Downstream Investment: Eramet And Danantara Partner For Future Growth

Table of Contents

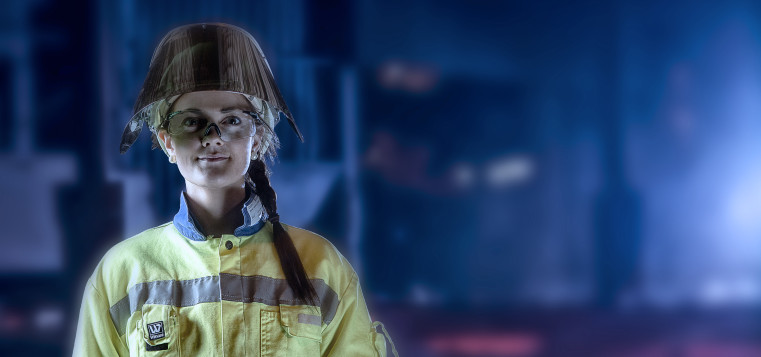

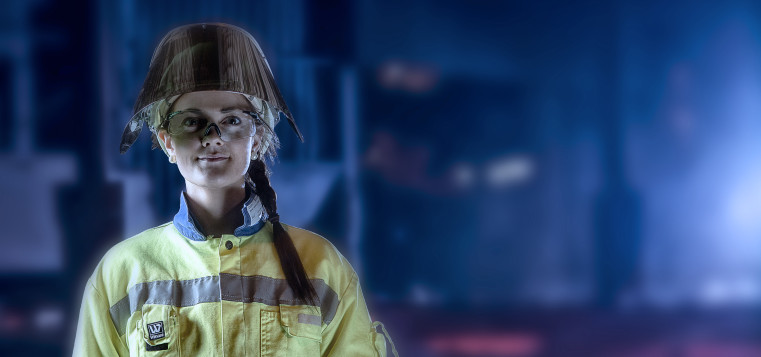

H2: Eramet's Strategic Downstream Expansion

Eramet's decision to pursue significant downstream investment reflects a proactive approach to navigating the challenges and opportunities within the nickel market.

H3: Rationale behind the Downstream Investment

Eramet's motives for this downstream investment are multifaceted:

- Expanding the Value Chain: Moving beyond raw material extraction to encompass processing and refining increases profitability and control.

- Securing Supply: Direct access to processed nickel ensures a stable supply chain, mitigating risks associated with fluctuating commodity prices and geopolitical uncertainties.

- Accessing New Markets: Value-added nickel products open doors to new customer segments and geographic markets, reducing reliance on traditional commodity markets.

- Increased Profitability: Processing nickel into higher-value products generates significantly higher margins compared to simply selling raw materials.

- Reduced Reliance on Commodity Pricing: Vertical integration reduces vulnerability to volatile commodity price swings.

Specific market challenges addressed by this investment include:

- Increasing demand for high-purity nickel in the electric vehicle (EV) battery sector.

- Growing competition from other nickel producers.

- The need for sustainable and ethically sourced nickel.

This partnership aligns perfectly with Eramet's overall strategic goals of sustainable growth, technological leadership, and enhanced profitability.

H3: Focus on Value-Added Products

Eramet's downstream investment focuses heavily on the production of value-added nickel products, specifically targeting:

- High-purity nickel sulfate for battery cathode production.

- Nickel alloys for specialized applications in aerospace and other high-tech industries.

- Nickel powders for additive manufacturing.

Market growth projections for these products are exceptionally strong, fueled by the burgeoning EV market and advancements in various technological sectors. Industry analysts predict significant annual growth rates for these niche nickel products in the coming years.

H3: Technological Advantages and Innovation

The partnership leverages cutting-edge technologies, including:

- Advanced hydrometallurgical processes for efficient and environmentally friendly nickel extraction.

- Precision alloying techniques to produce high-performance nickel alloys.

- Innovative powder production methods for additive manufacturing applications.

These technologies offer significant benefits, including improved efficiency, reduced environmental impact, and the production of higher-quality products. Eramet and Danantara will also collaborate on the development of future technologies, leveraging combined R&D expertise and potentially securing patents to protect their innovations.

