Deutsche Bank's Digital Transformation: Accelerated By IBM Software

Table of Contents

Introduction Paragraph: Deutsche Bank, a global leader in financial services, has embarked on a significant digital transformation journey. Central to this ambitious undertaking is the strategic deployment of IBM software solutions, which have proven instrumental in modernizing its infrastructure, enhancing operational efficiency, and driving innovation across its various business units. This article will delve into the key aspects of Deutsche Bank's digital transformation and explore the pivotal role played by IBM's technology. The success of this partnership highlights the transformative power of IBM software in the financial services sector.

H2: Modernizing Legacy Systems with IBM Software:

H3: Challenges of Legacy Systems: Financial institutions like Deutsche Bank often grapple with the challenges inherent in maintaining aging legacy systems. These systems, built decades ago, often lack the scalability, security, and integration capabilities needed in today's fast-paced, technology-driven environment. The limitations are multifaceted and impact various aspects of the business.

- Bullet Points:

- High maintenance costs due to expensive specialized staff and ongoing support contracts.

- Difficulty in integrating with newer technologies, hindering innovation and agility.

- Significant security risks due to outdated security protocols and vulnerabilities.

- Limited scalability to handle increasing transaction volumes and data growth.

- Inefficient processes leading to slower transaction times and reduced productivity.

H3: IBM's Role in Modernization: IBM software played a crucial role in addressing these challenges. Solutions like IBM Z, a highly secure and scalable mainframe platform, provided a robust foundation for modernizing Deutsche Bank's core systems. Simultaneously, IBM Cloud Pak for Data facilitated the migration and management of vast datasets, enabling improved data analysis and insights.

- Bullet Points:

- Improved performance and scalability, enabling Deutsche Bank to handle larger transaction volumes.

- Enhanced security posture through advanced encryption and access controls offered by IBM Z.

- Streamlined processes and reduced operational costs through automation and improved efficiency.

- Increased agility and responsiveness to market changes through quicker deployment of new features and services.

- Better integration between legacy and modern systems, fostering a more cohesive technology landscape.

H2: Cloud Migration and Enhanced Agility:

H3: The Strategic Shift to the Cloud: Migrating to the cloud offered Deutsche Bank significant advantages. It allowed for increased scalability to meet fluctuating demand, optimized resource allocation leading to cost reduction, and improved disaster recovery capabilities for business continuity. The move to the cloud also fostered greater agility and innovation.

- Bullet Points:

- Reduced infrastructure costs by eliminating the need for significant on-premise investments.

- Improved scalability and flexibility to adapt to changing business needs and market conditions.

- Enhanced disaster recovery capabilities ensuring business continuity in case of unforeseen events.

- Access to cutting-edge technologies and services offered through IBM's cloud ecosystem.

- A more agile development environment, facilitating quicker deployment of new applications and features.

H3: IBM Cloud Solutions for Deutsche Bank: Deutsche Bank leveraged various IBM cloud services to achieve a successful migration. IBM Cloud Private, for example, provided a secure and flexible hybrid cloud environment that allowed for a phased approach to migration. This minimized disruption to ongoing operations while realizing the benefits of the cloud.

- Bullet Points:

- Accelerated migration process through automated tools and expert support from IBM.

- Seamless integration with existing on-premise systems, minimizing disruption and ensuring data continuity.

- Enhanced security and compliance through IBM's robust cloud security features and adherence to industry regulations.

- Improved collaboration and efficiency through cloud-based tools and services.

H2: Data-Driven Decision Making with IBM Analytics:

H3: Leveraging Data for Competitive Advantage: In the highly competitive financial services industry, harnessing the power of data is crucial for success. Accessing, analyzing, and interpreting vast amounts of data enables better risk management, personalized customer experiences, and optimized trading strategies.

- Bullet Points:

- Improved risk management through predictive modeling and early detection of potential threats.

- Enhanced customer experience through personalized financial advice and tailored product offerings.

- Optimized trading strategies based on real-time market data analysis and predictive algorithms.

- More effective regulatory compliance through efficient data monitoring and reporting capabilities.

H3: IBM's Analytical Tools in Action: IBM's analytical tools, including Watson, played a significant role in Deutsche Bank's data-driven strategy. Watson's AI capabilities empowered the bank to derive faster insights from complex datasets, enabling more informed decisions across various business functions.

- Bullet Points:

- Faster insights from vast datasets, significantly accelerating the decision-making process.

- Improved fraud detection through sophisticated pattern recognition and anomaly detection algorithms.

- Predictive modeling for risk assessment, enabling proactive mitigation strategies.

- Personalized customer offers based on individual customer profiles and preferences.

3. Conclusion:

Deutsche Bank's successful digital transformation, significantly accelerated by the implementation of IBM software, showcases the importance of modernization, cloud adoption, and data-driven decision making in the financial sector. By leveraging IBM's comprehensive suite of solutions, Deutsche Bank has achieved significant improvements in efficiency, security, and innovation. This case study underscores the potential benefits of partnering with IBM for organizations seeking to embark on their own digital transformation journeys. Consider exploring how IBM can help accelerate your digital transformation with its powerful and proven software solutions.

