Despite Apple Price Target Cut, Wedbush Remains Bullish: Should You?

Table of Contents

Wedbush's Rationale for Maintaining a Bullish Outlook on Apple

Despite the price target reduction, Wedbush remains confident in Apple's long-term prospects. Their bullish stance is primarily based on several key factors:

Strong iPhone Sales and Services Growth

Even amidst global economic headwinds, iPhone sales remain remarkably strong. This resilience, coupled with the explosive growth of Apple's Services segment, forms the bedrock of Wedbush's optimism.

- Projected 15% YoY growth in Services revenue: Apple's services ecosystem, encompassing Apple Music, iCloud, Apple TV+, and more, continues to expand its user base and generate substantial recurring revenue.

- Strong iPhone 14 sales exceeding expectations: Despite supply chain challenges, the iPhone 14 series has performed exceptionally well, demonstrating continued demand for Apple's flagship product.

- Expansion into new markets and services: Apple's strategic expansion into emerging markets and the continuous development of new services provide significant avenues for future growth. This includes exploring new markets in developing countries and launching innovative services to enhance user experience.

Long-Term Growth Potential in Wearables and Other Hardware

Apple's innovation extends beyond the iPhone. The company's wearable segment, encompassing the Apple Watch and AirPods, shows immense growth potential.

- Dominance in the smartwatch market: The Apple Watch maintains a leading position in the smartwatch market, with continued innovation in health features and fitness tracking driving sales.

- AirPods' continued popularity: AirPods have become a ubiquitous accessory, and their continued popularity signals strong potential for future growth in the wireless audio market.

- Anticipation for Apple’s AR/VR headset: The highly anticipated launch of Apple's augmented reality/virtual reality headset could open up entirely new revenue streams and solidify Apple's position at the forefront of technological innovation.

Resilience Amidst Macroeconomic Uncertainty

Wedbush highlights Apple's resilience in the face of macroeconomic challenges. This is attributed to several factors:

- Strong brand loyalty: Apple enjoys exceptional brand loyalty, ensuring continued demand for its products even during economic downturns.

- Pricing power: Apple's premium pricing strategy reflects its strong brand and the perceived high quality of its products, allowing it to weather economic fluctuations more effectively than many competitors.

- Diversification of revenue streams: Apple's diversified revenue streams – from hardware sales to services and wearables – mitigate the risk associated with dependence on a single product category.

Reasons for the Apple Price Target Cut

While Wedbush remains bullish, the price target reduction reflects certain concerns:

Concerns about Supply Chain Issues

Lingering supply chain disruptions, though less severe than in previous years, still pose a potential threat to Apple's production and sales. Global geopolitical instability and the ongoing impact of the pandemic continue to present challenges.

Impact of Inflation and Consumer Spending

Rising inflation and reduced consumer spending globally could impact sales of Apple products, particularly higher-priced items. Consumers may postpone purchases or opt for less expensive alternatives.

Competition in the Smartphone Market

The smartphone market remains highly competitive, with strong contenders like Samsung and other Android manufacturers constantly innovating. Maintaining market share requires continuous innovation and effective marketing strategies.

Should You Follow Wedbush's Bullish Stance? A Balanced Perspective

Wedbush's bullishness is compelling, but it's crucial to approach this with a balanced perspective:

Consider Your Personal Risk Tolerance

Before investing in Apple stock or any stock, carefully assess your personal risk tolerance. Apple, while generally considered a stable investment, is still subject to market fluctuations.

Diversify Your Investment Portfolio

Diversification is key to mitigating risk. Don't put all your eggs in one basket. Spread your investments across various asset classes to reduce overall portfolio volatility.

Conduct Your Own Thorough Research

Wedbush's analysis is valuable, but it's essential to conduct your own thorough research and due diligence before making any investment decisions. Analyze Apple's financial statements, market trends, and competitive landscape independently.

Conclusion

Wedbush's maintained bullish outlook on Apple stock, despite a price target reduction, highlights the company's strong fundamentals and long-term growth potential. However, potential risks related to supply chain issues, inflation, and competition must be considered. Therefore, before investing in Apple stock, conduct thorough research, evaluate your risk tolerance, and diversify your portfolio accordingly. Remember to consult a financial advisor for personalized guidance tailored to your financial situation and investment goals. Careful consideration of these factors will help you determine whether investing in Apple stock aligns with your individual investment strategy.

