Elon Musk, Jeff Bezos, And Mark Zuckerberg: Billions Lost Since Trump's Inauguration

Table of Contents

Elon Musk's Shifting Fortune

Elon Musk, the visionary behind Tesla and SpaceX, has seen his net worth fluctuate wildly since 2017. While he remains incredibly wealthy, understanding the factors contributing to these fluctuations is crucial.

Tesla Stock Volatility

Tesla's stock price has been a rollercoaster ride, significantly impacting Musk's overall net worth. Several factors contributed to this volatility:

- Production Challenges: Early production bottlenecks and difficulties scaling manufacturing impacted investor confidence and led to stock price drops.

- Market Competition: The rise of other electric vehicle (EV) manufacturers intensified competition, putting pressure on Tesla's market share and stock price.

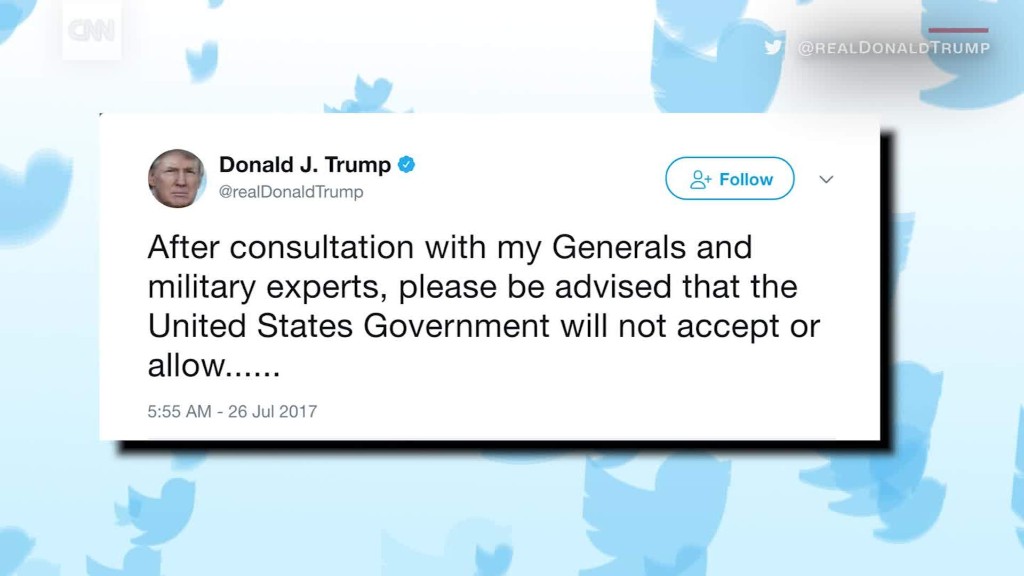

- Controversial Tweets: Musk's often controversial and unpredictable tweets have repeatedly sent shockwaves through the market, causing significant short-term fluctuations in Tesla's stock.

For example, Tesla's stock experienced a dramatic drop in 2018 following concerns about production issues and Musk's controversial tweets regarding taking Tesla private. These events, among others, directly impacted his net worth, demonstrating the inherent risk associated with such volatile investments. Analyzing Tesla's market capitalization reveals a clear correlation between production announcements, market competition, and the overall performance of the stock. Understanding the dynamics of the electric vehicle market is key to comprehending Musk’s fluctuating net worth.

SpaceX Investments and Risk

SpaceX, Musk's space exploration company, represents a significant portion of his overall wealth, but it's also a high-risk, high-reward venture.

- Ambitious Projects: SpaceX's ambitious projects, such as Starship development and Starlink satellite deployment, require massive capital investment with uncertain returns.

- Funding Rounds: While SpaceX has secured significant funding rounds, these investments represent a considerable financial commitment with a long-term payoff.

- Potential ROI: The long-term potential ROI of SpaceX's projects is substantial, but the inherent risks in space exploration mean that these ventures can significantly impact Musk's net worth depending on their success or failure. Space exploration investment remains a risky, though potentially highly lucrative, avenue for Musk's personal wealth.

Jeff Bezos' Amazon and Beyond

Jeff Bezos, the founder of Amazon, has also experienced shifts in his net worth since 2017. While he remains one of the world's richest individuals, his wealth has not been immune to economic and political pressures.

