D-Wave Quantum (QBTS) Stock Surge Explained: Monday's Price Increase

Table of Contents

News and Announcements Impacting QBTS Stock Price

Several factors related to news and announcements likely contributed to the D-Wave Quantum (QBTS) stock surge.

Specific Press Releases or News Articles

While specific details of the Monday surge require further investigation of press releases and official announcements, it's crucial to look for any positive news concerning D-Wave Quantum that might have triggered the increase. This could include:

- New partnerships or collaborations: A major partnership with a large technology company or research institution could significantly boost investor confidence and drive up the stock price.

- Successful product launches or milestones: Reaching key technological milestones or launching a new, improved quantum computer could generate positive media coverage and investor enthusiasm.

- Government grants or funding: Securing significant government funding for research and development could signal strong belief in the company's future and its potential to succeed.

- Positive analyst ratings or upgrades: Upgrades from prominent financial analysts could influence institutional investors to increase their holdings in QBTS, leading to a price increase. (Example: Link to a hypothetical analyst upgrade article if available)

Industry Trends Affecting Quantum Computing Stocks

The broader quantum computing market is also experiencing significant growth, influencing investor sentiment towards companies like D-Wave Quantum.

- Increased investment in the sector: Venture capital and government funding in quantum computing are accelerating, indicating a growing belief in the technology's long-term potential.

- Technological breakthroughs: Significant advancements in qubit technology, error correction, or algorithm development often lead to increased investor optimism across the entire sector.

- Competitive landscape: Positive developments from competitor companies can indirectly benefit the entire industry, including D-Wave Quantum, by increasing overall investor interest in the field.

Market Sentiment and Investor Behavior

Understanding market sentiment and investor behavior is crucial to deciphering the QBTS stock surge.

Increased Trading Volume and Volatility

Monday's price surge was likely accompanied by significantly increased trading volume compared to previous days. This heightened trading activity indicates a large influx of buyers, driving the price upwards. Increased volatility, characterized by sharp price swings, is a common characteristic of rapid price increases.

(Insert a hypothetical chart showing increased trading volume and price volatility here)

Potential explanations for the increased volume include:

- Short squeezes: A significant number of investors holding short positions (betting against the stock) might have been forced to cover their positions, buying back the stock and driving the price higher.

- Momentum trading: Traders may have jumped onto the bandwagon, further amplifying the price increase as more investors bought QBTS based on the upward momentum.

Speculative Investing and Hype

The quantum computing sector is still in its early stages, attracting significant speculative investment. This means some investors may be betting on future potential rather than focusing on current profitability.

- Social media influence: Positive buzz on social media platforms can rapidly spread information and potentially drive speculative buying.

- Fundamental vs. Speculative Valuation: It is crucial to differentiate between the fundamental value of QBTS (based on its assets and earnings) and its speculative value (based on market hype and future expectations). The Monday surge likely reflected a significant speculative component.

Technical Analysis of the QBTS Stock Chart

A technical analysis of the QBTS stock chart from Monday could reveal important patterns contributing to the price surge.

Chart Patterns and Indicators

(Insert a hypothetical chart showing key technical indicators like RSI, MACD, and support/resistance levels here)

Key technical indicators to examine include:

- Relative Strength Index (RSI): A high RSI value could indicate overbought conditions, suggesting a potential price correction.

- Moving Average Convergence Divergence (MACD): A bullish MACD crossover could signal a sustained upward trend.

- Support and Resistance Levels: Breaking through significant resistance levels often leads to substantial price increases.

Comparison to Previous Price Movements

Comparing Monday's surge with previous price movements in QBTS's history provides context.

- Magnitude of change: Quantify the percentage increase on Monday compared to previous significant price swings.

- Duration and sustainability: Analyze how long past surges lasted and whether they resulted in sustained price increases or subsequent corrections.

