Easing Monetary Policy: China Lowers Rates Amidst Tariff Pressures

Table of Contents

The Impact of Tariffs on the Chinese Economy

The ongoing trade war, characterized by escalating tariffs between the US and China, has dealt a significant blow to the Chinese economy. Chinese exports, a crucial driver of its growth, have faced decreased demand in key international markets. This has had a ripple effect, impacting various sectors and leading to broader economic uncertainty.

Specific sectors have been particularly hard hit. Manufacturing, a cornerstone of the Chinese economy, has experienced significant disruption due to reduced orders and increased costs associated with tariffs. Similarly, the agricultural sector has felt the pressure, with exports of goods like soybeans and pork facing substantial barriers.

- Decreased export demand: Reduced purchasing power in key export markets leads to lower production and potential factory closures.

- Weakened investor confidence: Uncertainty surrounding trade policies discourages both domestic and foreign investment.

- Supply chain disruptions: Tariffs and trade restrictions complicate and increase the cost of global supply chains.

- Potential job losses: Reduced economic activity in affected sectors can lead to significant job losses and increased unemployment.

China's Response: Easing Monetary Policy Through Interest Rate Cuts

Faced with these challenges, the People's Bank of China (PBOC) has responded by implementing a series of interest rate cuts. This easing monetary policy aims to stimulate economic activity, boost investment, and support the Yuan. The rationale is straightforward: lower interest rates make borrowing cheaper for businesses and consumers, encouraging investment and spending, thus increasing overall economic activity.

These measures are targeted at both businesses and consumers. Businesses can benefit from lower borrowing costs for expansion, while consumers may be encouraged to increase spending on durable goods and services.