Amazon's Evolving Market Position

Amazon's dominance in e-commerce has faced increasing challenges:

- Increased Competition: The growth of competitors like Walmart and other e-commerce platforms has eroded Amazon's market share, impacting its stock price.

- Antitrust Scrutiny: Increased antitrust scrutiny from regulatory bodies worldwide has created uncertainty and legal costs, affecting investor confidence.

- Impact on Amazon Stock: The combination of increased competition and regulatory challenges has directly impacted Amazon's stock price and, consequently, Bezos' net worth. A clear understanding of e-commerce competition and the evolving regulatory landscape is essential for assessing the factors affecting Amazon's valuation and Bezos' wealth.

Blue Origin and Diversification

Bezos' space exploration venture, Blue Origin, represents a significant diversification of his investments:

- Space Tourism: Blue Origin's focus on space tourism, through projects like New Shepard, represents a potentially lucrative, though still emerging, market.

- Financial Investment: The financial investment in Blue Origin is substantial, representing a considerable commitment of resources outside his primary Amazon holdings.

- Potential Impact on Net Worth: The success or failure of Blue Origin's endeavors will undoubtedly play a role in shaping Bezos' overall net worth in the coming years. Bezos' investments demonstrate a calculated strategy to diversify his holdings and mitigate the risks associated with relying solely on Amazon.

Mark Zuckerberg's Facebook (Meta) Challenges

Mark Zuckerberg, the founder of Meta (formerly Facebook), has witnessed a significant downturn in his net worth since 2017.

The Cambridge Analytica Scandal and Beyond

Several controversies and regulatory changes significantly impacted Meta's stock price and Zuckerberg's wealth:

- The Cambridge Analytica Scandal: The Cambridge Analytica scandal and subsequent data privacy concerns severely damaged Facebook's reputation and led to regulatory fines.

- Data Privacy Regulations: The implementation of stricter data privacy regulations, such as GDPR, increased compliance costs and further impacted Meta's profitability.

- Impact on Meta Stock: These scandals and regulations significantly impacted Meta's stock price and Zuckerberg's net worth, highlighting the risks associated with operating a large social media platform. Understanding data privacy regulations and their influence on tech giants is crucial to analyzing Meta's performance.

The Metaverse Gamble

Meta's significant investment in the Metaverse represents a high-stakes gamble:

- Investments in VR/AR: Meta has poured billions into virtual reality (VR) and augmented reality (AR) technologies, betting on the future of the Metaverse.

- User Adoption Rates: The success of this venture hinges heavily on user adoption rates and the overall development of the Metaverse ecosystem.

- Impact on Meta's Financial Performance: The financial performance of Meta's metaverse initiatives will significantly impact its stock price and Zuckerberg's net worth. The success of the Metaverse investment will prove pivotal in determining the future trajectory of Meta's financial health and Zuckerberg's overall wealth.

Conclusion

This analysis reveals that despite their initial success, the net worth of Elon Musk, Jeff Bezos, and Mark Zuckerberg has experienced significant fluctuations since Trump's inauguration. Factors such as stock market volatility, increased competition, regulatory scrutiny, and bold, risky investments have all played a role in these billions lost. Understanding these dynamics offers insights into the complexities of the modern global economy and the challenges faced even by the most successful entrepreneurs. To stay updated on the continuing saga of these tech giants and their fluctuating fortunes, continue following news and analysis related to billionaire net worth changes and tech industry fluctuations.

Featured Posts

-

New Report Uk To Tighten Visa Rules For Select Nationalities

May 10, 2025

New Report Uk To Tighten Visa Rules For Select Nationalities

May 10, 2025 -

Data Breach 90 Nhs Staff Accessed Nottingham Attack Victim Files

May 10, 2025

Data Breach 90 Nhs Staff Accessed Nottingham Attack Victim Files

May 10, 2025 -

Analyzing The Rhetoric Trumps Transgender Military Ban Explained

May 10, 2025

Analyzing The Rhetoric Trumps Transgender Military Ban Explained

May 10, 2025 -

Barys San Jyrman Rhlt Nhw Alfwz Bdwry Abtal Awrwba

May 10, 2025

Barys San Jyrman Rhlt Nhw Alfwz Bdwry Abtal Awrwba

May 10, 2025 -

Bondis Unprecedented Fentanyl Seizure A Major Blow To The Drug Trade

May 10, 2025

Bondis Unprecedented Fentanyl Seizure A Major Blow To The Drug Trade

May 10, 2025