Decoding Buffett's Apple Strategy: Insights For Long-Term Investors

Table of Contents

The Rationale Behind Buffett's Apple Investment

Buffett's investment in Apple wasn't a gamble; it was a calculated move rooted in his understanding of fundamental value and long-term growth potential. Several key factors underpinned this decision.

Apple's Strong Brand and Consumer Loyalty

Apple boasts an unparalleled brand reputation and fiercely loyal customer base. This translates into consistent recurring revenue streams, a key element of Buffett's investment philosophy.

- High customer satisfaction scores: Consistently ranking high in customer satisfaction surveys demonstrates the strength of the Apple brand and its ability to retain customers.

- Strong brand recognition: The Apple logo is globally recognized as a symbol of quality, innovation, and design, fostering brand loyalty and premium pricing power.

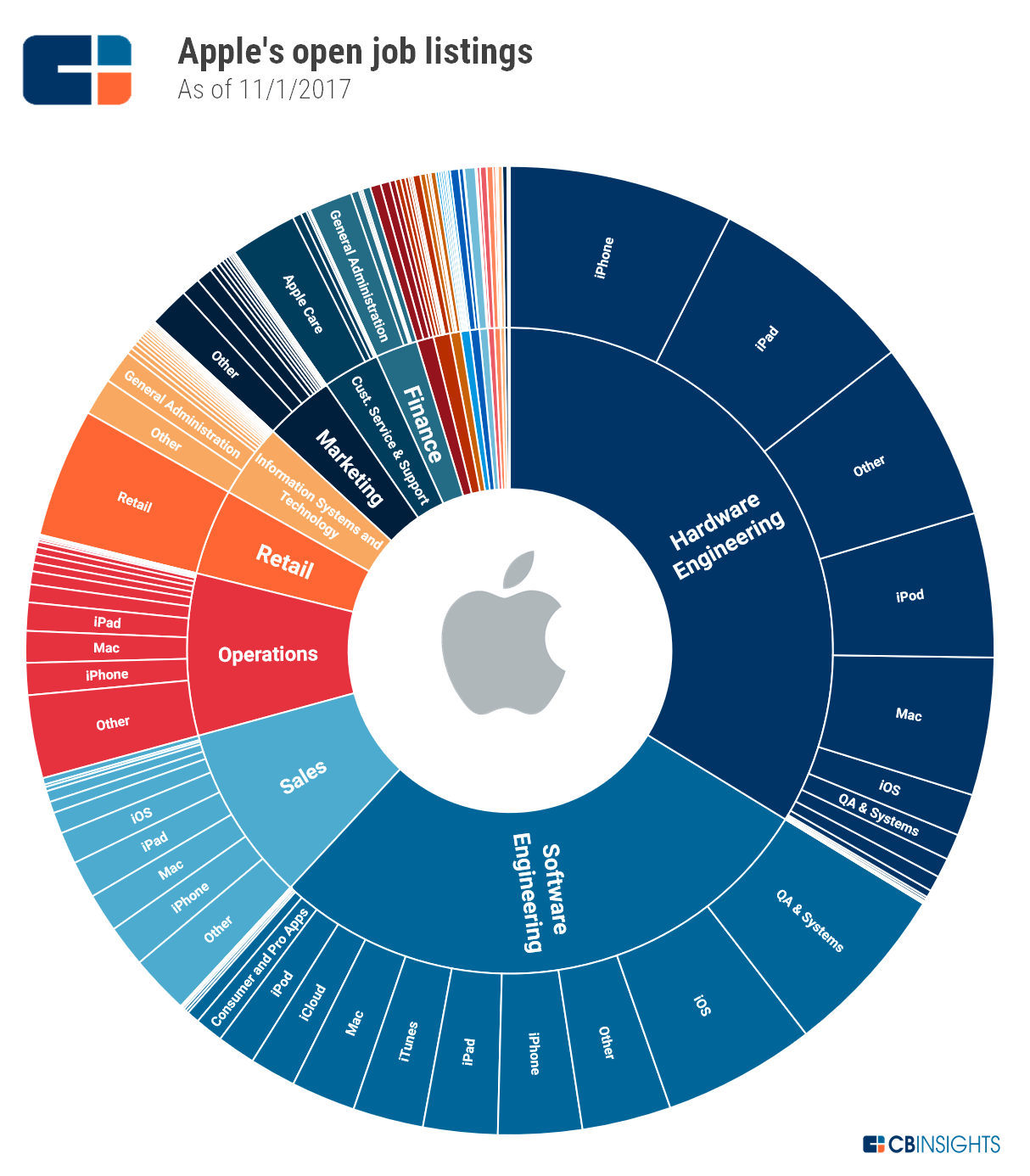

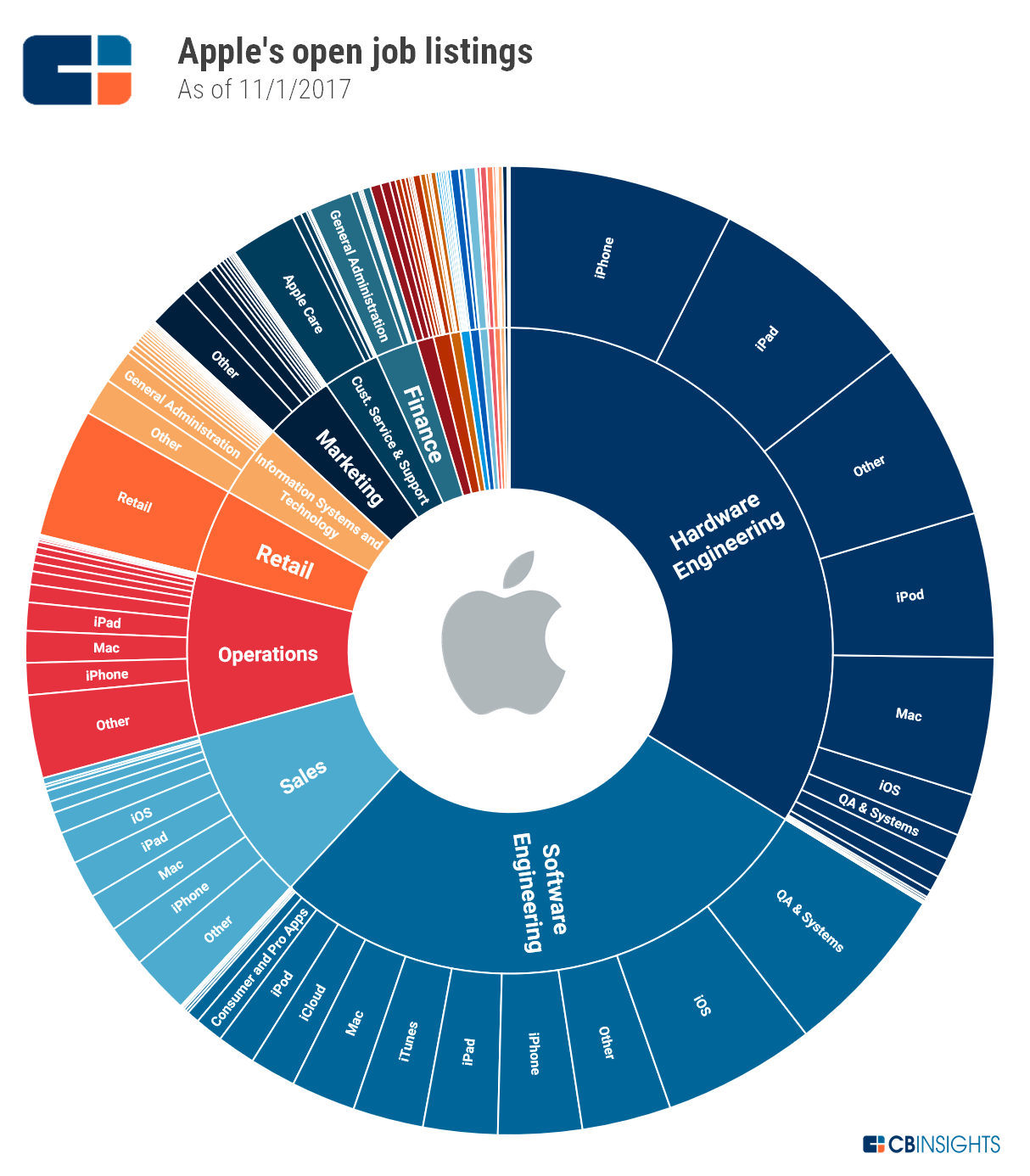

- Sticky ecosystem: The interconnectedness of iPhones, iPads, Macs, Apple Watches, and Apple services creates a "sticky" ecosystem, making it difficult for consumers to switch to competing brands. This "ecosystem lock-in" is a significant driver of recurring revenue.

- High switching costs: The investment in Apple's ecosystem (apps, data, etc.) creates high switching costs, further enhancing customer retention.

Keywords: Apple brand loyalty, consumer retention, recurring revenue, ecosystem lock-in, brand recognition, customer satisfaction.

Apple's Consistent Profitability and Cash Flow

