Economists' Warning: ECB Must Avoid Prolonging Recent Rate Cuts

Table of Contents

The Risks of Extended Low Interest Rates

Prolonged periods of low interest rates, while potentially stimulating short-term economic activity, carry significant risks. One of the most pressing concerns is the exacerbation of inflationary pressures. Low borrowing costs encourage increased spending and investment, potentially outstripping the economy's productive capacity and fueling further price increases. This can create a dangerous cycle where inflation becomes entrenched, eroding purchasing power and destabilizing the economy.

Furthermore, extended low interest rates can negatively impact savings and investment. Savers experience a decline in the real return on their deposits, diminishing their purchasing power. Simultaneously, investors may be incentivized to seek riskier assets to achieve higher returns, potentially leading to the formation of asset bubbles. These bubbles, when they burst, can trigger significant economic downturns.

- Increased borrowing costs in the long run: As inflation rises, central banks are forced to eventually raise interest rates sharply to control it, leading to higher borrowing costs for businesses and consumers.

- Potential asset bubbles: Low interest rates inflate asset prices (stocks, real estate), creating unsustainable bubbles prone to collapse.

- Reduced investor confidence due to uncertainty: The unpredictability of future interest rate movements can erode investor confidence, leading to decreased investment and economic stagnation.

- Weakening of the Euro: Persistently low interest rates can make the Euro less attractive to foreign investors, potentially leading to its depreciation against other currencies.

The current situation requires a careful evaluation of the ECB's monetary policy considering the potential for long-term negative impacts outweighing any short-term benefits.

Alternative Monetary Policy Options for the ECB

The ECB is not limited to solely adjusting interest rates. Several alternative monetary policy options could be considered to address the current economic challenges without the risks associated with prolonged low interest rates.

- Targeted fiscal stimulus: Government spending focused on specific sectors or regions could boost economic activity without the inflationary pressures of broad-based monetary easing.

- Structural reforms to boost productivity: Implementing reforms to enhance labor market flexibility, improve infrastructure, and reduce regulatory burdens can sustainably increase economic output.

- Gradual interest rate hikes: A carefully managed and communicated series of interest rate increases can gradually curb inflation without triggering a sharp economic slowdown.

- Communication strategy to manage market expectations: Clear and consistent communication from the ECB about its policy intentions is crucial to managing market expectations and avoiding unnecessary volatility.

Experts like Paul Krugman advocate for a more nuanced approach, suggesting a combination of targeted measures alongside careful interest rate adjustments, instead of relying solely on rate cuts. Others, like Nouriel Roubini, warn of the inherent dangers of prolonged low interest rates and advocate for a quicker shift towards a more restrictive monetary policy.

The Impact on European Economic Growth

The prolonged period of low interest rates poses both short-term and long-term risks to European economic growth. In the short term, while low rates might stimulate borrowing and spending, the inflationary pressures could significantly offset any positive effects. This could lead to a stagnation or even a recession, impacting various sectors differently. The tourism sector, for example, might initially benefit from increased spending, but a subsequent rise in interest rates could quickly reverse this trend.

In the long term, the risks associated with asset bubbles and weakened investor confidence could significantly hamper sustainable economic growth. Furthermore, regional disparities within the Eurozone could be exacerbated, with some regions disproportionately affected by the negative consequences of the ECB's monetary policy.

- Impact on different sectors of the economy: Different sectors will react differently to interest rate changes; some might thrive, while others could struggle.

- Regional disparities in economic performance: The effects of low interest rates may vary significantly across different Eurozone countries and regions.

- Potential for increased unemployment: A sharp economic slowdown or recession resulting from inappropriate monetary policy could lead to increased unemployment.

- Effect on government debt levels: Low interest rates can initially reduce the cost of government borrowing, but persistent inflation could negate these benefits and increase the debt burden in the long run.

Visual representations of economic data, such as charts and graphs illustrating GDP growth, inflation rates, and unemployment levels, would provide a clearer picture of the situation and its potential outcomes.

Calls for ECB Transparency and Accountability

The ECB's communication strategy regarding its monetary policy decisions is paramount for maintaining market confidence. Clear, transparent, and consistent communication is essential to manage market expectations and minimize uncertainty. This involves:

- Regular press conferences and updates: Frequent and detailed updates on the ECB's assessment of the economic situation and its policy intentions are necessary.

- Detailed explanations of policy decisions: The reasoning behind the ECB's decisions should be clearly articulated to ensure transparency and accountability.

- Independent audits of the ECB's actions: Regular independent audits can help to ensure that the ECB's actions are aligned with its mandates and objectives.

