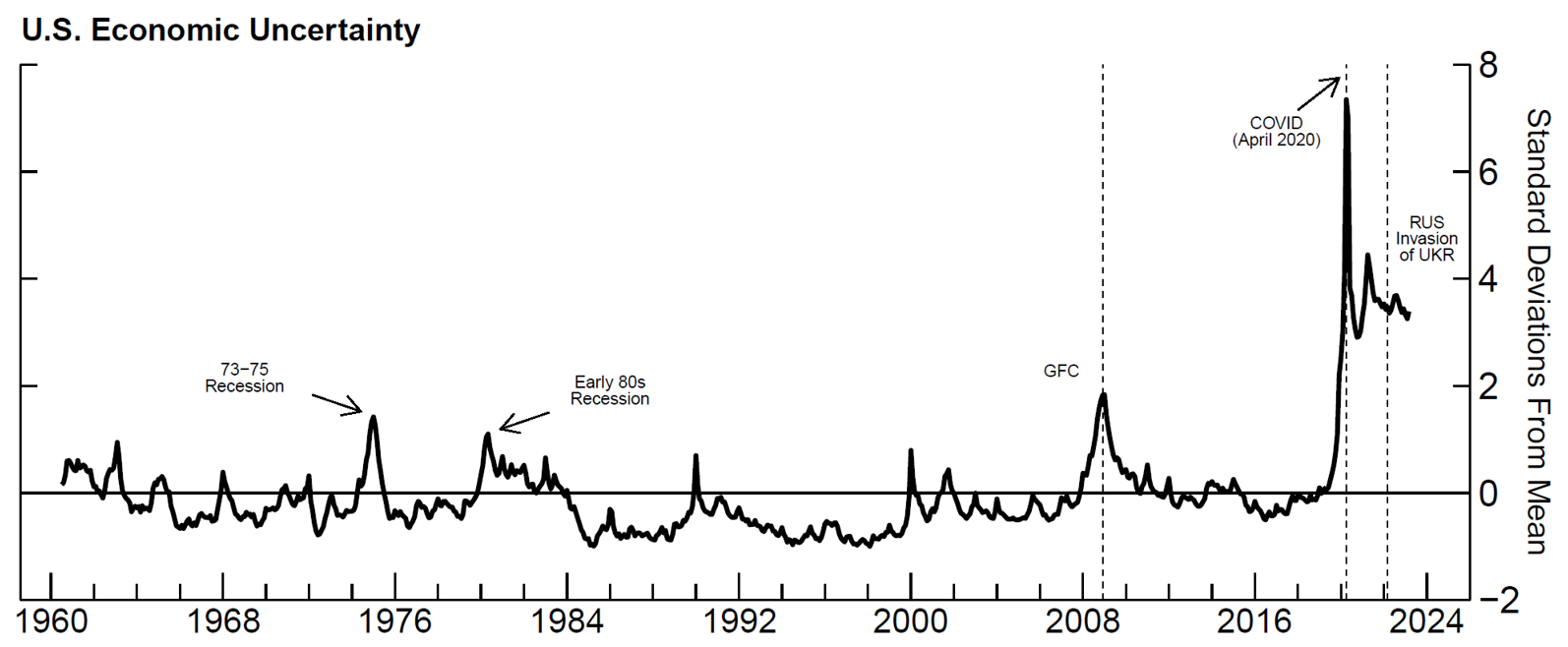

Economic Uncertainty Grows Amidst Rising Inflation And Unemployment

Table of Contents

The Inflationary Spiral and its Impact

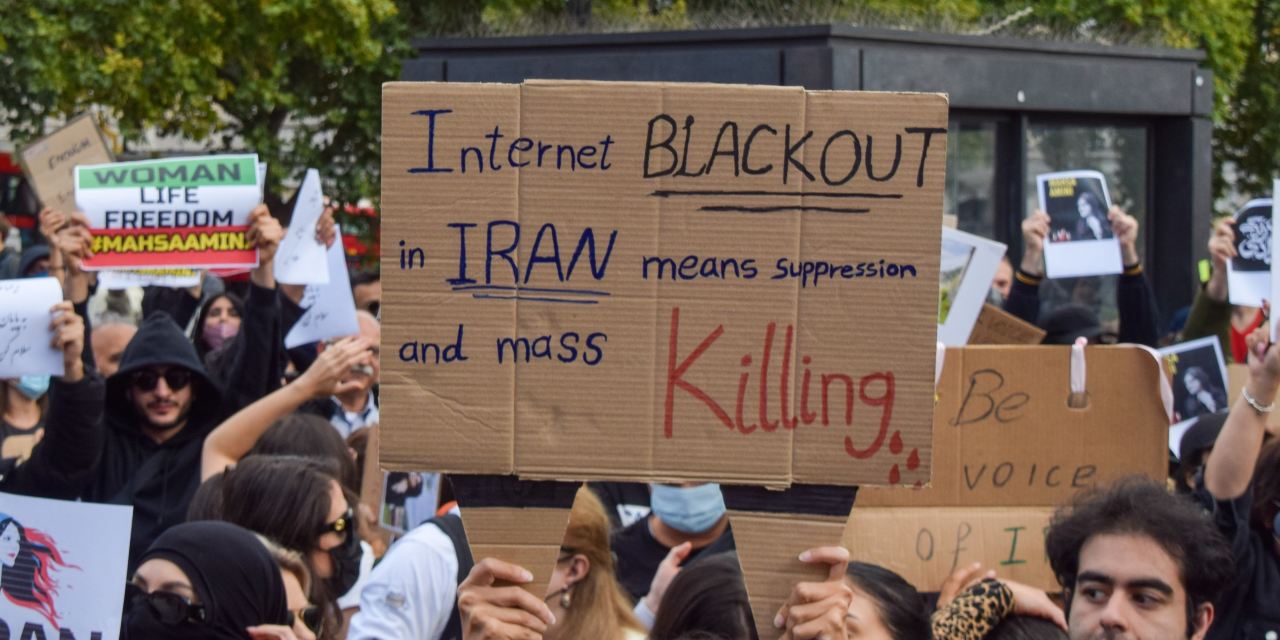

The current inflationary environment is characterized by a significant and persistent increase in the price of goods and services. This "inflationary spiral" is fueled by several interconnected factors. Supply chain disruptions, exacerbated by geopolitical instability and the lingering effects of the pandemic, have constrained the availability of goods, driving up prices. Simultaneously, soaring energy prices, particularly oil and natural gas, have added to the inflationary pressure, impacting transportation costs and manufacturing processes. Increased demand, coupled with limited supply, has further contributed to this upward trend in the inflation rate.

The impact of this rising inflation is far-reaching. Consumers are experiencing a significant erosion of their purchasing power, meaning their money buys less than it did previously. This reduction in real income forces consumers to cut back on spending, potentially leading to a slowdown in economic growth. Furthermore, businesses face increased costs for raw materials and labor, forcing them to either absorb these increases, reduce profit margins, or raise prices, further fueling the inflationary spiral. Central banks are responding by raising interest rates, a move intended to cool down the economy and curb inflation, but this can also stifle economic growth and potentially lead to a further increase in unemployment.

- Rising energy costs impacting household budgets: Heating bills, transportation costs, and the price of electricity are all significantly higher, squeezing household budgets.

- Increased food prices affecting low-income families: The rising cost of essential food items disproportionately affects low-income families, increasing food insecurity.