Apple's financial performance is a testament to its enduring success. Consistent profitability and robust free cash flow are hallmarks of the company, aligning perfectly with Buffett's value investing principles.

- High profit margins: Apple consistently maintains high profit margins, indicating strong pricing power and efficient operations.

- Robust cash reserves: Apple's massive cash reserves provide financial flexibility for acquisitions, research and development, and share buybacks.

- Consistent dividend payments: Apple's dividend payments provide a steady stream of income for investors, further enhancing the appeal of the stock.

- Share buybacks: Apple's aggressive share buyback program increases the value of remaining shares, benefiting existing shareholders.

Keywords: Apple financial performance, profitability, cash flow, dividend yield, share buybacks, financial strength.

Buffett's Value Investing Principles

The Apple investment embodies Buffett's core value investing principles: identifying undervalued companies with strong long-term growth potential.

- Understated value compared to intrinsic value: Buffett likely saw Apple as undervalued relative to its intrinsic value – the true worth of the company based on its future earnings potential.

- Strong management team: Apple's strong and experienced management team, under Tim Cook's leadership, has consistently delivered strong results.

- Long-term growth potential: Buffett recognized Apple's potential for long-term growth in existing and new markets.

- Wide economic moat: Apple's strong brand, loyal customer base, and innovative ecosystem create a wide economic moat, protecting it from competition.

Keywords: Value investing, intrinsic value, long-term investment, Warren Buffett investing principles, economic moat, understated value.

Analyzing Apple's Long-Term Growth Potential

Apple's success isn't just a reflection of its past; it's a testament to its ongoing innovation and expansion into new markets.

Innovation and Future Product Lines

Apple's commitment to innovation ensures its continued growth trajectory. New product lines and services are crucial to this strategy.

- Upcoming product launches: Apple consistently introduces new products and updates to existing ones, keeping its offerings fresh and competitive.

- Expansion into new service sectors: Apple is aggressively expanding its services revenue, generating recurring income streams from subscriptions and digital content.

- Potential for AR/VR adoption: Apple's potential entry into the augmented and virtual reality markets presents significant growth opportunities.

Keywords: Apple innovation, future products, service revenue, wearables market, AR/VR technology, technological innovation.

Global Market Expansion and Emerging Markets

Apple's global reach continues to expand, with significant growth potential in emerging markets.

- Market penetration in developing countries: Expanding into developing countries offers substantial growth opportunities as more people gain access to technology.

- Growth in Asia and other regions: Asia, in particular, presents a vast and largely untapped market for Apple products.

