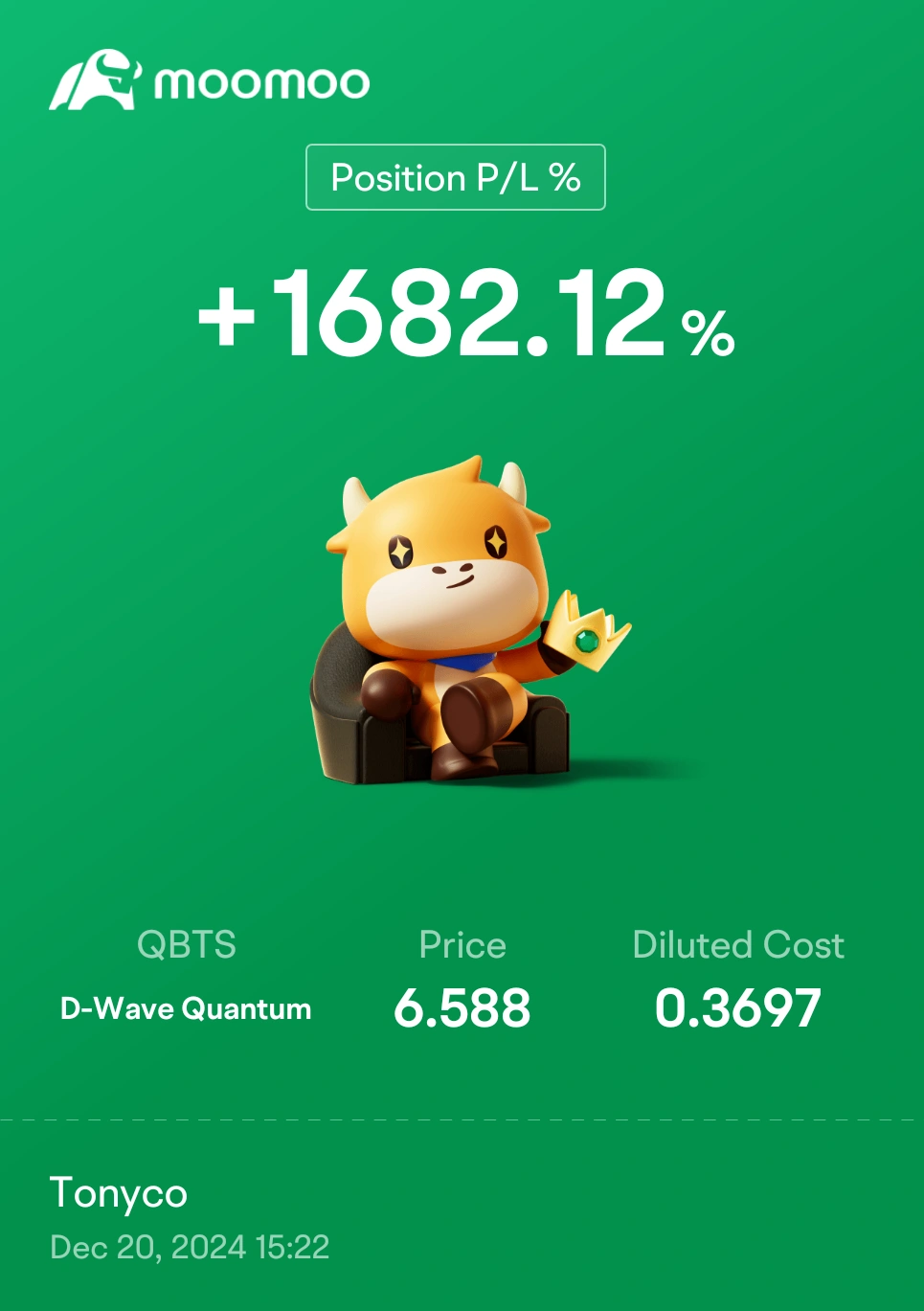

D-Wave Quantum (QBTS) Stock Plunge: Understanding Monday's Market Reaction

Table of Contents

Analyzing the QBTS Stock Drop: Key Factors

Several intertwined factors contributed to the dramatic fall in D-Wave Quantum (QBTS) stock. Understanding these elements is crucial for interpreting the market's reaction and assessing the company's future trajectory.

Disappointing Earnings Report

The primary driver of Monday's QBTS stock plunge was undoubtedly the company's disappointing earnings report. Specifics revealed a significant gap between expectations and reality, sending a negative signal to investors.

-

Revenue shortfall compared to projections: The reported revenue fell considerably short of analyst projections, indicating weaker-than-expected demand for D-Wave's quantum computing solutions. This shortfall, potentially in the millions of dollars (specific numbers should be inserted here if available from the actual report), raised serious concerns about the company's financial health and its ability to meet future targets.

-

Negative outlook for future quarters: The company's guidance for the coming quarters was equally discouraging, further fueling investor anxieties. A pessimistic outlook on revenue growth and profitability amplified the negative sentiment surrounding the QBTS stock.

-

Impact on profitability: The combined effect of lower-than-expected revenue and possibly increased operating costs resulted in a negative impact on profitability. This underscores the challenges D-Wave faces in translating technological advancements into sustainable financial performance.

Market Sentiment and the Wider Tech Sector

While the earnings report was the immediate catalyst, the broader market context also played a role in the QBTS stock drop. Monday's overall market performance, especially within the technology sector, contributed to the negative sentiment.