H2: Danantara's Role in the Partnership

Danantara brings invaluable expertise and resources to the partnership:

H3: Danantara's Expertise and Local Knowledge

Danantara's contributions are crucial for the success of the project:

- Local Market Access: Deep understanding of the Indonesian market and existing relationships facilitate seamless integration into the local nickel industry.

- Regulatory Expertise: Navigating Indonesian regulations and obtaining necessary permits is streamlined through Danantara's experience.

- Logistical Support: Danantara provides efficient and cost-effective logistical solutions for transporting raw materials and finished products.

- Workforce: Access to a skilled and experienced local workforce reduces operational costs and ensures a smooth transition.

Danantara's existing infrastructure, including processing facilities and transportation networks, provides a significant advantage to the partnership.

H3: Synergies and Shared Benefits

The partnership creates several key synergies and shared benefits:

- Shared Risk: Distributing investment risk between the two partners mitigates potential financial losses.

- Resource Optimization: Combining resources and expertise optimizes efficiency and reduces operational costs.

- Cost Savings: Leveraging Danantara’s local infrastructure and expertise results in significant cost savings.

This initial investment lays the groundwork for potential future collaborations beyond nickel, exploring other areas of mutual interest and further strengthening the partnership.

H2: Impact and Future Outlook for Downstream Investment

This downstream investment significantly enhances both Eramet and Danantara's market position:

H3: Market Position and Competitive Advantage

- Improved Competitiveness: Access to value-added products strengthens their competitive edge in the global nickel market.

- Increased Market Share Potential: Targeting high-growth segments allows for substantial market share expansion.

- Stronger Brand Positioning: Association with innovative and sustainable nickel products enhances brand reputation.

Compared to their previous positions as primarily raw material suppliers, this investment catapults them into a leadership position within the downstream nickel processing sector.

H3: Sustainability and Environmental Considerations

Sustainability is central to this project:

- Reduced Carbon Footprint: Employing efficient and eco-friendly processing techniques minimizes the environmental impact.

- Responsible Sourcing: Commitment to responsible sourcing of nickel ore ensures ethical and sustainable practices.

This commitment to sustainable development is reflected in their adherence to stringent environmental regulations and a dedication to minimizing their carbon footprint throughout the entire value chain.

H3: Financial Projections and Return on Investment

While specific financial figures are not yet publicly disclosed, the partnership anticipates significant long-term financial returns. The focus on high-value products and efficient operations suggests a strong potential for increased revenue and improved profitability.

Conclusion:

The Eramet and Danantara partnership represents a significant advancement in securing a robust future through strategic downstream investment. This collaboration effectively leverages the strengths of both organizations to unlock substantial growth opportunities within the nickel sector. By focusing on value-added products, sustainable practices, and technological innovation, this downstream investment positions them for long-term success in the dynamic global nickel market. Learn more about the benefits of strategic downstream investments and explore similar successful partnerships in the nickel industry.

Featured Posts

-

Republica Dominicana El Papel Clave En El Trafico De Armas Entre Ee Uu Y Haiti

May 14, 2025

Republica Dominicana El Papel Clave En El Trafico De Armas Entre Ee Uu Y Haiti

May 14, 2025 -

Eurovision Nqtt Thwl Fy Msyrt Sylyn Dywn Alfnyt

May 14, 2025

Eurovision Nqtt Thwl Fy Msyrt Sylyn Dywn Alfnyt

May 14, 2025 -

Wynonna And Ashley Judds Docuseries Family Trauma And Triumph

May 14, 2025

Wynonna And Ashley Judds Docuseries Family Trauma And Triumph

May 14, 2025 -

Vince Vaughns New Restaurant A First Look At The Nonnas Concept

May 14, 2025

Vince Vaughns New Restaurant A First Look At The Nonnas Concept

May 14, 2025 -

Hollyoaks Spoilers 9 Big Reveals Coming Next Week

May 14, 2025

Hollyoaks Spoilers 9 Big Reveals Coming Next Week

May 14, 2025