EToro Revives IPO Plans, Targeting $500 Million Funding Round

Table of Contents

eToro's Renewed Ambition: Why the IPO Now?

eToro's decision to pursue an IPO now is a strategic move driven by several factors. The timing suggests a confluence of favorable market conditions and internal company milestones. Let's examine the key reasons:

- Favorable Fintech IPO Market: The current market sentiment towards fintech IPOs appears relatively positive, with investors showing increased appetite for innovative financial technology companies. This presents a window of opportunity for eToro to secure a favorable valuation.

- Strong User Growth and Financial Performance: eToro has experienced significant user growth and improved financial performance in recent years. This demonstrable success story strengthens their IPO prospectus and attracts potential investors. This growth is partly attributed to the increasing popularity of social trading and copy trading features.

- Competitive Landscape and Market Positioning: eToro's robust platform and established brand position it well within the competitive landscape of online trading platforms. The IPO aims to solidify this position and further accelerate growth.

- Regulatory Landscape Shifts: Recent regulatory changes, while potentially presenting challenges, may also have opened up new opportunities for expansion and growth, further influencing eToro's decision to move forward with the IPO.

The $500 Million Target: Funding Plans and Allocation

The planned $500 million funding round is a substantial investment that reflects eToro's ambitious growth plans. The allocation of these funds is expected to focus on several key areas:

- Platform Expansion and Enhancement: A significant portion of the funds will likely be allocated to further develop the eToro platform, enhancing its functionality, user experience, and expanding its product offerings. This might include improvements to copy trading features and expanding the range of tradable assets.

- Strategic Acquisitions and Partnerships: eToro may use part of the funding to acquire smaller companies or forge strategic partnerships to expand its market reach and enhance its technological capabilities. This could involve acquiring companies specializing in specific trading niches or developing new technologies.

- Technological Advancements: Investing in cutting-edge technology is crucial for maintaining a competitive edge. eToro may allocate resources to AI-powered trading tools, enhanced security measures, and improved infrastructure.

- Implied Valuation: The $500 million funding round suggests a significant valuation for eToro, placing it among the leading players in the social trading and fintech sectors. This valuation will likely be a subject of intense scrutiny from investors and market analysts leading up to the IPO.

Impact on Investors and the Social Trading Market

The eToro IPO presents both opportunities and risks for investors. Let's explore the potential implications:

- Potential for High Returns: A successful IPO could generate significant returns for early investors, particularly if eToro continues its trajectory of growth and market dominance. However, this is speculative and depends on multiple factors.

- Risk Assessment: As with any investment, there are inherent risks involved. Market volatility, regulatory changes, and competitive pressures could all impact eToro's performance post-IPO. Investors need to carefully assess their risk tolerance.

- Social Trading Market Impact: The eToro IPO will likely have a significant impact on the social trading market, potentially attracting further investment and innovation in this burgeoning sector. This could lead to increased competition and better offerings for traders.

- Long-Term Growth Potential: The long-term prospects for eToro's stock are largely dependent on its ability to maintain its growth trajectory, adapt to changing market conditions, and successfully navigate the challenges of the highly competitive fintech sector. This depends on factors like user retention and regulatory compliance.

Regulatory Considerations and Potential Hurdles

Navigating the regulatory landscape is crucial for eToro's successful IPO. Several factors need consideration:

- Jurisdictional Regulations: eToro operates globally, meaning it must comply with various financial regulations in different jurisdictions. This can add complexity and cost to the IPO process.

- Compliance Costs: Meeting regulatory requirements will inevitably involve substantial costs, potentially impacting the profitability of the IPO and eToro's post-IPO performance.

- Potential Challenges: Potential regulatory challenges might include issues related to anti-money laundering (AML) compliance, data privacy regulations, and the ever-evolving landscape of financial regulations for online trading platforms. eToro will need to demonstrate its readiness to meet all necessary standards.

Conclusion

eToro's revived IPO plans, targeting a $500 million funding round, represent a significant development in the social trading market. The potential benefits for investors are substantial, but careful consideration of the risks is essential. The success of this eToro IPO will significantly impact both the company's future and the wider landscape of fintech and social trading investments. The allocation of funds, the implications for eToro stock, and the broader market effects all warrant continued attention.

Call to Action: Stay informed about the upcoming eToro IPO and its potential impact. Follow our updates for further analysis of the eToro stock offering and the evolving social trading landscape. Learn more about investing in the eToro IPO [link to relevant resource]. Don't miss out on the opportunity to invest in the future of social trading with the eToro IPO.

