Delinquent Student Loans: New Government Enforcement And Borrower Protections

Table of Contents

Increased Government Enforcement of Delinquent Student Loans

The government's approach to collecting delinquent student loan debt has become increasingly assertive. This renewed focus reflects the substantial amount of outstanding debt and the need to recover funds. Several aggressive strategies are now employed to pursue repayment from borrowers in default:

-

Wage Garnishment: A portion of a borrower's wages can be directly seized by the government to satisfy the debt. This is a significant financial impact, often leaving borrowers with reduced income.

-

Tax Refund Offset: The government can intercept and apply a borrower's federal tax refund towards their delinquent student loan balance. This means borrowers may receive a significantly smaller refund, or none at all.

-

Bank Account Levies: Funds can be directly withdrawn from a borrower's bank account to settle the outstanding debt. This can lead to overdraft fees and further complicate a borrower's financial situation.

-

Increased Use of Debt Collection Agencies: The government increasingly relies on private debt collection agencies to pursue delinquent borrowers, often leading to an increased volume of calls and collection attempts.

The Department of Education and the Treasury Department are the primary government agencies involved in these enforcement actions. Recent legal precedents have strengthened the government's ability to pursue these collection methods, emphasizing the seriousness of student loan default. Keywords associated with this increased enforcement include student loan default, government collection, wage garnishment, and tax refund offset.

New Borrower Protections for Delinquent Student Loans

While government enforcement has intensified, there are also expanded protections designed to assist borrowers struggling with repayment. These initiatives aim to make repayment more manageable and prevent unnecessary defaults:

-

Income-Driven Repayment (IDR) Plans: These plans adjust monthly payments based on a borrower's income and family size, making repayment more affordable. Several IDR plans exist, each with its own eligibility criteria.

-

Loan Forgiveness Programs: Programs like Public Service Loan Forgiveness (PSLF) offer the potential for loan forgiveness after a period of qualifying employment in public service. Eligibility requirements are specific and must be carefully reviewed.

-

Expanded Options for Loan Rehabilitation: Loan rehabilitation involves making consistent on-time payments for a specified period, which can remove the default status from a borrower's credit report.

-

Increased Transparency and Communication from Lenders: Efforts are underway to improve communication between lenders and borrowers, making it easier to understand repayment options and avoid default.

Understanding the eligibility criteria for these protections is crucial. The government provides various websites and resources to help borrowers navigate these options. Keywords related to these protections include student loan forgiveness, income-driven repayment, loan rehabilitation, and borrower defense. Utilizing these resources is key to finding the right fit for your individual situation.

Understanding Your Rights as a Borrower with Delinquent Student Loans

Knowing your rights and options is paramount when dealing with delinquent student loans. Proactive steps can significantly impact the outcome:

-

Contacting Your Loan Servicer: Open communication with your loan servicer is essential. They can help explore repayment options and potentially avoid default.

-

Exploring Repayment Options: Investigate all available repayment plans, including IDR plans and deferment or forbearance options.

-

Seeking Professional Advice: Consider consulting with a student loan counselor or financial advisor for personalized guidance and support.

Taking these proactive steps emphasizes the benefits of open communication and careful planning. Resources available through government websites and non-profit organizations can offer valuable support and guidance. Relevant keywords include student loan repayment, debt management, financial aid, and loan servicer.

Taking Control of Your Delinquent Student Loans

This article highlighted the intensified government enforcement of delinquent student loans alongside the expanded borrower protections available. Understanding your rights and responsibilities is crucial for navigating this complex landscape. Don't let delinquent student loans overwhelm you. Learn more about your options and take control of your financial future today by researching available resources for managing your delinquent student loans. Explore the links provided throughout this article and contact a student loan counselor for personalized guidance to find a repayment plan that fits your needs.

