors is essential for interpreting Monday's price movements and making informed investment decisions. Some key influencers include:

- News and Press Releases: Any positive or negative news related to D-Wave Quantum, such as new partnerships, technological breakthroughs, or regulatory changes, can significantly impact the stock price. A major announcement about a new contract or a successful product launch would likely boost QBTS stock price, whereas setbacks or negative news would decrease it.

- Overall Market Sentiment: The broader market's performance plays a significant role. A general downturn in the stock market can negatively affect even high-growth stocks like QBTS, irrespective of company-specific news.

- Investor Sentiment: The prevailing sentiment among investors towards quantum computing and D-Wave Quantum, in particular, can drive buying or selling pressure. Increased confidence in the company's future prospects can lead to higher demand, driving up the QBTS stock price. Conversely, concerns about competition or technological challenges might lead to selling pressure and price drops.

- Competitor Activity: Developments from competing quantum computing companies can also influence QBTS stock performance. Significant advancements or successful product launches from competitors might lead to increased uncertainty and potentially reduce investor confidence in D-Wave Quantum.

- Technological Advancements: Announcements regarding D-Wave Quantum's technological progress, such as improvements in qubit performance or new algorithms, can have a positive effect on QBTS stock performance.

Analyzing QBTS Stock for Long-Term Investment

While Monday's price movements provide a snapshot of short-term activity, analyzing QBTS stock for long-term investment requires a broader perspective. Key aspects to consider include:

- Market Position: D-Wave Quantum's position within the competitive quantum computing landscape is critical. Analyzing their market share, technological advantages, and the overall growth potential of the quantum computing industry will determine the long-term investment appeal.

