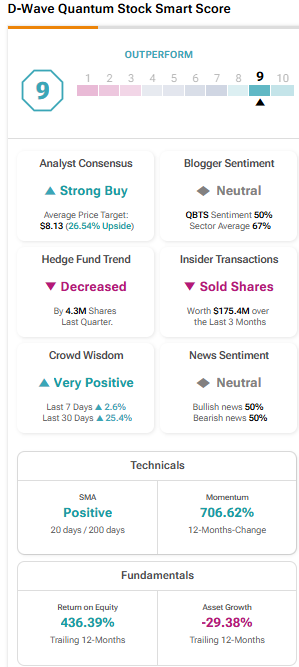

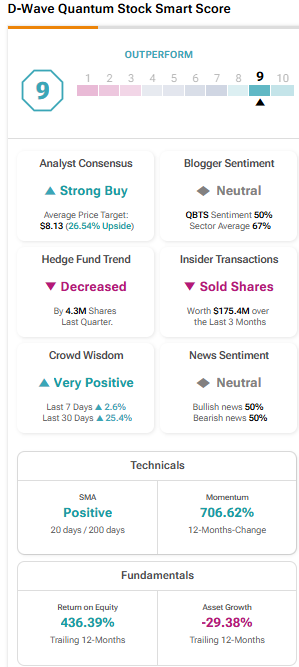

D-Wave Quantum (QBTS) Stock Price Movement On Monday: A Comprehensive Overview

Table of Contents

Opening Price and Early Trading Activity

The QBTS opening price on Monday set the tone for the day's trading. A comparison to Friday's closing price reveals whether the stock started the week with a gap up or down, indicating early investor sentiment. Analyzing the early trading volume is crucial; a high volume suggests strong interest, while low volume might point to a lack of conviction in either direction. Pre-market activity and any news releases before the market bell also significantly influenced the initial price action.

- Opening price: Compared to Friday's close – was it higher, lower, or unchanged?

- Early trading volume: High volume suggests strong initial interest; low volume may indicate indecision.

- Pre-market news impact: Any announcements or press releases before the market open played a significant role.

- Market trend comparison: How did QBTS perform relative to broader market trends on Monday morning?

Intraday Price Fluctuations and Key Turning Points

Monday's trading saw substantial QBTS price fluctuations, characterized by intraday volatility. Identifying the major peaks and troughs helps pinpoint key turning points. Technical analysis, employing indicators like support and resistance levels, can shed light on these movements. Correlating price changes with specific news events or announcements further enhances our understanding.

- Significant price changes: Pinpointing the times of major price shifts (e.g., sharp increases or drops).

- Magnitude of swings: Analyzing the extent of price fluctuations to understand the volatility.

- Correlation with market news: Identifying news that directly influenced QBTS's price.

- Technical analysis insights: Using support and resistance levels to understand price movement.

Closing Price and Volume

The closing price of QBTS stock summarizes Monday's trading activity, offering a snapshot of the day's performance. Analyzing the daily trading volume provides context; higher volume often indicates stronger conviction behind the price movement. By comparing the closing price to the opening price and intraday highs/lows, we can assess the overall direction and strength of the day's trading. This helps gauge investor sentiment and provides clues about future price direction.

- Closing price significance: Its position relative to the opening price indicates overall trend.

- Comparison to intraday highs/lows: Assessing the extent of price variation throughout the day.

- Daily trading volume analysis: High volume indicates stronger conviction in the price movement.

- Market sentiment interpretation: Inferring investor confidence based on price and volume.

Impact of News and Announcements

Any news or announcements related to D-Wave Quantum on Monday could significantly influence its stock price. Analyzing press releases, industry developments, and investor reactions to these events gives a comprehensive picture. Positive news might lead to price increases, while negative news could cause drops.

Comparison to Competitor Performance

To gain perspective on QBTS's performance, comparing it to competitors in the quantum computing sector is vital. Analyzing the performance of similar quantum computing stocks helps determine whether Monday's QBTS movement was unique or reflected a broader sector trend. This comparative analysis provides crucial context for evaluating the company's competitive position and market share.

Conclusion

Monday's D-Wave Quantum (QBTS) stock price movement showcased significant volatility. The opening price, intraday fluctuations, and closing price, combined with daily trading volume and the impact of any news or external factors, offer a compelling narrative of the day's trading. Understanding these elements is crucial for investors interested in navigating the complexities of the quantum computing market.

Call to Action: Stay informed about the dynamic D-Wave Quantum (QBTS) stock price by regularly checking our site for updated market analysis and insights into the burgeoning quantum computing sector. Learn more about investing in D-Wave Quantum (QBTS) and other promising technologies by [link to related resource/page]. Remember to always understand the inherent risks associated with investing in QBTS and other volatile stocks.

Featured Posts

-

Talisca Ile Yasanan Tartismanin Ardindan Fenerbahce Nin Tadic Transferi

May 20, 2025

Talisca Ile Yasanan Tartismanin Ardindan Fenerbahce Nin Tadic Transferi

May 20, 2025 -

Diskvalifikation I F1 Hamilton Och Leclerc En Djupdykning I Kontroversen

May 20, 2025

Diskvalifikation I F1 Hamilton Och Leclerc En Djupdykning I Kontroversen

May 20, 2025 -

Thursdays D Wave Quantum Qbts Stock Decline A Detailed Explanation

May 20, 2025

Thursdays D Wave Quantum Qbts Stock Decline A Detailed Explanation

May 20, 2025 -

Unlock The Nyt Mini Crossword April 20 2025 Answers And Clues

May 20, 2025

Unlock The Nyt Mini Crossword April 20 2025 Answers And Clues

May 20, 2025 -

Ghana Cote D Ivoire Succes De La Visite Diplomatique Du President Mahama A Abidjan

May 20, 2025

Ghana Cote D Ivoire Succes De La Visite Diplomatique Du President Mahama A Abidjan

May 20, 2025

Latest Posts

-

Sandylands U Full Tv Schedule And Viewing Information

May 20, 2025

Sandylands U Full Tv Schedule And Viewing Information

May 20, 2025 -

Gangsta Granny A Teachers Guide To Classroom Activities

May 20, 2025

Gangsta Granny A Teachers Guide To Classroom Activities

May 20, 2025 -

Complete Sandylands U Tv Guide Air Dates And Channel Info

May 20, 2025

Complete Sandylands U Tv Guide Air Dates And Channel Info

May 20, 2025 -

Gangsta Granny Costumes And Diy Projects For Children

May 20, 2025

Gangsta Granny Costumes And Diy Projects For Children

May 20, 2025 -

Sandylands U Tv Schedule Never Miss An Episode

May 20, 2025

Sandylands U Tv Schedule Never Miss An Episode

May 20, 2025