Dragon's Den Investment: How To Secure Funding For Your Venture

Table of Contents

H2: Crafting a Compelling Pitch Deck for Dragon's Den Style Investors

Securing Dragon's Den investment, or funding from similar sources, begins with a pitch deck that captivates, informs, and persuades. It’s your first impression, and it needs to be unforgettable.

H3: Understanding Your Audience

Before crafting a single slide, research your target investors. Understanding their investment history, preferred sectors, and risk tolerance is crucial.

- Knowing investor profiles: Research the individual investors you are pitching to; what are their previous investments? What industries do they favour?

- Aligning your business model: Ensure your business model aligns with their investment portfolio and interests. Don't pitch a tech startup to an investor solely focused on real estate.

- Understanding their risk tolerance: Tailor your pitch to reflect their risk appetite. High-growth, high-risk ventures might attract some, while others prefer safer, established businesses.

H3: The Power of a Concise and Engaging Narrative

Your pitch deck isn't just about numbers; it’s a story. Capture attention with a compelling narrative that clearly articulates your vision and passion.

- Creating a clear problem statement: Define the problem your business solves, concisely and powerfully.

- Showcasing a unique solution: Highlight what makes your solution different and better than existing alternatives. What’s your unique selling proposition (USP)?

- Presenting a compelling value proposition: Clearly articulate the value your business brings to customers and investors alike. What's the return on investment (ROI)?

H3: Data-Driven Projections and Financial Modeling

While storytelling is vital, your pitch needs a strong foundation in data. Realistic financial projections and detailed cost analysis build credibility.

- Realistic revenue projections: Present achievable, well-researched projections based on market analysis and sales forecasts.

- Clear cost analysis: Detail all costs associated with your business, demonstrating a thorough understanding of your expenses.

- Demonstrating profitability and ROI: Show investors how your business will generate profit and deliver a strong return on their investment.

H3: Highlighting the Team and its Expertise

Investors invest in people as much as ideas. Showcase your team's experience, expertise, and commitment.

- Team members' backgrounds: Highlight the relevant experience and skills of each team member.

- Relevant experience: Emphasize past successes and achievements that demonstrate your team's capabilities.

- Advisory board and strategic partnerships: Showcasing strong partnerships adds credibility and enhances your value proposition.

H2: Navigating the Dragon's Den (or Similar) Investment Process

Securing Dragon's Den investment requires more than just a great pitch deck. Understanding the process and preparing for every eventuality is critical.

H3: Pre-Pitch Preparation

Meticulous preparation is key. Practice your pitch repeatedly, anticipating tough questions and preparing for potential negotiation challenges.

- Practicing the pitch: Rehearse until you are confident and comfortable delivering your presentation.

- Anticipating tough questions: Brainstorm potential questions and prepare detailed answers.

- Preparing for negotiation: Understand your bottom line and be ready to negotiate investment terms effectively.

H3: Handling Investor Questions and Objections

Expect tough questions. Addressing weaknesses honestly and highlighting strengths confidently demonstrates adaptability and resilience.

- Confidently addressing weaknesses: Acknowledge any weaknesses, but emphasize how you're addressing them.

- Highlighting strengths: Focus on your business's key strengths and competitive advantages.

- Demonstrating adaptability: Show that you can adjust your strategy based on feedback and market changes.

H3: Negotiating Investment Terms

Understanding the terms of the investment is crucial. Negotiate favorable terms that align with your business goals and long-term vision.

- Equity vs. debt: Carefully consider the implications of equity vs. debt financing.

- Valuation: Understand your business's valuation and negotiate a fair price.

- Milestones: Establish clear milestones and targets to track progress and demonstrate value creation.

- Exit strategy: Have a clear plan for how investors can eventually exit their investment.

H2: Beyond the Dragons: Securing Funding from Other Sources

While Dragon's Den offers a high-profile platform, many other avenues exist for securing funding.

H3: Angel Investors and Venture Capital

Angel investors and venture capitalists offer substantial funding opportunities for high-growth businesses.

- Identifying suitable investors: Research investors who align with your business and industry.

- Networking strategies: Actively network to connect with potential investors.