-

Overall market performance on Monday: A general downturn in the tech market on Monday would have exacerbated the negative impact of the D-Wave Quantum earnings report. The simultaneous decline of other tech stocks suggests a broader market malaise, creating a less favorable environment for QBTS.

-

Performance of other quantum computing stocks: The performance of competitor quantum computing stocks on Monday should be analyzed to determine if the drop was specific to D-Wave or indicative of a broader sector-wide correction. If competitors also experienced declines, it points to a sector-specific downturn rather than just a D-Wave-specific problem.

-

Impact of interest rate hikes or other economic news: Macroeconomic factors such as interest rate hikes or other significant economic news can significantly impact investor sentiment. Such factors could have created a risk-averse environment, making investors more likely to sell off even relatively stable stocks, including QBTS.

Investor Reactions and Trading Volume

The severity of the QBTS stock drop was amplified by investor reactions and high trading volume, suggesting a degree of panic selling.

-

Trading volume compared to average daily volume: An unusually high trading volume on Monday, exceeding the average daily volume significantly, indicates a large number of investors simultaneously selling their QBTS shares. This points to a rapid and significant shift in investor sentiment.

-

Changes in analyst ratings and price targets: A decrease in analyst ratings or a lowering of price targets following the earnings report would have further fueled the sell-off. Negative analyst opinions can significantly impact investor confidence and lead to more selling pressure.

-

Number of short-sellers increasing or decreasing: Monitoring changes in the number of short-sellers (investors betting against the stock) can provide insights into market sentiment. A significant increase in short-selling activity would indicate a lack of confidence in the company's future prospects.

Long-Term Implications for D-Wave Quantum

The QBTS stock plunge has significant implications for D-Wave Quantum's long-term prospects, impacting its funding, development, and competitive position.

Impact on Future Funding and Development

The dramatic stock drop could create challenges for D-Wave in securing future funding and progressing its R&D initiatives.

-

Potential delays in product development: Reduced funding could lead to delays in the development of new quantum computing technologies and products, potentially hindering D-Wave's ability to compete effectively.

-

Difficulties in attracting new investors: The negative market reaction could make it more difficult to attract new investors, limiting D-Wave's access to capital for future growth and expansion.

-

Reduced resources for research and development: A decrease in available funds could necessitate cuts in research and development spending, potentially impacting innovation and the company's long-term technological leadership.

Competition in the Quantum Computing Market

The QBTS stock plunge might affect D-Wave's standing relative to its competitors in the rapidly evolving quantum computing market.

-

Competitive landscape overview: The quantum computing market is highly competitive, with major players such as IBM, Google, and others vying for market share. D-Wave's position within this competitive landscape has been significantly impacted by the recent market downturn.

-

Strengths and weaknesses of D-Wave compared to competitors: An objective assessment of D-Wave's strengths and weaknesses compared to its competitors is crucial. Identifying areas for improvement and leveraging existing advantages is essential for navigating the current challenges.

-

Potential market share shifts: The stock drop could lead to market share shifts, with competitors potentially capitalizing on D-Wave's difficulties. Maintaining a strong market position requires a strategic response to the current challenges.

Conclusion

The sharp decline in D-Wave Quantum (QBTS) stock on Monday resulted from a confluence of factors, including a disappointing earnings report, broader market sentiment, and investor reaction. While this presents challenges for the company's short-term prospects, it's crucial to maintain a long-term perspective on the potential of quantum computing. Further monitoring of D-Wave Quantum (QBTS) stock and understanding the company's strategic response to the recent downturn is essential for investors. Continue to research the D-Wave Quantum (QBTS) stock and the quantum computing industry to make informed decisions. Stay updated on future developments and news regarding the D-Wave Quantum (QBTS) stock performance and potential future growth. Understanding the intricacies of D-Wave Quantum (QBTS) stock is critical for navigating the complexities of the quantum computing investment landscape.

Featured Posts

-

William Goodge Conquering Australia On Foot A New Record

May 21, 2025

William Goodge Conquering Australia On Foot A New Record

May 21, 2025 -

Teknik Direktoer Secimi Klopp Veya Ancelotti Avantajlar Ve Dezavantajlar

May 21, 2025

Teknik Direktoer Secimi Klopp Veya Ancelotti Avantajlar Ve Dezavantajlar

May 21, 2025 -

Atp Bucharest Cobollis Historic First Championship

May 21, 2025

Atp Bucharest Cobollis Historic First Championship

May 21, 2025 -

Cassis Blackcurrant In Gastronomy Pairing And Applications

May 21, 2025

Cassis Blackcurrant In Gastronomy Pairing And Applications

May 21, 2025 -

The Goldbergs Every Season Ranked And Reviewed

May 21, 2025

The Goldbergs Every Season Ranked And Reviewed

May 21, 2025

Latest Posts

-

Trans Australia Run Is A New World Record On The Horizon

May 22, 2025

Trans Australia Run Is A New World Record On The Horizon

May 22, 2025 -

Fastest Trans Australia Run A New Benchmark Set

May 22, 2025

Fastest Trans Australia Run A New Benchmark Set

May 22, 2025 -

Australian Foot Race New Speed Record Set

May 22, 2025

Australian Foot Race New Speed Record Set

May 22, 2025 -

Could This Attempt Break The Trans Australia Run World Record

May 22, 2025

Could This Attempt Break The Trans Australia Run World Record

May 22, 2025 -

Fastest Across Australia Man Completes Unprecedented Foot Race

May 22, 2025

Fastest Across Australia Man Completes Unprecedented Foot Race

May 22, 2025