Dow Jones & S&P 500 Market Data: Live Updates For May 30

Table of Contents

Dow Jones Industrial Average (DJIA) Performance on May 30th

Opening Prices & Initial Trends

The Dow Jones Industrial Average opened at [Insert Opening Value Here] on May 30th, representing a [Insert Percentage Change - e.g., 0.5%] change from the previous day's closing value of [Insert Previous Day's Closing Value Here]. This initial movement indicated a [Insert Trend - e.g., cautiously optimistic] start to the trading day. Contributing factors included [Insert Factors - e.g., positive overnight earnings reports from key technology companies and a generally stable global market].

- Opening Value: [Insert Opening Value Here]

- Percentage Change from Previous Close: [Insert Percentage Change Here]

- Contributing Factors: [List specific news, economic data, or events]

Intraday Volatility and Key Turning Points

Throughout the day, the DJIA experienced significant volatility. A notable dip occurred around [Insert Time] following the release of [Insert News or Event], causing a [Insert Percentage Change - e.g., 1%] drop to [Insert Low Value Here]. However, the index recovered some ground later in the session, reaching a high of [Insert High Value Here] around [Insert Time] due to [Insert Reason - e.g., positive investor sentiment surrounding upcoming economic data]. Trading volume was relatively [Insert Volume Description - e.g., high], suggesting increased investor activity.

- Significant High: [Insert High Value Here] at [Insert Time]

- Significant Low: [Insert Low Value Here] at [Insert Time]

- Potential Causes for Volatility: [List specific news, economic data, or events]

- Trading Volume: [Insert Volume Data - e.g., above average]

Closing Prices and Daily Performance Summary

The Dow Jones Industrial Average closed at [Insert Closing Value Here] on May 30th, representing a [Insert Percentage Change - e.g., 0.2%] increase for the day. This relatively modest gain reflects a [Insert Market Sentiment - e.g., mixed] overall market sentiment.

- Final Closing Value: [Insert Closing Value Here]

- Percentage Change from Previous Day's Close: [Insert Percentage Change Here]

- Overall Market Sentiment: [Insert Sentiment - e.g., cautiously optimistic]

S&P 500 Index Performance on May 30th

Opening Prices & Early Market Behavior

The S&P 500 opened at [Insert Opening Value Here] on May 30th, showing a [Insert Percentage Change - e.g., 0.7%] increase compared to the previous day's close of [Insert Previous Day's Closing Value Here]. This positive opening suggested a [Insert Market Sentiment - e.g., bullish] start to the day, driven largely by [Insert Reason - e.g., positive economic forecasts].

- Opening Value: [Insert Opening Value Here]

- Percentage Change from Previous Close: [Insert Percentage Change Here]

- Initial Drivers: [List contributing factors]

Sectoral Performance and Key Movers

Sectoral performance within the S&P 500 was varied. The [Insert Sector - e.g., Technology] sector led the gains with a [Insert Percentage Change - e.g., 1.5%] increase, largely driven by strong performance from [Insert Company Example - e.g., Apple and Microsoft]. Conversely, the [Insert Sector - e.g., Energy] sector underperformed, declining by [Insert Percentage Change - e.g., 0.8%] due to [Insert Reason - e.g., falling oil prices].

- Top Performing Sector: [Insert Sector and Percentage Change]

- Bottom Performing Sector: [Insert Sector and Percentage Change]

- Key Movers: [List specific companies and their impact]

Closing Data and Market Summary

The S&P 500 closed at [Insert Closing Value Here] on May 30th, indicating a [Insert Percentage Change - e.g., 0.5%] daily gain. This positive performance reflects a generally [Insert Market Sentiment - e.g., positive] outlook among investors.

- Final Closing Price: [Insert Closing Value Here]

- Percentage Change from Previous Close: [Insert Percentage Change Here]

- Market Summary: [Brief overview of the day's trading]

Correlation and Comparison: Dow Jones vs. S&P 500 on May 30th

Analyzing the Relationship

On May 30th, the Dow Jones and S&P 500 exhibited a [Insert Correlation Type - e.g., positive] correlation, with both indices experiencing [Insert Movement Type - e.g., modest gains]. The percentage changes were relatively similar, suggesting that the overall market sentiment influenced both indices equally. [Explain any divergence if it occurred].

- Dow Jones Percentage Change: [Insert Percentage Change]

- S&P 500 Percentage Change: [Insert Percentage Change]

- Correlation Analysis: [Explain the relationship between the two indices]

Impact of Macroeconomic Factors

The movements of both the Dow Jones and S&P 500 were likely influenced by [Insert Macroeconomic Factor - e.g., positive economic data released earlier in the week], which boosted investor confidence. Additionally, [Insert Another Macroeconomic Factor - e.g., geopolitical stability] also contributed to the relatively positive performance of both indices.

