Dubai Holding's REIT IPO: A $584 Million Investment Opportunity

Table of Contents

Understanding Dubai Holding and its REIT Portfolio

Dubai Holding, a prominent investment company with a long history in Dubai's real estate sector, is behind this ambitious REIT offering. Their portfolio boasts a diverse collection of prime properties, contributing to the attractiveness of the Dubai Holding REIT IPO. The REIT's assets span various property types, including:

- Residential: High-end apartments and villas in sought-after locations across Dubai.

- Commercial: State-of-the-art office spaces and business parks, catering to a diverse tenant base.

- Hospitality: Luxury hotels and serviced apartments, benefiting from Dubai's booming tourism industry.

Specific high-profile properties included in the portfolio (if publicly available information exists) should be mentioned here, adding further credibility and attracting investor interest. For example, mentioning specific locations or landmark buildings can significantly enhance the appeal of the article.

- Overview of key assets within the REIT portfolio: [Insert specific details of key assets and their location, if available. For example: "The portfolio includes the iconic Burj Khalifa Residences and several prime commercial properties in the Dubai International Financial Centre."]

- Expected rental income and occupancy rates: [Insert data on projected rental income and occupancy rates. This information needs to be sourced from reliable financial reports or prospectuses.]

- Geographic diversification of the properties: [Discuss the spread of properties across different locations within Dubai, highlighting the risk mitigation aspect of this diversification.]

- Management team expertise and experience: [Highlight the experience and expertise of the management team, demonstrating the company's capacity to manage the REIT effectively.]

Investment Highlights and Potential Returns of the Dubai Holding REIT IPO

The Dubai Holding REIT IPO presents a compelling investment case built upon several key strengths:

-

High Potential Returns: The combination of stable rental income and anticipated capital appreciation offers investors the potential for significant returns.

-

Stable Income Stream: The REIT's diversified portfolio of high-quality properties is expected to generate a consistent stream of rental income, providing a stable foundation for dividend payouts.

-

Diversification Benefits: Investing in a REIT provides diversification beyond individual property ownership, reducing overall investment risk.

-

Projected dividend yield: [Insert projected dividend yield data, sourced from reliable financial reports or prospectuses. This is a critical factor for attracting income-seeking investors.]

-

Potential for capital growth: [Discuss the factors that may contribute to capital appreciation, such as market trends, property value increases, and overall economic growth.]

-

Risk assessment and mitigation strategies: [Address potential risks, such as market volatility and interest rate fluctuations, and outline the mitigation strategies employed by the REIT.]

-

Comparison to competitor REITs (if data available): [Compare the projected returns and risk profile of the Dubai Holding REIT with similar REITs in the region, highlighting its competitive advantages.]

The IPO Process and Investment Considerations for the Dubai Holding REIT

Understanding the IPO process and associated risks is crucial for potential investors.

- IPO timeline and key dates: [Include details about the offer period, listing date, and other important dates related to the IPO. These are usually found in official IPO documents.]

- Minimum investment amount: [State the minimum investment amount required to participate in the IPO.]

- Application process and requirements: [Outline the steps involved in applying for shares in the Dubai Holding REIT IPO.]

- Risks associated with REIT investment: [Clearly explain the inherent risks associated with REIT investments, such as market volatility, interest rate sensitivity, and tenant default risk.]

- Tax implications for investors: [Outline the tax implications for investors, including any applicable capital gains taxes or dividend taxes.]

Dubai's Real Estate Market and Future Outlook for the Dubai Holding REIT

Dubai's real estate market is experiencing significant growth, driven by several factors including:

- Government Initiatives: Supportive government policies and infrastructure development are fueling real estate expansion.

- Tourism: The booming tourism sector contributes significantly to the demand for residential and hospitality properties.

- Economic Growth: The overall economic strength of Dubai provides a stable backdrop for the real estate market.

These factors create a positive outlook for the Dubai Holding REIT, although potential challenges and risks should always be acknowledged.

- Current market trends and predictions: [Provide insights into current market trends and forecasts for the future, supporting the positive outlook for the REIT.]

- Impact of government initiatives on the real estate market: [Discuss how government policies and initiatives are positively impacting the market.]

- Long-term growth potential of Dubai's real estate sector: [Provide a reasoned assessment of the long-term growth potential of Dubai's real estate market.]

- Potential challenges and risks facing the market: [Acknowledge potential risks and challenges, such as global economic uncertainty or changes in government policy.]

Conclusion

The Dubai Holding REIT IPO presents a compelling investment opportunity with the potential for high returns driven by a diversified portfolio of prime properties in Dubai's flourishing real estate market. The strong fundamentals of the underlying assets, coupled with the positive outlook for Dubai's economy, make this IPO an attractive proposition for both income-seeking and growth-oriented investors. However, it is essential to carefully consider the associated risks before making an investment decision. Don't miss out on this lucrative investment opportunity. Learn more about the Dubai Holding REIT IPO today and explore how to invest in this exciting venture! [Insert links to relevant resources, such as the official IPO prospectus and financial news articles.] Consider researching further on the topic of Dubai Holding REIT investment and Dubai REIT IPO to make an informed decision.

