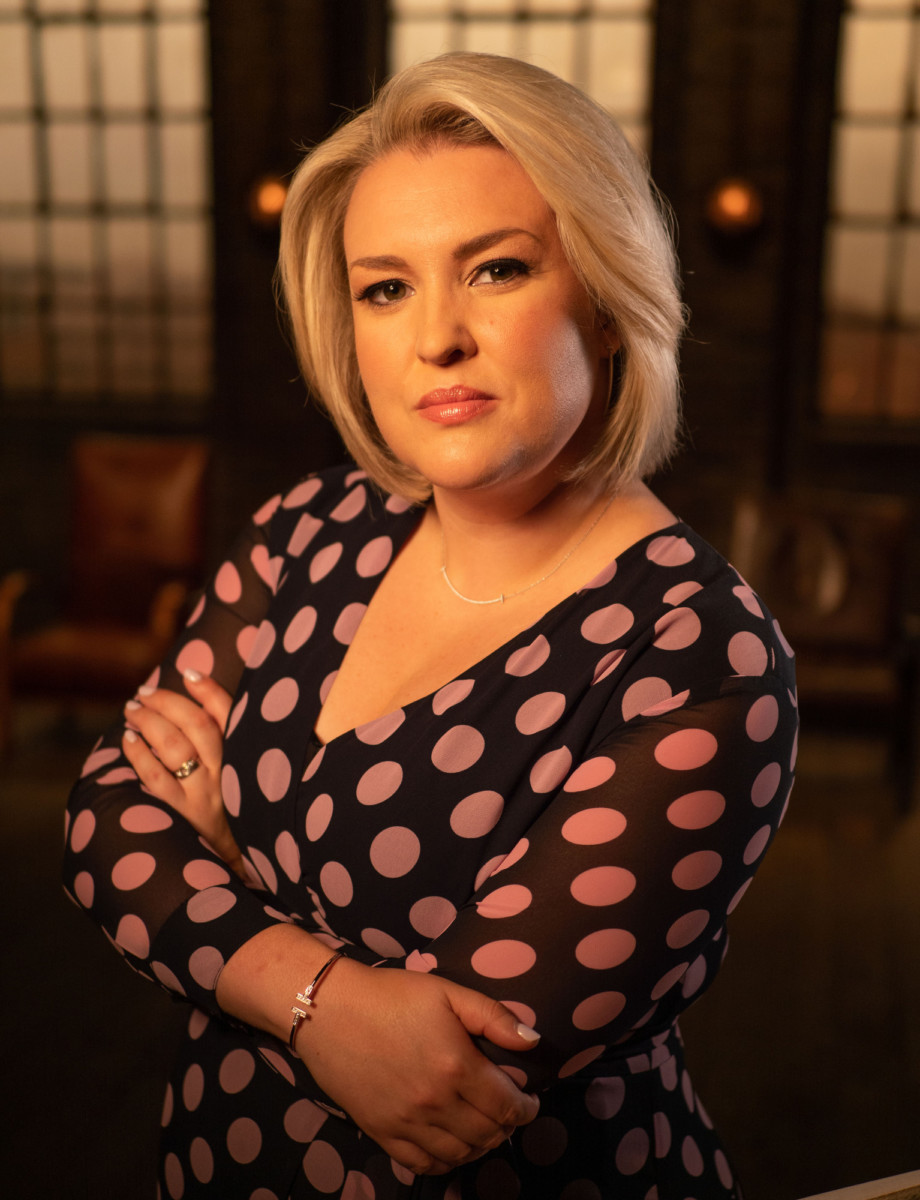

Dragon Den: Unexpected Twist As Entrepreneur Snubs Investors For Lower Offer

Table of Contents

The Entrepreneur's Pitch and Initial Offers

Sarah's pitch centered on EcoThreads, a company producing high-quality, sustainable clothing using recycled materials. Her innovative approach resonated with the Dragons, who recognized the growing demand for eco-friendly fashion. The investment offers poured in:

- Dragon 1 (Deborah): Offered £200,000 for 30% equity, highlighting the high growth potential she saw in EcoThreads.

- Dragon 2 (Peter): Offered £250,000 for 35% equity, emphasizing the strong market validation and Sarah's impressive business plan.

- Dragon 3 (Touker): Offered £150,000 for 25% equity, citing a more cautious approach given the perceived risks associated with a new, albeit promising, market.

The differences in offers stemmed from varying risk assessments. Deborah and Peter saw higher growth potential, justifying the higher valuations and equity demands. Touker, known for his more conservative investment style, took a more measured approach, reflecting his assessment of the market and inherent risks. Sarah’s negotiation skills also played a role, as she expertly pitched the unique selling points of EcoThreads, influencing the Dragons' final offers.