- Macroeconomic Factors: [List factors and their impact]

- Data Points: [Include relevant data to support the analysis]

Conclusion

In summary, both the Dow Jones and S&P 500 indices showed positive performance on May 30th, though the gains were modest. Monitoring these key indices remains crucial for navigating the complexities of the financial markets. The correlation between the two indices suggests a generally consistent market sentiment. Stay informed about the ever-changing financial landscape by regularly checking back for up-to-date Dow Jones & S&P 500 market data and analysis. Don't miss out on critical market insights – bookmark this page and check back tomorrow!

Featured Posts

-

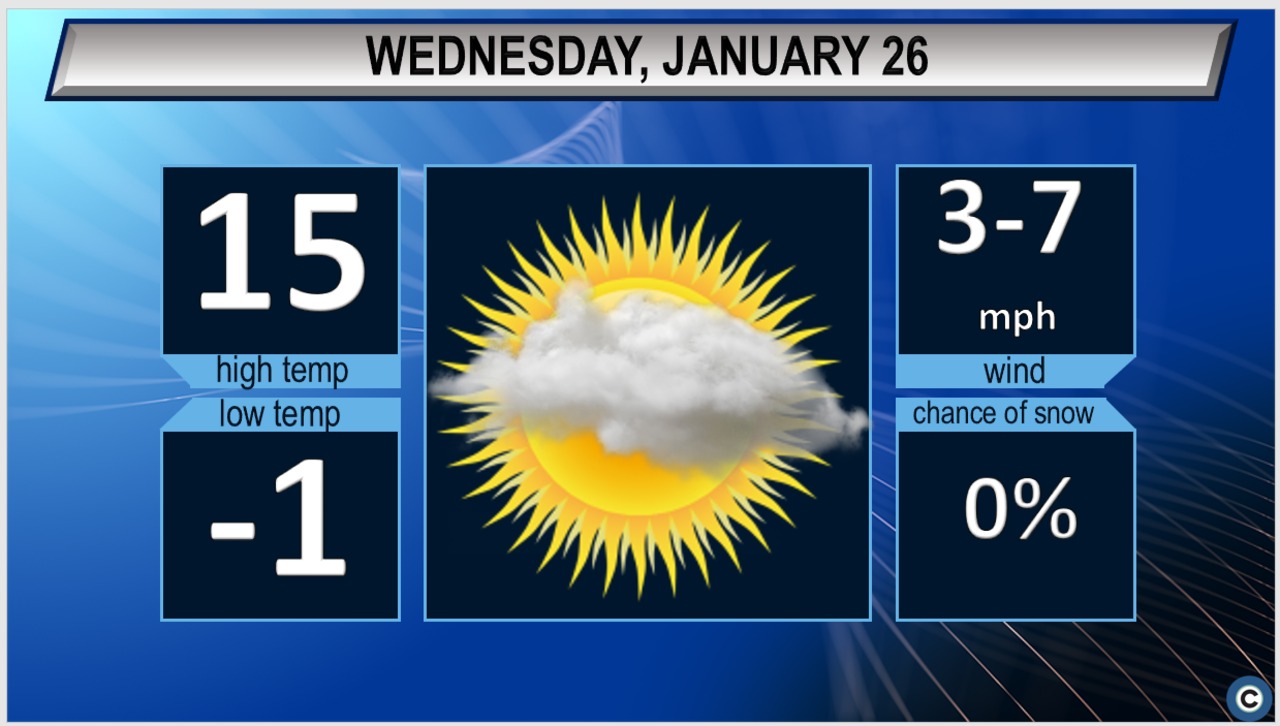

Clear Skies And Dry Weather Predicted For Northeast Ohio On Tuesday

May 31, 2025

Clear Skies And Dry Weather Predicted For Northeast Ohio On Tuesday

May 31, 2025 -

Elon Musks Departure From Trump Administration A Confirmation And Analysis

May 31, 2025

Elon Musks Departure From Trump Administration A Confirmation And Analysis

May 31, 2025 -

The Good Life Practical Strategies For A Fulfilling Life

May 31, 2025

The Good Life Practical Strategies For A Fulfilling Life

May 31, 2025 -

Build Up To The Champions League Final Psg Vs Inter Milan

May 31, 2025

Build Up To The Champions League Final Psg Vs Inter Milan

May 31, 2025 -

Banksy Broken Heart Mural Headed To Auction

May 31, 2025

Banksy Broken Heart Mural Headed To Auction

May 31, 2025