Decoding The House Republicans' Trump Tax Cut Proposal

Table of Contents

Key Features of the Proposed Trump Tax Cut Proposal

This new proposal aims to significantly reduce tax burdens for individuals and corporations, echoing the core tenets of the 2017 Tax Cuts and Jobs Act. While specific details are still emerging, initial reports suggest a focus on lowering individual income tax rates, reducing the corporate tax rate, and potentially making adjustments to capital gains taxes. The exact parameters of these changes are still subject to revision and debate within the Republican party itself.

-

Proposed Changes to Individual Income Tax Brackets: Reports indicate a potential lowering of the individual income tax brackets, aiming to provide tax relief for a broad range of taxpayers. The specific percentage reductions and income thresholds are yet to be finalized. Further details are expected as the legislation is refined.

-

Changes to Corporate Tax Rates: A key element of the proposal involves lowering the corporate tax rate. This reduction is intended to stimulate business investment and economic growth by increasing corporate profitability. The proposed rate is currently subject to negotiations and could vary.

-

Impact on Capital Gains Taxes: The treatment of capital gains taxes remains a point of contention. Some proposals suggest lowering capital gains taxes, which could benefit investors and spur economic activity. However, others argue against this, citing concerns about income inequality.

-

Changes to Deductions and Credits: The proposal may also include modifications to existing deductions and tax credits, such as the standard deduction and the child tax credit. The extent of these changes is currently unclear, adding to the complexity of assessing the overall impact.

-

Sunset Provisions: A critical aspect to consider is the presence or absence of sunset provisions. Tax cuts enacted with sunset clauses will eventually expire, leading to potential tax increases down the line unless further legislative action is taken.

Economic Impacts of the Trump Tax Cut Proposal – Potential Benefits

Proponents of the Trump Tax Cut Proposal argue it will boost economic growth, create jobs, and stimulate investment. They point to the potential for increased consumer spending due to higher disposable income, as well as enhanced business investment, leading to job creation and economic expansion.

-

Projected GDP Growth: Supporters cite economic models suggesting significant GDP growth in response to the tax cuts. However, these projections often rely on specific assumptions that are debatable and require further scrutiny. (Note: Specific citations and source material would be inserted here in a fully developed article.)

-

Increased Business Investment and Expansion: Lower corporate taxes are expected to encourage businesses to invest more in equipment, technology, and expansion, leading to higher productivity and job creation. (Note: Citations and data sources would be included in a complete article.)

-

Impact on Wages and Employment: The proposed cuts aim to stimulate job growth by increasing business profitability. While this effect is anticipated, the magnitude remains uncertain, and various economic factors could influence the outcome. (Note: Source material would be included here.)

-

Increased Consumer Spending: Lower taxes often translate to increased disposable income for consumers, leading to increased consumer spending and boosting economic activity. (Note: Sources would be cited.)

Economic Impacts of the Trump Tax Cut Proposal – Potential Drawbacks

Critics of the Trump Tax Cut Proposal raise concerns about several potential negative economic consequences. These include a substantial increase in the national debt, inflationary pressures, and a widening of income inequality.

-

Projected Increase in the National Debt: Significant tax cuts without corresponding spending cuts can lead to a substantial increase in the national debt. This could have long-term implications for the country's fiscal health and economic stability. (Note: Citations and data sources would be included here.)

-

Potential for Increased Inflation: Increased consumer spending and business investment driven by tax cuts could put upward pressure on prices, leading to inflation. This could erode purchasing power and negate some of the benefits of the tax cuts. (Note: Sources and supporting data would be included.)

-

Impact on Income Inequality: Critics argue that tax cuts disproportionately benefit high-income earners, potentially exacerbating income inequality. This could lead to social and economic instability. (Note: Sources and data would be cited in a complete article.)

-

Disproportionate Benefits to High-Income Earners: The structure of the proposed tax cuts might provide greater tax relief to high-income individuals and corporations compared to lower-income households, potentially widening the gap in wealth distribution. (Note: Data and source material would be added here)

Political Ramifications and Public Opinion on the Trump Tax Cut Proposal

The political landscape surrounding the Trump Tax Cut Proposal is highly charged. Its passage faces potential challenges, depending on the level of bipartisan support (or opposition) it receives. Public opinion polls will play a key role in shaping the political debate and influencing legislative outcomes.

-

Support from Different Political Parties: The proposal is likely to receive strong support from Republicans but face significant opposition from Democrats. The level of bipartisan support (or lack thereof) will be crucial in determining its legislative fate.

-

Public Opinion Polls: Public opinion surveys will provide valuable insights into public sentiment toward the proposal. Understanding public approval or disapproval will influence both the political debate and the likelihood of the proposal’s success. (Note: Citations for relevant polls and surveys would be included.)

-

Challenges in Passing the Legislation: Given the narrow margins in Congress, the Trump Tax Cut Proposal faces considerable challenges in securing the necessary votes for passage. Compromises and negotiations might be required to garner sufficient support.

-

Impact on Upcoming Elections: The Trump Tax Cut Proposal is likely to be a major topic of discussion during upcoming elections, influencing voter choices and shaping the political landscape.