- Increased communication with stakeholders: Open communication with businesses, investors, and the general public is crucial to build trust and understanding.

Criticisms of the ECB's communication strategy often cite a lack of clarity and consistency in its messaging, leading to uncertainty in the markets. Increased transparency is essential to restore and maintain confidence in the institution and its policies.

Conclusion: The Urgency to Re-evaluate ECB Rate Cut Policy

The potential consequences of prolonging the current policy of interest rate cuts are significant. The risks of persistent inflation, asset bubbles, weakened investor confidence, and ultimately a potential recession, are substantial. The ECB must urgently consider alternative monetary policies that mitigate these risks while promoting sustainable economic growth within the Eurozone. Furthermore, increased transparency and accountability are crucial to maintaining market confidence and ensuring the effectiveness of the ECB's actions. It is crucial to closely monitor the ECB's actions and advocate for a monetary policy that avoids the pitfalls of prolonged low interest rates and prioritizes long-term economic stability. Stay informed about ECB decisions and demand responsible and sustainable monetary policy.

Featured Posts

-

Flowers Miley Cyrus Czy To Nowy Hit Roku Recenzja Singla

May 31, 2025

Flowers Miley Cyrus Czy To Nowy Hit Roku Recenzja Singla

May 31, 2025 -

Building The Good Life Practical Steps For Lasting Well Being

May 31, 2025

Building The Good Life Practical Steps For Lasting Well Being

May 31, 2025 -

Pairing Rosemary And Thyme With Other Herbs And Spices

May 31, 2025

Pairing Rosemary And Thyme With Other Herbs And Spices

May 31, 2025 -

Harvard Foreign Student Ban Judges Ruling And Implications

May 31, 2025

Harvard Foreign Student Ban Judges Ruling And Implications

May 31, 2025 -

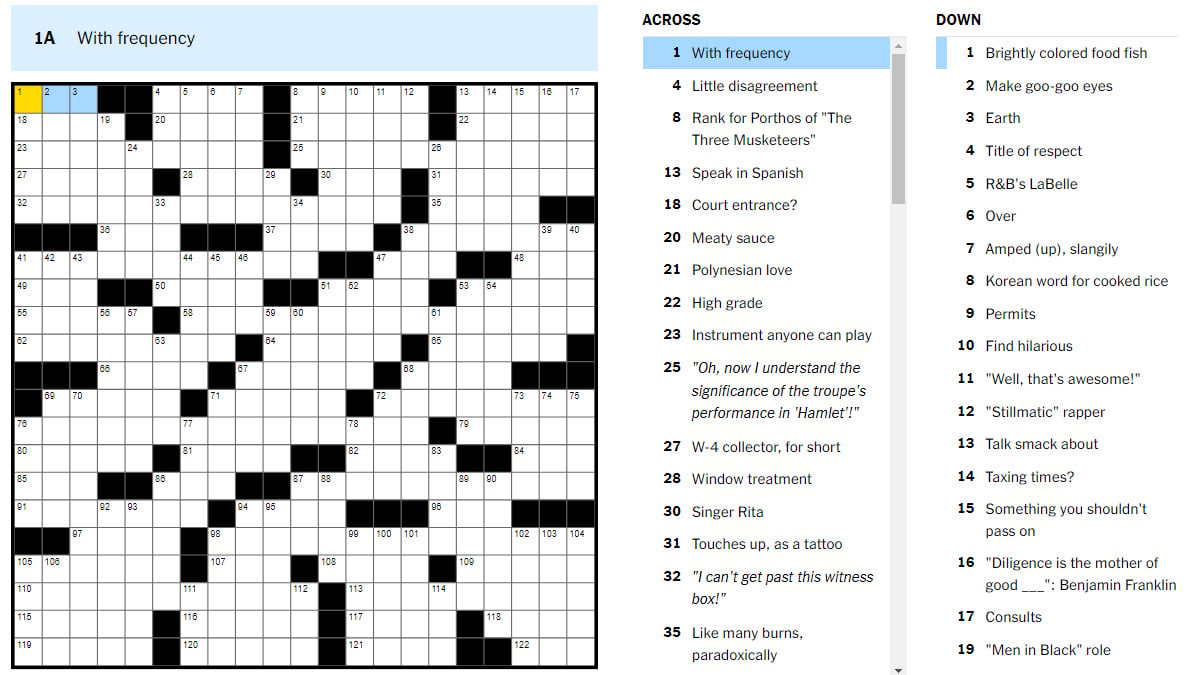

Nyt Mini Crossword Answers Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Answers Saturday May 3rd

May 31, 2025