- Preparing for due diligence: Be prepared for a thorough due diligence process.

H3: Crowdfunding Platforms

Crowdfunding platforms provide an alternative route to securing early-stage funding directly from the public.

- Choosing the right platform: Select a platform that aligns with your target audience and business model.

- Creating a compelling campaign: Develop a persuasive campaign that resonates with potential backers.

- Managing the crowdfunding process: Effectively manage the campaign and communicate with backers.

H3: Government Grants and Subsidies

Government grants and subsidies can provide crucial financial support for eligible businesses.

- Eligibility criteria: Determine your eligibility for various government funding programs.

- Application process: Understand the application process and requirements.

- Accessing relevant resources: Utilize government resources and support networks.

3. Conclusion

Securing Dragon's Den investment, or any form of funding, requires a multifaceted approach. Crafting a compelling pitch deck, understanding the investment process, and exploring diverse funding options are all crucial steps. By mastering these aspects, you significantly improve your chances of attracting the investment you need to propel your venture to success. Secure your Dragon's Den investment today – start preparing your pitch deck and explore the various funding avenues available to make your entrepreneurial dreams a reality. Master the art of securing funding for your venture and learn how to present your business to secure the investment you need.

Featured Posts

-

Chien Thang Vang Doi Cua Truong Dh Ton Duc Thang Tai Giai Bong Da Sinh Vien Quoc Te 2025

May 01, 2025

Chien Thang Vang Doi Cua Truong Dh Ton Duc Thang Tai Giai Bong Da Sinh Vien Quoc Te 2025

May 01, 2025 -

Sedlacek Predvida Jokic I Jovic Na Evrobasketu

May 01, 2025

Sedlacek Predvida Jokic I Jovic Na Evrobasketu

May 01, 2025 -

La Carriere Et La Famille D Une Star Nba Menacees Par Des Celebrations Irresponsables

May 01, 2025

La Carriere Et La Famille D Une Star Nba Menacees Par Des Celebrations Irresponsables

