Dragon's Den Investment Strategies: What Works And What Doesn't

Table of Contents

Successful Dragon's Den Investment Strategies

Securing a Dragon's investment requires more than just a good idea; it demands a well-defined strategy backed by meticulous planning and execution. Here are some key strategies employed by successful entrepreneurs:

Strong Business Plan & Market Research

A solid business plan is the cornerstone of any successful investment pitch. This isn't just a document; it's a roadmap demonstrating a deep understanding of your market and your ability to navigate its complexities.

- Detailed market research: Understand your target audience, their needs, and their spending habits. Analyze market size, growth potential, and competitive landscape.

- Clear revenue projections: Present realistic and well-justified revenue forecasts, demonstrating a clear path to profitability.

- Realistic financial models: Develop detailed financial projections, including startup costs, operating expenses, and funding requirements.

- Strong understanding of the target market: Show the Dragons that you know your customer inside and out – their pain points, their preferences, and how your product or service addresses their needs.

- A competitive advantage analysis: Highlight what sets your business apart from competitors. Is it superior technology, a unique business model, or a stronger team?

Example: Many successful Dragon's Den pitches, like those involving innovative tech solutions or unique product designs, showcased rigorous market analysis demonstrating significant market potential and a well-defined competitive advantage.

Passionate & Credible Pitch

Your pitch isn't just about your business; it's about you. The Dragons invest in people as much as they invest in ideas. A passionate and credible delivery can make all the difference.

- Confident delivery: Present your ideas with confidence and enthusiasm, showing your belief in your business.

- Clear articulation of the value proposition: Communicate concisely and clearly why your product or service is valuable and how it solves a problem.

- Showcasing expertise and experience: Highlight your relevant skills and experience, demonstrating your capability to execute your business plan.

- Answering questions concisely and effectively: Prepare for tough questions and answer them honestly and directly.

- Demonstrating market understanding: Show the Dragons you've done your homework and truly understand your market.

Example: Entrepreneurs who displayed genuine passion and a deep understanding of their business, effectively communicating their vision and answering challenging questions with confidence, often secured investments.

Scalable & Profitable Business Model

The Dragons are looking for significant returns on their investments. Your business model needs to demonstrate high profit potential and the ability to scale rapidly.

- Clear path to growth: Outline a realistic strategy for expanding your business, reaching new markets, and increasing revenue.

- Potential for expansion: Demonstrate the potential to grow beyond your current stage, highlighting opportunities for national or international expansion.

- High profit margins: Show that your business can generate significant profits, indicating a strong return on investment for the Dragons.

- Strong unit economics: Demonstrate that each sale or transaction is profitable, contributing to overall business profitability.

- Clear exit strategy: Outline a potential exit strategy, such as an acquisition or IPO, showcasing a potential return on investment for the Dragons.

Example: Companies with proven business models showing strong unit economics and clear potential for scaling operations have consistently impressed the Dragons.

Strong Team & Expertise

Investors invest in people as much as in ideas. A strong team with the right expertise is crucial for success.

- Relevant industry experience: Highlight the experience and skills of your team members, demonstrating their capacity to execute the business plan.

- Strong leadership: Showcase strong leadership within your team, demonstrating the capacity to manage growth and overcome challenges.

- Complementary skills: Ensure your team possesses a diverse range of skills and expertise, covering all critical aspects of the business.

- Advisory board: Consider highlighting the presence of a strong advisory board, offering additional expertise and guidance.

- Clear roles and responsibilities: Demonstrate a clear understanding of each team member's roles and responsibilities.

Example: Many successful pitches on Dragon's Den featured experienced and well-rounded teams with a clear understanding of their roles and responsibilities.

Unsuccessful Dragon's Den Investment Strategies

Conversely, certain strategies consistently lead to unsuccessful pitches. Avoiding these pitfalls is crucial for securing investment.

Lack of Market Research & Poor Financial Projections

Insufficient market research and unrealistic financial projections are major red flags for investors.

- Unrealistic revenue projections: Overly optimistic revenue projections without supporting data raise serious concerns about the entrepreneur's understanding of the market.

- Inadequate market analysis: Failing to conduct thorough market research demonstrates a lack of preparation and understanding.

- Ignoring competition: Not acknowledging or addressing the competitive landscape suggests a naive approach to the market.

- Lack of understanding of the target market: A superficial understanding of your target market demonstrates a lack of commitment and preparation.

- Poor financial modeling: Inaccurate or incomplete financial models raise questions about the entrepreneur's financial literacy and preparedness.

Example: Many unsuccessful pitches suffered from wildly optimistic revenue projections that were not grounded in reality.

Weak Pitch & Poor Communication

A weak pitch and poor communication skills can derail even the most promising business idea.

- Unclear value proposition: Failing to clearly articulate the value proposition makes it difficult for investors to understand the business's potential.

