Dismissing Valuation Concerns: BofA's Analysis Of The Stock Market

Table of Contents

BofA's Key Arguments for a Positive Stock Market Outlook

BofA's core thesis challenges the notion that the market is overvalued, despite elevated price-to-earnings ratios (P/E). Their positive outlook is built upon several key pillars:

-

Strong Corporate Earnings Growth Projections: BofA projects robust earnings growth for many companies, fueled by sustained economic activity and technological innovation. This growth, they argue, justifies the current high valuations. Their BofA Global Research team points to specific sectors showing particularly strong growth potential.

-

Resilience of the US Economy: The US economy, despite facing headwinds, demonstrates remarkable resilience. Factors contributing to this resilience include a robust labor market and continued consumer spending. This economic strength underpins BofA's belief in sustained corporate profitability.

-

Impact of Technological Advancements: Technological innovation continues to drive productivity gains and create new market opportunities. BofA highlights the transformative potential of AI, cloud computing, and other emerging technologies, contributing significantly to long-term growth projections.

-

Favorable Monetary Policy (or Lack Thereof): While interest rates have risen, BofA’s analysis suggests that the current monetary policy, while less stimulative than in previous years, is not necessarily restrictive enough to derail economic growth or significantly impact corporate profitability.

-

Potential for Further Interest Rate Cuts: Depending on future economic data, BofA's analysts see a possibility of future interest rate cuts. This would likely provide further support to the market and stimulate economic activity. This is a key factor in their stock market outlook.

Addressing the Valuation Concerns Directly

BofA acknowledges the high P/E ratios and other valuation metrics that might initially suggest an overvalued market. However, they counter these concerns using several strategies:

-

Alternative Valuation Metrics: Instead of relying solely on P/E ratios, BofA employs a broader range of valuation metrics, such as price-to-sales ratios and discounted cash flow analysis, to provide a more comprehensive assessment.

-

Focus on Long-Term Growth Potential: Their analysis emphasizes long-term growth potential rather than focusing solely on short-term valuations. This long-term perspective allows for a more nuanced understanding of the market's intrinsic value.