Featured Posts

-

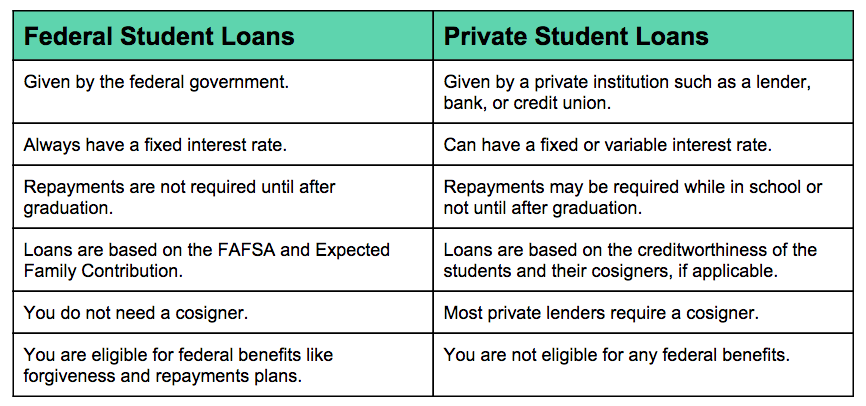

The Trump Family Tree A Guide To The Former Presidents Family Members

May 17, 2025

The Trump Family Tree A Guide To The Former Presidents Family Members

May 17, 2025 -

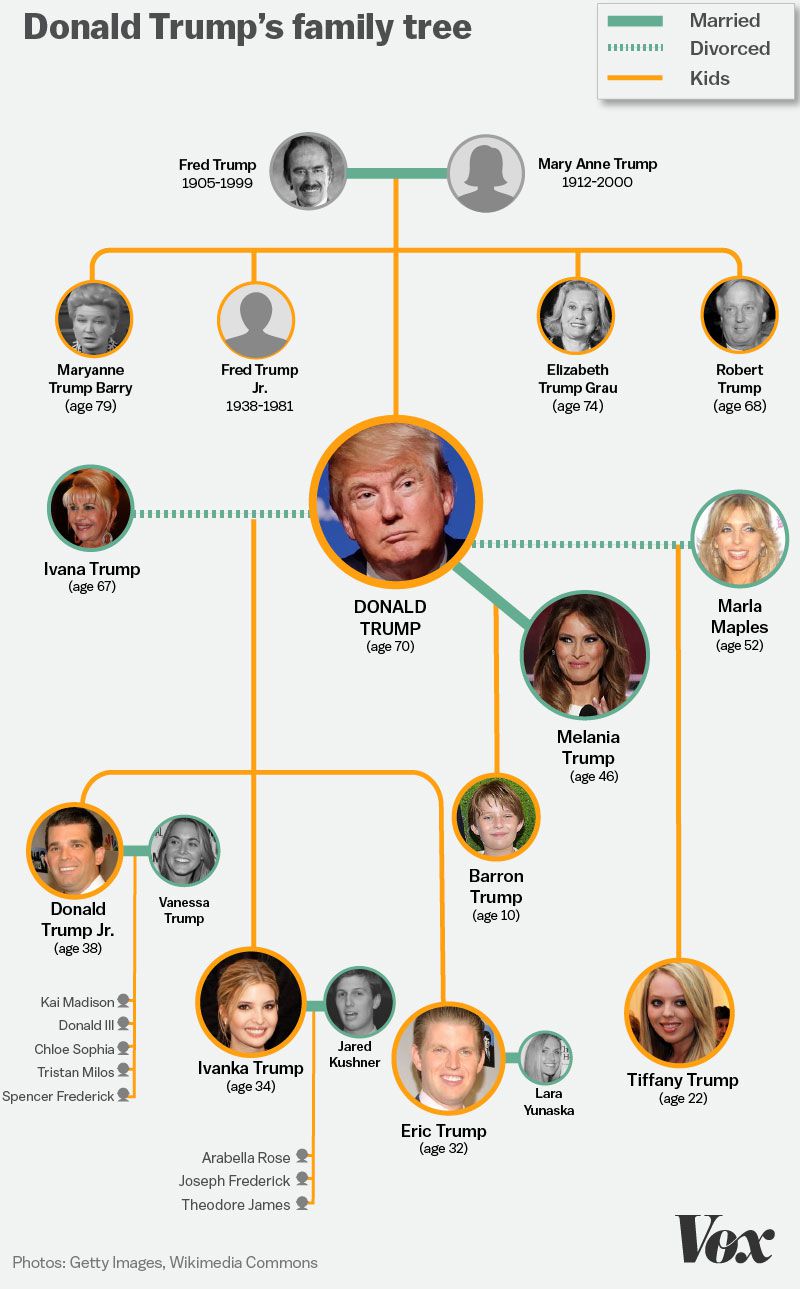

Fortnite Cosmetic Changes A Refund Indicates Major Updates

May 17, 2025

Fortnite Cosmetic Changes A Refund Indicates Major Updates

May 17, 2025 -

