D-Wave Quantum (QBTS) Stock's Sharp Rise: A Comprehensive Analysis

Table of Contents

Recent Developments Driving QBTS Stock Price

Several key factors have fueled the recent surge in D-Wave Quantum (QBTS) stock. These positive developments showcase the company's growing momentum in the competitive quantum computing market.

Positive Financial Results and Revenue Growth

D-Wave Quantum has reported encouraging financial results, signaling increasing acceptance of its quantum annealing technology. This positive financial performance has significantly boosted investor confidence in the company's future.

- Q[Insert Quarter] 2024 Revenue: [Insert Actual or Projected Revenue Figures – e.g., a 25% increase year-over-year]. This signifies strong growth and market penetration.

- Profitability Milestones: [Insert information on profitability, or progress towards profitability – e.g., reduced operating losses, positive EBITDA]. This demonstrates the company's increasing efficiency and ability to manage costs effectively.

- Strategic Partnerships: D-Wave's collaborations with [mention key partners – e.g., major tech companies, research institutions] have broadened its market reach and application development opportunities. These partnerships validate the market's belief in their quantum annealing technology and its potential applications. These partnerships directly translate into increased revenue streams and further bolstering the D-Wave Quantum (QBTS) stock price.

The improved financial performance has directly impacted the stock's valuation, making it an increasingly attractive investment for those interested in the burgeoning quantum computing industry.

