Economists Predict Rate Cuts Following Weak Retail Sales Data

Table of Contents

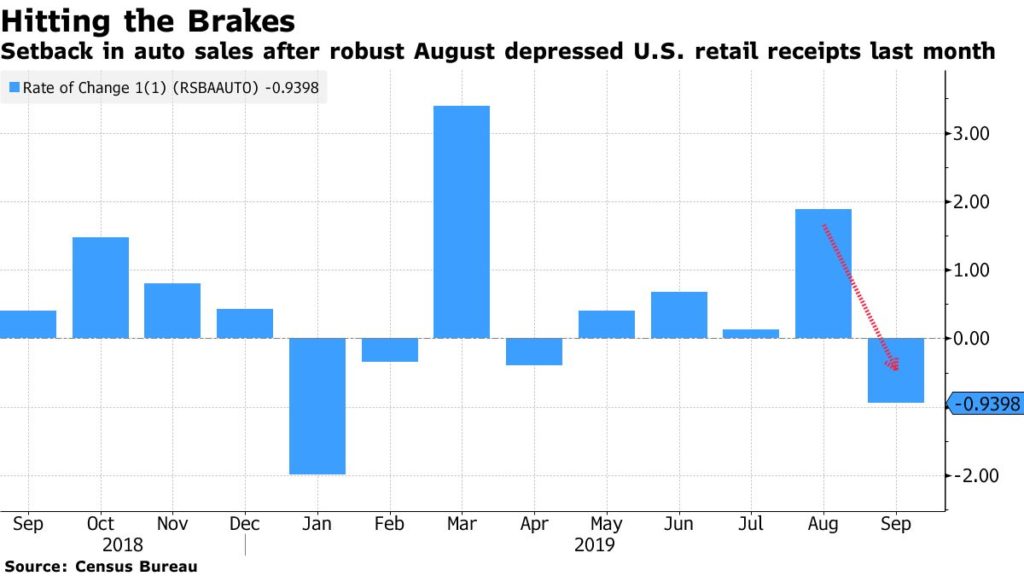

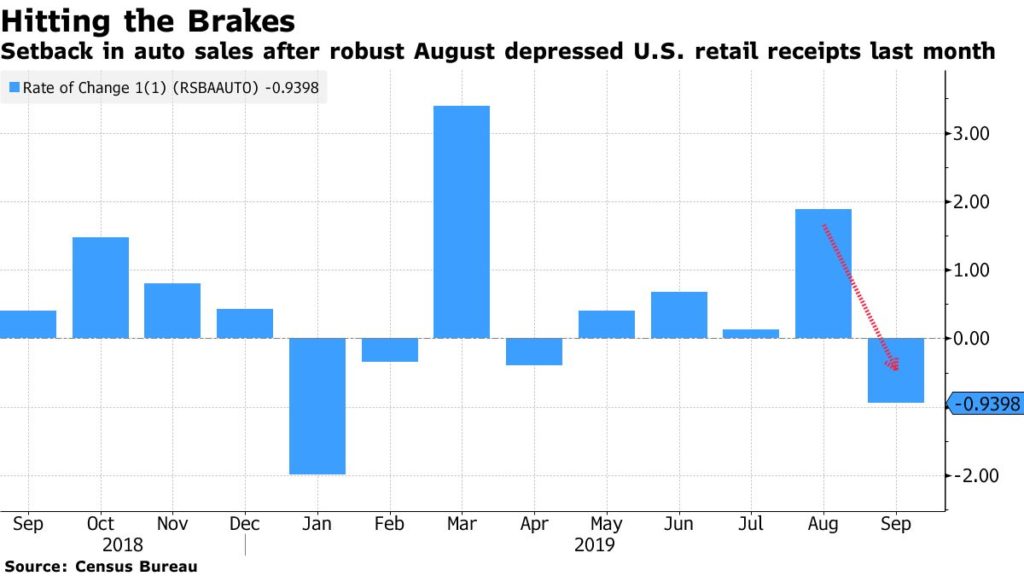

Weak Retail Sales: A Deeper Dive

Analyzing the Data

Retail sales figures for [Month, Year] revealed a significant decline of [Percentage]% compared to the previous month and [Percentage]% below analysts' expectations. This represents the sharpest monthly fall in [Number] months. The data paints a bleak picture across multiple sectors.

- Clothing sales: Experienced a [Percentage]% drop, indicating decreased consumer confidence in discretionary spending.

- Electronics sales: Showed a decline of [Percentage]%, potentially reflecting postponed purchases due to economic uncertainty.