Featured Posts

-

Economic Development In West Virginia Targeting Marylands Tech Sector

May 30, 2025

Economic Development In West Virginia Targeting Marylands Tech Sector

May 30, 2025 -

California Coast Algae Bloom Impacts On Marine Ecosystems

May 30, 2025

California Coast Algae Bloom Impacts On Marine Ecosystems

May 30, 2025 -

Europe 1 Soir Week End Aurelien Veron Et Laurent Jacobelli

May 30, 2025

Europe 1 Soir Week End Aurelien Veron Et Laurent Jacobelli

May 30, 2025 -

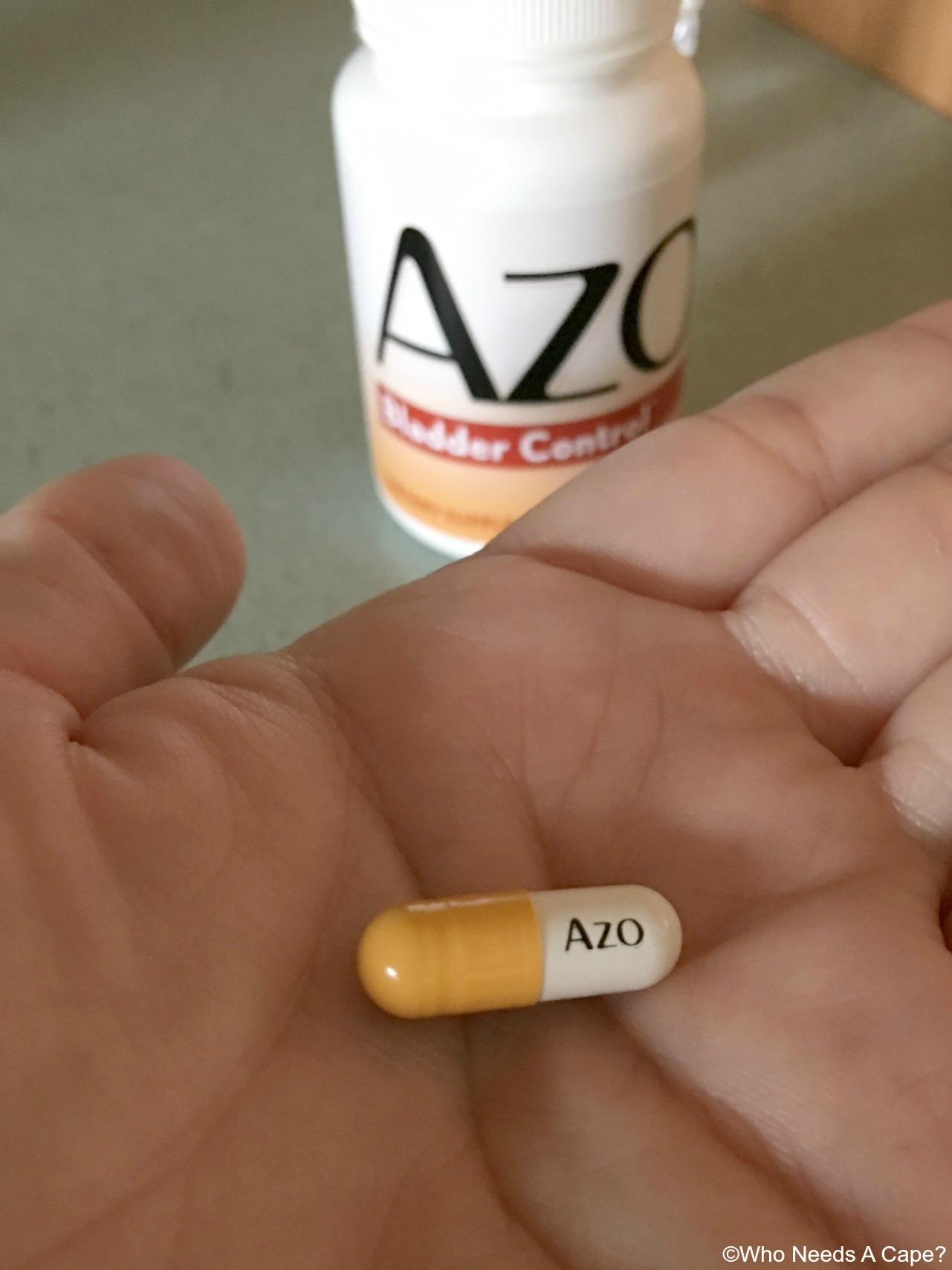

Primera For Women Natural Bladder Control Solutions

May 30, 2025

Primera For Women Natural Bladder Control Solutions

May 30, 2025 -

Cts Eventim Strong Start To The Year With Significant Growth

May 30, 2025

Cts Eventim Strong Start To The Year With Significant Growth

May 30, 2025