Featured Posts

-

Activite Des Cordistes A Nantes Impact De La Construction Des Grandes Tours

May 21, 2025

Activite Des Cordistes A Nantes Impact De La Construction Des Grandes Tours

May 21, 2025 -

Snls 50th Season Ends On A High Note Record Breaking Episode Details

May 21, 2025

Snls 50th Season Ends On A High Note Record Breaking Episode Details

May 21, 2025 -

Trans Australia Run Record A New World Standard

May 21, 2025

Trans Australia Run Record A New World Standard

May 21, 2025 -

Cassis Blackcurrant A Comprehensive Guide

May 21, 2025

Cassis Blackcurrant A Comprehensive Guide

May 21, 2025 -

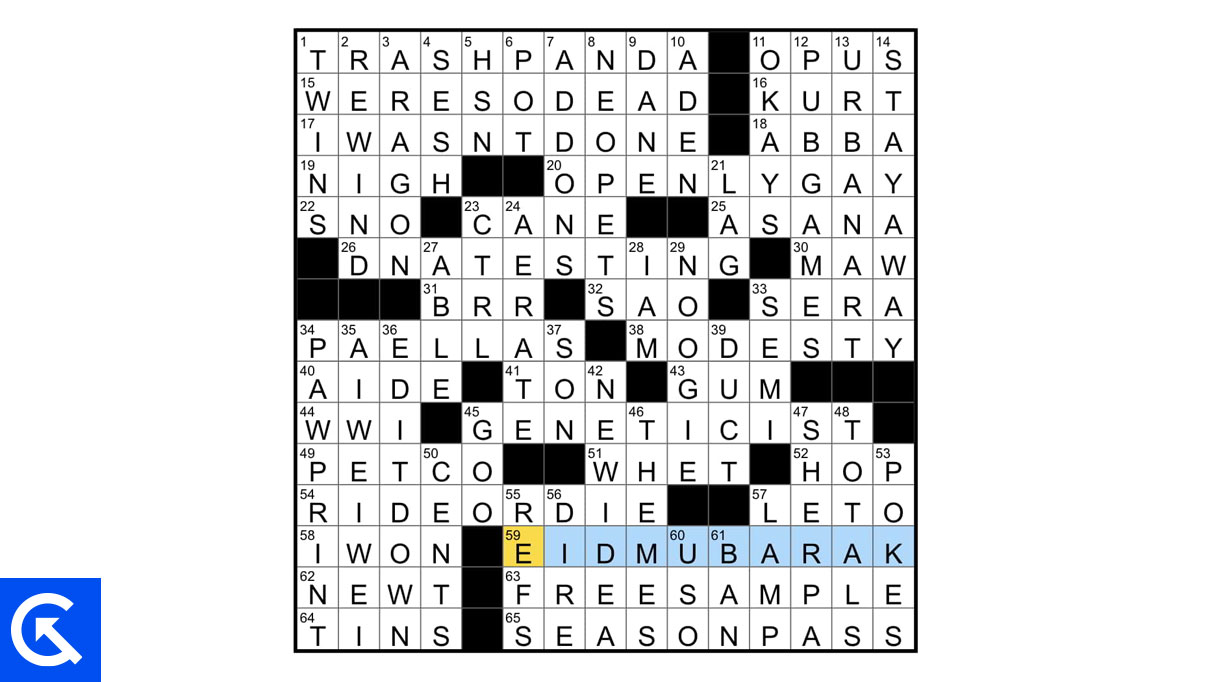

April 18 2025 Nyt Mini Crossword Answers And Help

May 21, 2025

April 18 2025 Nyt Mini Crossword Answers And Help

May 21, 2025

Latest Posts

-

March 8th Wordle Solution 1358 Hints And Full Answer

May 22, 2025

March 8th Wordle Solution 1358 Hints And Full Answer

May 22, 2025 -

Wordle 370 Hints And Clues For Thursday March 20th

May 22, 2025

Wordle 370 Hints And Clues For Thursday March 20th

May 22, 2025 -

Wordle Answer Today March 8th Hints And Solution For Puzzle 1358

May 22, 2025

Wordle Answer Today March 8th Hints And Solution For Puzzle 1358

May 22, 2025 -

Wordle 1367 Monday March 17th Get The Answer And Clues

May 22, 2025

Wordle 1367 Monday March 17th Get The Answer And Clues

May 22, 2025 -

Wordle Puzzle 1367 Hints Clues And Answer For March 17th

May 22, 2025

Wordle Puzzle 1367 Hints Clues And Answer For March 17th

May 22, 2025