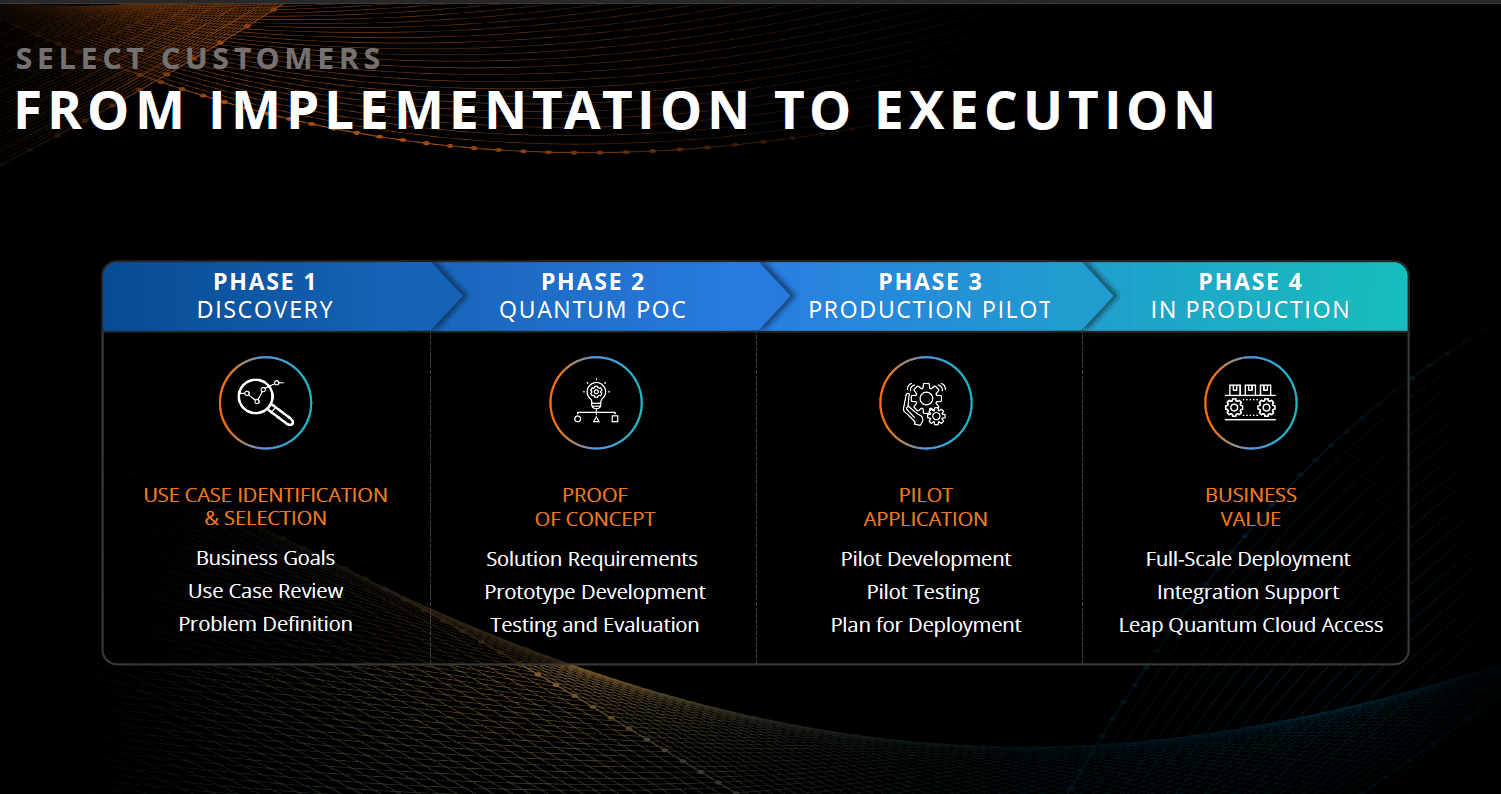

Technological Advancements and Product Launches

D-Wave continues to push the boundaries of quantum computing with significant technological breakthroughs and new product launches. These advancements solidify its position as a leader in quantum annealing technology.

- Leap 2 Quantum System: The launch of the Leap 2 system, with its enhanced capabilities, has expanded the possibilities for quantum computing applications in various sectors, driving investor interest. This upgraded system demonstrates D-Wave's commitment to innovation and leadership within the quantum computing field.

- Software and Algorithm Development: D-Wave's continuous improvement of its software and algorithms makes its quantum computers more accessible and efficient. This makes the technology more viable for a broader range of clients and applications.

- Hybrid Classical-Quantum Solutions: D-Wave is focusing on hybrid approaches, combining classical and quantum computing, to deliver practical solutions for real-world problems. This strategic move showcases the company's understanding of the current needs of the market, highlighting its forward-thinking approach.

These technological leaps showcase D-Wave’s commitment to innovation, driving investor confidence and positively impacting the D-Wave Quantum (QBTS) stock.

Increased Investor Interest and Market Sentiment

The growing interest in the quantum computing sector, coupled with positive media coverage and analyst upgrades, has significantly influenced the D-Wave Quantum (QBTS) stock price.

- Analyst Upgrades: Several reputable analysts have issued positive ratings and increased price targets for QBTS stock, reflecting a bullish outlook on the company's future. Positive expert opinions contribute significantly to influencing overall market sentiment.

- Increased Media Attention: Increased media coverage of D-Wave’s achievements has raised the company's profile and generated greater public awareness, leading to increased interest from retail and institutional investors. Positive media attention is crucial for fostering broader investor interest.

- Overall Market Trends: The overall positive sentiment towards technology stocks and the growing recognition of quantum computing's potential have further contributed to the stock's rise. This favorable market climate for technology investments bolsters the growth of D-Wave Quantum (QBTS) stock.

Analyzing the Risks Associated with Investing in QBTS Stock

While the outlook for D-Wave Quantum (QBTS) stock appears promising, investors must carefully consider the inherent risks associated with investing in this sector.

Market Volatility and Risk Tolerance

The technology sector, and particularly the nascent quantum computing industry, is known for its volatility. Investors should have a high risk tolerance and understand that sharp price fluctuations are possible.

- Price Fluctuations: The D-Wave Quantum (QBTS) stock price is susceptible to rapid changes based on market sentiment, news events, and competitive pressures. This volatility requires investors to be prepared for potential short-term losses.

