D-Wave Quantum (QBTS) Stock Performance: Monday's Decrease Explained

Table of Contents

Market-Wide Factors Influencing QBTS Stock

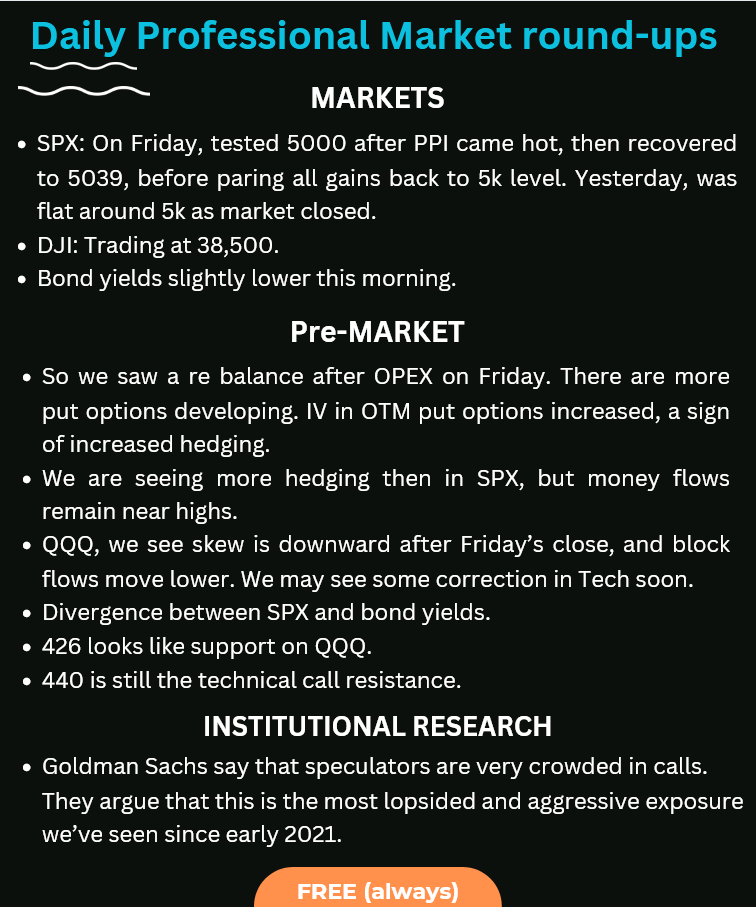

Overall Market Sentiment

Monday's market performance played a crucial role in QBTS's decline. The overall stock market sentiment was negative, impacting numerous sectors. This broader downturn created a ripple effect, influencing even relatively stable stocks like D-Wave Quantum.

- Increased Interest Rates: Concerns about further interest rate hikes by central banks dampened investor enthusiasm.

- Inflationary Pressures: Persistent inflation concerns fueled uncertainty about future economic growth.

- Geopolitical Instability: Ongoing geopolitical tensions added to the general market anxiety.

These factors contributed to a decrease in the S&P 500 and Nasdaq indices, indicating a general risk-off sentiment among investors. The negative performance of these major market indices likely had a knock-on effect on smaller-cap stocks such as QBTS.

Sector-Specific Pressures

Beyond the overall market downturn, the technology sector, and more specifically, the quantum computing sector, might have experienced specific headwinds on Monday. Negative news or performance from competing quantum computing companies could have influenced investor perception of the entire sector.

- Competition: News about advancements or funding rounds from rival quantum computing companies could have shifted investor attention and capital away from D-Wave.

- Industry-Wide Concerns: Any negative reports or analyses regarding the overall potential or timeline for widespread quantum computing adoption could impact investor confidence in the sector as a whole.

- Lack of near-term revenue: The nascent nature of the Quantum Computing industry, and the relatively long-term investment horizons, can cause volatility in the markets.

Tracking news from leading quantum computing companies and industry publications is crucial for understanding sector-specific pressures on QBTS stock price.

D-Wave Quantum (QBTS) Specific News and Events

Absence of Positive Catalysts

The absence of positive news or significant announcements from D-Wave Quantum itself could have contributed to the stock's decline. In the absence of encouraging developments, investor sentiment can turn negative, leading to selling pressure.

- Delayed Announcements: Any anticipated product launches, partnerships, or funding announcements that were delayed or didn't materialize would likely negatively impact the stock.

- Lack of Positive Earnings Reports: The absence of upbeat earnings forecasts or reports would not inspire investor confidence.

- Missed Market Expectations: Failure to meet or exceed market expectations can cause disappointment and selling amongst investors.

