Dogecoin's Recent Decline: A Correlation With Tesla And Elon Musk's Activities

Table of Contents

Dogecoin, the popular meme cryptocurrency, has experienced significant price fluctuations recently. This article explores the correlation between Dogecoin's recent decline and the actions and statements of Elon Musk and Tesla, examining the impact of their influence on the volatile cryptocurrency market. We'll delve into specific events and analyze their effect on Dogecoin's price and investor sentiment. Understanding this relationship is crucial for navigating the complexities of the cryptocurrency market and making informed investment decisions.

Elon Musk's Influence on Dogecoin's Price

Musk's Tweets and Their Market Impact

Elon Musk's pronouncements, particularly on Twitter, have repeatedly shown a direct correlation with Dogecoin's price movements. His tweets, often cryptic or humorous, can trigger significant price swings, highlighting the immense power of social media influence on cryptocurrency markets.

- Example 1: A tweet mentioning Dogecoin, even without explicit endorsement, has historically led to a rapid increase in trading volume and price, often referred to as a "pump."

- Example 2: Conversely, a negative or even neutral tweet can lead to a sharp price drop, creating significant losses for investors. This illustrates the high-risk nature of investing based on social media sentiment.

- Psychological Impact: Musk's actions cultivate a fervent following within the Dogecoin community, leading to a strong emotional response to his every utterance. This amplifies the impact of his tweets, making Dogecoin particularly susceptible to market manipulation through social media.

- Data Points: (Here, one would ideally insert charts and graphs showcasing specific instances of Dogecoin's price reacting to Musk's tweets. For example, a chart showing the price spike following a positive tweet and a subsequent dip after a negative one.) These visual aids would strengthen the argument and improve SEO. Keywords used in captions and alt text: Elon Musk tweets, Dogecoin pump and dump, social media influence, market manipulation.

Tesla's Acceptance (or Lack Thereof) of Dogecoin

Tesla's previous acceptance of Dogecoin as a payment method for certain merchandise generated significant positive sentiment and boosted the coin's price. However, the subsequent reversal of this policy had a considerably negative effect on investor confidence, leading to a notable price decrease.

- Impact on Investor Confidence: The initial acceptance signaled a degree of legitimacy for Dogecoin, attracting new investors. The reversal suggested a lack of long-term commitment, undermining investor confidence and prompting many to sell.

- Implications for Cryptocurrency Adoption: Tesla's actions highlight the challenges and risks associated with cryptocurrency adoption by large corporations. The volatility and regulatory uncertainties associated with cryptocurrencies make them a risky proposition for established businesses.

- Keywords: Tesla Dogecoin, cryptocurrency payments, corporate adoption, investor sentiment.

Understanding Dogecoin's Volatility and Inherent Risks

Dogecoin's Speculative Nature

Dogecoin's primary value proposition stems from its meme-based origins and community engagement, rather than any underlying technological innovation or real-world utility. This lack of intrinsic value makes it highly susceptible to speculation and price volatility.

- Speculation and Hype: The price is largely driven by hype, fueled by social media trends and news cycles, rather than fundamental factors. This makes it an extremely risky investment.

- High-Risk Investment: Investing in Dogecoin carries significantly higher risk than many other asset classes. Investors should be prepared for substantial losses.

- Keywords: Meme coin investment, high-risk investment, cryptocurrency volatility, speculative assets.

Market Sentiment and FOMO

The Fear Of Missing Out (FOMO) significantly influences Dogecoin's price. Rapid price increases attract new investors, further fueling the price rise in a self-reinforcing cycle. However, this can quickly reverse, leading to panicked selling and sharp price drops.

- Market Sentiment Shifts: News, social media trends, and Elon Musk's tweets can dramatically shift market sentiment, impacting the price almost instantaneously. This unpredictability makes it challenging to time the market effectively.

- Keywords: FOMO, market sentiment, cryptocurrency speculation, price manipulation.

Alternative Factors Affecting Dogecoin's Price

Broader Cryptocurrency Market Trends

Dogecoin's price is not isolated from the broader cryptocurrency market. Overall trends in the cryptocurrency market, particularly Bitcoin's price, significantly influence Dogecoin's performance.

- Correlation with Bitcoin: Dogecoin often moves in tandem with Bitcoin, suggesting a strong correlation between the two. A downturn in the Bitcoin market typically leads to a decline in Dogecoin's price.

- Macroeconomic Factors and Regulation: Regulatory uncertainty, macroeconomic conditions, and global events can all impact the entire cryptocurrency market, affecting Dogecoin indirectly.

- Keywords: Bitcoin price, cryptocurrency market cap, regulatory uncertainty, macroeconomic factors.

Competition from other Meme Coins

The emergence of competing meme coins poses a threat to Dogecoin's market share and price. The meme coin sector is crowded, and new entrants can quickly divert investor attention and capital.

- Competitive Landscape: The meme coin space is dynamic and competitive. New projects with unique features or marketing strategies can easily attract investors away from Dogecoin.

- Keywords: Meme coin competition, altcoins, cryptocurrency market share.

Conclusion

Dogecoin's recent price decline is demonstrably linked to the activities of Elon Musk and Tesla, highlighting the significant influence of social media and corporate actions on cryptocurrency markets. However, this is only part of a complex equation. Dogecoin's inherent volatility, speculative nature, and susceptibility to market sentiment and FOMO contribute to its price fluctuations. Understanding these factors, along with the broader cryptocurrency market trends and the competitive landscape, is critical for informed investment decisions.