- Long-Term Investment: Investing in QBTS requires a long-term perspective. Quantum computing is still a developing field, and significant returns may not be realized immediately. A longer-term strategy is crucial to navigate the inherent volatility of the market.

Competition in the Quantum Computing Industry

The quantum computing industry is highly competitive, with established players and emerging startups vying for market share.

- Key Competitors: D-Wave faces competition from companies like IBM, Google, and IonQ, each pursuing different approaches to quantum computing. Understanding this competitive landscape is crucial for assessing the long-term viability of D-Wave's technology.

- Technological Advancements: The rapid pace of innovation in this sector means that D-Wave must continuously innovate to maintain its competitive edge. Falling behind in technological advancements could significantly impact its market position and profitability.

Long-Term Investment Outlook and Potential Returns

Despite the risks, the long-term potential of quantum computing is substantial, potentially offering significant returns for early investors in D-Wave Quantum (QBTS) stock.

- Market Growth: The quantum computing market is projected to experience significant growth in the coming years, presenting potential opportunities for D-Wave. This potential growth is a key driver for the ongoing interest in D-Wave Quantum (QBTS) stock.

- Technological Uncertainty: The long-term success of D-Wave and its technology is still uncertain. The nascent nature of the industry presents numerous unknowns and challenges. Investors need to understand these uncertainties when assessing potential risks and returns.

Conclusion

The recent rise in D-Wave Quantum (QBTS) stock is attributable to a combination of positive financial results, significant technological advancements, and growing investor interest in the quantum computing sector. However, investing in QBTS carries inherent risks, including market volatility and intense competition. The long-term outlook for D-Wave Quantum (QBTS) stock remains promising, but dependent on continued innovation and successful navigation of the competitive landscape. While D-Wave Quantum (QBTS) stock's recent performance is promising, it's crucial to conduct thorough due diligence and consider your risk tolerance before investing in this volatile sector. Further research into D-Wave Quantum (QBTS) stock and the quantum computing market is strongly recommended.

Featured Posts

-

Premier League 2024 25 Champions Photo Celebration

May 21, 2025

Premier League 2024 25 Champions Photo Celebration

May 21, 2025 -

Le Bouillon A Clisson Un Festival De Spectacles Engages

May 21, 2025

Le Bouillon A Clisson Un Festival De Spectacles Engages

May 21, 2025 -

Understanding The Appeal Of Gangsta Granny A Childrens Literature Analysis

May 21, 2025

Understanding The Appeal Of Gangsta Granny A Childrens Literature Analysis

May 21, 2025 -

Breaking Israel Lifts Food Restrictions Allows Supplies Into Gaza

May 21, 2025

Breaking Israel Lifts Food Restrictions Allows Supplies Into Gaza

May 21, 2025 -

Drier Weather Ahead How To Stay Safe And Prepared

May 21, 2025

Drier Weather Ahead How To Stay Safe And Prepared

May 21, 2025

Latest Posts

-

Original Sin Season 1 Finale A Re Evaluation Of Dexters Debra Morgan Handling

May 22, 2025

Original Sin Season 1 Finale A Re Evaluation Of Dexters Debra Morgan Handling

May 22, 2025 -

Dexter New Blood Blu Ray Steelbook Release Everything You Need To Know

May 22, 2025

Dexter New Blood Blu Ray Steelbook Release Everything You Need To Know

May 22, 2025 -

Original Sins Finale How It Makes Dexters Debra Morgan Mistake Worse

May 22, 2025

Original Sins Finale How It Makes Dexters Debra Morgan Mistake Worse

May 22, 2025 -

Dexter Resurrection Wat Betekent De Terugkeer Van Lithgow En Smits

May 22, 2025

Dexter Resurrection Wat Betekent De Terugkeer Van Lithgow En Smits

May 22, 2025 -

Bevestigd John Lithgow En Jimmy Smits In Dexter Resurrection

May 22, 2025

Bevestigd John Lithgow En Jimmy Smits In Dexter Resurrection

May 22, 2025