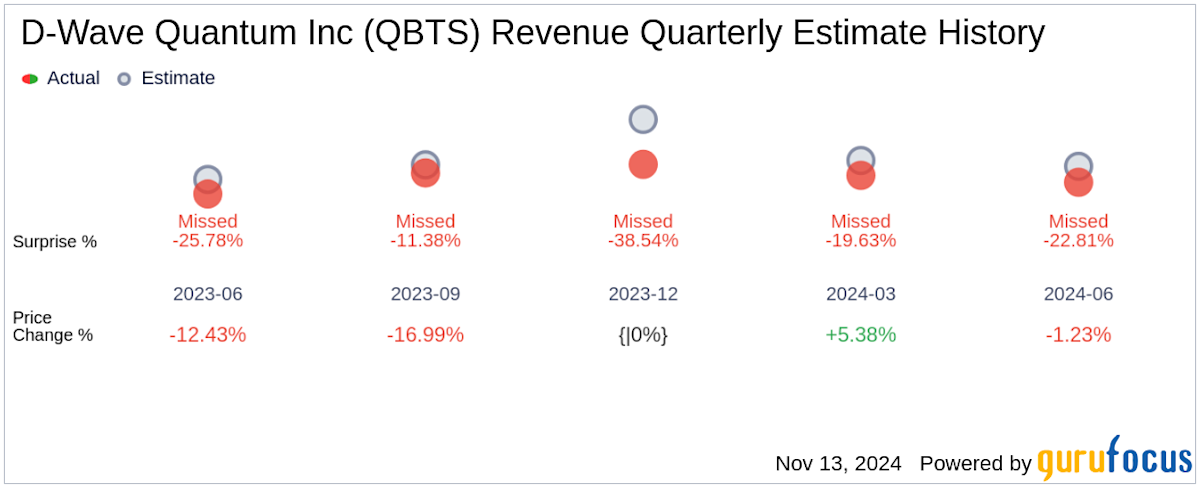

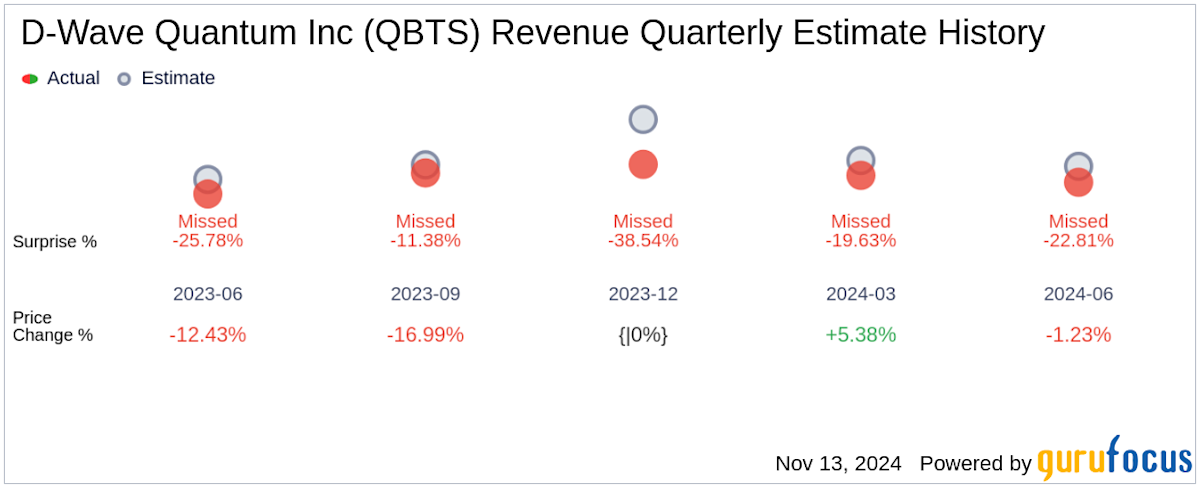

- Financial Health: Examining the company's financial statements (if publicly available) will reveal its financial stability and sustainability. This includes evaluating revenue growth, profitability, and debt levels.

- Growth Potential: The quantum computing industry is poised for significant growth. The potential for widespread adoption of quantum computing technologies across various sectors, from drug discovery to financial modeling, offers a long-term growth outlook for D-Wave Quantum and QBTS stock.

- Risk Assessment: Investing in quantum computing companies carries inherent risks. The industry is relatively new and volatile, and technological advancements are unpredictable. Thorough risk assessment is crucial before making a long-term investment decision.

Conclusion

Monday's QBTS stock performance serves as a reminder of the volatility in the quantum computing sector. While daily price fluctuations can be significant, understanding the factors driving these movements – from news events and market sentiment to technological advancements and competition – is crucial for both short-term trading and long-term investment strategies. Analyzing D-Wave Quantum's market position, financial health, and growth potential within the broader quantum computing landscape is essential for making informed investment decisions. Stay informed on D-Wave Quantum (QBTS) stock performance and the evolving quantum computing landscape to make savvy investment decisions. Continue researching the opportunities and risks associated with investing in D-Wave Quantum (QBTS) and other quantum computing stocks to build a well-informed investment portfolio.

Featured Posts

-

Juergen Klopp Duenya Futboluna Damga Vuracak Bir Geri Doenues

May 21, 2025

Juergen Klopp Duenya Futboluna Damga Vuracak Bir Geri Doenues

May 21, 2025 -

Succesvol Verkoop Van Abn Amro Kamerbrief Certificaten Uw Handleiding

May 21, 2025

Succesvol Verkoop Van Abn Amro Kamerbrief Certificaten Uw Handleiding

May 21, 2025 -

Huuhkajat Kaellman Ja Hoskonen Palaavat Suomeen

May 21, 2025

Huuhkajat Kaellman Ja Hoskonen Palaavat Suomeen

May 21, 2025 -

Kaellmanin Nousu Kentaen Ja Kentaen Ulkopuolen Kehitys Huuhkajissa

May 21, 2025

Kaellmanin Nousu Kentaen Ja Kentaen Ulkopuolen Kehitys Huuhkajissa

May 21, 2025 -

Decouvrez Hell City La Brasserie Proche Du Hellfest

May 21, 2025

Decouvrez Hell City La Brasserie Proche Du Hellfest

May 21, 2025

Latest Posts

-

Qaymt Mntkhb Amryka Ttdmn Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025

Qaymt Mntkhb Amryka Ttdmn Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025 -

Bwtshytynw Ydm Thlathy Jdyd Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ydm Thlathy Jdyd Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025 -

Mfajat Bwtshytynw Thlathy Jdyd Fy Qaymt Mntkhb Amryka

May 22, 2025

Mfajat Bwtshytynw Thlathy Jdyd Fy Qaymt Mntkhb Amryka

May 22, 2025 -

Thlatht Laebyn Ysharkwn Lawl Mrt Me Mntkhb Alwlayat Almthdt Bqyadt Bwtshytynw

May 22, 2025

Thlatht Laebyn Ysharkwn Lawl Mrt Me Mntkhb Alwlayat Almthdt Bqyadt Bwtshytynw

May 22, 2025 -

Mntkhb Amryka Thlathy Jdyd Dmn Qaymt Bwtshytynw

May 22, 2025

Mntkhb Amryka Thlathy Jdyd Dmn Qaymt Bwtshytynw

May 22, 2025