- Localization strategies: Tailoring products and services to local markets is essential for success in international expansion.

Keywords: Global market expansion, emerging markets, international growth, market penetration, global reach.

Lessons for Long-Term Investors from Buffett's Apple Strategy

Buffett's Apple investment provides valuable lessons for any long-term investor.

The Importance of Identifying Strong Businesses

Successful long-term investing hinges on identifying companies with sustainable competitive advantages.

- Conduct thorough due diligence: Before investing, conduct thorough research to understand a company's fundamentals, financials, and competitive landscape.

- Assess management quality: A strong and competent management team is crucial for long-term success.

- Focus on long-term fundamentals: Don't be swayed by short-term market fluctuations; focus on the long-term fundamentals of the business.

Keywords: Due diligence, company fundamentals, management quality, competitive advantage, long-term vision.

The Power of Patient, Long-Term Investing

Patience and discipline are essential for long-term investment success.

- Avoid impulsive trading decisions: Resist the urge to buy and sell based on short-term market noise.

- Focus on long-term growth: Invest in companies with the potential for sustained, long-term growth.

- Ride out market volatility: Market volatility is inevitable; maintaining a long-term perspective is key to weathering market storms.

Keywords: Long-term investment, patience, market volatility, buy and hold strategy, disciplined investing.

Conclusion

Buffett's Apple strategy demonstrates the power of identifying strong, fundamentally sound businesses with long-term growth potential. By focusing on consistent profitability, strong brands, and a wide economic moat, Buffett has secured significant returns for Berkshire Hathaway shareholders. The key takeaways are clear: thorough due diligence, a focus on long-term fundamentals, and unwavering patience are essential ingredients for successful long-term investing. Decode your own investment strategy using the principles of Buffett's Apple approach. Learn more about leveraging Buffett's Apple Strategy for your long-term portfolio and discover how to identify similarly promising investments. Keywords: Buffett's Apple Strategy, long-term investing, value investing, Apple stock, investment strategy, long-term growth.

Featured Posts

-

Aorus Master 16 Gigabyte Review High End Gaming Laptop Analysis

May 06, 2025

Aorus Master 16 Gigabyte Review High End Gaming Laptop Analysis

May 06, 2025 -

Nba Playoffs Game 1 Knicks Vs Celtics Prediction And Best Betting Options

May 06, 2025

Nba Playoffs Game 1 Knicks Vs Celtics Prediction And Best Betting Options

May 06, 2025 -

Watch Knicks Vs Celtics 2025 Nba Playoffs A Guide

May 06, 2025

Watch Knicks Vs Celtics 2025 Nba Playoffs A Guide

May 06, 2025 -

Raising Venice Innovative Solutions To The Citys Flooding Crisis

May 06, 2025

Raising Venice Innovative Solutions To The Citys Flooding Crisis

May 06, 2025 -

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

May 06, 2025

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

May 06, 2025

Latest Posts

-

Where To Watch Celtics Vs Magic Game 5 On April 29th

May 06, 2025

Where To Watch Celtics Vs Magic Game 5 On April 29th

May 06, 2025 -

Celtics Vs Magic Game 5 Date Time How To Watch And Live Stream

May 06, 2025

Celtics Vs Magic Game 5 Date Time How To Watch And Live Stream

May 06, 2025 -

Celtics Vs Magic Game 5 Time Tv Channel And Live Stream Info April 29

May 06, 2025

Celtics Vs Magic Game 5 Time Tv Channel And Live Stream Info April 29

May 06, 2025 -

Boston Celtics Playoff Matchups Complete Schedule Against Orlando Magic

May 06, 2025

Boston Celtics Playoff Matchups Complete Schedule Against Orlando Magic

May 06, 2025 -

2024 Nba Playoffs Boston Celtics Game Schedule Vs Orlando Magic

May 06, 2025

2024 Nba Playoffs Boston Celtics Game Schedule Vs Orlando Magic

May 06, 2025