-

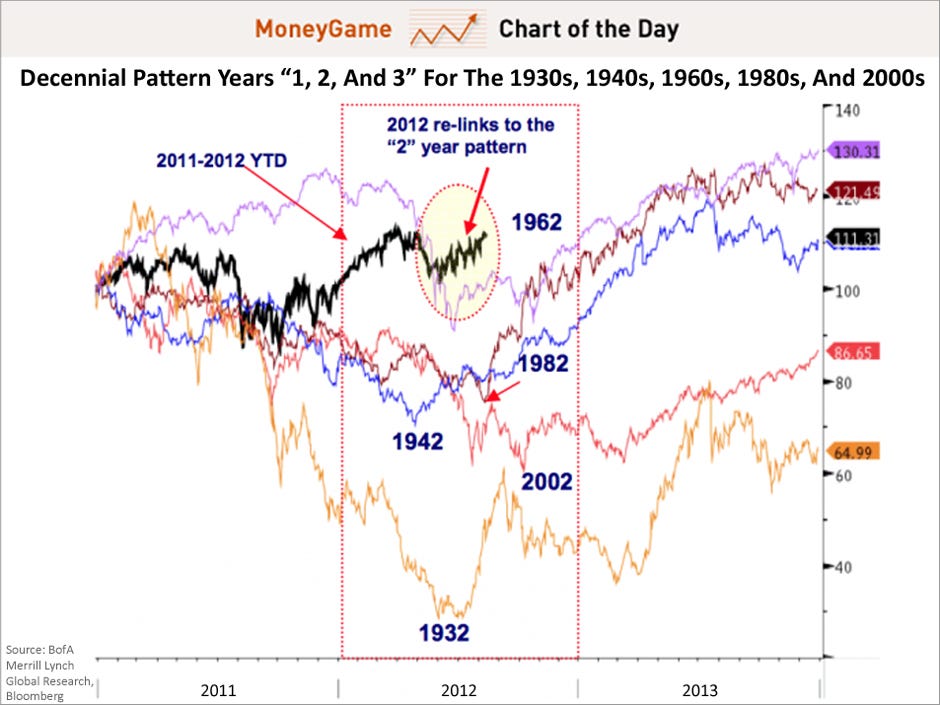

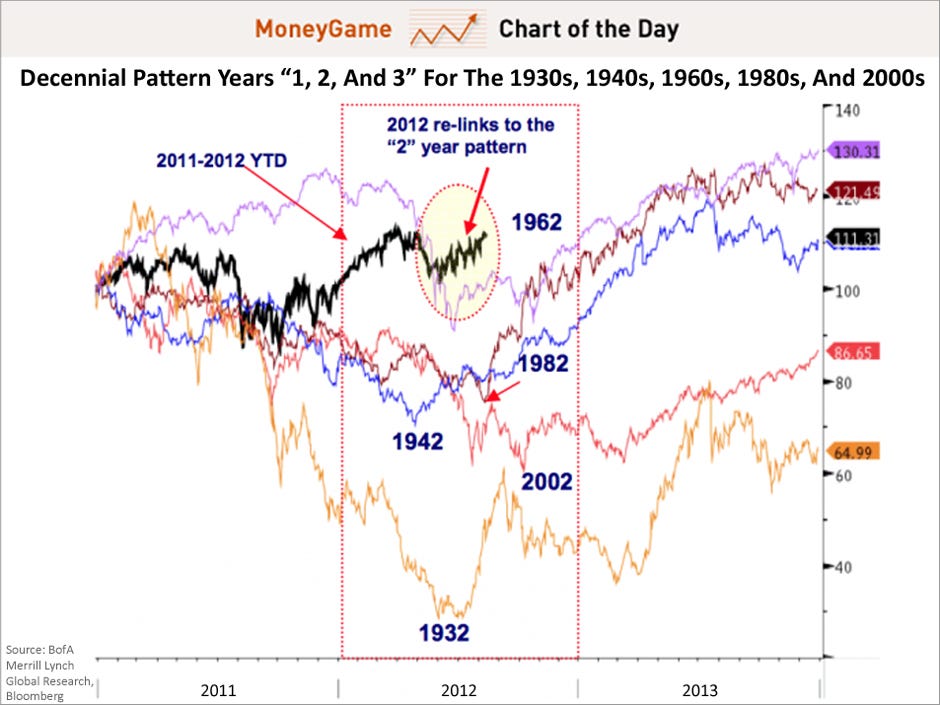

Comparison to Historical Valuations: BofA compares current valuations to historical market data, showing that while current valuations are high, they are not unprecedented in the context of economic cycles.

-

Undervalued Stocks and Sectors: Despite the overall high valuations, BofA's sector analysis identifies specific sectors and companies that they believe are currently undervalued, offering selective investment opportunities. Their research highlights these opportunities within their market analysis.

BofA's Recommendations and Investment Strategies

Based on their analysis, BofA recommends a cautiously optimistic approach to the stock market. They favor certain sectors with strong growth prospects, recommending a diversified portfolio approach to manage risk. Their specific recommendations include:

-

Sector-Specific Investment Strategies: BofA highlights specific sectors, such as technology and healthcare, as particularly promising for long-term growth.

-

Portfolio Diversification: To mitigate risk, BofA stresses the importance of diversification across different sectors and asset classes.

-

Risk Management Techniques: They suggest employing risk management techniques, such as stop-loss orders and hedging strategies, to protect against potential market downturns.

-

Investment Horizon: BofA emphasizes the importance of a long-term investment horizon, aligning investment strategies with long-term growth projections.

Navigating Market Uncertainty with BofA's Stock Market Analysis

BofA's analysis presents a compelling case for a positive stock market outlook, even in the face of high valuations. Their key arguments, focusing on strong earnings growth projections, economic resilience, technological advancements, and a nuanced perspective on monetary policy, contribute to their optimistic stance. Crucially, their approach acknowledges valuation concerns but counters them by utilizing alternative metrics and emphasizing long-term growth potential. By considering their findings and incorporating their recommendations into your stock market valuation and investment strategy, you can navigate market uncertainty more effectively. Remember to conduct your own thorough research before making any investment decisions. For a more detailed look at BofA's analysis, [link to BofA's full report, if available]. Keywords: BofA stock market outlook, stock market analysis, investment decisions, financial planning.

Featured Posts

-

Florida State University Security Flaw Fuels Student Anxiety Despite Rapid Police Action

Apr 22, 2025

Florida State University Security Flaw Fuels Student Anxiety Despite Rapid Police Action

Apr 22, 2025 -

Fsu Security Gap A Case Study In Rapid Response And Lingering Student Anxiety

Apr 22, 2025

Fsu Security Gap A Case Study In Rapid Response And Lingering Student Anxiety

Apr 22, 2025 -

Is Blue Origins Downfall Larger Than Katy Perrys Public Image Issues

Apr 22, 2025

Is Blue Origins Downfall Larger Than Katy Perrys Public Image Issues

Apr 22, 2025 -

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 22, 2025

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 22, 2025 -

Auto Dealers Renew Fight Against Electric Vehicle Regulations

Apr 22, 2025

Auto Dealers Renew Fight Against Electric Vehicle Regulations

Apr 22, 2025

Latest Posts

-

Sheehan Ipswich Towns Undiscouraged Response

May 12, 2025

Sheehan Ipswich Towns Undiscouraged Response

May 12, 2025 -

Victoria De Knicks Sobre Sixers Anunoby Destaca Con 27 Puntos Philadelphia Extiende Racha Negativa

May 12, 2025

Victoria De Knicks Sobre Sixers Anunoby Destaca Con 27 Puntos Philadelphia Extiende Racha Negativa

May 12, 2025 -

Sheehans Resilience Ipswich Town Remain Undeterred

May 12, 2025

Sheehans Resilience Ipswich Town Remain Undeterred

May 12, 2025 -

27 Puntos De Anunoby Guian A Knicks A Victoria Sobre Sixers

May 12, 2025

27 Puntos De Anunoby Guian A Knicks A Victoria Sobre Sixers

May 12, 2025 -

Knicks Derrotan A Sixers Anunoby Brilla Con 27 Puntos Philadelphia Suma 9 Derrotas

May 12, 2025

Knicks Derrotan A Sixers Anunoby Brilla Con 27 Puntos Philadelphia Suma 9 Derrotas

May 12, 2025