Dow Jones, S&P 500 Stock Market Report: April 23rd

Table of Contents

Dow Jones Industrial Average Performance on April 23rd

Opening, High, Low, and Closing Prices

The Dow Jones Industrial Average opened at 33,820.00, reaching a high of 33,950.50 throughout the day. However, it experienced some downturn, hitting a low of 33,750.20 before settling at a closing price of 33,850.75.

Percentage Change and Volatility

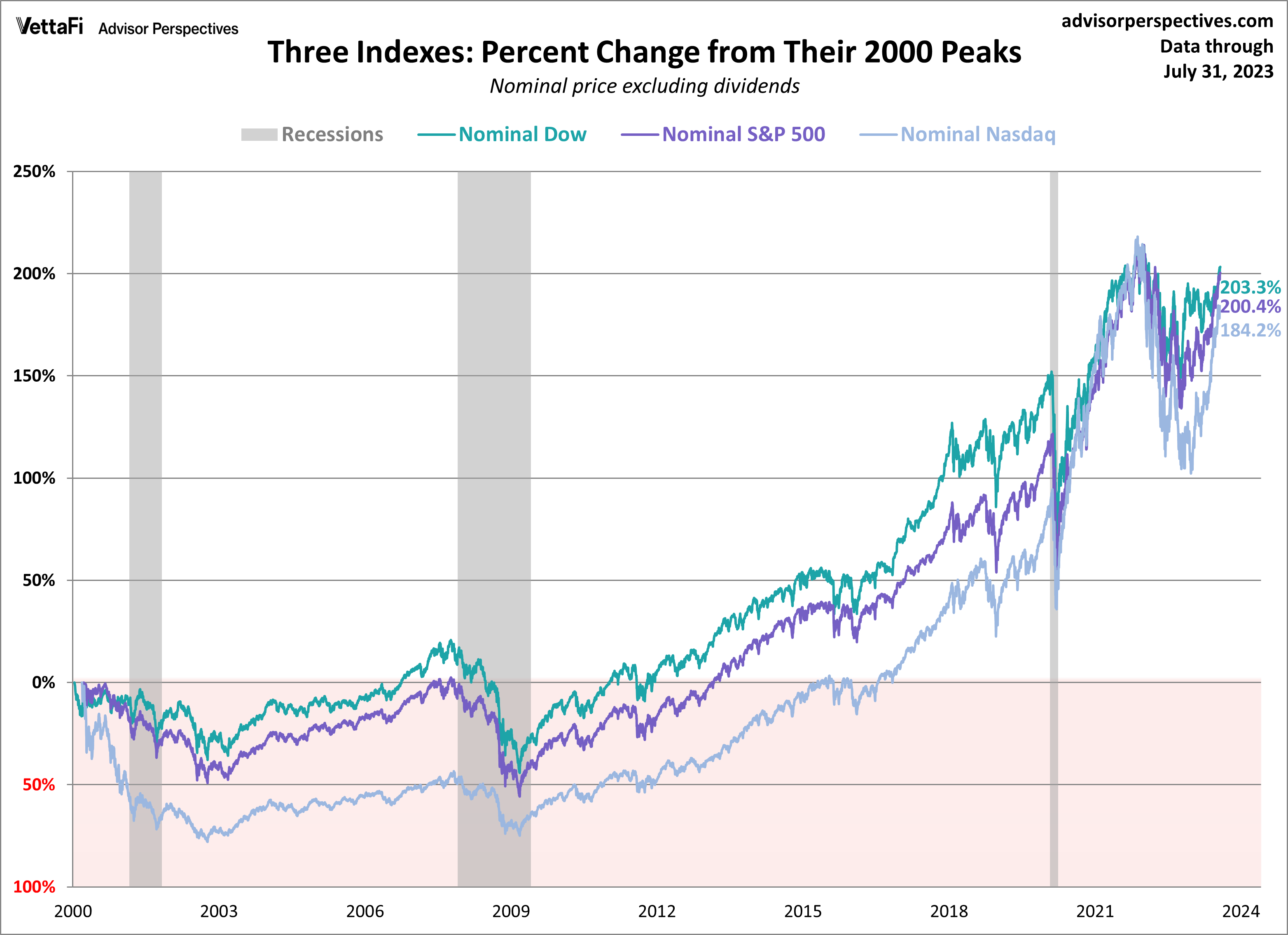

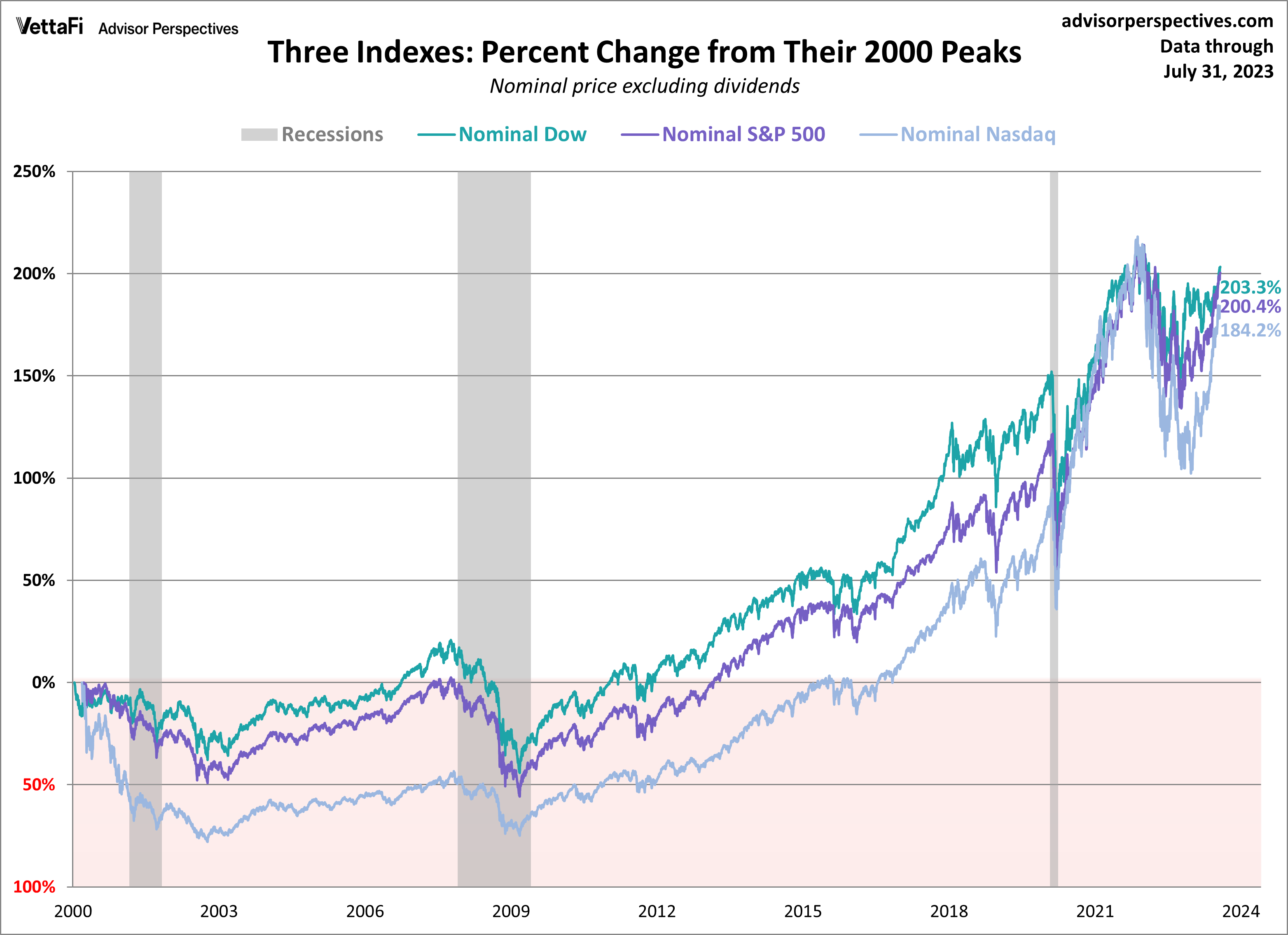

The Dow Jones experienced a daily percentage change of +0.09% compared to the previous day's close. While this represents a modest gain, the intraday volatility was noticeable, indicating uncertainty in the market. This volatility is depicted in the chart below: [Insert chart showing Dow Jones intraday price movements on April 23rd].