- Central banks raising interest rates to combat inflation: Higher interest rates make borrowing more expensive, potentially slowing down economic activity.

- The impact of inflation on savings and investments: The real return on savings and investments is diminished by high inflation, eroding the value of accumulated wealth.

Unemployment on the Rise: Job Losses and Economic Fallout

The rising inflation rate is not the only significant economic challenge; unemployment figures are also climbing, signaling a potential economic downturn. Layoffs are increasing across various sectors, with some industries particularly hard-hit. This rise in job losses has significant consequences, leading to reduced consumer spending, decreased economic output, and a decline in overall economic confidence. The ripple effect on the economy is considerable, as decreased spending translates to lower demand for goods and services, potentially leading to further job losses in a vicious cycle. The widening skills gap further exacerbates the problem, as many available jobs require specific skills that unemployed workers lack.

- Sectors experiencing the highest job losses: The technology, retail, and manufacturing sectors are among those experiencing the most significant job losses.

- Impact on consumer confidence and spending: Job insecurity leads to decreased consumer confidence and reduced spending, further slowing economic growth.

- Government initiatives to support job creation: Governments are implementing various initiatives, such as job training programs and infrastructure projects, to stimulate job creation.

- The long-term effects of unemployment on individuals and the economy: Prolonged unemployment can have devastating effects on individuals, leading to financial hardship, mental health issues, and social exclusion. For the economy, it represents lost productivity and potential.