Conclusion: Analyzing the Future of D-Wave Quantum (QBTS) Stock

The D-Wave Quantum (QBTS) stock surge on Monday was likely a result of a confluence of factors including positive news or announcements, broader industry trends, increased trading volume fueled by speculation, and potentially favorable technical indicators. While the surge presents exciting possibilities, it's crucial to remember the inherent risks involved in investing in a relatively young and volatile sector like quantum computing.

Key Takeaways: The interplay between news, market sentiment, and technical analysis significantly impacted the QBTS stock price. Speculative investing played a considerable role in Monday’s surge.

Future Outlook: While the future of QBTS remains uncertain, continued technological advancements and increased industry investment could support long-term growth. However, investors should remain cautious and consider the inherent risks of speculative investments in this emerging technology.

Call to Action: Stay informed about the latest developments in the quantum computing sector to make informed decisions about your D-Wave Quantum (QBTS) stock investments. [Link to a reputable financial news source or D-Wave's investor relations page]

Featured Posts

-

Abn Amro Hogere Huizenprijzen Verwacht Ondanks Dalende Rente

May 21, 2025

Abn Amro Hogere Huizenprijzen Verwacht Ondanks Dalende Rente

May 21, 2025 -

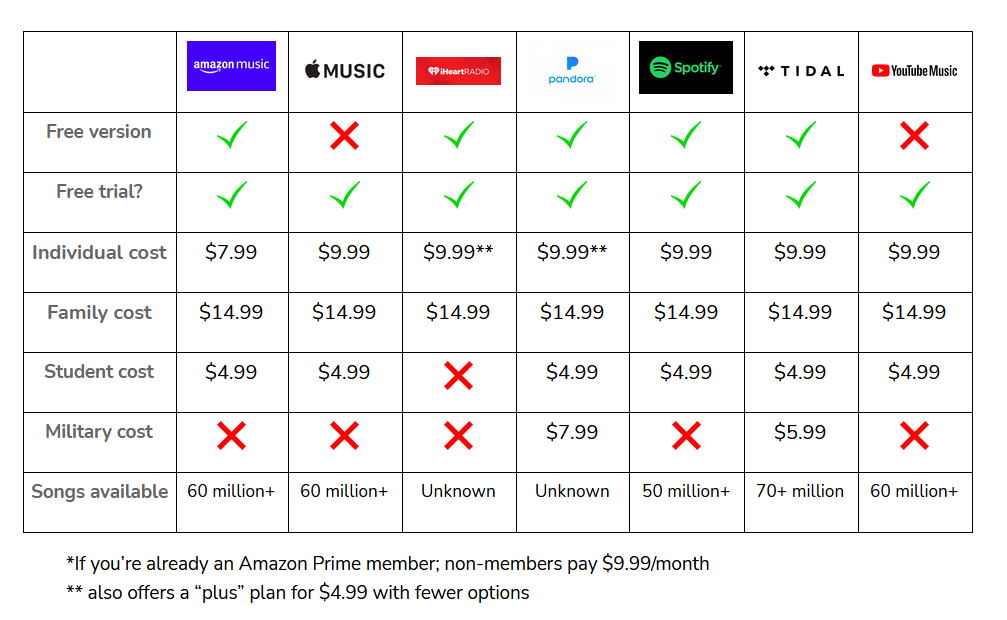

Live Bundesliga Matches Online Top Streaming Services Compared

May 21, 2025

Live Bundesliga Matches Online Top Streaming Services Compared

May 21, 2025 -

Abn Amro Voedingsbedrijven En De Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025

Abn Amro Voedingsbedrijven En De Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025 -