May 01, 2025 -

Dallas Star Dies At 100

May 01, 2025

Dallas Star Dies At 100

May 01, 2025 -

Hkm Qdayy Dd Ryys Shbab Bn Jryr

May 01, 2025

Hkm Qdayy Dd Ryys Shbab Bn Jryr

May 01, 2025

Latest Posts

-

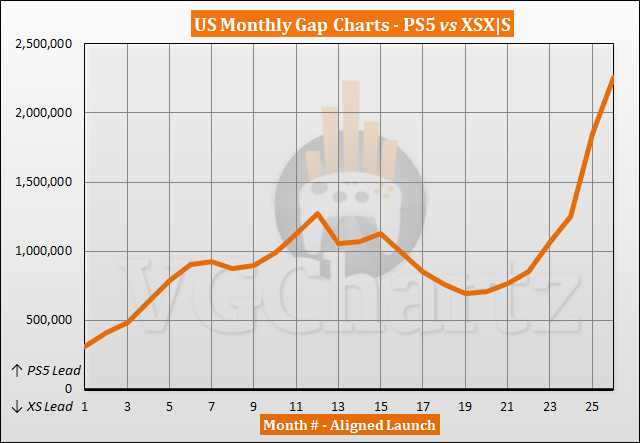

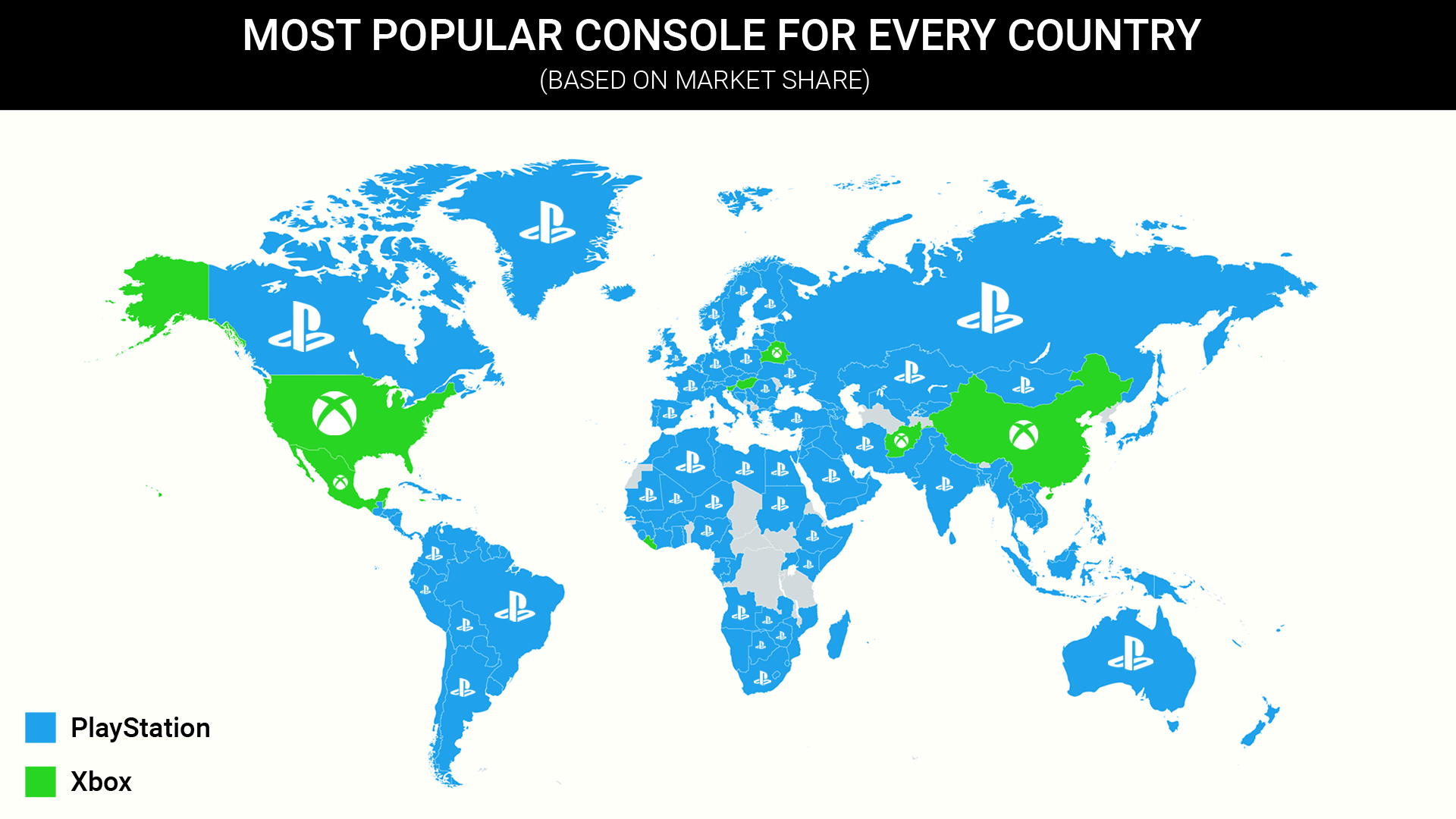

The Us Console War Ps 5 And Xbox Series X S Sales Numbers Compared

May 02, 2025

The Us Console War Ps 5 And Xbox Series X S Sales Numbers Compared

May 02, 2025 -

Jw 24 Dlyl Shaml Hwl Blay Styshn 6

May 02, 2025

Jw 24 Dlyl Shaml Hwl Blay Styshn 6

May 02, 2025 -

Comparing Ps 5 And Xbox Series X S Sales Performance In The Us Market

May 02, 2025

Comparing Ps 5 And Xbox Series X S Sales Performance In The Us Market

May 02, 2025 -

Analyzing Us Sales Data Ps 5 Dominates Or Xbox Series X S Closing The Gap

May 02, 2025

Analyzing Us Sales Data Ps 5 Dominates Or Xbox Series X S Closing The Gap

May 02, 2025 -

Us Console Sales Showdown Ps 5 Vs Xbox Series X S Market Share

May 02, 2025

Us Console Sales Showdown Ps 5 Vs Xbox Series X S Market Share

May 02, 2025