Dutch Stock Market Suffers Further Losses In US Trade Dispute

Table of Contents

Impact on Key Dutch Sectors

The escalating trade war has had a ripple effect across various key sectors of the Dutch economy, significantly impacting the performance of the Dutch stock market. Let's examine the most affected areas:

Financial Services

The financial sector, a cornerstone of the Dutch economy, is particularly vulnerable to global economic uncertainty. The US trade dispute introduces several challenges:

- Increased uncertainty leads to decreased investment: The volatile nature of the global market, fueled by trade tensions, makes investors hesitant to commit capital, leading to decreased investment in Dutch financial institutions.

- Potential for reduced cross-border transactions: Trade disputes often lead to increased regulatory scrutiny and barriers to cross-border transactions, impacting the profitability of Dutch banks and financial service providers.

- Impact on major Dutch banks and insurance companies: Major players in the Dutch financial sector are seeing reduced profits and are adapting their strategies to navigate this period of uncertainty. This impacts their stock performance and the overall Dutch stock market index (AEX).

Agriculture and Food Exports

Dutch agriculture, a significant contributor to the national GDP, faces substantial challenges due to imposed tariffs and reduced global demand.

- Reduced demand for Dutch dairy and horticultural products: Tariffs imposed on Dutch agricultural exports to the US and other countries have resulted in a decrease in demand for high-quality Dutch dairy products, flowers, and other agricultural goods.

- Impact on smaller farms and agricultural businesses: Smaller farms and businesses are particularly vulnerable, facing difficulties in competing with subsidized agricultural products from other countries. This translates to lower profits and increased risk for investments in this sector.

- Potential for job losses in the agricultural sector: The reduced demand and increased financial pressures could lead to job losses and business closures within the Dutch agricultural sector, further impacting investor sentiment regarding the Dutch stock market.

Technology and Manufacturing

Dutch technology and manufacturing companies are not immune to the negative effects of the trade dispute. They are facing:

- Increased costs for imported raw materials: Tariffs and trade barriers increase the cost of imported raw materials, making Dutch manufacturers less competitive in the global market.

- Decreased competitiveness in the global market: The increased costs coupled with potential retaliatory tariffs from other countries reduce the competitiveness of Dutch manufactured goods and technology products internationally.

- Potential for factory closures and job losses: Faced with higher production costs and reduced demand, some companies may be forced to consider factory closures and job cuts, which will negatively impact the Dutch stock market's performance.

Investor Sentiment and Market Volatility

The Dutch stock market index (AEX) has shown considerable volatility in recent months, directly reflecting the uncertainty surrounding the US trade dispute. Investor confidence is low, leading to:

- Capital flight: Investors are withdrawing investments from the Dutch stock market, seeking safer havens amid the uncertainty.

- Reduced investment: New investments are significantly reduced, hindering economic growth and further depressing the AEX.

- Significant share price drops: Several prominent Dutch companies, particularly those in the sectors mentioned above, have experienced substantial share price drops. Analyzing the trading volume and market capitalization provides further evidence of these losses.

Government Response and Mitigation Strategies

The Dutch government is actively working to mitigate the negative impacts of the trade dispute. This includes:

- Economic stimulus packages: The government is considering and implementing various economic stimulus packages to support affected industries and stimulate economic growth.

- Support for affected industries: Specific measures are being implemented to assist businesses in the agricultural, manufacturing, and financial sectors.

- Trade negotiations: The Dutch government is actively involved in trade negotiations, seeking to de-escalate the conflict and secure favorable trade agreements. The effectiveness of these interventions will significantly influence the recovery of the Dutch stock market.

Long-Term Outlook for the Dutch Stock Market

The long-term effects of the US trade dispute on the Dutch economy and its stock market remain uncertain. Several factors will play a crucial role:

- Resolution of the trade dispute: A swift and favorable resolution to the trade conflict would significantly boost investor confidence and market recovery.

- Government policy effectiveness: The success of government interventions and stimulus packages will greatly influence the speed and extent of the market's recovery.