While Dogecoin's price remains volatile and influenced by external factors like Elon Musk's actions, understanding these correlations is crucial for informed investment decisions. Conduct thorough research and carefully consider the risks before investing in Dogecoin or any other cryptocurrency. Stay informed about the latest developments in the Dogecoin market and the impact of Elon Musk and Tesla’s activities on this volatile cryptocurrency.

Featured Posts

-

Solve The Nyt Crossword April 6 2025 Strands Puzzle

May 09, 2025

Solve The Nyt Crossword April 6 2025 Strands Puzzle

May 09, 2025 -

Bed Antqalh Llahly Almsry Mstwa Fyraty Me Alerby Alqtry

May 09, 2025

Bed Antqalh Llahly Almsry Mstwa Fyraty Me Alerby Alqtry

May 09, 2025 -

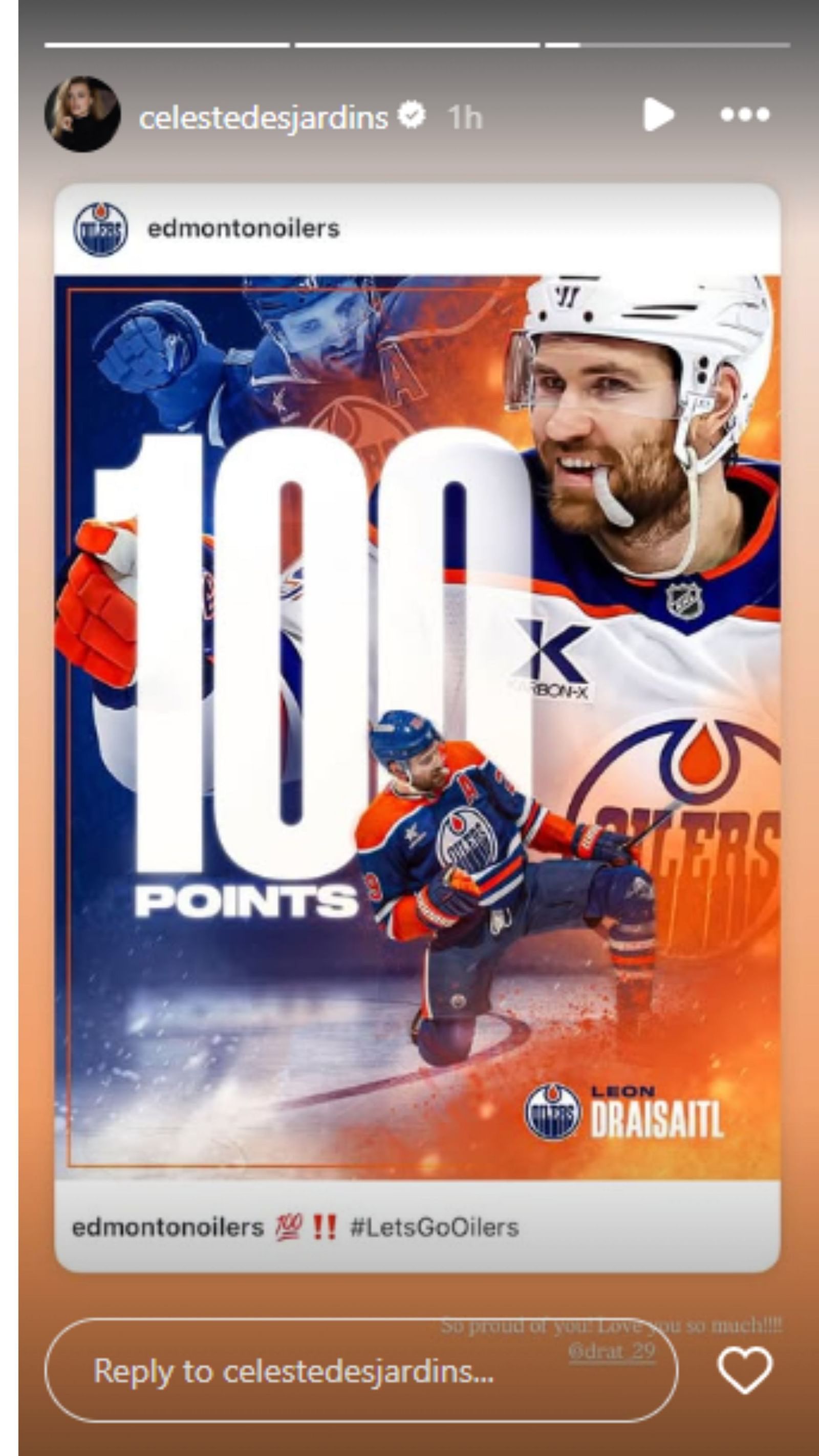

Leon Draisaitls 100 Point Milestone Oilers Defeat Islanders In Overtime

May 09, 2025

Leon Draisaitls 100 Point Milestone Oilers Defeat Islanders In Overtime

May 09, 2025 -

Market Volatility And Political Tensions Cause Pakistan Stock Exchange Website Issues

May 09, 2025

Market Volatility And Political Tensions Cause Pakistan Stock Exchange Website Issues

May 09, 2025 -

Pakistan Sri Lanka Bangladesh Pledge Deeper Capital Market Ties

May 09, 2025

Pakistan Sri Lanka Bangladesh Pledge Deeper Capital Market Ties

May 09, 2025