Featured Posts

-

West Ham United Makes Formal Offer For Kyle Walker Peters

May 24, 2025

West Ham United Makes Formal Offer For Kyle Walker Peters

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

Peremozhtsi Yevrobachennya Ostanni 10 Rokiv De Voni Zaraz

May 24, 2025

Peremozhtsi Yevrobachennya Ostanni 10 Rokiv De Voni Zaraz

May 24, 2025 -

M56 Collision Car Over Turns Motorway Casualty Requires Treatment

May 24, 2025

M56 Collision Car Over Turns Motorway Casualty Requires Treatment

May 24, 2025 -

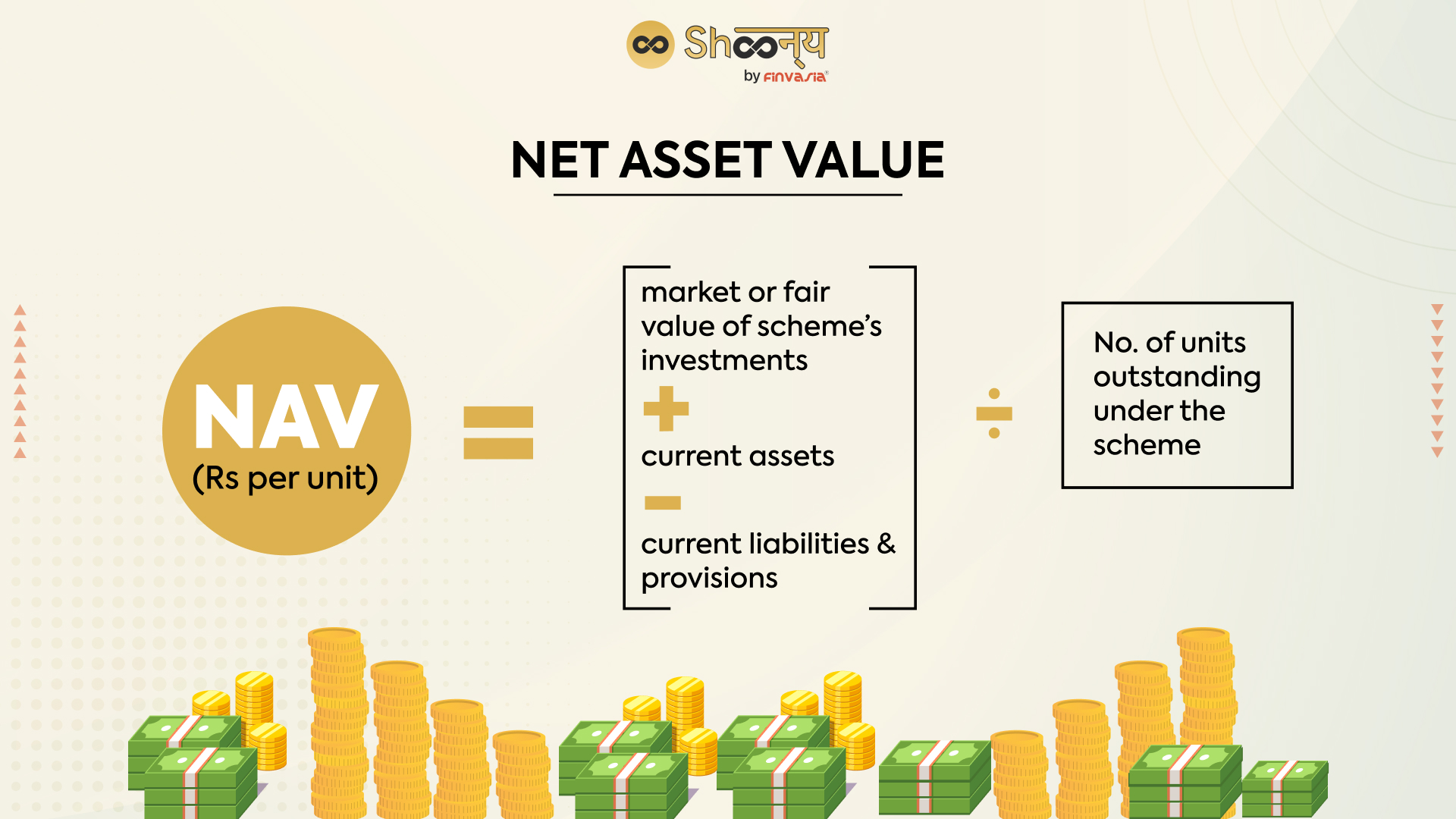

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Latest Posts

-

Podcast Production Revolution Ai Simplifies Repetitive Scatological Document Processing

May 24, 2025

Podcast Production Revolution Ai Simplifies Repetitive Scatological Document Processing

May 24, 2025 -

Ai Digest Transforming Repetitive Scatological Documents Into Engaging Podcasts

May 24, 2025

Ai Digest Transforming Repetitive Scatological Documents Into Engaging Podcasts

May 24, 2025 -

From Scatological Documents To Podcast Ais Role In Content Transformation

May 24, 2025

From Scatological Documents To Podcast Ais Role In Content Transformation

May 24, 2025 -

Guilty Plea Lab Owner Admitted To Faking Covid 19 Test Results

May 24, 2025

Guilty Plea Lab Owner Admitted To Faking Covid 19 Test Results

May 24, 2025 -

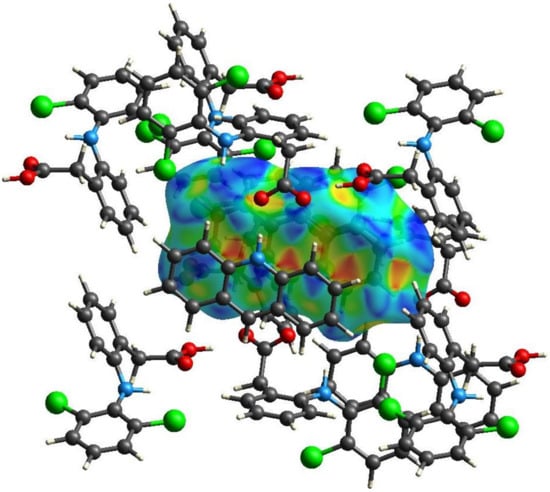

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025