Key Sectors Driving Performance

The technology sector played a significant role in the Dow's positive performance. Strong earnings reports from several tech giants fueled buying pressure. Conversely, the energy sector showed some weakness, influenced by fluctuating oil prices.

- Top 3 Performing Stocks:

- Company A: +2.5% (Strong earnings beat)

- Company B: +1.8% (Positive market sentiment)

- Company C: +1.5% (Successful product launch)

- Bottom 3 Performing Stocks:

- Company D: -1.2% (Disappointing earnings)

- Company E: -0.8% (Concerns about future growth)

- Company F: -0.5% (Negative news regarding a product recall)

S&P 500 Index Performance on April 23rd

Opening, High, Low, and Closing Prices

The S&P 500 opened at 4,130.00, reaching an intraday high of 4,150.80. The low for the day was 4,120.50, with a final closing price of 4,145.20.

Percentage Change and Volatility

The S&P 500 showed a daily percentage change of +0.37%, outperforming the Dow Jones. [Insert chart comparing Dow Jones and S&P 500 performance on April 23rd]. The volatility in the S&P 500 mirrored that of the Dow, reflecting a broader market uncertainty.

Sector-Specific Analysis

The technology sector was a significant driver of the S&P 500's gains, while the consumer discretionary sector showed mixed results. Healthcare and financials exhibited relatively stable performance.

- Top Performing Sectors: Technology, Communication Services

- Bottom Performing Sectors: Energy, Utilities

Market Sentiment and Investor Behavior on April 23rd

Analysis of Trading Volume

Trading volume was slightly above the recent average, suggesting increased investor activity and interest in the market.

Investor Sentiment Indicators

The VIX (volatility index) remained relatively stable, indicating a moderate level of market uncertainty. Put/call ratios showed a slight shift towards calls, suggesting a modestly bullish sentiment, although not overwhelmingly so.

Impact of News and Events

The release of positive economic data contributed to a generally positive market sentiment. However, geopolitical tensions continued to exert some pressure on investor confidence.

- Overall Sentiment: Moderately bullish, with underlying caution.

- Reflection in Price Movements: The positive closing prices for both indices reflected a predominantly positive, though cautious, investor sentiment.

Conclusion: Understanding the Dow Jones and S&P 500 Market Movements

April 23rd's market performance showed a modest gain for both the Dow Jones and S&P 500, driven largely by strong performances in the technology sector and positive economic data. However, underlying volatility highlighted continued market uncertainty. The relatively stable VIX and a slight shift toward bullish sentiment indicated cautious optimism among investors. For a clearer picture of future market trends, continuous monitoring of economic indicators and geopolitical events is crucial. Return to our site for future Dow Jones, S&P 500 stock market reports and stay informed about the ever-changing landscape of the stock market. Consider subscribing to our newsletter for regular updates!

Featured Posts

-

Nbas Second Investigation Into Ja Morant What We Know

Apr 24, 2025

Nbas Second Investigation Into Ja Morant What We Know

Apr 24, 2025 -

Nba Probe Into Ja Morant Incident What We Know So Far

Apr 24, 2025

Nba Probe Into Ja Morant Incident What We Know So Far

Apr 24, 2025 -

Chalet Girls Unveiling The Reality Of Luxury Ski Season Work

Apr 24, 2025

Chalet Girls Unveiling The Reality Of Luxury Ski Season Work

Apr 24, 2025 -

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 24, 2025

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 24, 2025 -

Oblivion Remastered Official Release Date And Details From Bethesda

Apr 24, 2025

Oblivion Remastered Official Release Date And Details From Bethesda

Apr 24, 2025