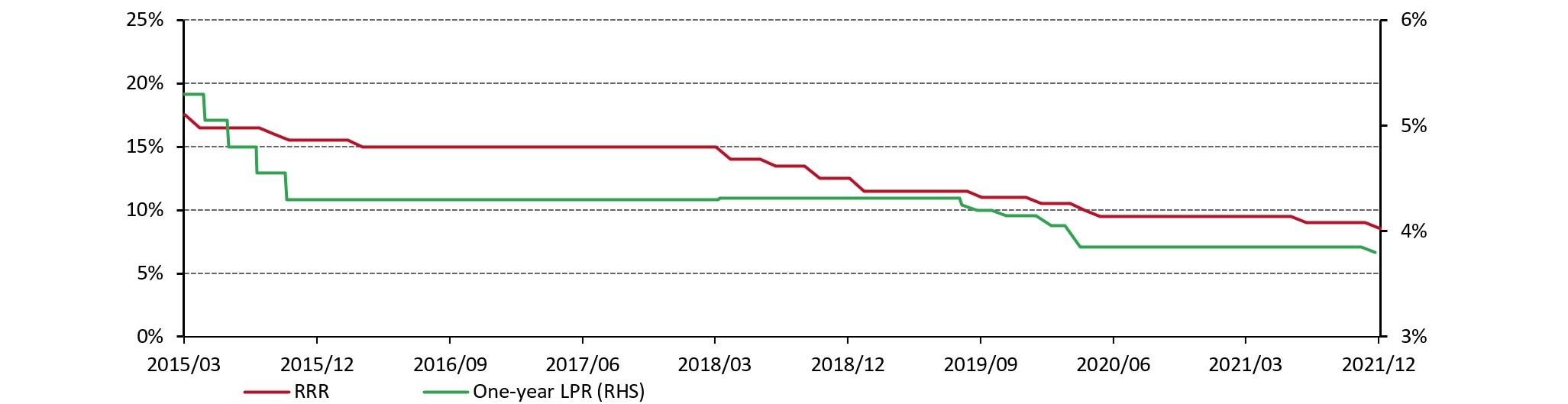

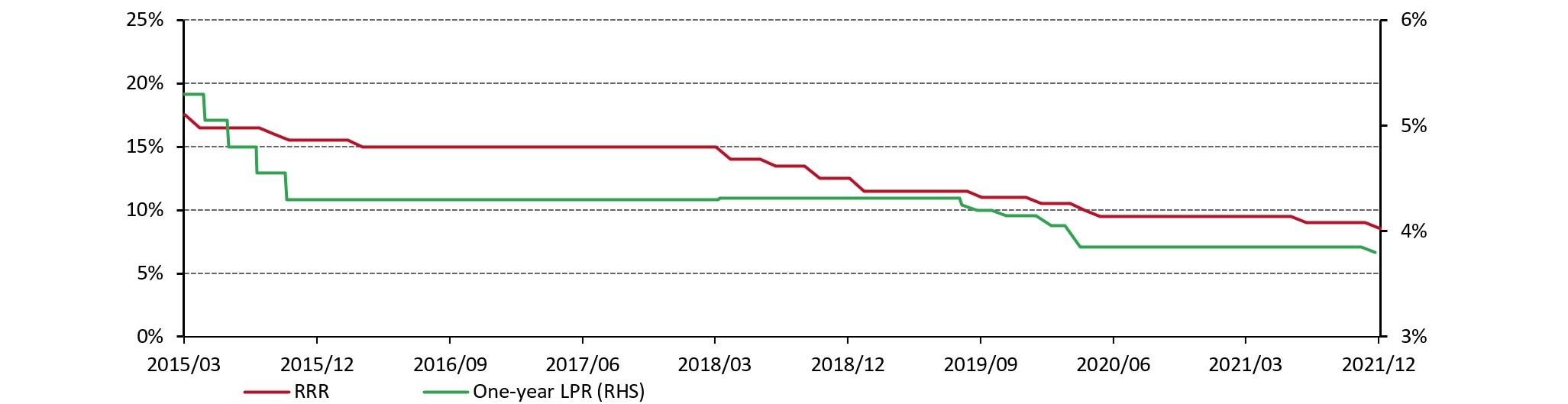

- Specific rate cut percentages: The PBOC has implemented several cuts to key interest rates, including the benchmark lending rate and the medium-term lending facility (MLF) rate. (Specific percentages should be added here when the article is published, referencing official PBOC announcements).

- Impact on lending rates: These cuts translate to lower lending rates for banks, making loans more accessible and affordable for businesses and individuals.

- Government initiatives accompanying the rate cuts: The rate cuts are often coupled with other government initiatives, such as increased infrastructure spending, to further boost economic activity.

Other Measures to Ease Monetary Policy Beyond Interest Rate Cuts

The PBOC's response extends beyond interest rate cuts. Additional measures are being employed to further loosen monetary policy and support economic growth. These actions complement the interest rate cuts, creating a more comprehensive approach to economic stimulus.

- Reserve requirement ratio adjustments: Lowering the reserve requirement ratio (RRR) allows banks to lend more freely, increasing the money supply.

- Increased liquidity injections: The PBOC injects additional liquidity into the banking system through various channels to ensure sufficient funds are available for lending.

- Measures to support small and medium-sized enterprises (SMEs): SMEs are a crucial part of the Chinese economy, and the PBOC has implemented specific measures to ease their access to credit and financial support.

Potential Effects and Challenges of Easing Monetary Policy

Easing monetary policy carries both potential benefits and risks. While the intended effect is a boost to economic activity, there are potential downsides that need careful consideration.

The positive impacts could include:

- Increased economic activity: Lower interest rates should incentivize investment and spending, leading to higher GDP growth.

- Improved consumer spending: Cheaper borrowing costs can lead to increased consumer spending, driving demand.

However, there are also potential risks:

- Potential inflation risks: Increased money supply and higher demand could lead to inflationary pressures.

- Increased corporate debt: Easy access to credit might encourage excessive borrowing by companies, increasing overall debt levels.

The PBOC faces the challenge of balancing economic stimulus with maintaining financial stability. Managing the delicate equilibrium between promoting growth and mitigating risks is a key priority.

Analyzing China's Easing Monetary Policy and its Future Implications

In conclusion, China's easing monetary policy, primarily through interest rate cuts and other supportive measures, is a direct response to the economic challenges posed by tariffs and the slowing global economy. While the aim is to stimulate growth and counter the negative impacts of the trade war, the effectiveness of these measures will depend on various factors, including the global economic outlook and the effectiveness of supplementary government initiatives. The potential for inflation and increased debt levels are risks that need careful monitoring.

To gain a deeper understanding of the complexities of China's economic strategies, it is crucial to stay informed about future developments. Stay updated on further developments regarding China's easing monetary policy and its effects by subscribing to our newsletter. Learn more about the intricacies of China’s economic policy response to global tariff pressures and how monetary policy adjustments affect global markets.

Featured Posts

-

15 April 2025 Daily Lotto Winning Numbers

May 08, 2025

15 April 2025 Daily Lotto Winning Numbers

May 08, 2025 -

Arsenal Protiv Ps Zh Polnaya Istoriya Evrokubkovykh Vstrech

May 08, 2025

Arsenal Protiv Ps Zh Polnaya Istoriya Evrokubkovykh Vstrech

May 08, 2025 -

Ravens Sign De Andre Hopkins A 1 Year Deal Analysis

May 08, 2025

Ravens Sign De Andre Hopkins A 1 Year Deal Analysis

May 08, 2025 -

Arsenal Vs Psg A Tougher Semi Final Clash Than Real Madrid

May 08, 2025

Arsenal Vs Psg A Tougher Semi Final Clash Than Real Madrid

May 08, 2025 -

The Great Decouplings Impact On Businesses And Investors

May 08, 2025

The Great Decouplings Impact On Businesses And Investors

May 08, 2025