Economic Challenges Facing The Offshore Wind Industry

Table of Contents

High Capital Expenditure and Financing Risks

The offshore wind industry requires substantial upfront investment, posing significant economic challenges. This high capital expenditure (CAPEX) and the associated financing risks are major hurdles to overcome.

The Cost of Offshore Wind Turbine Installation & Maintenance

The initial investment for offshore wind farms is enormous. This includes the considerable costs associated with wind turbine manufacturing, foundation construction, and installation.

- High manufacturing costs: Producing wind turbines, especially those designed for the harsh offshore environment, demands advanced technology and specialized materials, driving up manufacturing costs.

- Specialized vessel requirements: Installing turbines offshore necessitates specialized vessels capable of operating in challenging weather conditions, adding to the overall expenditure.

- Challenging weather conditions: Adverse weather conditions frequently cause delays and necessitate costly modifications to installation plans, significantly impacting project timelines and increasing costs.

- Long-term maintenance expenses: Offshore wind farms require ongoing operational expenditure (OPEX) for maintenance, repairs, and component replacements, adding to the long-term financial burden.

Securing financing for these projects is equally difficult due to these high costs and long-term commitment required. The return on investment (ROI) is often delayed by several years, impacting the attractiveness of the projects for investors.

Securing Project Financing and Investor Confidence

Securing project finance for large-scale offshore wind projects is a major challenge. The long lead times, inherent technological risks, and dependence on stable policy environments create significant uncertainty for investors.

- Long payback periods: The substantial upfront investment necessitates long payback periods, making it less appealing to investors seeking quicker returns.

- Dependence on government subsidies and policies: Many offshore wind projects rely on government subsidies and supportive policies, creating vulnerability to policy changes and uncertainties.

- Fluctuating energy prices: The profitability of offshore wind projects is also affected by fluctuations in energy prices, impacting investor confidence and returns.

- Technological uncertainties: Ongoing technological advancements and the inherent complexities of offshore wind technology introduce risks and uncertainties that need to be considered. Risk mitigation strategies are crucial in securing financing. This often involves utilizing green bonds, attracting private equity, and developing robust risk assessment models.

Supply Chain Bottlenecks and Material Costs

The offshore wind industry is heavily reliant on global supply chains for crucial components. Disruptions within these chains pose a significant threat to project timelines and costs.

Dependence on Global Supply Chains

The industry's reliance on global supply chains for turbines, foundations, cables, and other critical components creates significant vulnerabilities.

- Increased demand for components: The rapidly growing demand for offshore wind components often leads to shortages and delays, driving up prices and impacting project schedules.

- Reliance on specific manufacturers: Dependence on a limited number of manufacturers for specialized components creates single points of failure, increasing the risk of delays and cost overruns.

- Trade wars, tariffs, and transportation issues: Geopolitical instability, trade wars, tariffs, and logistical challenges can disrupt supply chains, leading to increased costs and project delays.

- Manufacturing capacity constraints: The current manufacturing capacity may not be able to meet the rapidly growing demands of the industry, creating a bottleneck and further driving up prices.

Rising Costs of Raw Materials and Components

The fluctuating prices of raw materials significantly impact project costs. Inflation and volatile commodity markets add further complexity.

- Increased steel prices: Steel is a major component in wind turbine construction and foundations, and price fluctuations directly impact project budgets.

- Fluctuating energy prices: Energy price volatility affects manufacturing costs, as energy is a significant input in the production process.

- Potential for shortages of rare earth elements: Some components require rare earth elements, creating concerns about potential supply shortages and price volatility.

Grid Connection and Transmission Challenges

Integrating large-scale offshore wind farms into existing electricity grids presents significant infrastructure and regulatory challenges.

The Infrastructure Gap

Upgrading existing electricity grids to accommodate the influx of power from offshore wind farms requires significant investment in new infrastructure.

- Transmission line construction costs: Building new high-voltage transmission lines to connect offshore wind farms to onshore grids is expensive and time-consuming.

- Grid reinforcement: Existing grids often require reinforcement to handle the increased power capacity from offshore wind farms, adding to the costs.

- Integration challenges: Integrating large amounts of variable renewable energy from offshore wind farms requires advanced grid management systems to ensure stability.

- Potential for grid instability: The intermittent nature of wind power can lead to grid instability if not properly managed, necessitating investment in grid stabilization technologies.

Permitting and Regulatory Hurdles

Obtaining the necessary permits and approvals for grid connections and offshore wind farm development is a complex and lengthy process.

- Environmental impact assessments: Thorough environmental impact assessments are required, potentially delaying project timelines and incurring costs.

- Stakeholder consultations: Extensive stakeholder consultations are needed, involving multiple government agencies, local communities, and environmental organizations.

- Regulatory approvals: Navigating various regulatory approvals at the national and regional levels can be lengthy and challenging.

- Potential legal challenges: Projects can face legal challenges from various stakeholders, delaying progress and increasing costs.

Conclusion

The offshore wind industry faces substantial economic hurdles, including high capital expenditure, supply chain vulnerabilities, and grid connection complexities. Addressing these challenges requires strategic investment, robust policy frameworks, efficient supply chain management, and innovative solutions for grid integration. Overcoming these obstacles is crucial to unlocking the vast potential of the offshore wind industry and achieving global renewable energy targets. Further research, collaboration between industry stakeholders, and supportive government policies are essential to mitigate these economic challenges and accelerate the growth of the offshore wind industry. Learn more about navigating these challenges by exploring [link to relevant resource/further reading].

