DBS Bank: A Breathing Space For Major Polluters To Go Green

Table of Contents

DBS Bank's Green Financing Initiatives

DBS Bank is at the forefront of sustainable finance, offering a range of innovative financial instruments designed to support businesses in their transition to greener operations. Their commitment extends beyond simple rhetoric; it's reflected in tangible actions and substantial financial support.

Innovative Loan Structures for Sustainable Transitions

DBS provides tailored loan structures to encourage sustainable practices. These aren't simply "greenwashed" loans; they're specifically designed to support environmentally friendly projects and upgrades.

- Specific Loan Types: DBS offers a variety of financing options, including green bonds, sustainability-linked loans, and transition loans. Green bonds fund specific green projects, while sustainability-linked loans offer better interest rates based on achieving pre-defined ESG targets. Transition loans assist companies in moving away from high-carbon activities.

- Successful Projects: Examples include financing for renewable energy projects in Southeast Asia, assisting manufacturing plants in upgrading to more energy-efficient equipment, and supporting the development of sustainable supply chains.

- Favorable Terms: DBS offers competitive interest rates and flexible repayment schedules to make these green financing options more accessible to major polluters. This financial breathing space is crucial for large-scale transitions.

Investment in Renewable Energy Projects

A significant aspect of DBS Bank's commitment to sustainable finance is its substantial investment in renewable energy projects globally.

- Specific Investments: DBS has invested heavily in solar and wind energy projects across multiple countries, supporting the development of large-scale renewable energy infrastructure. They've also funded projects focused on improving energy efficiency and reducing reliance on fossil fuels.

- Geographic Focus: Their investment portfolio spans various regions, reflecting a global commitment to tackling climate change, with a particular focus on Asia.

- Scale of Investment: The sheer scale of these investments signals a long-term dedication to transitioning away from fossil fuels and towards a cleaner energy future.

Supporting Green Technology Development

DBS actively promotes the development of new green technologies by funding research and development and forging partnerships with innovative companies.

- Technology Companies: DBS has supported numerous start-ups and established companies developing cutting-edge green technologies, such as carbon capture systems, improved battery technology for electric vehicles, and waste-to-energy solutions.

- Types of Technologies: The bank focuses on technologies that directly address pollution reduction, energy efficiency, and the circular economy.

- Long-Term Impact: This investment in innovation is critical for driving long-term reductions in greenhouse gas emissions and achieving a more sustainable future.

The Role of ESG (Environmental, Social, and Governance) Investing

DBS Bank's commitment to environmental sustainability extends beyond its green financing initiatives. They have fully integrated ESG factors into their overall investment strategy.

Integrating ESG Factors into Investment Decisions

ESG considerations are no longer an afterthought for DBS; they're central to their investment decision-making process.

- Specific ESG Factors: DBS considers a wide range of ESG factors, including carbon emissions, waste management, water usage, biodiversity protection, and human rights standards.

- Impact on Investment Decisions: Companies with strong ESG scores are favored, while those with poor performance are often excluded from investment opportunities. This approach actively steers capital towards more sustainable businesses.

- Transparent Reporting: DBS provides transparent reporting on their ESG performance, allowing stakeholders to assess their commitment to sustainability.

Attracting ESG-Conscious Investors

DBS's strong ESG profile attracts investors who prioritize sustainability, driving further growth in sustainable finance.

- Growth in ESG Investments: The increasing demand for ESG-compliant investments benefits DBS by attracting a growing pool of environmentally conscious investors.

- Positive Media Coverage: Their dedication to sustainable practices has resulted in positive media coverage, enhancing their reputation and attracting further investment.

- Benefits for DBS: This focus on ESG investing enhances the bank's reputation, attracts talent, and contributes to its long-term financial stability.

Addressing Criticisms and Challenges

While DBS Bank's commitment to sustainable finance is commendable, it's important to acknowledge the challenges involved in balancing profitability with environmental responsibility.

Balancing Profitability with Sustainability

A key challenge lies in balancing the pursuit of financial returns with the long-term goals of environmental sustainability.

- Potential Conflicts of Interest: The bank must carefully manage potential conflicts of interest between its financial goals and its environmental commitments.

- Managing Risk: Green investments often carry higher risks compared to traditional investments, requiring careful risk management strategies.

- Long-Term Commitment: True sustainability requires a long-term commitment, not just short-term initiatives. This requires sustained dedication from the bank's leadership and consistent investment.

The Need for Increased Transparency and Accountability

Ensuring transparency and accountability in reporting on environmental impact is paramount to avoid greenwashing.

- Independent Verification: Independent verification of sustainability claims is crucial to maintain credibility and prevent misleading statements.

