Dow Jones Steady Climb: Positive PMI Data Fuels Market Confidence

Table of Contents

Positive PMI Data: A Key Driver of Market Confidence

Understanding the PMI

The Purchasing Managers' Index (PMI) is a key economic indicator that tracks the activity levels of purchasing managers within the manufacturing and services sectors. It's calculated based on a survey of purchasing managers, who provide insights into various aspects of their businesses, such as production levels, new orders, employment, and supplier deliveries. A PMI above 50 generally signals expansion, while a reading below 50 suggests contraction.

- Manufacturing PMI: This component focuses specifically on the manufacturing sector, providing insights into industrial production, new orders, and inventory levels. A strong manufacturing PMI indicates robust economic growth.

- Services PMI: This component measures the activity within the services sector, encompassing industries such as retail, finance, and healthcare. A healthy services PMI reflects consumer spending and overall economic health.

- Composite PMI: This combines the manufacturing and services PMIs to provide a broader overview of the overall economy.

Historically, strong PMI readings have correlated strongly with positive market performance, reflecting a healthier economic outlook and increased investor confidence. Conversely, weak PMI data often foreshadows market corrections.

PMI Numbers and Market Reaction

The recent release of PMI data showed significantly positive numbers, exceeding analysts' expectations. The manufacturing PMI reached a [insert actual number], its highest level in [time period], while the services PMI registered [insert actual number], also indicating strong expansion. This positive data spurred a considerable rally in the Dow Jones.

- Technology Sector Surge: The strong PMI fueled significant gains in the technology sector, with companies like [insert example company] seeing substantial stock price increases due to increased demand for their products and services.

- Consumer Goods Growth: The positive services PMI also boosted the consumer goods sector, indicating strong consumer spending and fueling the growth of companies like [insert example company].

[Insert relevant chart or graph here illustrating PMI data and its correlation with Dow Jones performance.]

Investor Sentiment and Increased Confidence

The positive PMI data translated directly into a marked increase in investor confidence. This is evidenced by:

- Increased Trading Volumes: Trading activity on the stock market increased significantly following the PMI release, demonstrating a surge in investor participation.

- Upward Trend in Stock Prices: The Dow Jones experienced a considerable upward trend, with many stocks reaching new highs.

- Positive Analyst Forecasts: Analysts revised their forecasts upwards for economic growth, further bolstering investor optimism and fueling the Dow Jones steady climb.

This renewed confidence impacts investment decisions by encouraging investors to allocate more capital to the stock market, leading to increased market liquidity and overall stability.

Analyzing the Dow Jones's Steady Climb

Sector-Specific Performance

While the positive PMI data benefitted the broader market, certain sectors within the Dow Jones experienced more significant growth than others.

- Technology and Consumer Discretionary: These sectors were particularly sensitive to the positive PMI, reflecting strong consumer confidence and increased demand for technology-related products and services.

- Financials: The improved economic outlook also positively impacted the financial sector, with banks and other financial institutions benefiting from increased lending activity.

[Insert example companies and their stock performance data.] It's worth noting that [mention any sector that underperformed], which serves as a reminder that even positive economic indicators don't always translate uniformly across all sectors.

Technical Indicators

Several technical indicators corroborate the positive trend in the Dow Jones. For example:

- Moving Averages: The 50-day and 200-day moving averages are currently above each other, indicating a strong uptrend.

- RSI (Relative Strength Index): The RSI is above [insert number], suggesting that the market is not currently overbought.

[Insert relevant chart illustrating these technical indicators.] These indicators suggest a sustained positive trend, but it is important to consider their limitations and interpret them alongside other economic factors.

Potential Risks and Challenges

Despite the current positive momentum, several potential risks and challenges could impact the continued steady climb of the Dow Jones.

- Inflationary Pressures: Persistently high inflation could erode consumer spending and dampen economic growth, potentially impacting market sentiment.

- Geopolitical Uncertainty: Global geopolitical events can significantly influence market volatility and investor confidence.

- Interest Rate Hikes: Potential interest rate hikes by central banks could curb economic activity and lead to market corrections.

Understanding these factors is crucial for investors to make informed decisions and manage risk effectively.

Conclusion

The positive PMI data has played a significant role in boosting market confidence and driving the Dow Jones's steady climb. The strong correlation between positive PMI readings and the positive performance of the Dow Jones is undeniable. Key takeaways include the significance of the PMI as an economic indicator and its direct impact on investor sentiment.

Stay tuned for updates on the Dow Jones steady climb. Monitor the PMI and other key indicators to track the Dow Jones performance and understand how the PMI can influence your Dow Jones investments. Making informed investment decisions requires staying abreast of key economic data and understanding its implications for the market.

Featured Posts

-

Konchita Vurst O Evrovidenii 2025 Ee Prognoz Na Chetyrekh Pobediteley

May 24, 2025

Konchita Vurst O Evrovidenii 2025 Ee Prognoz Na Chetyrekh Pobediteley

May 24, 2025 -

Paris Faces Economic Headwinds Luxury Sector Decline March 7 2025

May 24, 2025

Paris Faces Economic Headwinds Luxury Sector Decline March 7 2025

May 24, 2025 -

The New Single From Joy Crookes Carmen

May 24, 2025

The New Single From Joy Crookes Carmen

May 24, 2025 -

Paris Economic Slowdown Luxury Sector Impact March 7 2025

May 24, 2025

Paris Economic Slowdown Luxury Sector Impact March 7 2025

May 24, 2025 -

Zal De Snelle Markt Draai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 24, 2025

Zal De Snelle Markt Draai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 24, 2025

Latest Posts

-

Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De La Course

May 24, 2025

Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De La Course

May 24, 2025 -

Brest Urban Trail Les Visages De L Evenement Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail Les Visages De L Evenement Benevoles Artistes Et Partenaires

May 24, 2025 -

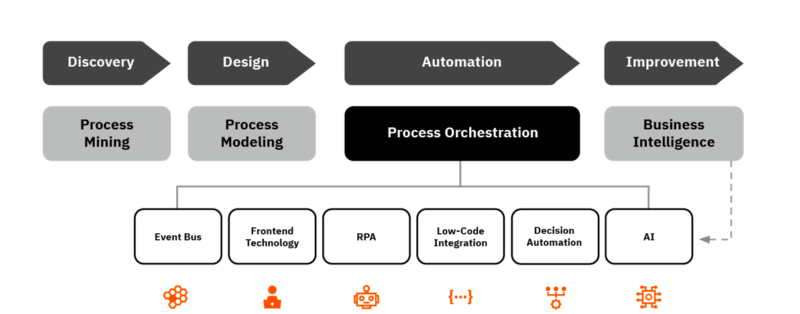

Camunda Con 2025 Optimizing Ai And Automation With Process Orchestration In Amsterdam

May 24, 2025

Camunda Con 2025 Optimizing Ai And Automation With Process Orchestration In Amsterdam

May 24, 2025 -

Camunda Con 2025 Amsterdam Orchestration For Maximum Ai And Automation Roi

May 24, 2025

Camunda Con 2025 Amsterdam Orchestration For Maximum Ai And Automation Roi

May 24, 2025 -

Re Energizing The Partnership Bangladeshs Growth Strategy In Europe

May 24, 2025

Re Energizing The Partnership Bangladeshs Growth Strategy In Europe

May 24, 2025