- Global economic conditions: The overall health of the global economy will also play a significant role in influencing the long-term performance of the Dutch stock market. Expert opinions and forecasts provide a range of possible scenarios.

Conclusion

The escalating US trade dispute has undeniably dealt a significant blow to the Dutch stock market, impacting key sectors and causing considerable investor uncertainty. The losses experienced across various industries highlight the interconnectedness of the global economy and the vulnerability of even strong economies to protectionist policies. While the Dutch government is taking steps to mitigate the damage, the long-term effects remain uncertain. Close monitoring of the Dutch stock market and the ongoing trade negotiations is crucial for investors and businesses alike. Stay informed about further developments impacting the Dutch stock market and its recovery prospects. Understanding the complexities of the Dutch stock market in this challenging global environment is key to making informed investment decisions.

Featured Posts

-

M6 Drivers Face Long Delays After Van Crash

May 25, 2025

M6 Drivers Face Long Delays After Van Crash

May 25, 2025 -

The Republican Party And Trump A Deal In The Making

May 25, 2025

The Republican Party And Trump A Deal In The Making

May 25, 2025 -

Urgent Flood Advisory Miami Valley Residents Urged To Prepare For Severe Weather

May 25, 2025

Urgent Flood Advisory Miami Valley Residents Urged To Prepare For Severe Weather

May 25, 2025 -

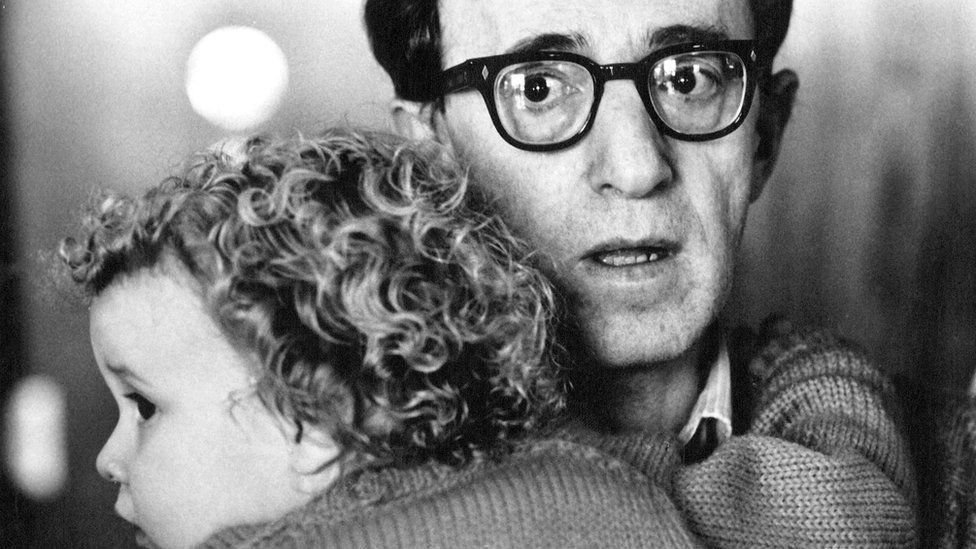

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025 -

Bangladeshs Return To Europe A Focus On Collaborative Growth

May 25, 2025

Bangladeshs Return To Europe A Focus On Collaborative Growth

May 25, 2025

Latest Posts

-

Hampshire And Worcester Counties Under Flash Flood Threat Thursday

May 25, 2025

Hampshire And Worcester Counties Under Flash Flood Threat Thursday

May 25, 2025 -

Flash Flood Threat In Parts Of Pennsylvania Through Thursday Morning

May 25, 2025

Flash Flood Threat In Parts Of Pennsylvania Through Thursday Morning

May 25, 2025 -

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025 -

Pennsylvania Flash Flood Warning Heavy Rain Until Thursday

May 25, 2025

Pennsylvania Flash Flood Warning Heavy Rain Until Thursday

May 25, 2025 -

Flash Flood Threat North Central Texas Braces For Intense Rainfall And Potential Flooding

May 25, 2025

Flash Flood Threat North Central Texas Braces For Intense Rainfall And Potential Flooding

May 25, 2025