- Consistent Reporting Standards: Adopting and adhering to consistent reporting standards ensures comparability and allows for accurate assessment of environmental impact.

- Addressing Greenwashing: Active efforts must be made to prevent and address potential greenwashing concerns, ensuring that sustainability initiatives are genuine and effective.

Conclusion

DBS Bank is playing a pivotal role in facilitating a greener future for major polluters. Their diverse green financing initiatives, strong commitment to ESG investing, and proactive approach to addressing challenges demonstrate a significant contribution to environmental sustainability. By providing a financial "breathing space" for companies to undertake necessary transitions, DBS is driving meaningful change. Discover how DBS Bank is providing a crucial breathing space for major polluters to adopt sustainable practices and contribute to a healthier planet. Learn more about DBS Bank's commitment to sustainable finance and their initiatives supporting major polluters' transition to greener practices by visiting [insert link to DBS Bank's sustainability reports or relevant webpage here].

Featured Posts

-

Breaking Bread With Scholars A Guide To Meaningful Academic Discussion

May 08, 2025

Breaking Bread With Scholars A Guide To Meaningful Academic Discussion

May 08, 2025 -

El Emotivo Gesto De Pulgar Un Mensaje Al Corazon De La Hinchada Del Flamengo

May 08, 2025

El Emotivo Gesto De Pulgar Un Mensaje Al Corazon De La Hinchada Del Flamengo

May 08, 2025 -

Players Call Out National Media The Thunders Response

May 08, 2025

Players Call Out National Media The Thunders Response

May 08, 2025 -

How Matt Damon Chooses Roles Advice From Ben Affleck

May 08, 2025

How Matt Damon Chooses Roles Advice From Ben Affleck

May 08, 2025 -

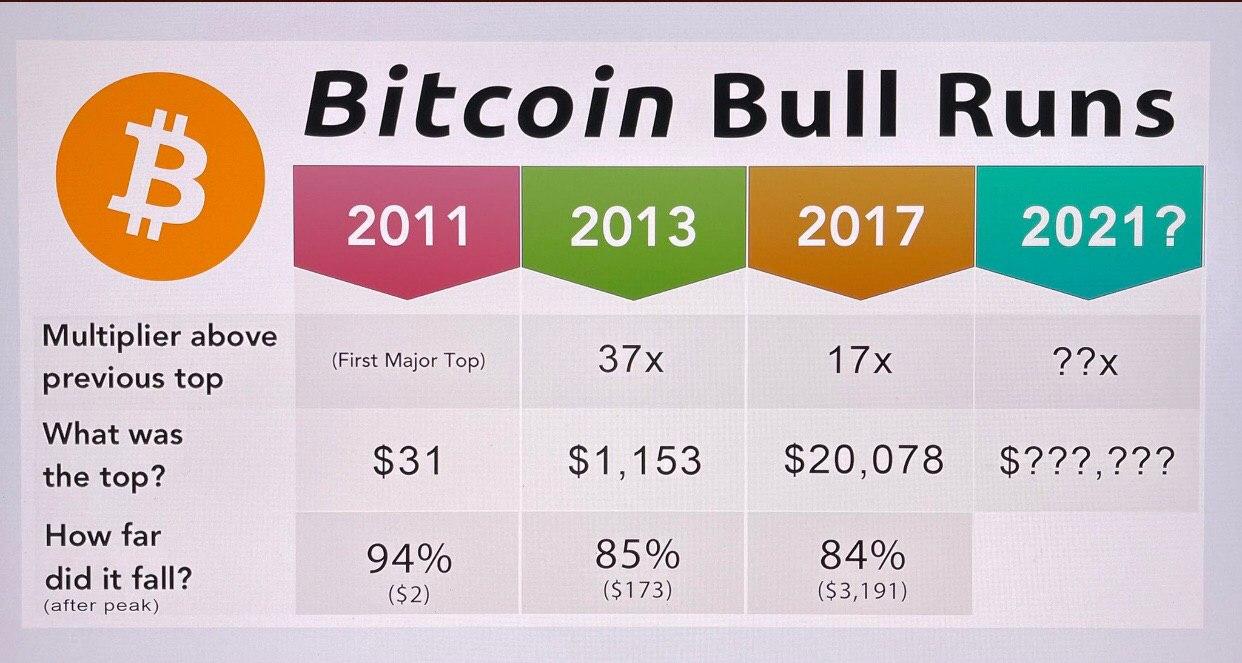

Bitcoin Rebound Is This The Start Of A New Bull Market

May 08, 2025

Bitcoin Rebound Is This The Start Of A New Bull Market

May 08, 2025