Deutsche Bank's New Deals Team Targets Growth In Defense Finance

Table of Contents

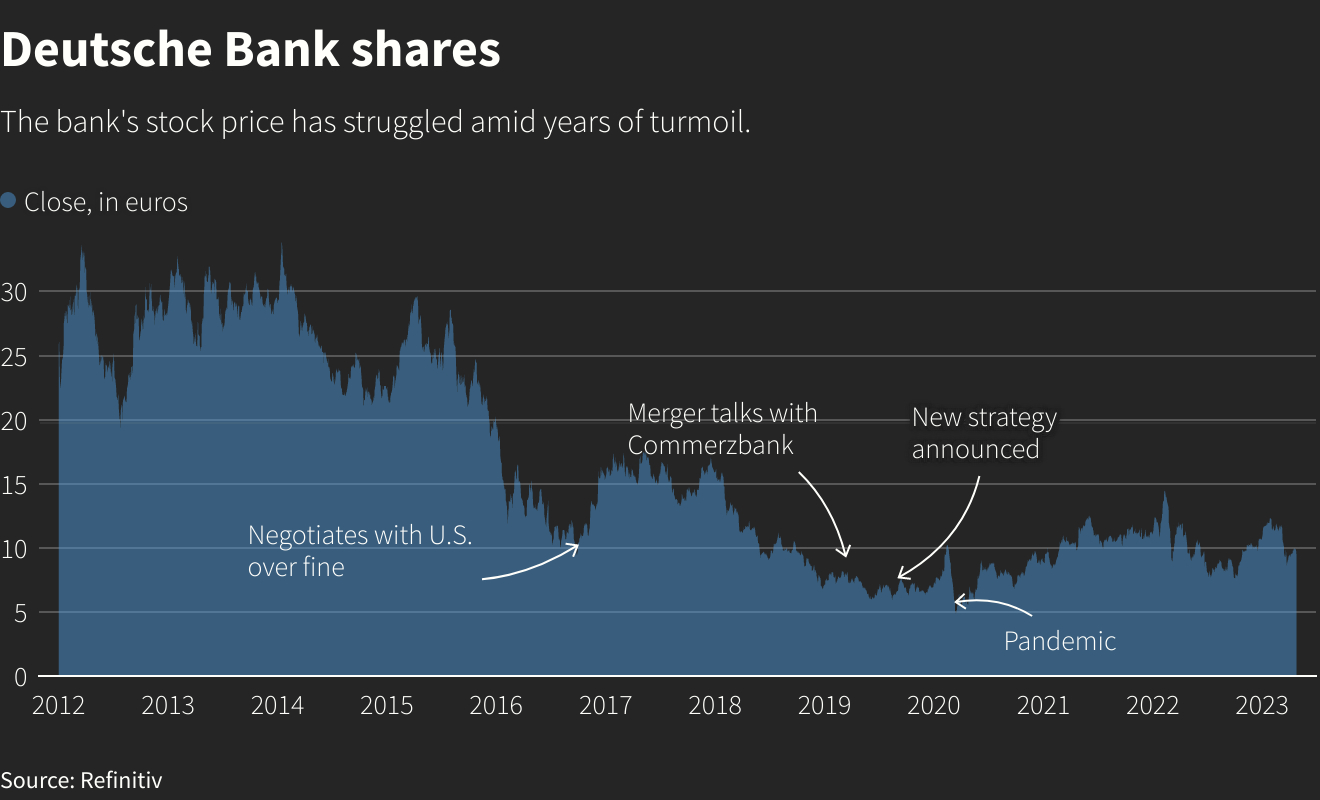

Deutsche Bank's Strategic Focus on the Defense Finance Sector

Deutsche Bank's foray into the defense finance sector is a calculated move driven by several key factors. The immense market potential, coupled with underserved needs within the industry, presents a compelling case for expansion. The bank recognizes the increasing demand for sophisticated financial solutions from defense contractors, government agencies, and other players in the global defense ecosystem.

Deutsche Bank's new deals team will concentrate on several key areas within defense finance, including:

-

Mergers and Acquisitions (M&A): Advising on and financing strategic acquisitions and mergers within the defense industry.

-

Debt Financing: Providing tailored debt solutions, including syndicated loans and bonds, to defense companies.

-

Equity Offerings: Assisting defense firms with raising capital through Initial Public Offerings (IPOs) and other equity transactions.

-

Project Finance: Structuring and financing large-scale defense projects, including infrastructure development and technological upgrades.

-

Specific Examples: The team is already actively involved in several significant transactions, including advising on the acquisition of a leading cybersecurity firm by a major defense contractor and structuring a bond issuance for a European defense manufacturer.

-

Key Personnel: The team comprises experienced professionals with deep expertise in the defense sector, regulatory compliance, and complex financial transactions. Their combined experience positions Deutsche Bank to provide unparalleled client service.

