D-Wave Quantum (QBTS) Stock: Why The Significant Drop In 2025?

Table of Contents

Market Saturation and Increased Competition in the Quantum Computing Sector

The quantum computing industry, while still nascent, is experiencing a rapid increase in competition. This heightened rivalry significantly impacted D-Wave's market position and contributed to the QBTS stock drop. No longer is D-Wave the sole major player; the emergence of powerful competitors with diverse approaches to quantum computation has created a more crowded and competitive landscape.

- Increased competition from Google, IBM, and other companies: Giants like Google and IBM, with their substantial resources and focus on gate-based quantum computing, pose a significant threat to D-Wave’s market share. Their advancements in qubit technology and broader ecosystem development are attracting significant investor interest.

- Development of alternative quantum computing technologies: The emergence of various quantum computing approaches, including gate-based models, superconducting qubits, and trapped ion technologies, presents alternative solutions to the problems that quantum annealing addresses. This diversification reduces D-Wave's unique selling proposition.

- Pricing pressures from new entrants: The influx of new players into the quantum computing market inevitably leads to pricing pressures. Companies are striving to offer competitive pricing, impacting D-Wave's profitability and potentially hindering future growth.

- Slow adoption rate of quantum computing by large corporations: Despite the technological advancements, the practical application of quantum computing in various industries remains relatively slow. This slower-than-expected adoption rate translates into reduced demand for quantum computing solutions, impacting D-Wave's revenue streams.

Challenges in Scaling Quantum Annealing Technology

D-Wave's core technology, quantum annealing, faces inherent limitations compared to other quantum computing architectures. Scaling up the number of qubits while maintaining their coherence, a crucial factor for performance, presents significant technological hurdles. These challenges directly impacted the company's ability to deliver on its promises and contributed to the QBTS stock decline.

- Difficulty in scaling up the number of qubits: Increasing the number of qubits is essential for solving more complex problems. However, scaling quantum annealers presents significant engineering and manufacturing challenges, limiting D-Wave's ability to compete with the rapid advancements in gate-based systems.

- Challenges in maintaining qubit coherence: Maintaining the delicate quantum states of qubits (coherence) is crucial for accurate computation. The longer the coherence time, the more complex the problems that can be solved. D-Wave’s challenges in this area have hampered the performance and scalability of its systems.

- Limited applicability of quantum annealing to certain problems: Quantum annealing is particularly well-suited for optimization problems. However, its applicability to a broader range of computational tasks is limited compared to the more versatile gate-based models. This limitation restricts the potential market for D-Wave's technology.

- High cost of research and development: Continued investment in research and development is crucial for overcoming the technological challenges. The substantial costs associated with this ongoing effort can put a strain on the company’s finances and impact investor confidence.

Investor Sentiment and Market Volatility

The drop in QBTS stock price wasn't solely due to D-Wave's internal factors; broader market trends and investor sentiment played a significant role. Negative news coverage, analyst downgrades, and a general market downturn contributed to the decline.

- Overall market downturn and investor risk aversion: A broader economic downturn often leads investors to move away from riskier assets, including those in emerging technologies like quantum computing.

- Negative news coverage and analyst downgrades: Negative press coverage and downgrades from financial analysts can significantly impact investor confidence and lead to sell-offs.

- Lack of significant breakthroughs or positive announcements: The absence of major breakthroughs or positive announcements regarding technological advancements or significant contract wins can negatively affect investor perception and stock valuation.

- Changes in investor expectations: Initially high expectations surrounding quantum computing may have been unmet, leading to a reassessment of D-Wave's potential and a subsequent decline in stock price.

Financial Performance and Revenue Projections

D-Wave's financial performance in the period leading up to the stock price drop played a crucial role in the downturn. Lower-than-expected revenue growth and increased operating costs likely contributed to investor concerns.

- Lower-than-expected revenue growth: Slower-than-anticipated growth in revenue indicates challenges in penetrating the market and securing new customers.