- Nervous or unconvincing delivery: A lack of confidence and poor delivery can undermine the credibility of the pitch.

- Inability to answer questions effectively: Failing to address investor concerns effectively can raise serious doubts about the entrepreneur's capabilities.

- Lack of passion: A lack of enthusiasm and passion for the business can be a significant turn-off for investors.

- Poor understanding of the business: A lack of in-depth knowledge about the business raises concerns about the entrepreneur's commitment and capabilities.

Example: Numerous pitches have fallen flat due to unclear communication, nervous presentations, and inability to answer critical questions effectively.

Unscalable Business Model & Low Profitability

A business model that lacks scalability or profitability is unlikely to attract significant investment.

- Limited growth potential: A business with limited growth potential offers little incentive for investors seeking significant returns.

- Low profit margins: Low profit margins indicate a weak business model and limited potential for profitability.

- Dependence on a single customer: Reliance on a single customer creates significant risk and limits scalability.

- High operating costs: High operating costs reduce profitability and hinder the ability to scale.

- Lack of a clear exit strategy: An absence of a clear exit strategy raises questions about the long-term viability of the business.

Example: Businesses with niche markets and limited growth potential often struggle to attract investment.

Lack of a Strong Team & Expertise

A lack of a strong team and relevant expertise can significantly reduce the likelihood of securing funding.

- Inexperienced team: A team lacking relevant experience raises doubts about the ability to execute the business plan.

- Lack of relevant skills: The absence of essential skills within the team hinders the business's ability to operate effectively.

- Unclear roles and responsibilities: A lack of clearly defined roles and responsibilities creates organizational inefficiencies.

- Absence of a strong leader: A lack of strong leadership can hinder the team's ability to achieve its goals.

- Insufficient industry knowledge: A lack of industry knowledge demonstrates a lack of preparation and understanding.

Example: Many pitches featuring inexperienced teams or lacking crucial skills have failed to secure investment.

Conclusion

Mastering Dragon's Den investment strategies requires a multi-faceted approach. Success hinges on a robust business plan supported by thorough market research, a compelling and confident pitch, a scalable and profitable business model, and a strong, experienced team. Conversely, neglecting these elements – particularly lacking crucial market research, presenting a weak pitch, or showcasing an unsustainable business model – virtually guarantees failure. Analyze your own business plan using the insights shared here. Study successful Dragon's Den pitches to glean further inspiration and refine your approach. Master your Dragon's Den investment strategies today and increase your chances of securing funding!