Featured Posts

-

Should Nigel Farage Step Down The Case For Rupert Lowe In Reform

May 03, 2025

Should Nigel Farage Step Down The Case For Rupert Lowe In Reform

May 03, 2025 -

Keller School District Why Splitting Is Detrimental

May 03, 2025

Keller School District Why Splitting Is Detrimental

May 03, 2025 -

Is Rupert Lowe The Right Leader For Reform A Case For Farages Departure

May 03, 2025

Is Rupert Lowe The Right Leader For Reform A Case For Farages Departure

May 03, 2025 -

From Missouri To The Nhl Clayton Kellers 500 Point Achievement

May 03, 2025

From Missouri To The Nhl Clayton Kellers 500 Point Achievement

May 03, 2025 -

Deportista Suizo Se Corona Campeon En La Vuelta A Murcia

May 03, 2025

Deportista Suizo Se Corona Campeon En La Vuelta A Murcia

May 03, 2025

Latest Posts

-

A Harry Potter Remakes Path To Success Six Necessary Steps

May 03, 2025

A Harry Potter Remakes Path To Success Six Necessary Steps

May 03, 2025 -

Will The Harry Potter Remake Succeed 6 Essential Ingredients

May 03, 2025

Will The Harry Potter Remake Succeed 6 Essential Ingredients

May 03, 2025 -

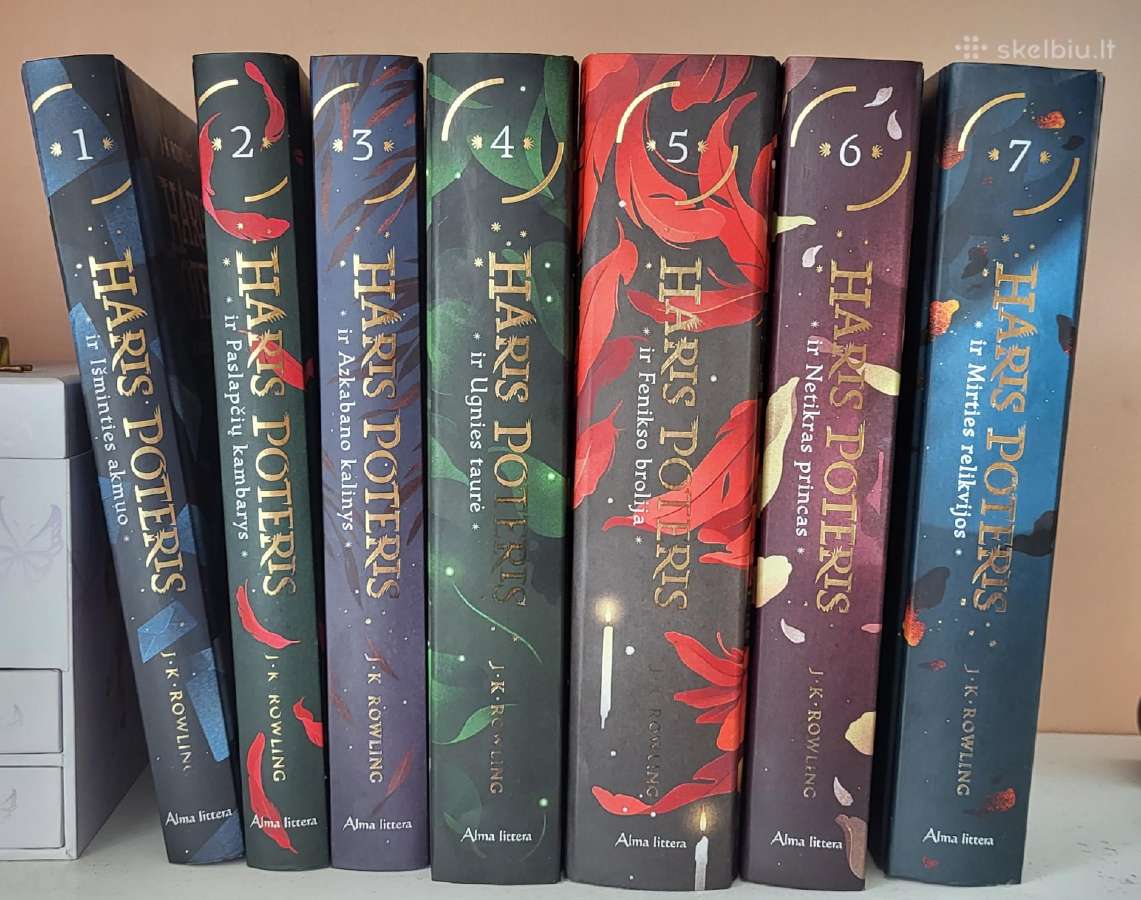

Hario Poterio Parko Atidarymas Sanchajuje 2027 Metu Laukimas

May 03, 2025

Hario Poterio Parko Atidarymas Sanchajuje 2027 Metu Laukimas

May 03, 2025 -

Sanchajus Arteja Hario Poterio Parko Atidarymas 2027 Metais

May 03, 2025

Sanchajus Arteja Hario Poterio Parko Atidarymas 2027 Metais

May 03, 2025 -

Harry Potter Shop Chicago Location Hours And Must See Items

May 03, 2025

Harry Potter Shop Chicago Location Hours And Must See Items

May 03, 2025