- Furniture sales: Also suffered a significant downturn of [Percentage]%, suggesting a slowdown in home improvement projects.

Several factors contributed to this unexpected slump.

- High inflation: Persistently high inflation continues to erode purchasing power, forcing consumers to cut back on non-essential spending.

- Increased interest rates: Previous interest rate hikes have increased borrowing costs, making it more expensive for consumers to finance purchases.

- Supply chain disruptions: While easing, lingering supply chain issues continue to impact the availability of certain goods, leading to higher prices and reduced consumer choice.

- Shifting consumer preferences: Consumers are increasingly prioritizing essential goods over discretionary purchases, reflecting a change in spending habits driven by economic uncertainty.

Economists' Predictions and Rationale

The Consensus on Rate Cuts

Following the release of the disappointing retail sales data, a growing chorus of economists and financial analysts are predicting that the central bank will implement rate cuts in the coming months. Many believe a cut is imminent, with some predicting multiple cuts before the end of the year.

- "The weak retail sales data leaves the central bank with little choice but to cut rates," stated [Economist's Name], chief economist at [Financial Institution].

- [Another Economist's Name] from [Another Financial Institution] predicts a [Percentage]% rate cut at the next monetary policy meeting, potentially followed by further reductions.

The predictions vary in magnitude, with some suggesting a more aggressive approach to rate cuts than others. However, the consensus points towards a significant easing of monetary policy.

Justification for Rate Cut Expectations

Economists justify the expectation of rate cuts by highlighting the crucial role of monetary policy in stimulating economic activity. The weak retail sales data signals a significant slowdown in consumer spending, a key driver of economic growth.

- Stimulating economic activity: Lower interest rates make borrowing cheaper, encouraging both consumers and businesses to increase spending and investment.

- Influencing consumer borrowing and spending: Reduced interest rates can boost consumer confidence, leading to increased borrowing for purchases like homes and cars.

- Impact on inflation and employment: While rate cuts can potentially reignite inflation, the current situation prioritizes boosting economic activity and employment levels over immediate inflation control.

Potential Impacts of Rate Cuts

Benefits of Rate Cuts

While there are risks associated with rate cuts, the potential benefits are significant.

- Stimulating consumer spending and economic growth: Lower interest rates should incentivize consumer spending and investment, potentially boosting economic growth.

- Lowering borrowing costs for businesses: Reduced borrowing costs make it easier for businesses to invest in expansion and create jobs, supporting overall economic recovery.

- Potential positive effects on the housing market: Lower mortgage rates could help revive the housing market, stimulating construction and related industries.

Risks Associated with Rate Cuts

It's crucial to acknowledge the potential downsides of implementing rate cuts.

- Potential for increased inflation: Lower interest rates could fuel inflation by increasing the money supply and boosting demand.

- Risks of fueling asset bubbles: Lower interest rates can inflate asset prices, potentially creating unsustainable bubbles in the stock market and real estate.

- Impact on the value of the currency: Rate cuts can weaken a nation's currency, impacting import and export costs.

Conclusion

In summary, weak retail sales data has significantly increased the likelihood of imminent rate cuts by the central bank. Economists predict these rate cuts are necessary to stimulate economic growth and counteract the slowdown in consumer spending. While there are potential benefits, including increased consumer spending and business investment, risks such as increased inflation and asset bubbles must be carefully considered. The central bank faces a delicate balancing act in managing these competing forces. Stay tuned for updates on the central bank's decision regarding rate cuts and their potential impact on your finances. Understanding the implications of these rate cuts is crucial in navigating the current economic climate.

Featured Posts

-

Open Ai And Chat Gpt An Ftc Investigation Begins

Apr 28, 2025

Open Ai And Chat Gpt An Ftc Investigation Begins

Apr 28, 2025 -

Auto Dealers Double Down On Opposition To Electric Vehicle Requirements

Apr 28, 2025

Auto Dealers Double Down On Opposition To Electric Vehicle Requirements

Apr 28, 2025 -

China Adjusts Tariffs Implications For Us China Trade Relations

Apr 28, 2025

China Adjusts Tariffs Implications For Us China Trade Relations

Apr 28, 2025 -

Dwyane Wade On Doris Burkes Insightful Thunder Vs Timberwolves Commentary

Apr 28, 2025

Dwyane Wade On Doris Burkes Insightful Thunder Vs Timberwolves Commentary

Apr 28, 2025 -

Jack Link 500 Props Betting Guide Talladega Superspeedway 2025

Apr 28, 2025

Jack Link 500 Props Betting Guide Talladega Superspeedway 2025

Apr 28, 2025