Featured Posts

-

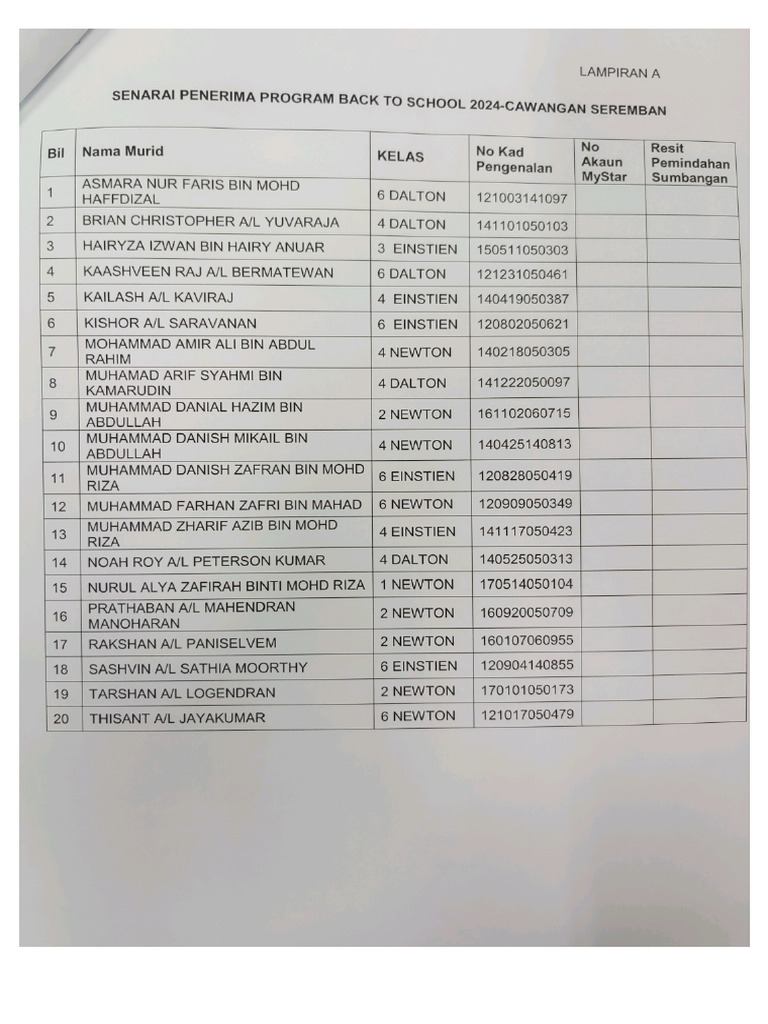

125 Murid Asnaf Sibu Terima Manfaat Program Kembali Ke Sekolah Tabung Baitulmal Sarawak 2025

May 01, 2025

125 Murid Asnaf Sibu Terima Manfaat Program Kembali Ke Sekolah Tabung Baitulmal Sarawak 2025

May 01, 2025 -

Ex Wkrn Co Hosts Nikki Burdine And Neil Orne Partner On Upcoming Projects

May 01, 2025

Ex Wkrn Co Hosts Nikki Burdine And Neil Orne Partner On Upcoming Projects

May 01, 2025 -

Ripple Xrp Investment Weighing The Risks And Rewards For Potential Millionaires

May 01, 2025

Ripple Xrp Investment Weighing The Risks And Rewards For Potential Millionaires

May 01, 2025 -

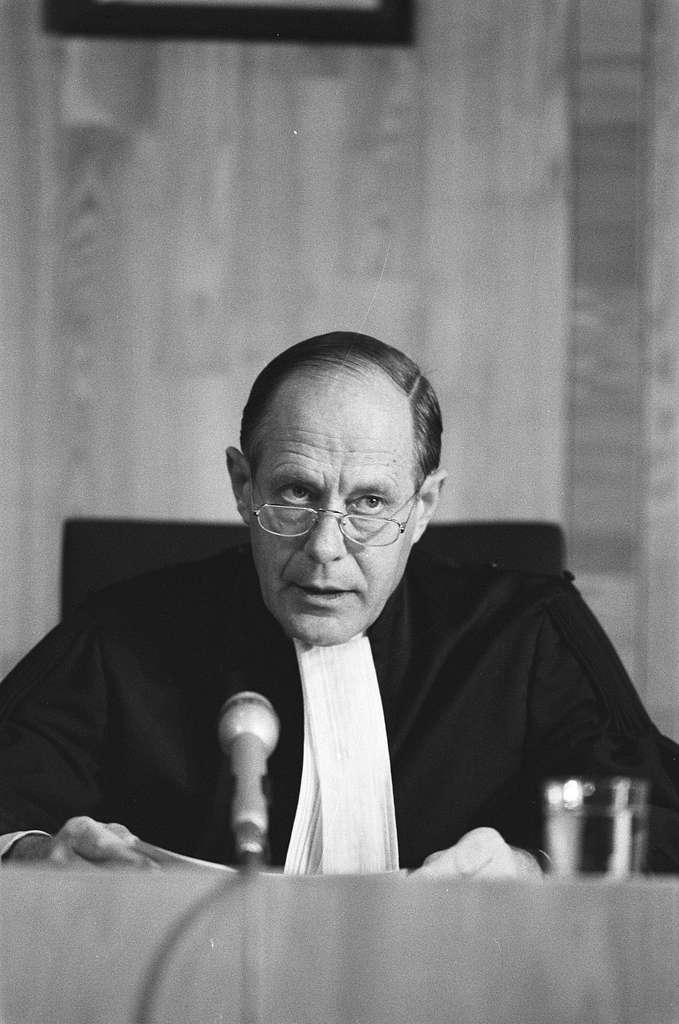

Stroomnetproblemen Kampen Kort Geding Tegen Enexis

May 01, 2025

Stroomnetproblemen Kampen Kort Geding Tegen Enexis

May 01, 2025 -

Analyzing Ziaire Williams Performance Capitalizing On A Second Opportunity

May 01, 2025

Analyzing Ziaire Williams Performance Capitalizing On A Second Opportunity

May 01, 2025

Latest Posts

-

Geen Stijl Definitie Van Een Zware Auto Volgens De Media

May 01, 2025

Geen Stijl Definitie Van Een Zware Auto Volgens De Media

May 01, 2025 -

Gratis New York Times Toegang Via Nrc De Reden

May 01, 2025

Gratis New York Times Toegang Via Nrc De Reden

May 01, 2025 -

Nrc Biedt Gratis Toegang Tot The New York Times Waarom Nu

May 01, 2025

Nrc Biedt Gratis Toegang Tot The New York Times Waarom Nu

May 01, 2025 -

Concerns Rise Nrc Seeks Action Against Anti Muslim Schemes In Bangladesh

May 01, 2025

Concerns Rise Nrc Seeks Action Against Anti Muslim Schemes In Bangladesh

May 01, 2025 -

Waarom Geeft Nrc Nu Gratis Toegang Tot The New York Times

May 01, 2025

Waarom Geeft Nrc Nu Gratis Toegang Tot The New York Times

May 01, 2025