Navigating Economic Uncertainty: Strategies for Individuals and Businesses

Navigating this period of economic uncertainty requires proactive strategies for both individuals and businesses. For individuals, robust financial planning is crucial. This includes creating a realistic budget that prioritizes essential expenses, building an emergency fund to cover unexpected costs, and diversifying investments to mitigate risk. Exploring alternative income streams, such as freelancing or part-time work, can also provide a crucial safety net.

Businesses, on the other hand, need to focus on business continuity planning. This includes developing strategies to weather economic downturns, such as streamlining operations, reducing costs, and exploring new markets or revenue streams. Investing in employee training and development can also help businesses adapt to changing economic conditions and maintain a competitive edge.

- Tips for creating a robust budget: Track expenses carefully, prioritize essential spending, and identify areas where savings can be made.

- Strategies for diversifying investments: Spread investments across different asset classes to reduce risk.

- Importance of emergency savings: Aim to have 3-6 months of living expenses in an easily accessible savings account.

- Business continuity planning for economic downturns: Develop strategies to reduce costs, streamline operations, and explore new markets.

- Exploring alternative income streams: Consider freelancing, part-time work, or investing in income-generating assets.

Government Intervention and Policy Responses

Governments play a crucial role in mitigating the impact of economic uncertainty through fiscal and monetary policies. Fiscal policy, involving government spending and taxation, can be used to stimulate economic activity, for instance, through infrastructure projects or direct financial aid to households and businesses. Monetary policy, controlled by central banks, influences interest rates and the money supply to manage inflation and support economic growth. Social safety nets, such as unemployment benefits and social assistance programs, provide crucial support to those affected by job losses. The effectiveness of these interventions varies, and careful consideration of their potential consequences is essential.

Conclusion

The current economic climate, characterized by rising inflation and unemployment, presents significant challenges. However, by understanding the underlying factors driving economic uncertainty and implementing appropriate strategies, individuals and businesses can navigate this turbulent period more effectively. Proactive financial planning, risk management, and adaptability are crucial in mitigating the potential negative impacts. Building resilience against future downturns requires a multifaceted approach that combines personal preparedness with effective government policies. Stay informed about the evolving economic landscape and develop a robust plan to address the challenges of rising inflation and unemployment. Learn more about effective strategies for navigating economic uncertainty and build resilience against future downturns.

Featured Posts

-

Could A Beloved Nissan Classic Car Return Speculation And Rumors

May 30, 2025

Could A Beloved Nissan Classic Car Return Speculation And Rumors

May 30, 2025 -

Kawasaki W175 Cafe Motor Klasik Modern Untuk Pecinta Gaya Retro

May 30, 2025

Kawasaki W175 Cafe Motor Klasik Modern Untuk Pecinta Gaya Retro

May 30, 2025 -

Crisis In The Housing Market A Deep Dive Into Falling Home Sales

May 30, 2025

Crisis In The Housing Market A Deep Dive Into Falling Home Sales

May 30, 2025 -

Us Visa Restrictions New Rules Target Social Media Censorship

May 30, 2025

Us Visa Restrictions New Rules Target Social Media Censorship

May 30, 2025 -

Pegula Defeats Collins To Win Charleston Title

May 30, 2025

Pegula Defeats Collins To Win Charleston Title

May 30, 2025

Latest Posts

-

Minnesota Air Quality Crisis Canadian Wildfire Smoke Impact

May 31, 2025

Minnesota Air Quality Crisis Canadian Wildfire Smoke Impact

May 31, 2025 -

Researchers Find Link Between Canadian Wildfires Nyc Cooling And Air Toxicants

May 31, 2025

Researchers Find Link Between Canadian Wildfires Nyc Cooling And Air Toxicants

May 31, 2025 -

Canadian Red Cross Response To Manitoba Wildfires Ways To Donate And Volunteer

May 31, 2025

Canadian Red Cross Response To Manitoba Wildfires Ways To Donate And Volunteer

May 31, 2025 -

Supporting Manitoba Wildfire Victims A Guide To Red Cross Assistance

May 31, 2025

Supporting Manitoba Wildfire Victims A Guide To Red Cross Assistance

May 31, 2025 -

The Tudor Pelagos Fxd Chrono Pink A Comprehensive Release Guide

May 31, 2025

The Tudor Pelagos Fxd Chrono Pink A Comprehensive Release Guide

May 31, 2025