Positive news and demonstrable progress are vital for maintaining investor confidence in a growth stock like QBTS.

Potential Negative News or Rumors

The spread of negative news or rumors about D-Wave Quantum could also contribute to the price drop. Analyst downgrades, negative press coverage, or concerns about the company's future prospects can all negatively impact stock performance.

- Negative Analyst Reports: Downgrades by financial analysts can trigger a sell-off as investors react to professional opinions.

- Unfavorable Media Coverage: Negative press reports regarding the company's technology, management, or financial outlook would further impact stock price.

- Concerns about Future Prospects: Any speculation or legitimate concerns about D-Wave's long-term growth potential would dissuade investors.

It's crucial to differentiate between credible and unsubstantiated information when evaluating the impact of news on QBTS stock performance.

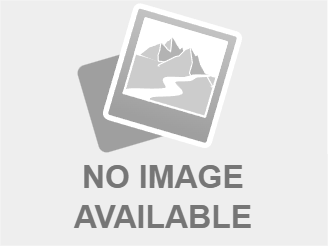

Technical Analysis of QBTS Stock Chart

Chart Patterns

Analyzing the QBTS stock chart on Monday can reveal technical indicators that might explain the price decline. While we won't delve into complex technical jargon here, observing simple trends like support and resistance levels and moving averages can provide additional context. (Note: A simple chart would be inserted here in a published article).

- Support and Resistance Breakdowns: A breakdown below key support levels could trigger further selling.

- Moving Average Crossovers: Negative crossovers of key moving averages can be bearish signals for traders.

- Overall Trend: A prevailing downward trend preceding Monday's drop would intensify selling pressure.

Trading Volume

Examining the trading volume on Monday is equally important. Unusually high volume during a price drop indicates strong selling pressure, while unusually low volume suggests a less significant shift in investor sentiment.

- High Volume: High trading volume alongside the price drop would reinforce the significance of the downward movement.

- Low Volume: Low volume might suggest a less impactful event, possibly temporary, and less indicative of a major shift in investor sentiment.

- Volume Comparison: Comparing Monday's trading volume to previous days’ volume provides valuable context to determine the magnitude of the sell-off.

Understanding the interplay between price movement and trading volume helps contextualize the significance of the QBTS stock price drop.

Conclusion: Navigating the Volatility of D-Wave Quantum (QBTS) Stock

Monday's decrease in D-Wave Quantum (QBTS) stock price resulted from a confluence of factors, including general market weakness, potential sector-specific pressures, and the absence of positive catalysts for the company. Analyzing both market-wide and company-specific news, along with technical chart patterns and trading volume, offers a more complete understanding of the price movement. Remember that investing in quantum computing, and specifically in QBTS stock, entails significant risk.

To effectively navigate the volatility of D-Wave Quantum (QBTS) stock, continuous monitoring of the "D-Wave Quantum (QBTS) stock performance," thorough research, diversification of your investment portfolio, and consultation with a financial advisor are crucial steps. Don't rely solely on short-term fluctuations; focus on the long-term potential and risks inherent in this exciting but still developing sector.

Featured Posts

-

Richard Mille Rm 72 01 Charles Leclercs New Racing Watch

May 20, 2025

Richard Mille Rm 72 01 Charles Leclercs New Racing Watch

May 20, 2025 -

Festlegung Der Endgueltigen Form Durch Die Architektin

May 20, 2025

Festlegung Der Endgueltigen Form Durch Die Architektin

May 20, 2025 -

Jennifer Lawrence Welcomes Second Child With Cooke Maroney

May 20, 2025

Jennifer Lawrence Welcomes Second Child With Cooke Maroney

May 20, 2025 -

El Mundo Celebra Positiva Actualizacion Sobre Michael Schumacher

May 20, 2025

El Mundo Celebra Positiva Actualizacion Sobre Michael Schumacher

May 20, 2025 -

Nyt Mini Crossword March 15 Solutions

May 20, 2025

Nyt Mini Crossword March 15 Solutions

May 20, 2025

Latest Posts

-

Jalkapallo Kaellman Ja Hoskonen Eroavat Puolalaisseurasta

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Eroavat Puolalaisseurasta

May 20, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotiin

May 20, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotiin

May 20, 2025 -

Kaellman Ja Hoskonen Loppu Puolassa Mitae Seuraavaksi

May 20, 2025

Kaellman Ja Hoskonen Loppu Puolassa Mitae Seuraavaksi

May 20, 2025 -

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 20, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 20, 2025 -

Suomalaiset Jalkapalloilijat Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025

Suomalaiset Jalkapalloilijat Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025