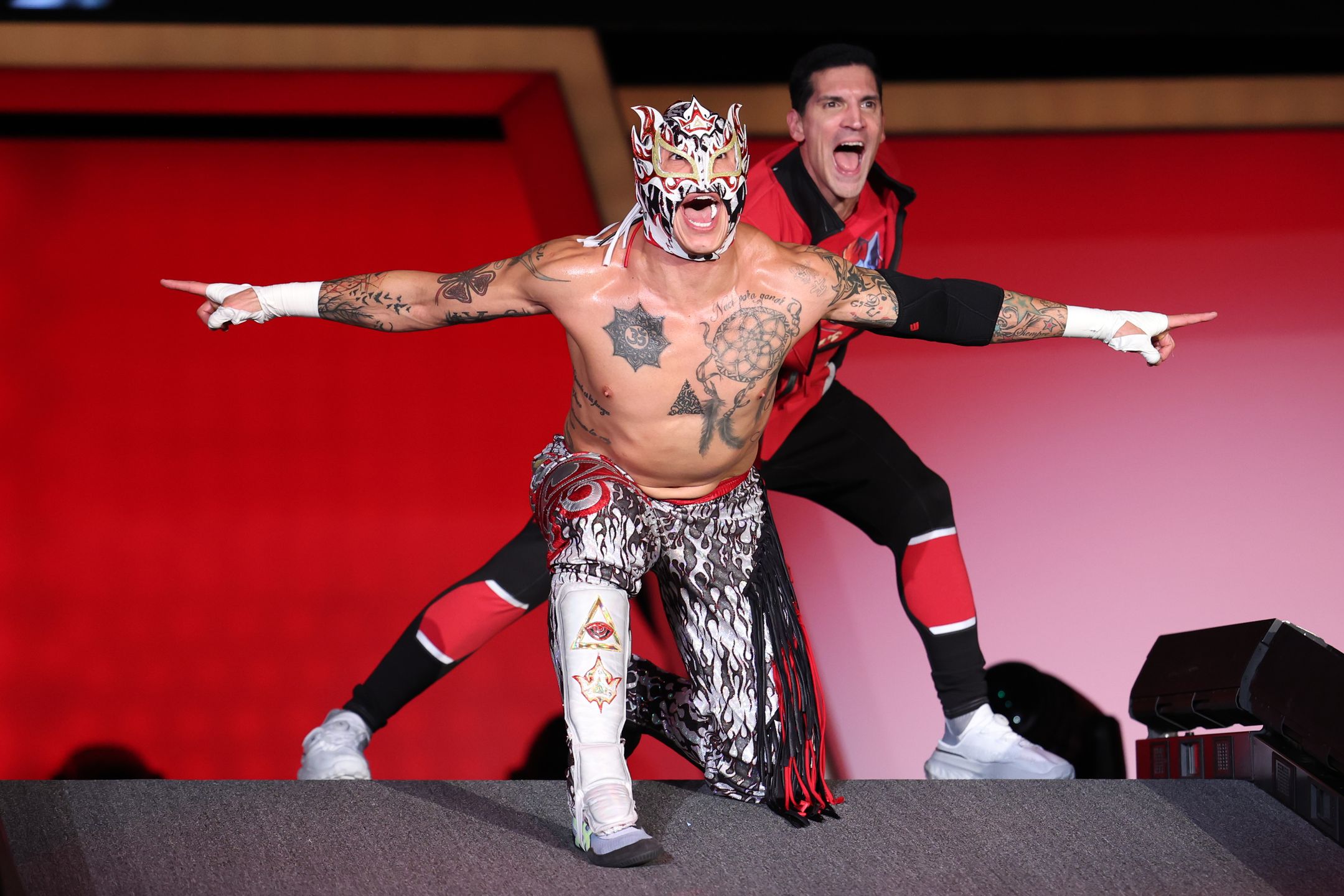

Former Aew Star Rey Fenix Debuts On Smack Down His Wwe Ring Name

May 21, 2025

Former Aew Star Rey Fenix Debuts On Smack Down His Wwe Ring Name

May 21, 2025 -

D Wave Quantum Qbts Stock Valuation Under Scrutiny Following Kerrisdale Report

May 21, 2025

D Wave Quantum Qbts Stock Valuation Under Scrutiny Following Kerrisdale Report

May 21, 2025

Latest Posts

-

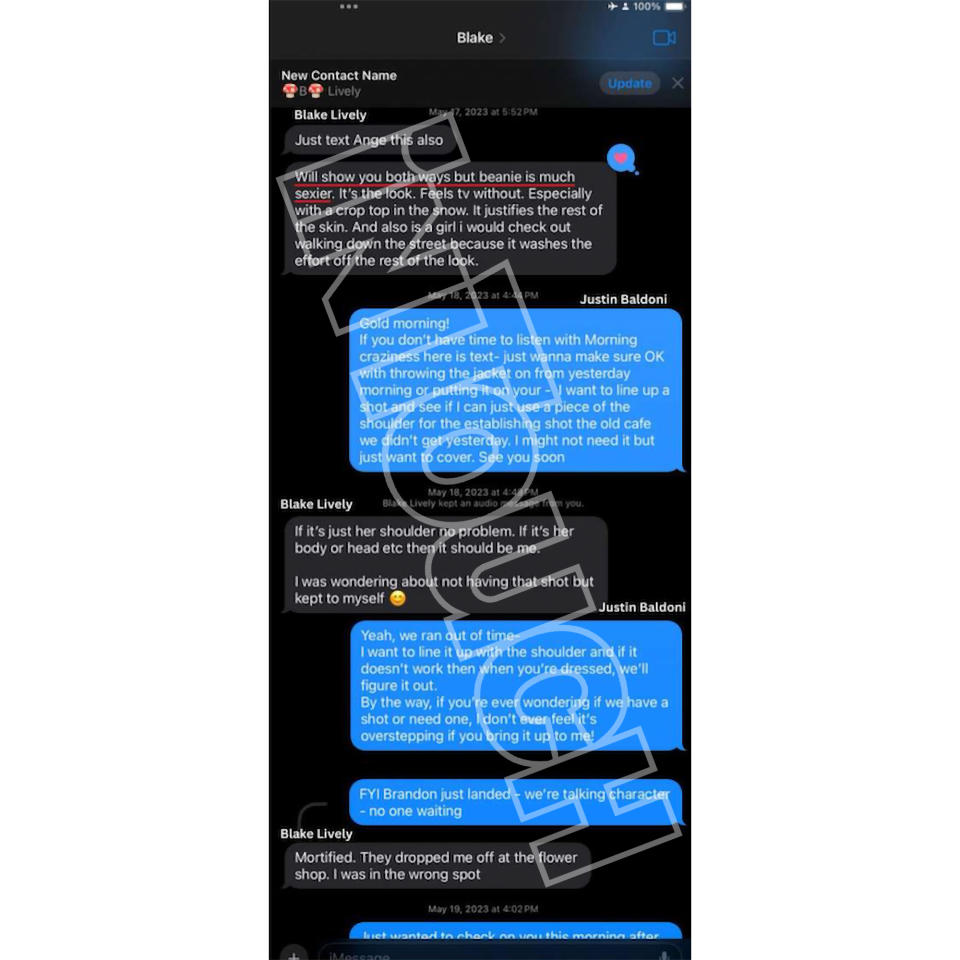

Blake Lively Alleged Controversies And Recent News

May 22, 2025

Blake Lively Alleged Controversies And Recent News

May 22, 2025 -

Blake Lively And The Latest Allegations What We Know So Far

May 22, 2025

Blake Lively And The Latest Allegations What We Know So Far

May 22, 2025 -

The Blake Lively Alleged Incident Context And Analysis

May 22, 2025

The Blake Lively Alleged Incident Context And Analysis

May 22, 2025 -

The Blake Lively Allegations A Comprehensive Analysis Of Recent Reports

May 22, 2025

The Blake Lively Allegations A Comprehensive Analysis Of Recent Reports

May 22, 2025 -

Exploring The Allegations A Critical Analysis Of The Blake Lively Case

May 22, 2025

Exploring The Allegations A Critical Analysis Of The Blake Lively Case

May 22, 2025