Does An "Angry" Elon Musk Benefit Tesla?

Table of Contents

The Impact of Elon Musk's Public Persona on Tesla's Brand Image

Elon Musk's public image is undeniably intertwined with Tesla's brand. His persona, often characterized by outspokenness and even anger, has both positive and negative consequences.

Positive Aspects: Cultivating a Cult of Personality

- Rebellious Image: Musk's maverick image resonates deeply with a specific demographic – those who appreciate disruptive innovation and challenge the status quo. He's often portrayed as a visionary, a modern-day Edison defying conventions.

- The "Disruptor" Appeal: This rebellious image positions Tesla not just as a car company, but as a revolutionary force in the automotive industry, fighting against established players and pushing the boundaries of technology.

- Successful Marketing Leverage: Musk's personality has been cleverly leveraged in Tesla's marketing campaigns. His outspokenness generates buzz and keeps Tesla in the headlines, often replacing the need for traditional advertising. This unconventional approach has cultivated a cult-like following.

- Attracting Risk-Taking Investors: The inherent risk associated with Musk's leadership style might actually attract investors who are comfortable with volatility and see the potential for high rewards. The significant growth Tesla has experienced reflects this. For example, the initial investment in Tesla was quite risky and many investors were apprehensive about Musk's unpredictable nature; however, those who did invest saw substantial returns, proving that risk can lead to high reward in the long run.

Negative Aspects: Damage to Reputation and Brand Trust

- Controversial Statements & Outbursts: Instances of Musk's anger, erratic behavior, and controversial tweets have undoubtedly damaged Tesla's public image. These events generate negative media coverage and can alienate potential customers.

- Potential for Boycotts: Some consumers have voiced their disapproval of Musk's actions, leading to calls for boycotts of Tesla products. Although these boycotts have had a relatively limited effect, they still represent a significant risk to Tesla's brand reputation.

- Erosion of Brand Trust: Consistent negative publicity can erode consumer trust in the brand, impacting long-term sales and customer loyalty. The perception of instability associated with Musk's behavior could dissuade some consumers from investing in Tesla vehicles.

- Legal Ramifications: Musk's impulsive tweets and statements have also resulted in legal challenges and regulatory scrutiny, which indirectly harm Tesla's reputation and stability. For example, the SEC investigation and subsequent settlements have cost Tesla valuable resources and distracted from core business activities.

The Correlation Between Elon Musk's Behavior and Tesla's Stock Price

Elon Musk's actions have a demonstrable impact on Tesla's stock price, both in the short and long term.

Short-Term Volatility

- Immediate Market Reactions: Controversial tweets or public appearances often lead to immediate and significant fluctuations in Tesla's stock price. Positive news can send the stock soaring, while negative news can trigger sharp declines.

- Social Media Sentiment: The speed and reach of social media magnify the impact of Musk's actions, with online sentiment directly influencing investor decisions and short-term market volatility. Any significant negative publicity tends to translate into a negative stock price impact.

- News Cycle Dominance: Tesla's stock price is highly sensitive to news cycles. When Musk dominates the headlines, whether for good or bad reasons, the stock price frequently follows suit.

- Example: Significant price drops have been observed after controversial tweets, demonstrating the direct correlation between Musk's public behavior and investor confidence. Conversely, positive announcements often correlate with a rise in stock price, highlighting investor anticipation.

Long-Term Impact on Investor Sentiment

- Erosion of Long-Term Confidence: While short-term gains can be achieved through the "Musk effect," consistently erratic behavior could ultimately erode long-term investor confidence. Investors might question the company's stability and future prospects under such leadership.

- Impact on Funding and Partnerships: The perception of instability caused by Musk's behavior could impact Tesla's ability to secure future funding rounds and form strategic partnerships. Potential investors and collaborators may hesitate to associate with a company perceived as volatile and unpredictable.

- Long-term risks: Over the long-term, the unpredictable nature of Musk's behavior poses a risk to investors who are looking for sustainable growth and stability. Consistent volatility can erode investor trust and lead to lower returns in the long run.

Alternative Leadership Styles and Their Potential Impact on Tesla's Success

It's crucial to consider how alternative leadership styles might affect Tesla's trajectory.

Comparison with Other CEOs

- Contrast with other Tech CEOs: Comparing Musk's style to other successful tech CEOs like Tim Cook (Apple) or Satya Nadella (Microsoft) reveals a significant difference in approach. Cook and Nadella are known for their more measured and less controversial public personas.

- Different Leadership Approaches: While Musk's approach emphasizes disruptive innovation and high risk, other CEOs prioritize stability, consistent communication, and careful risk management. Each style has its advantages and disadvantages.

- Benefits of Different Approaches: A more measured approach could lead to increased investor trust and reduced market volatility, enabling a more sustainable growth trajectory.

Hypothetical Scenarios: A More Measured Approach

- Impact on Investor Relations: A more reserved CEO might improve investor relations by projecting a sense of stability and predictability. This could attract long-term investors focused on steady returns rather than high-risk, high-reward scenarios.

- Improved Public Perception: A less controversial public image could significantly enhance Tesla's public perception, improving brand trust and customer loyalty. This could potentially lead to increased sales and reduced risks related to negative publicity.

- Sustained Growth: A less volatile approach could enable Tesla to focus on sustained, long-term growth rather than being subject to the constant ups and downs driven by Musk's public actions.