J Jocyte Grizta I Europa Atstovaus Lietuvai Cempionate

May 17, 2025

J Jocyte Grizta I Europa Atstovaus Lietuvai Cempionate

May 17, 2025 -

Fortnite Item Shop Update A Disappointment For Many Fans

May 17, 2025

Fortnite Item Shop Update A Disappointment For Many Fans

May 17, 2025 -

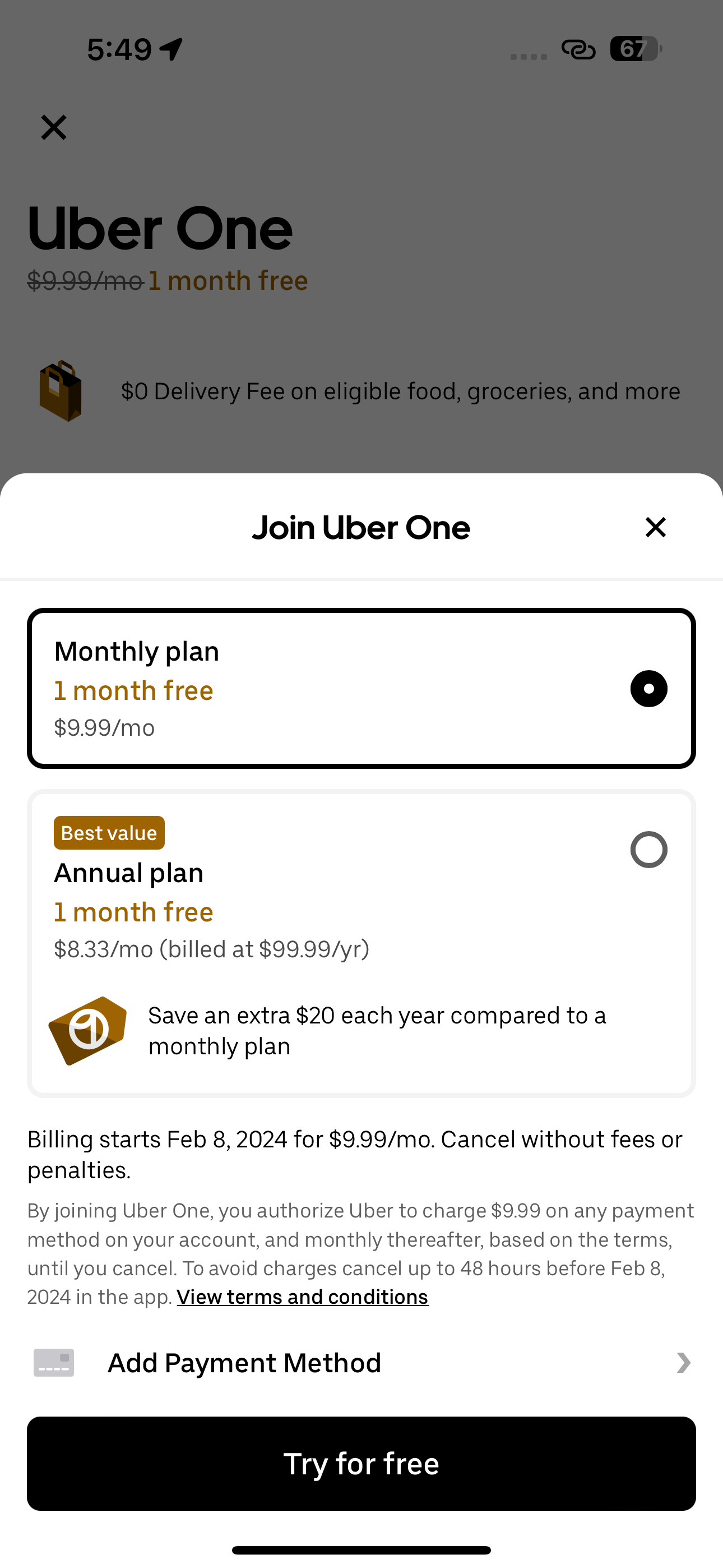

Uber One Kenya Discounts And Free Deliveries Now Available

May 17, 2025

Uber One Kenya Discounts And Free Deliveries Now Available

May 17, 2025