-

Quantifiable Goals: Deutsche Bank aims to capture a significant market share within the next three years, targeting a substantial increase in revenue generation within the defense finance portfolio.

The Competitive Landscape and Deutsche Bank's Advantage

The defense finance landscape is competitive, with established players like Goldman Sachs, JPMorgan Chase, and Citigroup vying for market share. However, Deutsche Bank possesses distinct advantages that will help it differentiate itself:

-

Global Network: Deutsche Bank's extensive global network provides unparalleled access to international markets and capital sources, offering significant benefits to clients operating across borders.

-

Specialized Expertise: The team's deep understanding of the defense industry's regulatory landscape and unique financial challenges provides clients with tailored solutions.

-

Financial Strength: Deutsche Bank's robust financial position ensures its ability to provide substantial funding for large-scale defense projects and transactions.

-

Competitive Comparison: Unlike some competitors who focus primarily on a single region, Deutsche Bank offers a truly global reach, enabling comprehensive service across diverse markets.

-

Unique Services: Deutsche Bank leverages cutting-edge technology and data analytics to provide enhanced due diligence, risk assessment, and deal structuring capabilities.

-

Strategic Partnerships: The bank is actively forging strategic partnerships with industry leaders to expand its reach and expertise within the defense sector.

Challenges and Opportunities in Defense Finance

The defense finance sector, while promising, presents inherent challenges:

- Regulatory Hurdles: Navigating complex regulations and compliance requirements related to defense contracting and export controls is a significant undertaking.

- Geopolitical Risks: Global political instability and conflicts can significantly impact investment decisions and project timelines.

- Fluctuating Government Spending: Defense budgets are often subject to fluctuations based on geopolitical events and economic conditions.

However, opportunities for growth are equally significant:

-

Technological Advancements: The rapid advancement of technologies like AI, cybersecurity, and hypersonics is driving significant investment in the defense sector.

-

Increasing Defense Budgets: Many nations are increasing defense spending in response to geopolitical threats, leading to increased demand for financial services.

-

Privatization Trends: The privatization of certain defense-related functions creates further opportunities for private sector investment and financing.

-

Regulatory Changes: The team closely monitors evolving regulatory frameworks to ensure compliance and advise clients on navigating the changing landscape.

-

Emerging Technologies: Deutsche Bank invests heavily in research and development to understand the financial implications of emerging technologies within the defense industry.

-

Geopolitical Impact: The team utilizes sophisticated geopolitical risk models to evaluate the impact of external factors on investment decisions.

Deutsche Bank's Approach to Responsible Defense Finance

Deutsche Bank is committed to upholding the highest ethical standards and adhering to ESG (Environmental, Social, and Governance) principles within the defense finance sector. The bank has implemented robust policies and procedures to ensure responsible lending and investment practices.

- ESG Initiatives: Deutsche Bank actively integrates ESG considerations into its due diligence processes, prioritizing investments in companies with strong sustainability records.

- Certifications and Standards: The bank adheres to relevant industry standards and best practices for ethical conduct in finance.

- Transparency and Ethical Conduct: Deutsche Bank is committed to transparency and maintaining the highest ethical standards in all its defense finance activities.

Conclusion

Deutsche Bank's strategic focus on defense finance positions it for significant growth in a rapidly expanding market. By leveraging its global network, specialized expertise, and commitment to responsible finance, Deutsche Bank is uniquely positioned to serve clients in this dynamic sector. The challenges are undeniable, but the opportunities are even greater. Explore Deutsche Bank's Defense Finance solutions and learn more about our approach to this critical market. Contact our Defense Finance experts today to discuss your investment or advisory needs.

Featured Posts

-

Sports Stadiums A Key To Breaking The Downtown Doom Loop

May 10, 2025

Sports Stadiums A Key To Breaking The Downtown Doom Loop

May 10, 2025 -

Elon Musks Net Worth Fluctuation During Trumps Initial 100 Days

May 10, 2025

Elon Musks Net Worth Fluctuation During Trumps Initial 100 Days

May 10, 2025 -

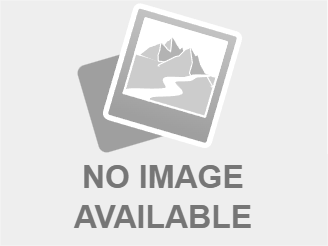

Jeanine Pirros Controversial Remarks On Due Process And El Salvador Prison Transfers

May 10, 2025

Jeanine Pirros Controversial Remarks On Due Process And El Salvador Prison Transfers

May 10, 2025 -

Weight Loss Drug Boom Contributes To Weight Watchers Bankruptcy

May 10, 2025

Weight Loss Drug Boom Contributes To Weight Watchers Bankruptcy

May 10, 2025 -

Sensex Gains 200 Points Nifty Surges Past 18 600 Market Update

May 10, 2025

Sensex Gains 200 Points Nifty Surges Past 18 600 Market Update

May 10, 2025