Featured Posts

-

Celine Dion Ne Eurovizion 2025 A Do Te Jete Zvicra Skena E Surprizes

May 14, 2025

Celine Dion Ne Eurovizion 2025 A Do Te Jete Zvicra Skena E Surprizes

May 14, 2025 -

Alkaras Inspiracija I Uzor Mladim Sportistima

May 14, 2025

Alkaras Inspiracija I Uzor Mladim Sportistima

May 14, 2025 -

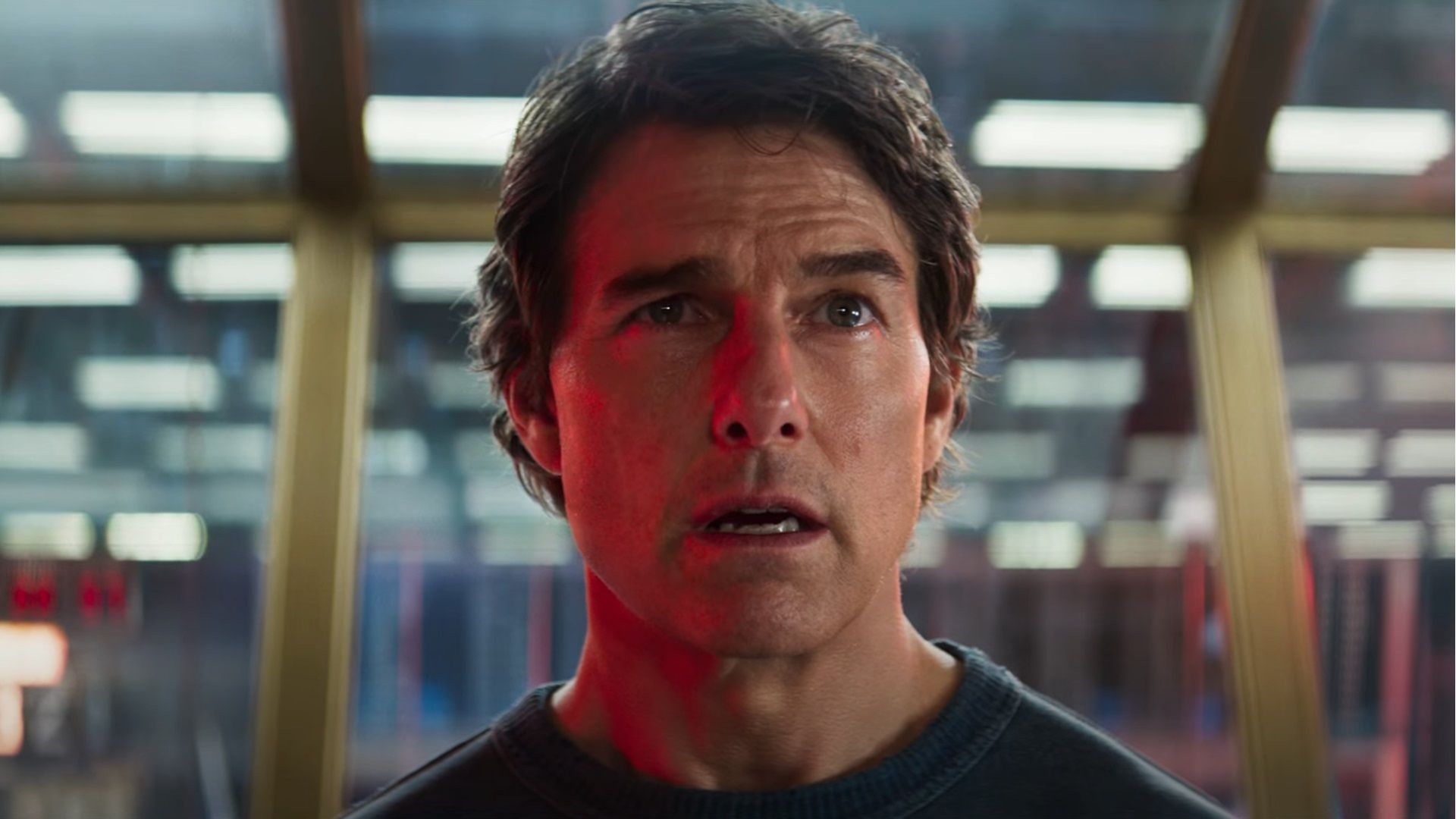

Mission Impossible Dead Reckoning Tom Cruises Breathtaking 8000 Foot Stunt

May 14, 2025

Mission Impossible Dead Reckoning Tom Cruises Breathtaking 8000 Foot Stunt

May 14, 2025 -

Decoding The Betrayal Examining The Suits La Premiere Event

May 14, 2025

Decoding The Betrayal Examining The Suits La Premiere Event

May 14, 2025 -

The Future Of Euphoria Beyond Season 3 On Hbo

May 14, 2025

The Future Of Euphoria Beyond Season 3 On Hbo

May 14, 2025