- Increased operating costs and expenses: The high cost of research and development, coupled with other operating expenses, can significantly impact profitability.

- Negative or declining profit margins: A decline in profit margins indicates a widening gap between revenue and expenses, a major concern for investors.

- Revised financial forecasts: Any downward revisions to financial forecasts typically lead to negative market reactions, fueling further stock price declines.

Conclusion: Navigating the Future of D-Wave Quantum (QBTS) Stock

The significant drop in D-Wave Quantum (QBTS) stock in 2025 stemmed from a confluence of factors: increased competition, challenges in scaling quantum annealing technology, negative investor sentiment, and less-than-stellar financial performance. While D-Wave continues to be a pioneer in quantum computing, investors need to carefully consider the inherent risks and challenges facing the company. The future of QBTS remains uncertain, dependent on D-Wave's ability to overcome technological hurdles, secure new customers, and improve its financial outlook. Before making any investment decisions regarding D-Wave Quantum (QBTS) stock, thorough due diligence and a comprehensive understanding of the quantum computing landscape are crucial. Learn more about the evolving landscape of D-Wave Quantum (QBTS) and other quantum computing stocks to make informed investment choices.

Featured Posts

-

Transfer Spekuelasyonlari Juergen Klopp Hangi Takimi Sececek

May 21, 2025

Transfer Spekuelasyonlari Juergen Klopp Hangi Takimi Sececek

May 21, 2025 -

Gladbach Defeat Mainzs Top Four Bid Strengthened

May 21, 2025

Gladbach Defeat Mainzs Top Four Bid Strengthened

May 21, 2025 -

Alleged Britains Got Talent Feud David Walliams Takes Aim At Simon Cowell

May 21, 2025

Alleged Britains Got Talent Feud David Walliams Takes Aim At Simon Cowell

May 21, 2025 -

Jacob Friis Julkisti Avauskokoonpanonsa Kamara Ja Pukki Vaihdossa

May 21, 2025

Jacob Friis Julkisti Avauskokoonpanonsa Kamara Ja Pukki Vaihdossa

May 21, 2025 -

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025

Latest Posts

-

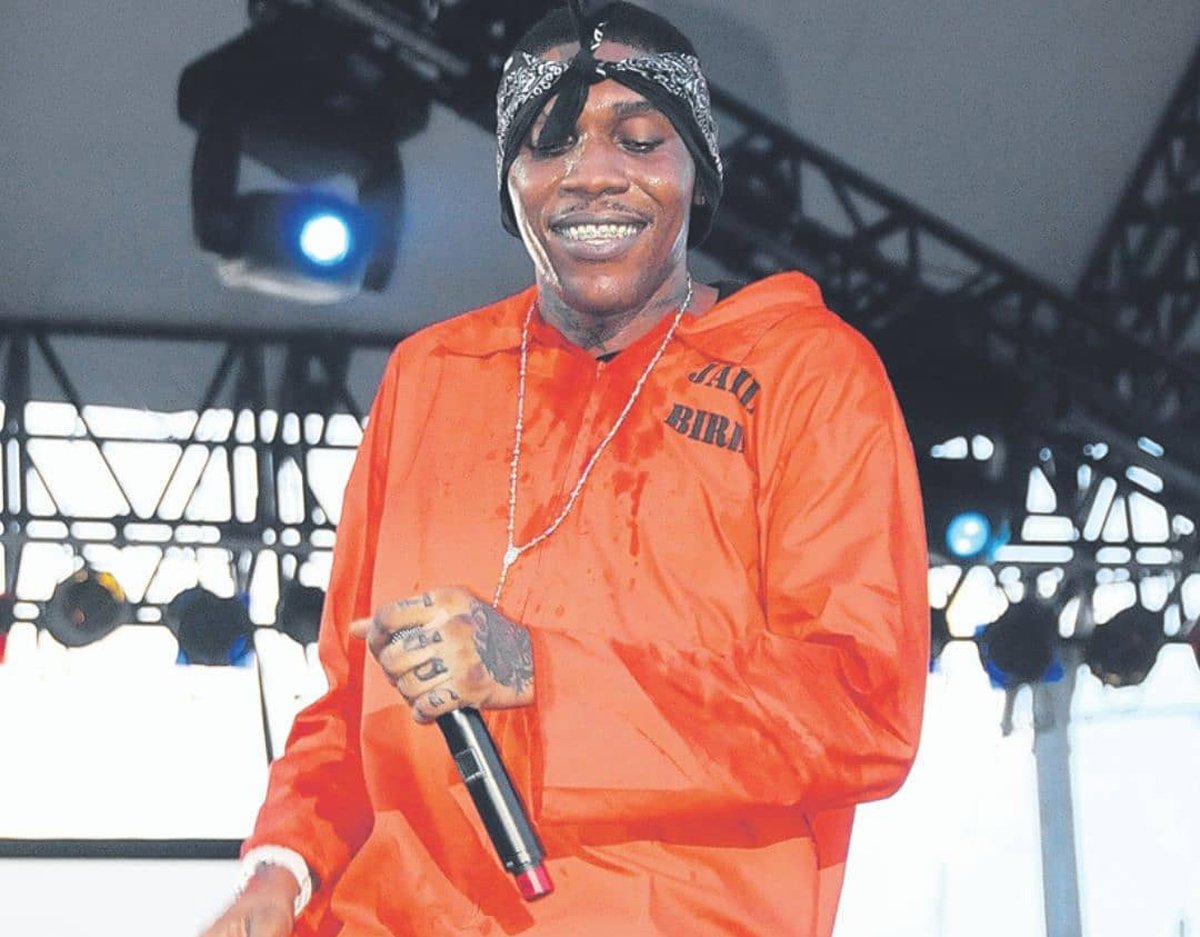

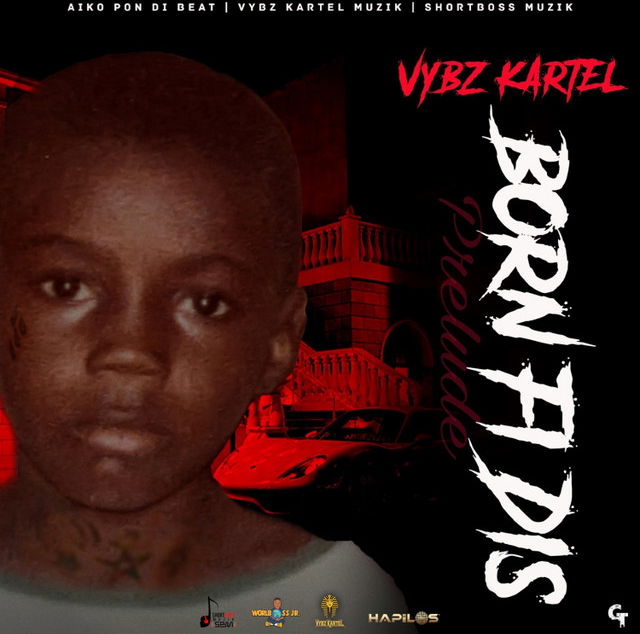

Vybz Kartel Dominates Brooklyn With Back To Back Sold Out Shows

May 22, 2025

Vybz Kartel Dominates Brooklyn With Back To Back Sold Out Shows

May 22, 2025 -

Sold Out Shows Vybz Kartels Brooklyn Concerts A Huge Success

May 22, 2025

Sold Out Shows Vybz Kartels Brooklyn Concerts A Huge Success

May 22, 2025 -

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025 -

Vybz Kartels Support As Dancehall Artist Faces Tt Travel Restrictions

May 22, 2025

Vybz Kartels Support As Dancehall Artist Faces Tt Travel Restrictions

May 22, 2025 -

Vybz Kartel Brooklyn Shows Sell Out Proving Continued Popularity

May 22, 2025

Vybz Kartel Brooklyn Shows Sell Out Proving Continued Popularity

May 22, 2025