Conclusion

The House Republicans' Trump Tax Cut Proposal is a complex piece of legislation with far-reaching economic and political implications. While proponents argue it will stimulate economic growth and job creation, critics express concerns about increased national debt, inflation, and income inequality. Understanding the potential benefits and drawbacks of this proposal requires careful consideration of its multifaceted impacts. Understanding the intricacies of the Trump Tax Cut Proposal is crucial for informed participation in the political process. Stay informed about the latest developments and engage in discussions to better understand the potential impact of this significant legislative initiative. Continue to follow news and analysis on the Trump tax cut proposal and its various iterations for further insights.

Featured Posts

-

Rock Stock Earnings Preview Potential Impacts And Investment Strategies

May 13, 2025

Rock Stock Earnings Preview Potential Impacts And Investment Strategies

May 13, 2025 -

Sabadell In Talks With Unicaja Investors Potential Merger On The Horizon

May 13, 2025

Sabadell In Talks With Unicaja Investors Potential Merger On The Horizon

May 13, 2025 -

Rising Temperatures Health Departments Heat Advisory And Safety Tips

May 13, 2025

Rising Temperatures Health Departments Heat Advisory And Safety Tips

May 13, 2025 -

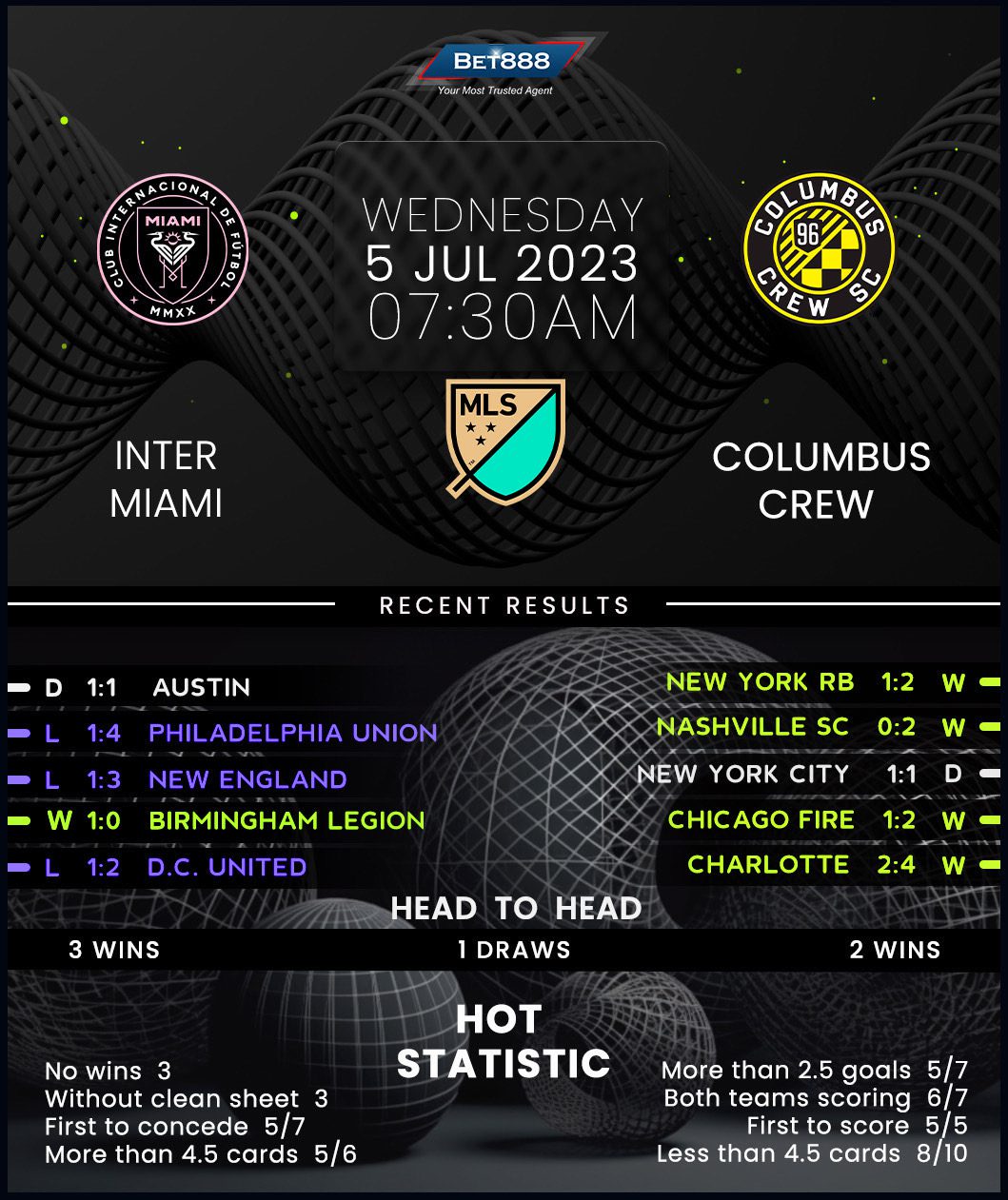

Record Crowd Sees Inter Miamis 1 0 Win Against Columbus Crew

May 13, 2025

Record Crowd Sees Inter Miamis 1 0 Win Against Columbus Crew

May 13, 2025 -

Live With Kelly And Ryan Consuelos Addresses Ripas Recent Absence

May 13, 2025

Live With Kelly And Ryan Consuelos Addresses Ripas Recent Absence

May 13, 2025

Latest Posts

-

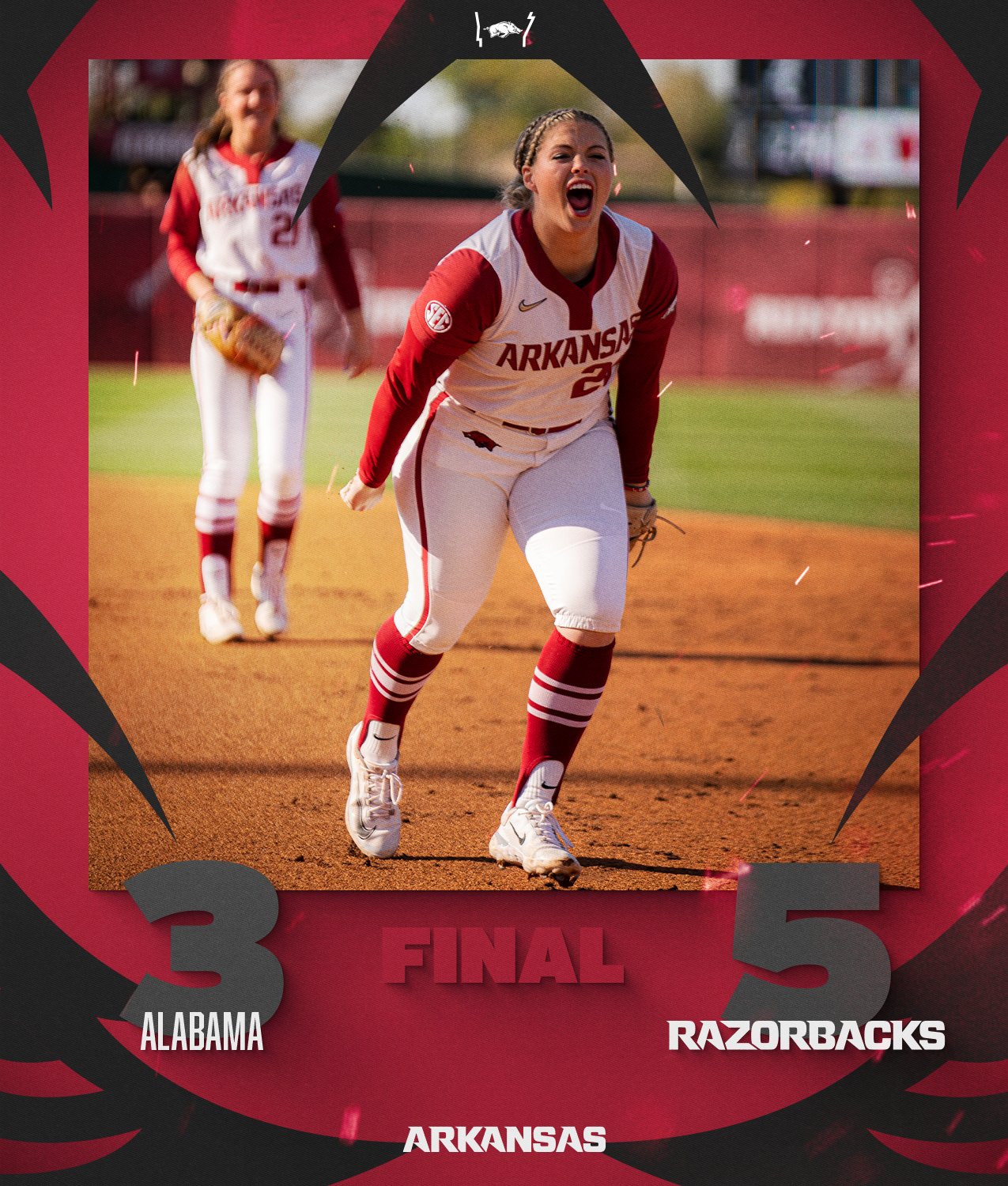

Razorback Power Hitter Leads Softball Charge

May 14, 2025

Razorback Power Hitter Leads Softball Charge

May 14, 2025 -

When To Intentionally Walk Aaron Judge A Strategic Analysis

May 14, 2025

When To Intentionally Walk Aaron Judge A Strategic Analysis

May 14, 2025 -

Arkansas Razorbacks Softball Queen Of The Diamond

May 14, 2025

Arkansas Razorbacks Softball Queen Of The Diamond

May 14, 2025 -

Record 8 2 Billion Iwi Asset Growth Outpaces Expectations

May 14, 2025

Record 8 2 Billion Iwi Asset Growth Outpaces Expectations

May 14, 2025 -

Arkansas Softball Power Hitting Dominance

May 14, 2025

Arkansas Softball Power Hitting Dominance

May 14, 2025