The Shocking Decision: Why the Lower Offer Was Chosen

Sarah's decision to accept Touker's £150,000 offer over the larger sums from Deborah and Peter shocked the panel. Her reasoning was multifaceted:

- Better Terms and Conditions: Touker's offer involved less equity dilution, allowing Sarah to retain greater control over her company's future direction.

- Stronger Investor Alignment: Touker's experience in building and scaling retail businesses aligned perfectly with EcoThreads' growth strategy. His expertise was invaluable.

- Long-Term Growth Potential: While the initial investment was smaller, Sarah saw greater long-term potential with Touker's strategic guidance, believing this partnership would yield greater returns than the larger, but less strategically aligned, investments.

Sarah stated, "While the other offers were financially larger, I felt that Touker's understanding of my vision and his experience in the industry would be invaluable in navigating the challenges ahead. Maintaining control of my company was also a priority."

The Dragons' Reactions and Subsequent Analysis

The Dragons were visibly surprised. Deborah and Peter expressed their disappointment, though they acknowledged the strategic rationale behind Sarah's choice. The episode sparked considerable debate about investment strategies. Did Sarah make the right decision? The short-term financial gain might have been lower, but her long-term prospects, given Touker's expertise and the retained company control, could prove significantly more advantageous. The episode highlighted that a successful investment depends not just on the sum of money, but the quality of the partnership and strategic alignment.

Lessons Learned from This Unexpected Twist

Sarah's bold move offers several valuable lessons for aspiring entrepreneurs:

- Value Beyond the Monetary: The worth of an investment extends beyond the monetary value. Strategic partnerships, expertise, and maintaining control are crucial for long-term success.

- Due Diligence is Key: Thorough research on potential investors, understanding their investment philosophies, and aligning with their values is essential.

- Master Negotiation Skills: Strong negotiation skills allow entrepreneurs to secure the best terms, even if it means accepting a lower initial investment.

- Choose the Right Partner: The right investor can be more valuable than a larger investment from someone less aligned with your vision.

Dragon's Den: The Power of Strategic Investment Decisions

Sarah Jones's unconventional choice on Dragon's Den served as a powerful reminder that securing investment is about more than just the highest bid. The episode highlighted the importance of due diligence, negotiation skills, and aligning with investors whose expertise and vision complement your own. Ultimately, a strategic investment, even if smaller, can fuel greater long-term growth and success. Are you an entrepreneur seeking investment? Learn more about securing strategic funding, even if it means rejecting higher offers! [Link to relevant resources]

Featured Posts

-

Eskisehir Tip Fakueltesi Oegrencilerinin Stres Yoenetme Yoentemi Boks

May 01, 2025

Eskisehir Tip Fakueltesi Oegrencilerinin Stres Yoenetme Yoentemi Boks

May 01, 2025 -

Episimos I Pari Stin Euroleague Kai Tin Epomeni Xronia

May 01, 2025

Episimos I Pari Stin Euroleague Kai Tin Epomeni Xronia

May 01, 2025 -

Alteawn Tezyz Alslslt Almmyzt Fy Mwajht Thdyat Alshbab

May 01, 2025

Alteawn Tezyz Alslslt Almmyzt Fy Mwajht Thdyat Alshbab

May 01, 2025 -

Commodity Classification For Xrp Ripples Settlement With The Sec

May 01, 2025

Commodity Classification For Xrp Ripples Settlement With The Sec

May 01, 2025 -

Travel Agent Incentive Ponant Offers 1 500 Flight Credit For Paul Gauguin Cruises

May 01, 2025

Travel Agent Incentive Ponant Offers 1 500 Flight Credit For Paul Gauguin Cruises

May 01, 2025

Latest Posts

-

Ai Driven Podcast Creation Analyzing Repetitive Scatological Documents

May 02, 2025

Ai Driven Podcast Creation Analyzing Repetitive Scatological Documents

May 02, 2025 -

Open Ai Simplifies Voice Assistant Development

May 02, 2025

Open Ai Simplifies Voice Assistant Development

May 02, 2025 -

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

May 02, 2025

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

May 02, 2025 -

Ai Transforms Repetitive Scatological Documents Into Insightful Podcasts

May 02, 2025

Ai Transforms Repetitive Scatological Documents Into Insightful Podcasts

May 02, 2025 -

Pandemic Fraud Lab Owner Convicted For Fake Covid Test Results

May 02, 2025

Pandemic Fraud Lab Owner Convicted For Fake Covid Test Results

May 02, 2025