Conclusion

The relationship between Elon Musk's "angry" persona and Tesla's success is complex and multifaceted. While his rebellious image and disruptive approach have contributed to Tesla's growth and cultivated a loyal following, his volatile public behavior presents significant risks to the company's long-term stability and brand reputation. The short-term gains might be offset by the long-term damage caused by investor uncertainty and negative publicity. Ultimately, whether Elon Musk's anger ultimately benefits or harms Tesla remains a subject of ongoing debate and observation. What's your take on Elon Musk's impact? Does Elon Musk's anger ultimately hurt or help Tesla? Share your thoughts in the comments below!

Featured Posts

-

Sputnikoviy Internet Dlya Ukrainy Nemetskoe Skrytoe Finansirovanie Cherez Eutelsat

May 27, 2025

Sputnikoviy Internet Dlya Ukrainy Nemetskoe Skrytoe Finansirovanie Cherez Eutelsat

May 27, 2025 -

Hailey Bieber U Gucci Neocekivana Kombinacija Vintage Haljine I Obuce

May 27, 2025

Hailey Bieber U Gucci Neocekivana Kombinacija Vintage Haljine I Obuce

May 27, 2025 -

Tramp Proti Svift Rozgadka Politichnoyi Vorozhnechi

May 27, 2025

Tramp Proti Svift Rozgadka Politichnoyi Vorozhnechi

May 27, 2025 -

Avrupa Merkez Bankasi Ndan Yeni Tarifelere Yoenelik Uyari

May 27, 2025

Avrupa Merkez Bankasi Ndan Yeni Tarifelere Yoenelik Uyari

May 27, 2025 -

Abhishek Bachchan And Nora Fatehis Close Bond Sparks Divorce Speculation After Aishwaryas Absence

May 27, 2025

Abhishek Bachchan And Nora Fatehis Close Bond Sparks Divorce Speculation After Aishwaryas Absence

May 27, 2025

Latest Posts

-

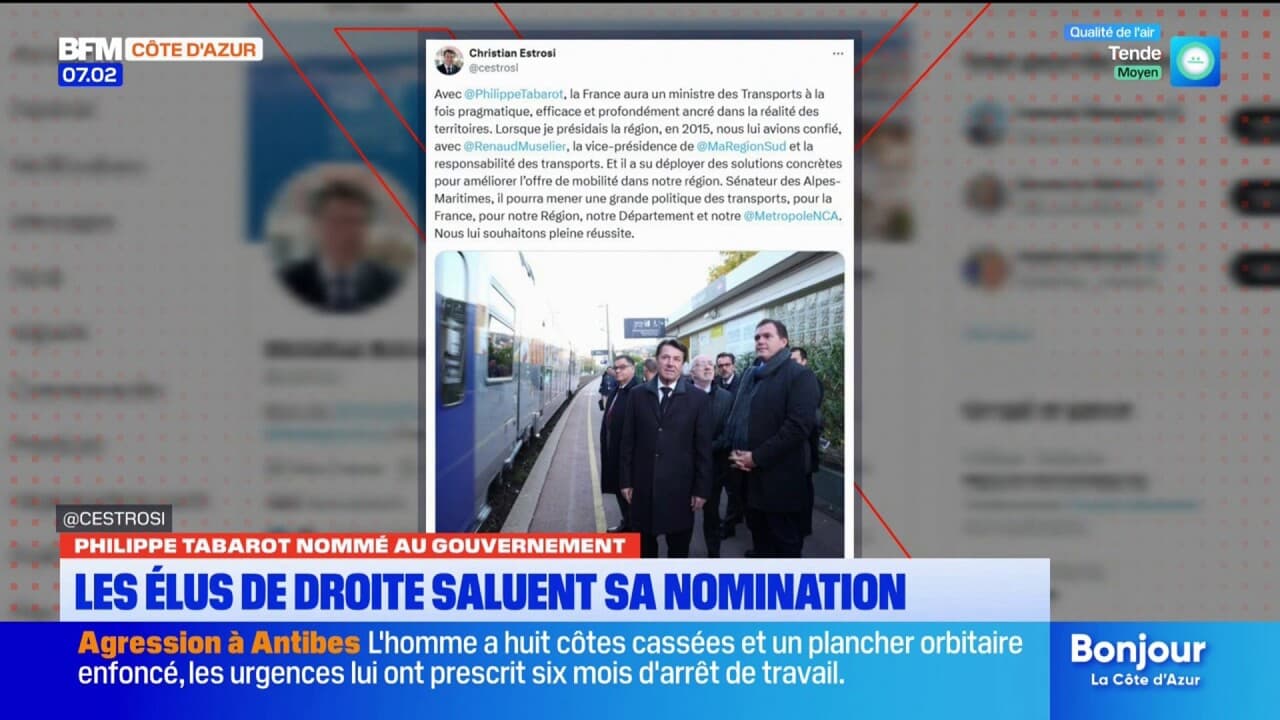

Declaration De Philippe Tabarot Sur La Greve Et Les Revendications A La Sncf

May 30, 2025

Declaration De Philippe Tabarot Sur La Greve Et Les Revendications A La Sncf

May 30, 2025 -

Droits De Douane Mode D Emploi Et Procedures

May 30, 2025

Droits De Douane Mode D Emploi Et Procedures

May 30, 2025 -

Greve A La Sncf Le Depute Philippe Tabarot S Exprime Sur Les Revendications

May 30, 2025

Greve A La Sncf Le Depute Philippe Tabarot S Exprime Sur Les Revendications

May 30, 2025 -

Comprendre Les Droits De Douane Un Guide Pratique

May 30, 2025

Comprendre Les Droits De Douane Un Guide Pratique

May 30, 2025 -

Annulation A69 Le Recours De L Etat Pour Le Sud Ouest

May 30, 2025

Annulation A69 Le Recours De L Etat Pour Le Sud Ouest

May 30, 2025